[ad_1]

baona/iStock via Getty Images

OppFi (NYSE:OPFI) is a rare free cash flow generating company in a sea of loss-making fintechs. This has not stopped the Chicago-based subprime lender from being pulled into the market rout that has collapsed valuations and reduced the common share prices of some previously high-flying stocks to pennies. The company does face headwinds from regulation and recession, two factors that threaten to unwind the efforts being made by management to improve OppFi’s operational efficiency.

Management has tightened OppFi’s lending model, reducing its scoring parameters to shift its customer mix to individuals with higher credit ratings. This was in response to rising charge-offs which threatened the previous mode of operations and required the company to charge material interest rates on its ending receivables just to break even. These rates left the company vulnerable to regulatory action, most notably by California’s consumer finance regulator who accused the fintech of predatory lending practices and initiated legal proceedings as OppFi has apparently overcharged 38,000 Californians since the onset of the pandemic.

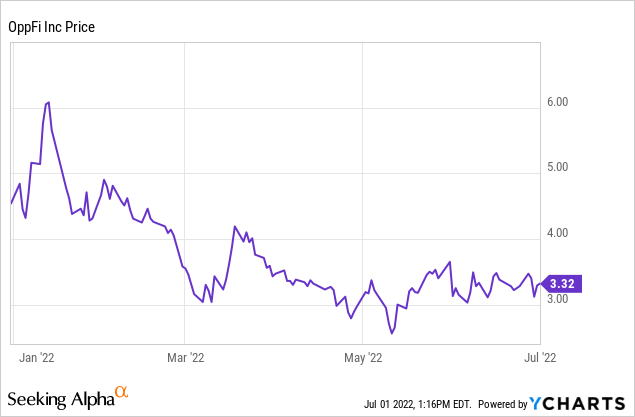

This has not helped a stock price down by 70% from its 52-week highs, albeit up from lows of $2.56 in May. Hence, continued shareholder value creation will be built on how well the company’s updated lending standards are able to reduce charge-offs and help withstand a possible recession.

The business model is not inherently revolutionary. There will always be a segment of the broader American population unable to get mainstream credit due to their lower-quality financial standing. This has and will continue to drive demand for subprime loans. Some OppFi bulls argue that a recessionary environment rather than acting as an impediment to growth would actually accelerate loan origination. Indeed, management during their fiscal 2022 first quarter earnings call stated that the current macro conditions of multi-decade inflation highs and rising interest rate is fueling demand for their products.

Strong Financials Despite Deteriorating Macro Conditions

OppFi last reported its earnings result for its fiscal 2022 first quarter which saw revenue come in at $100.7 million, an increase of 19.5% over the year-ago period but a miss of $5.38 million on consensus estimates. The company reported basic EPS of $0.08, a significant beat on estimates for a negative $0.03 EPS. This came on the back of $162.8 million in net originations, down sequentially from $186.7 million in the previous quarter but up by 63% from $99.8 million in the comparable year-ago quarter.

The company’s net charge-off rates climbed during the quarter with charge-offs as a percentage of average receivables rising to 56% from 53% in the fourth quarter of 2021. It was also up from 30% in the year-ago quarter. Whilst management stated this rise in net charge-offs was due to now discontinued segments, there was no insight into just how much of loan origination growth was being driven by these segments. So we might see a material slowdown in loan originations in the coming quarters as the effect of a reduced lending scope. Free cash flow during the quarter stood at $41 million, down incrementally from $42.4 million in the year-ago quarter.

OppFi did reaffirm guidance for fiscal 2022 revenue growth of between 20%-25% and an adjusted net income margin of 8%-12%. At a minimum, this would place revenue for OppFi’s 2022 fiscal year revenue at $418.8 million with net income at $33.5 million. This guidance could be derailed by a further deterioration of the economy. A number of economic forecasts, on a best-case scenario, are penciling in a heavy stagnation of the US economy this year. This likely drove management to get ahead of what could be even higher rates of charge-offs by discounting lending to riskier individuals. A move that could also help in the defense against the current regulatory blowback.

The company’s valuation currently stands at $366 million, placing its price to fiscal 2022 revenue multiple at 0.87x. A multiple below 1x reflects just how far investor sentiment towards OppFi has fallen.

The Future And Recession

The most pertinent concern I’d have against a position in OppFi remains the risk posed by a possible recession to the subprime consumer lending market. The macro environment is fast being characterized by falling consumer confidence and anemic economic growth, not ideal conditions for loans to be paid back.

Whilst the share buyback program and the recent inclusion in the Russell 2000 Index could act as a stimulus for a short-term boost to its common shares, the long-term outlook for the company will fundamentally be determined by just how rigorous its new lending standards are against what could fast become unsustainable charge-offs. This low revenue multiple does provide a margin of safety if the company is able to maintain revenue growth with stricter lending standards, so the shares might be a good addition for more risk-seeking investors.

Source link