[ad_1]

SusanneB

There seem to be around 40 companies in the United States which qualify as dividend kings – companies that have increased their dividend for 50 or more consecutive years. And one of the companies in this very exclusive list, which is mostly composed of companies from the industrials sector, the consumer staples sector, and utility sector, is Emerson Electric Co. (NYSE:EMR).

In my last article about Emerson Electric – which was published in August 2021 when the stock was trading for $92 – I considered the company rather a hold. However, with the business improving and the stock price declining, Emerson Electric might be a solid investment at this point. In the following article, I will explain my bullish thesis. And let’s start by looking at the dividend, as we are talking about a dividend king.

Dividend King

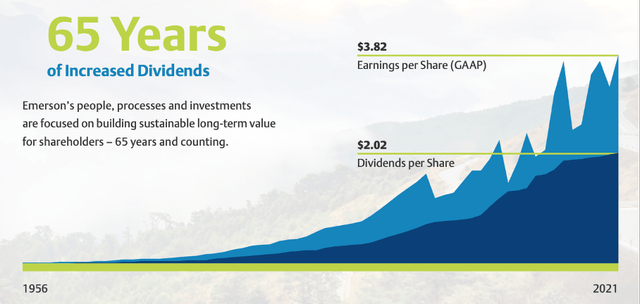

With 65 years of increasing dividends, there are just a few companies in the world with a longer streak of consecutive dividend increases – The Coca-Cola Company (KO) might be an example. And while this is proof that Emerson Electric is a reliable dividend payer, management was increasing the dividend in very small steps in the last few years – probably just to maintain its status as a dividend king. In many cases, the dividend was just increased by one cent (or sometimes even just half a cent), and in the last five years the dividend increased only with a CAGR of 1.37%. But with the payout ratio being only 42% (declining from over 80% in 2017) right now, Emerson Electric should be able to increase the dividend at a higher pace again (in line with earnings per share growth). Right now, Emerson Electric is paying a quarterly dividend of $0.515, which is resulting in a dividend yield of 2.6%.

Emerson Electric Annual Report 2021

Growth

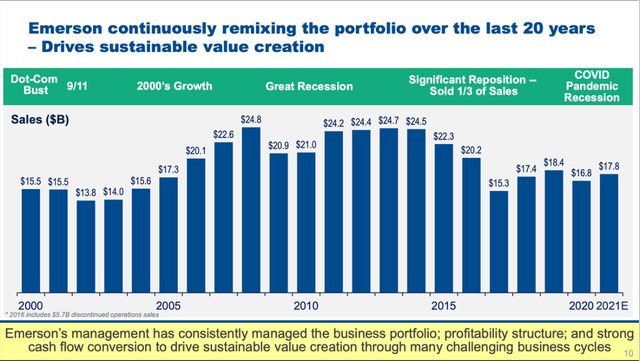

And there is a reason why Emerson Electric was increasing the dividend only in very small steps in the last few years – the company was really struggling to grow its top line over the last two decades. Or, as management put it: Emerson Electric was continuously remixing the portfolio over the last 20 years. And between 2000 and 2021, sales did not increase much – from $15.5 billion in 2000 to $18.2 billion in 2021 resulting in a CAGR of 0.77%.

Emerson Electric 2021 Investor Conference

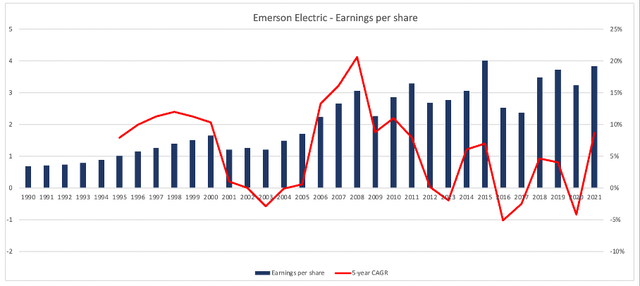

But while Emerson Electric was clearly struggling to grow its top line in the last two decades, the company could increase earnings per share with a solid pace. By focusing on the company’s profitability structure and margins, Emerson Electric increased earnings per share with a CAGR of 5.68% in the years between 1990 and 2021.

Improving Picture

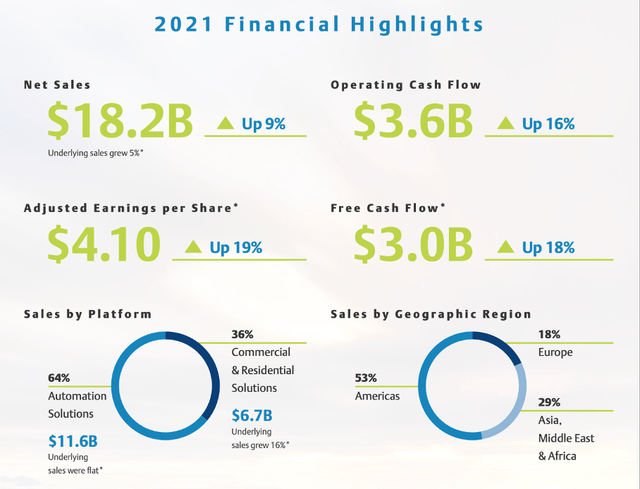

Emerson Electric was clearly struggling in the last decade to improve its top line (and bottom line), but the picture seems to improve again. When looking at fiscal 2021 results, we can see high single-digit or even double-digit growth rates, with net sales increasing 9% YoY, adjusted earnings per share increasing 19% YoY, and free cash flow increasing 18% YoY.

Emerson Electric Annual Report 2021

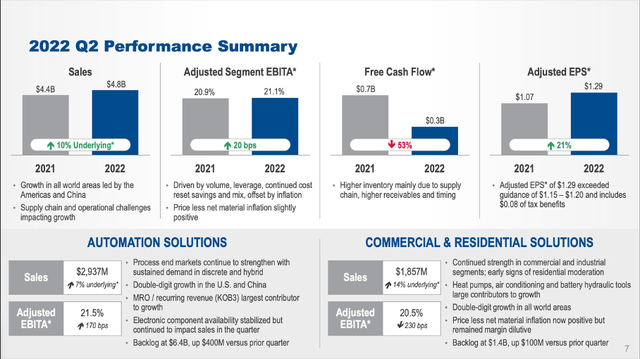

And when looking at second quarter results for fiscal 2022, growth could continue. While net sales increased from $4,431 million in Q2/21 to $4,791 million in Q2/22 resulting in 8.1% year-over-year growth, diluted earnings per share declined from $1.13 in the same quarter last year to $0.93 this quarter (reflecting a decline of 17.7%). However, when looking at adjusted earnings per share we see an increase from $1.07 in Q2/21 to $1.29 in Q2/22 – resulting in 20.6% year-over-year growth.

Emerson Electric Q2/22 Presentation

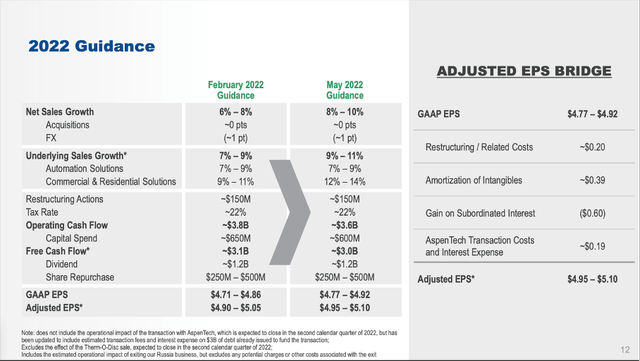

And when looking at the guidance for fiscal 2022, the company is expecting these strong growth rates to continue at least for the next two quarters. While the company is now expecting net sales to grow between 8% and 10% (with underlying sales growth being between 9% and 11%), GAAP EPS are expected to be between $4.77 and $4.92 (resulting in 24.9% to 28.8% YoY growth) and adjusted earnings per share are expected to be between $4.95 and $5.10 (resulting in 20.7% to 24.4% YoY growth). Free cash flow is expected to be around $3 billion.

Emerson Electric Q2/22 Presentation

And analysts seem quite optimistic for the next few years. Between fiscal 2021 and fiscal 2026, analysts are expecting earnings per share to grow with a CAGR around 9% and are expecting earnings per share to be around $6.30 in fiscal 2026.

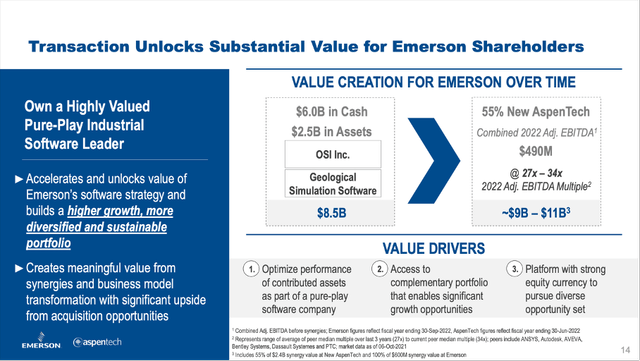

Growth by Acquisition: Aspen Technology

One way for Emerson Electric to continue growing is by acquisitions. And while we are not talking about an acquisition, the deal with Aspen Technology, Inc. (AZPN) that was announced last year might be an example. Aspen Technology is a provider for enterprise asset performance management, and the company’s goal is to accelerate the digital transformation by optimizing assets to run safer, greener, longer, and faster. The company is especially addressing complex environments like chemical, mining, or pharmaceutical businesses. Emerson Electric is contributing not only $6 billion in cash to the new business (as every Aspen Technology shareholder received $87 per share and 0.42 shares in the new company for every share they owned before) but also Emerson’s OSI Inc. and geological simulation software assets (which are worth about $2.5 billion). In return, Emerson Electric will get a 55% stake in the new AspenTech company.

Emerson Electric Aspen Technologies Presentation

The new AspenTech is expected to generate more than $1 billion in annual sales and about $500 million in adjusted EBITDA as well as $360 million in free cash flow. Additionally, both companies are expecting about $110 million total EBITDA from synergies in 5 years from now.

The new company is targeting the high-growth $60 billion industrial software segment and the U.S. annual manufacturing investments in software were clearly outpacing the investments in property, plants, and equipment. Since 1990, the investments in software were growing with a CAGR around 10%.

Growth by Share Buybacks

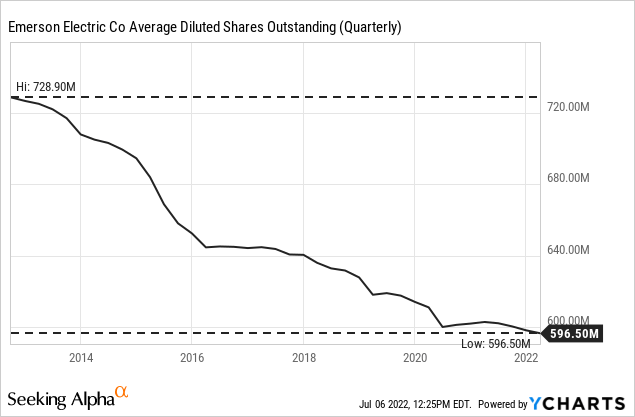

Another way for Emerson Electric to grow its bottom line is by using share buybacks. In the past, share buybacks have always been an important tool for Emerson Electric and during the last ten years, the company decreased the number of outstanding shares about 2% annually.

In its guidance for fiscal 2022, management also announced that Emerson Electric will spend about $250 million to $500 million on share buybacks again. However, Emerson Electric could spend even more money on share buybacks. On March 31, 2022, Emerson Electric had $6,929 million in cash and cash equivalents on its balance sheet, which can be used, for example, to repurchase outstanding shares. And considering the current market capitalization of $48 billion, this is enough to repurchase one out of every seven outstanding shares.

Of course, Emerson Electric can also use the cash in different ways – for example repaying $2,762 million in short-term and $8,203 million in long-term debt. However, when a business is struggling to grow, share buybacks are a good way to spend the generated free cash flow. Especially as the stock seems to be rather undervalued right now.

Intrinsic Value Calculation

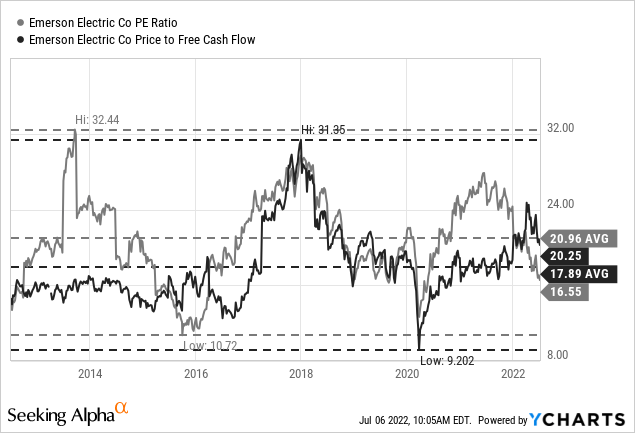

Emerson Electric is certainly not an exciting, high-growth business. However, that does not mean it can’t be a great investment. And when looking at the simple valuation metrics, Emerson Electric seems rather cheap right now. The stock is trading for a P/E ratio of 16.55 and as the P/E ratio was constantly getting lower in the last few months, Emerson Electric is now trading below the average P/E ratio of the last 10 years (which was 20.96). And although Emerson Electric was clearly trading for lower P/E ratios in the last 10 years – in 2015 for example it was trading for only 11 times earnings – the stock seems reasonably valued.

When looking at the price-free-cash-flow, the picture is a bit different as the P/FCF ratio increased during the last few months. Right now, Emerson Electric is trading for 20.25 times free cash flow, which is above the average P/FCF ratio of the last ten years (17.89).

And to determine an intrinsic value for which we can buy Emerson Electric, we are once again using a discount cash flow calculation. As basis, we are using the estimated free cash flow of $3 billion for fiscal 2022. When taking 597 million outstanding shares and a 10% discount rate, Emerson Electric must grow free cash flow about 4% annually to be fairly valued right now. And 4% growth certainly seems to be achievable, as 2-3% growth could already stem from share buybacks and another 2% growth could stem from top line growth or margin improvements. And when being a little more optimistic and assuming a 5% to 6% growth till perpetuity (5.5% growth should be achievable for Emerson Electric), we get an intrinsic value of $111.67.

Recession

While we have looked at several ways how Emerson Electric can continue to grow – using share buybacks, making acquisitions – and calculated an intrinsic value for the business, it seems like we have overlooked one important aspect that should get attention – the potential upcoming recession. This is especially true for Emerson Electric as an industrial company, as these kinds of businesses are seldom recession-proof.

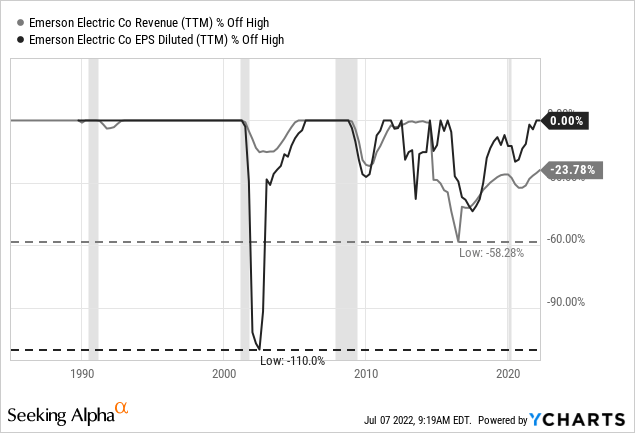

When looking at the last 40 years and the different recessions, we can’t really claim that Emerson Electric is recession-proof. Especially in the recession during the early 2000s and the Great Financial Crisis we see the business clearly being affected by the recession. Especially after the recession in the early 2000s, earnings per share declined extremely steep. And of course, not every recession was the same, and the COVID-19 recession as well as the recession in the early 1990s had only a small effect on revenue and earnings per share.

However, we should be careful – especially when looking at revenue. As mentioned above, Emerson Electric restructured its business quite often, which could also have resulted in a declining revenue. And we must assume that a severe recession will impact Emerson Electric in the coming years, and this should also be reflected in our intrinsic value calculation. We use similar assumptions as in the calculation above but assume a 20% decline in fiscal 2023 followed by a 20% increase in fiscal 2024 and then 5% to 6% growth till perpetuity. When using these assumptions, we get an intrinsic value of $96.49 for the stock, and Emerson Electric remains rather undervalued.

Conclusion

We should not expect spectacular returns for Emerson Electric in the years to come as it rather falls into the category of boring stocks. Emerson Electric is not an exciting stock or company, but a solid investment and one that is letting you sleep well at night. And the stock seems to be undervalued a bit – even when assuming another recession that will have a negative effect on the business.

Source link