[ad_1]

Karlis Dambrans/iStock Editorial via Getty Images

Thesis

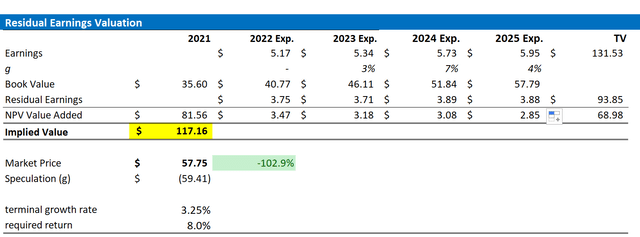

Samsung stock (OTC:SSNLF) is down some 30% YTD, in line with the performance of most international equities. However, as compared to the general market, SSNLF looks very cheap. In fact, now trading at a one-year forward P/E of x8.5 and EV/EBITDA of x2.9 there is a strong case to be made that Samsung Electronics is a bargain. At least, this is what I strongly believe. Based on a residual earnings framework, which I anchor on consensus analyst EPS estimates, I calculate a fair implied share price of $117.16/share and thus >100% upside.

A Quick Company Overview

Samsung is one of the world’s leading electronics companies with a strong market position in semiconductor manufacturing, industrial electronic equipment and consumer products such as smartphones, tablets, personal computers, televisions and home appliances. In addition, Samsung also makes internet network systems and telecommunications equipment. That said, there are five major business segments: (1) IT and Mobile Communications, which accounts for 40% of sales, (2) Semiconductors with over 25% of sales, (3) Consumer Electronics with approximately 20% of sales, (4) Display Products, over 10% of sales, and (5) Harman with nearly 5% of sales. From a geographical perspective, Samsung is a true global player: North America is the company’s largest market with about 35% of sales, followed by Europe with nearly 20%, and China, Asia/Africa, and South Korea contributing another 15% each.

Amazing Fundamentals

Samsung’s business fundamentals are highly attractive. The company is writing record revenues and profits. In 2021 the company generated $244.3 billion of sales, which represents a 20% increase as compared to 2020. Based on a 12% margin, Samsung achieved a net-income of $30 billion, or $5.02/share. Cash from operations was even more impressive: $56.9 billion. Also, Samsung’s Q1 2022 doesn’t indicate any slowdown. For the first three months of 2022, the company generated $64.5 billion of revenues and recorded a net-income of $8.1 billion.

Equally impressive is the company’s balance sheet strength. As of Q1 2022, Samsung held $104 billion of cash and liquid investments and only $12.9 billion of total debt. Thus, the >$90 billion should imply M&A optionality and potentially enormous shareholder distributions. For reference, Samsung’s market cap is about $270 billion.

I believe Samsung’s strong business fundamentals are sustainable. Even though the global economy might see a recession in 2H 2022/1H 2023, challenges are likely temporary. On a long-term horizon, investors should not forget that Samsung is poised to benefit from secular growth trends in semiconductors, telecommunications, and digital convergence technology. Moreover, Samsung’s strong technology in both logic and memory chip should give the company a leading position in the long-term logic and memory integration trend. That said, analysts agree with my bullish market thesis. According to market consensus estimates, revenues for 2022, 2023 and 2024 are expected at $244 billion, $257 billion and $275 billion, which would x2 GDP growth. Respectively, EPS are estimated at $5.17, $5.34, and $5.73. (Source: Bloomberg Terminal, July 5th)

Residual Earnings Valuation

So, if analyst consensus is right about SSNLF’s business forecast, what could be a fair per-share value for the company’s stock? To answer the question, I have constructed a Residual Earnings framework and anchor on the following assumptions:

- To forecast EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise.

- To estimate the cost of capital, I use the WACC framework. I model a three-year regression against the S&P 500 to find the stock’s beta. For the risk-free rate, I used the U.S. 10-year treasury yield as of July 05, 2022. My calculation indicates a fair WACC of 8%.

- To derive SSNLF’s tax rate, I extrapolate the 3-year average effective tax-rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply expected nominal GDP growth plus one percentage point to a favorable growth outlook.

- I do not model any share-buyback-further supporting a conservative valuation.

Based on the above assumptions, my calculation returns a base-case target price for SSNLF of $117.16/share, implying material upside of about >100%.

Analyst consensus EPS; Author’s calculations

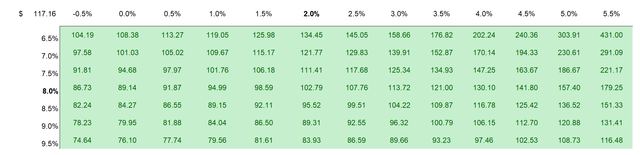

I understand that investors might have different assumptions with regard to SSNLF’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation. The risk/reward looks highly favorable to me. In fact, all tested combinations imply upside!

Analyst consensus EPS; Author’s calculations

Risks

I think Samsung is significantly de-risked at current valuation levels. However, investors should monitor a few risks and temporary headwinds: 1) slowing consumer confidence due to inflation outpacing wage growth and rising interest rates could cause a temporary slowdown in Samsung’s sales number of consumer electronics products; 2) loss of competitive advantage in various business segments such as PC and smartphones given accelerating industry competition; 3) higher than expected R&D investments in order to realize new product initiatives and/or to defend competitive positioning; 4) macroeconomic uncertainty relating to the monetary policy actions; 5) That said, much of Samsung’s share price volatility is currently driven by investor sentiment towards risk and growth assets. Thus, investors should expect price volatility even though SSNLF’s business outlook remains unchanged.

Conclusion

Samsung stock is one of the best buying opportunities that I have seen for a long time. Trading at x2.9 EV/EBITDA, the company is undoubtedly very cheap on an absolute valuation level. Considering a relative valuation versus x3.9-which is still very cheap-Samsung stock should have 35% upside. Personally, I like to value Samsung based on a residual earnings framework anchored on analyst consensus estimates. That said, I calculate a fair implied share price of $117.16/share, implying more than 100% upside. Strong Buy.

Source link