[ad_1]

vm/E+ via Getty Images

Investment Thesis

Crown Castle (NYSE:CCI) is a wide moat business in a growing industry. The company is rapidly expanding its fiber and small cell offerings. Management is committed to growing shareholder returns at a solid rate. I think the risk to reward is favorable at the current price.

Broad exposure to US communications infrastructure

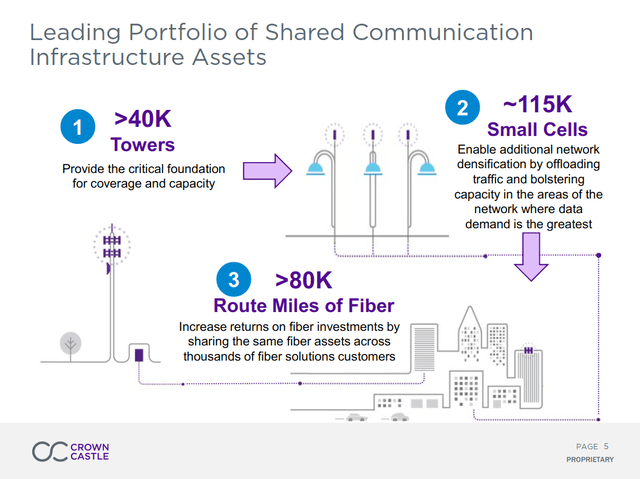

Crown Castle has a strong, diversified offering in the United States communications industry. The company leases towers, fiber, and small cells to a variety of wireless carriers and other institutions.

About two thirds of the company’s revenue comes from its towers. These are one of the company’s oldest offerings, and generate strong gross margins of 70%.

The rest of the company’s revenue comes from its fast growing fiber offerings. These encompass both direct fiber leasing and the company’s small cell network. These pieces of infrastructure are the most effective in high density locations.

Crown Castle FY 2021 Earnings Presentation

Crown Castle’s business has a very wide moat. Their infrastructure is critical to wireless carriers and also difficult to replace. Many municipalities have regulations that make it very difficult to build towers next to ones that already exist. This drives down churn and allows Crown Castle to negotiate better terms. The company has a 98% to 99% renewal rate in both of its core segments.

One of the biggest risks to the business is from customers that build their own infrastructure. But Crown Castle can lease the same towers to multiple customers. This gives the company exceptional pricing power.

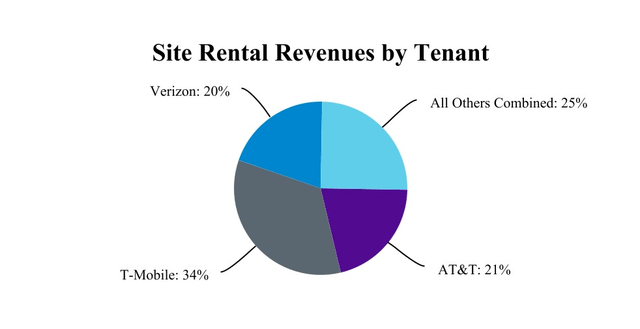

Crown Castle’s customers are typically more defensive businesses. AT&T (T), T-Mobile (TMUS), and Verizon (VZ) make up about three quarters of the company’s revenue. Internet connectivity is now a necessity of daily life for most people. These services are unlikely to experience significant drops in demand.

Most of Crown Castle’s remaining revenue is made up of similarly defensive clients. Clients in their enterprise fiber segment include universities, government institutions, and healthcare providers. These customers have lower churn rates, further decreasing the risk of Crown Castle’s business model.

Continued opportunities for growth

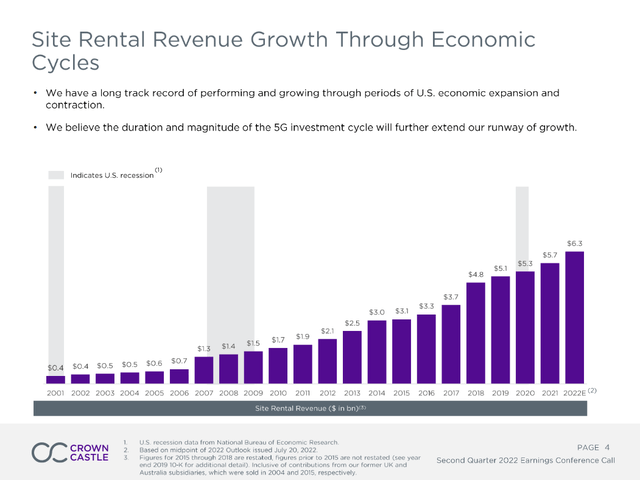

Crown Castle has a long history of growth in both economic expansions and pullbacks. The company has consistently added to its rental revenues for over 20 years. 5G has become the focus of the latest investment cycle. Wireless carriers have been committing to heavy capital investments across many years. This dynamic should reduce the risk during a recession.

Crown Castle Q2 2022 Earnings Presentation

The company is aggressively adding to its small cell network. About 55,000 to 60,000 small cells are in their network, and another 55,000 are under contract. The company plans to add 5,000 new small cells this year and 10,000 next year.

The economics of the small cell business are especially strong. One of Crown Castle’s competitive advantages is its ability to co-locate customers. The company can lease a tower or small cell to multiple customers at the same time. This increases the total returns for Crown Castle. It also allows them to pass some savings on to their customers. The company positions itself as the cheapest way to get access to strong 5G infrastructure.

At a recent investor conference, Crown Castle’s CFO described the returns from small cell projects.

We start with an initial return when we build these things from scratch, a greenfield project of 6% to 7% cash flow — annual cash flow divided by the capital we’ve put in at the very beginning. So our initial cash flow yields are 6% to 7%. Those grow to about 10% to 12% when we add a second tenant to that same system and they grow to 15% to 18% or so when we had a third tenant. Our cost of capital being somewhere in the mid to high single digits. That to our view, doing 2x to 3x our cost of capital in a business like ours that has such low risk is something that we think generates a tremendous amount of long-term shareholder return.

Demand for data is increasing. Wireless carriers will have to add new infrastructure to keep up with the extra traffic. A lot of this extra demand is in dense urban areas. Towers are impractical in these areas, so small cells are the primary solution. I see a lot of potential for continued growth in this business.

Consistently strong shareholder returns

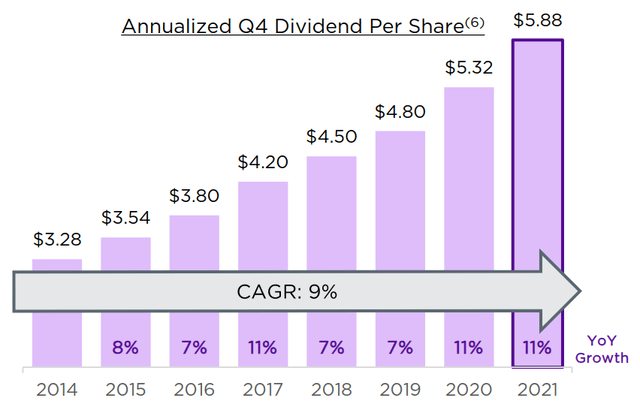

Crown Castle has a long term goal of 7% to 8% dividend growth per year. This is strong for a company that is already paying out billions in dividends each year. These dividends are well covered by the company’s top line growth. Crown Castle has consistently managed to convert 30% to 40% of its top line into dividends since the start of the 5G cycle in 2017.

Crown Castle FY 2021 Earnings Presentation

Inflation is a risk to the business. The company feels good about its ability to offset cost inflation. But their tower business has rental escalators of only about 3% annually. Their small cell business has lower escalators of about 1.5%. I believe that most indicators point to a decreasing rate of inflation. But you may want to be more cautious if you are worried about continuous elevated inflation.

A reasonable valuation for the risk

Crown Castle is trading at a forward P/AFFO of just under 25. This is a premium to many other 5G infrastructure plays. This is offset by their more consistent, lower risk business model.

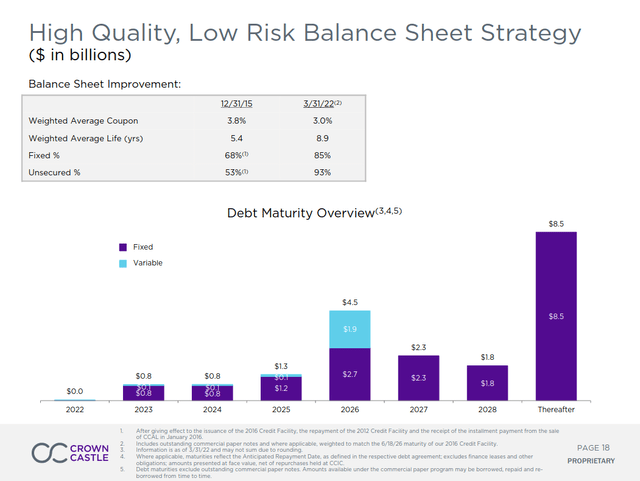

The company has about $63 in net debt per share. I think this is reasonable since their debt has extremely low interest rates and long maturities. Management used the low rate environment of the past few years to lock in low fixed rates for their debt.

Crown Castle FY 2021 Earnings Presentation

This is about the range I’d be willing to pay for a company growing its cash returns by high single digits. Based on management’s commentary, I think the returns could be even higher. 5G is driving major trends, such as rapidly growing wireless broadband internet services. Crown Castle is well positioned to benefit from growth in these new products and segments.

Crown Castle trades at a premium compared to other 5G and internet infrastructure stocks I’ve covered. But I believe it also has the lowest risk.

Final Verdict

Crown Castle is a solid company with a low risk business model. The business has reasonable opportunities for growth as 5G investment increases. Keep an eye out for Crown Castle’s third quarter report in October. That’s when management will issue guidance for the 2023 fiscal year.

I recommend buying this stock at the current valuation. I think shares are a good choice for investors looking for income or lower volatility.

Source link