[ad_1]

Robert Way/iStock Editorial via Getty Images

Thesis

The market is valuing PVH at ca. half of what it has been trading at for the past +5 years. The longer-term business prospects and expected cash flows are, however, no worse now compared to that period.

Fears over a cutback in consumer spending, potential stagflation, etc. are not to be ignored and might materialize. The market reaction to such uncertainties has, however, been too severe, which has created an attractive asymmetry in risk/reward.

PVH in brief

PVH Corp. (NYSE:PVH) is the owner of two iconic apparel brands: Tommy Hilfiger and Calvin Klein. These brands make up >90% of total company sales and EBIT. The <10% balance comes from less-known apparel brands which are sold through various wholesale channels.

Introduction

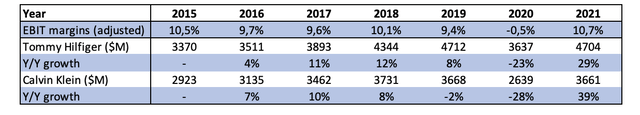

Tommy Hilfiger and Calvin Klein have both grown sales and maintained a stable margin level over many years:

Note: Margins are for PVH (Table created by author from 10-K data)

The factors that drove this trend are still present, and a continued ability to generate cash is therefore expected.

PVH and most of its international apparel peers outsource production to third party manufacturers. PVH, for example, outsources apparel production to ca. 1100 different manufacturers. Ralph Lauren (RL) outsources to ca. 300 different manufacturers and peers like Hugo Boss (OTCQX:BOSSY), Capri Holdings (CPRI), Levi Strauss (LEVI) (and many more) run a similar strategy. This decreases the significance of cost advantages between larger and smaller apparel companies. The price consumers are willing to pay for the brand therefore grows in importance in the margin level equation.

PVH’s long-term history of profitability and sales growth means that the TH and CK brand have been strong enough to attract consumer demand at a price where it has been lucrative for PVH – c. 10% EBIT margins. Many missteps over many years would have to be made in order to impair the TH and CK brand to a point where the historical trend would break (in a normal environment).

With the 10% EBIT margin guidance for FY23 and no brand deterioration from FY22, I assume that PVH currently has the same profit-generating abilities that it possessed in the past. A strong brand is not easy to build nor is it easy to destroy.

That is my way of saying: I do not see anything fundamentally different (in a bad way at least) about PVH now vs prior years. Management shares this view, and I, therefore, do not expect fundamentally worse business results in a normal economic environment going forward.

Base case

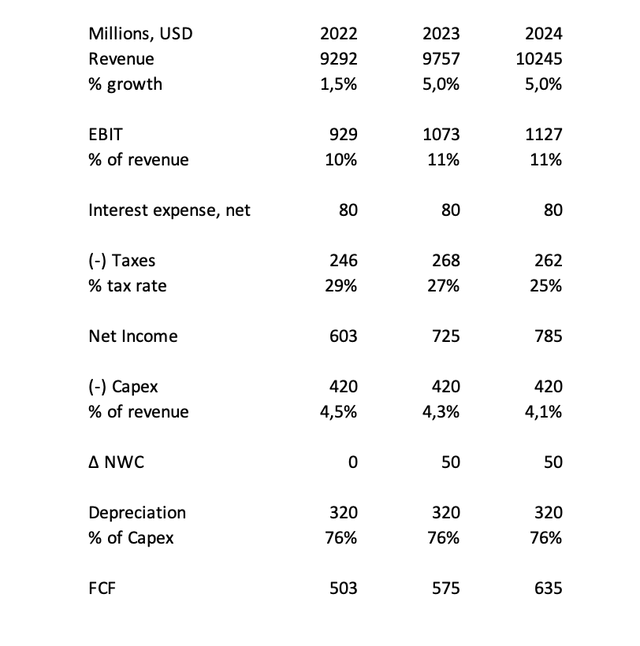

In a base case scenario with the above-mentioned information in mind, I expect something like:

The tax rate assumption is based on comments from the 2022 Investor day and the Capex amount is based on the 2022 investor day presentation. I have assumed a 1 percentage point increase in EBIT margins for 2024 as they increase penetration in higher margin sales channels (Digital DTC and other DTC) and lower penetration in their wholesale value channel. PVH themselves have set out a 15% EBIT margin goal for 2025 – meeting this goal is not required for the investment to work out as I will illustrate. An 11% EBIT margin works just fine.

While I do not have the numbers needed to calculate the margin change in relation to channel mix development, an increase in DTC penetration is mentioned as the primary driver of their 500bps EBIT margin expansion target. It seems logical that, e.g., O&O digital sales will increase in the mix and that wholesale sales to B&M stores will decrease as mall traffic declines – thus, some improvement in profitability from a change in channel mix seems like a reasonable assumption.

Base case in valuation perspective

Using the base case assumptions, I get 2024 earnings of $785mm. There were 68.7mm weighted average diluted shares outstanding as of Q1 2022. This results in 2024 diluted EPS of $11.43 – this ignores the cash accumulation in preceding years and a shareholder-friendly capital allocation policy. This should not be ignored, so:

PVH’s capital allocation priorities are as follows: 1) invest for growth; 2) maintain strong balance sheet; 3) return cash to shareholders.

Investing for growth – 1) – is accounted for through the elevated Capex level. If we assume a 20/80 split between 2) and 3), and ignore cash generated during 2022, we get $240mm of cash going to principal payments and $970mm going towards share buybacks (the dividend is insignificant at c. $10mm per annum).

If we assume an average share price of $85 in the period of the buybacks, the share count at the end of 2024 would be c. 57mm. Using the new share count, EPS would be $13.77 – this is not 100% correct as I use the ending share count in the denominator instead of the average, but you get the idea.

Historical 1-year forward P/E ratios were around 14x in the 2014-2019 period, then lowered to the 10x range from 2019-Covid. If we apply a forward multiple of 9 on 2024 EPS of $13.77, we get a share price of $123. Given the 1-year forward valuation, the $123 per share would then be for the end of 2023. This would result in 98% upside from the current $62 per share over 1.5 years for an IRR of 58%.

Another note, net debt is lower now compared to historical levels – the P/E multiple of 9 that I used is, therefore, even more conservative.

Another relative valuation thought

PVH acquired Tommy Hilfiger in 2010 and Warnaco – the then licensee of Calvin Klein Jeans and Underwear – in 2013. Both firms were acquired for $3.1B each. Today ca. 10 years later, PVH’s EV is just $5.7B.

The private market transactions were done at an EBITDA multiple of 9x for Tommy Hilfiger and an 8x EBITDA multiple for Warnaco. If we value PVH at these same multiples today, that is 8.5x estimated 2022 EBITDA of $1.25B, we get $10.63B in enterprise value. Subtracting the net debt amount of $1.5B results in an equity value of $9.13B vs the current $4.2B – that is an upside of 117%.

Why does this opportunity exist?

It seems odd that we are able to buy a company that is just as good fundamentally as it has been for the past +5 years at half the price. A fine and already proven business earning ca. 12% on equity capital in an understandable industry and with a shareholder-oriented management should not trade at 5.8x next year’s earnings (which are not abnormal earnings or anything of the sort).

The reason we get this opportunity is, of course, because the market fears and thus discounts the potential for an economic contraction, inflation, rising interest rates, supply chain difficulties – you name it. How these factors develop will certainly have an impact on PVH in the short-term, but the degree of that impact is not easy to estimate.

Thoughts on potential outcomes

The base case scenario means that similar results to what has been achieved in the past will continue, and thus a similar business value should be assigned – that is, ca. 2x from current prices. The valuation re-rate would occur when the market acknowledges that PVH continues to have a cash flow profile similar to what has been seen in the past. In other words, it will happen when it is understood by the market that the risks that are currently being heavily discounted into the price won’t materialize in the expected way. That could take a couple of years, but it will most likely take less time. If business results follow my base case numbers somewhat, I expect to see a re-rate starting before year end 2023. This would result in the ca. 60% IRR over 1.5 years that I outlined above.

The risk that is being heavily discounted into the stock price is the risk of short-term declines in business results if the world economy worsens enough for that to happen. I note that the Great Financial Crisis a decade and some ago had a minimal impact on most apparel companies. If, however, we end up in a scenario more severe for apparel companies than during the GFC, the time it would take to reach the base case results and returns would increase. The length of the increase depends on how long it would take for either the economy or for investors views on the economy to normalize.

So when thinking about a bear case, I would think about for how long the economy would be at a state where business results would be very bad. The eventual outcome would still be the same but the IRR would have to be adjusted based on thoughts about the above.

I will note a thing though: Given the 2x upside (and potentially more) on normalized business numbers, a bad economic environment would have to be both very bad and also very lengthy for it to result in a bad IRR from the current share price. In other words, a lot of bad is already baked into the share price.

To give an idea: If inflation cools down at the cost of consumer spending, the investment will work out just fine. A severe cutback in consumer spending causing a 20% sales decline for PVH in 2023 would not make the current share price of $62 pricy. If we cut 2023 earnings estimates by 35% (to account for some operating leverage), we get to $470mm of earnings. Assuming an average share count of 63mm in 2023, we get to $7.5 EPS. At a trailing P/E multiple of 10x, that is a $75 share price. From that point, an improvement in the economy would eventually happen and more upside would be realized.

One can play around with different scenarios and draw a conclusion.

Concluding thoughts

I cannot know anything for sure, but the risk/reward profile seems to be in my favor at $62 per share. In an environment anything close to “normal,” the upside is very compelling. In an environment much worse than “normal,” any downside would be fairly limited given what is already baked into the stock price.

I think the odds are good, and I, therefore, view PVH as a buy.

Source link