[ad_1]

krystiannawrocki/E+ via Getty Images

Investment Thesis

Synopsys (NASDAQ:SNPS) is an electronic design automation company. The company has multiple catalysts which can push the stock’s upside, but I believe the increasing demand from China will act as a primary catalyst for the company. The company has also made one significant acquisition and announced an accelerated share repurchase plan. After considering the rising demand for the products and additional catalysts, I believe this stock should be a part of everyone’s portfolio. That’s why I assign a buy rating on the stock.

Company Overview

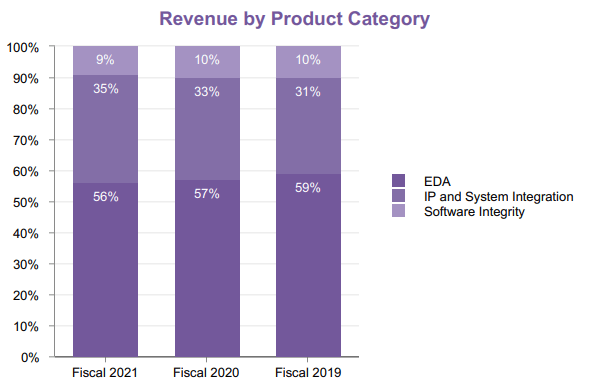

Electronic design automation business Synopsys is situated in Mountain View, California, specializing in silicon design and verification, silicon intellectual property, and software security. The company is a world leader in the provision of electronic design automation (EDA) software used by engineers to create and test integrated circuits (ICS), also referred to as chips. As an alternative to building their own circuits, engineers can employ semiconductor intellectual property (IP) products, which are pre-designed circuits, as elements of more significant chip designs. In a number of diverse industries, including electronic, financial services, automotive, medicine, power, and industrials, the company is also a market leader in providing software tools and services that enhance the security, quality, and compliance of software. The company earns 56% of its revenue from the EDA segment, while IP and System Integration contribute 35% to the company revenue. The software Integrity segment generates 9%of the total revenue.

SEC: 10-K Synopsys

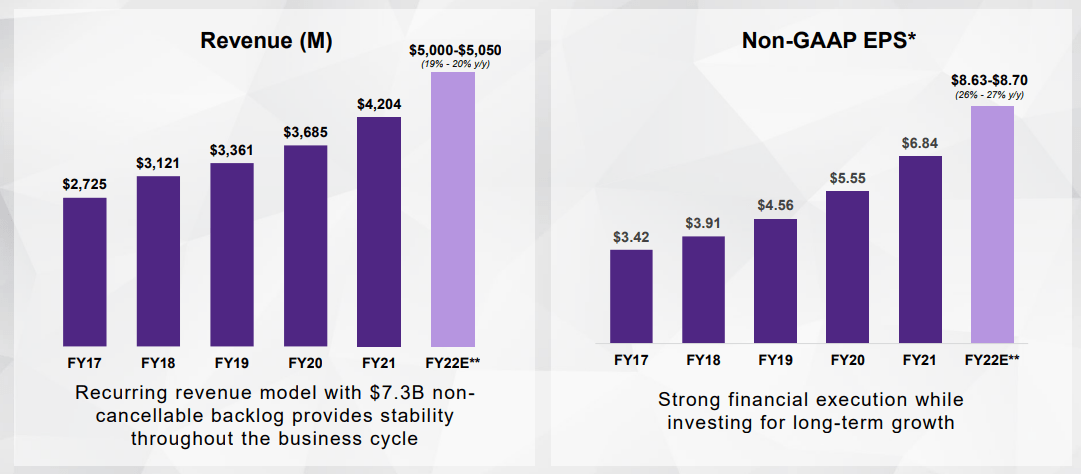

The company currently holds 3,400 United States and foreign patents and will continue to pursue additional patents in the future. The company’s revenue has grown with a 9.06% five-year CAGR, and the EPS has grown at 14.87% CAGR in the last five years.

Investor Presentation: Slide No. 42

Demand from China

Chinese clients may be spending more on Synopsys’ electronic design automation (EDA) software and other technologies to fast commercialize homegrown chips due to government incentives to produce semiconductors domestically instead of purchasing foreign-made ones. Most of China’s chips are still likely created using EDA software from US-based Cadence and Synopsys despite the country’s investments in homegrown semiconductors. China may produce the majority of the world’s chips by 2030, thanks to government subsidies totaling more than $150 billion that are scheduled to begin in 2014. This might increase Synopsys’ revenues for the year, but it could also be dangerous if there is a decline in business with China, which rose by 34% year over year in fiscal 2021 to account for 13% of overall sales. Pre-purchasing in China may also be boosting sales over worries about additional trade restrictions; while this effect may only be transitory, it will boost SNPS’ earnings in the coming quarters.

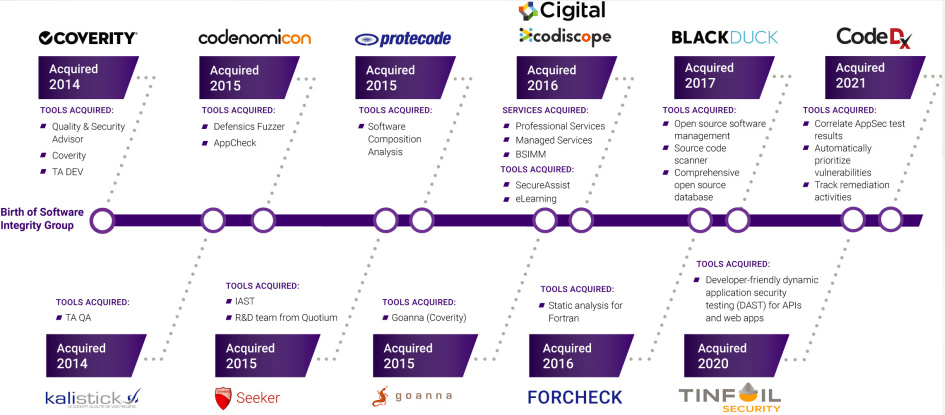

Acquisition of WhiteHat Security

The company has a long track record of strategic investment and acquisitions. The company aims to develop new products and enhance existing software and products through all of these acquisitions. In the last decade, the company has completed many significant acquisitions such as Protecode, Tinfoil, Codenomicon, etc. The purpose of these acquisitions is to attract new customers and capture the market share.

Investor Presentation: Slide No. 34

Recently, the company has added one more significant acquisition to this list. It has acquired WhiteHat Security, a provider of application security Software-as-a-Service (SAAS). This acquisition will provide key SaaS capabilities and market-segment-leading dynamic application security testing (DAST) technology which will make the company’s position stronger in security testing industry. The company has paid $330 million in cash. I believe this acquisition will be one of the key events for SNPs in FY2023 as it will expand SNPS’ operational capacity.

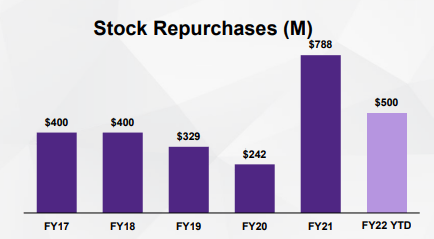

Accelerated Share Repurchase

Another reason to buy SNPS is a capital return to shareholders in the form of the share repurchase. The company has maintained a long track record of buybacks. Since 2017, the company has repurchased more than $2.5 billion worth of shares from its shareholder. Recently the company announced the repurchase of $200 million worth of Synopsys shares under the accelerated share repurchase program with a total of 523,000 shares buyback.

Investor Presentation: Slide No. 43

Financials

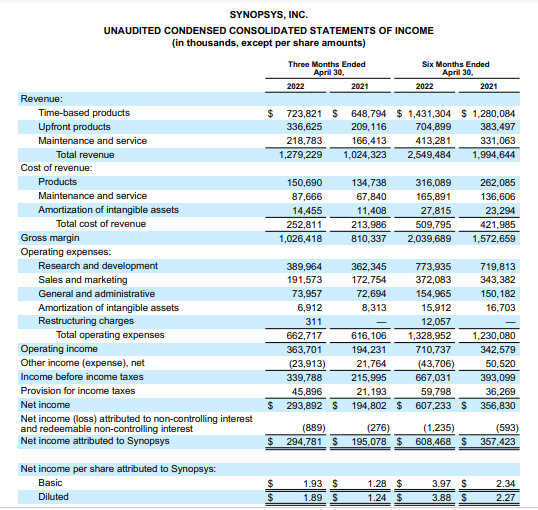

SEC: 10-Q Synopsys

Synopsys declared its Q2 2022 results ending April 30. The company reported total revenue of $1.27 billion compared to $1.02 billion in Q2 2021, a 25% jump. The main reason for this increase can be attributed to sustained demand growth in the semiconductor and system design segments of the company. I believe this segment’s demand will likely continue in FY22 and FY23. The company reported a net income of $0.294 as compared to $0.195 in the year-ago period, a stellar 51% increase. The increase in operating expense margins was the main reason for this income jump. The diluted EPS as per GAAP stood at $1.89, a significant 52.4% increase from Q2 2021 EPS of $1.24. Overall, the company reported strong Q2 2022 results with a positive outlook for the rest of FY22.

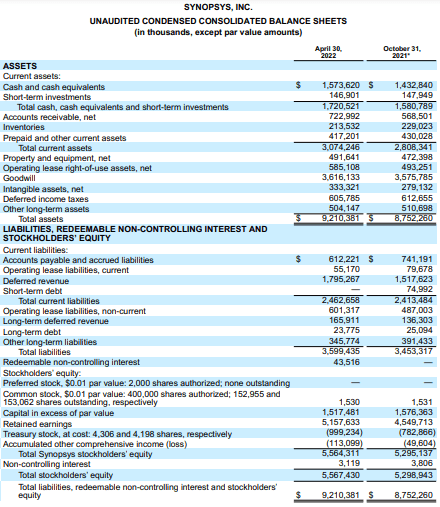

SEC: 10-Q Synopsys

The company reported a healthy balance sheet with total cash and cash equivalent of $1.57 billion and long-term debt of negligible $23.77 million dollars. It doesn’t have any short-term debt either. This is one of the best features of the company, its liquidity. As per my analysis, the deferred revenue needs to be managed by the company and execute those orders efficiently in the coming quarters to achieve its targets.

Aart de Geus, Chairman and CEO of Synopsys, stated,

Synopsys delivered an outstanding fiscal second quarter, exceeding our guidance targets with strength across all product groups and geographies. Based on strong first half execution and confidence in our business, we are raising our full-year targets substantially. Our financial momentum builds on three drivers: an unmatched product portfolio with groundbreaking new innovations, robust semiconductor and electronics market demand, and excellent operational execution. For fiscal 2022, we expect to grow annual revenue approximately 20% and pass the $5 billion milestone, drive further operating margin expansion, grow earnings per share by more than 25%, and generate approximately $1.6 billion in operating cash flow.

Risk Factor

High Competition: Synopsys operates in a highly competitive space with competition from resourceful companies like AMD, Cadence Design Systems and Rockwell Automation. This makes operational functioning very difficult as the company consistently has to provide products and services at competitive prices. Also, the company must invest heavily in R&D as the semiconductor is evolving at an incredible pace, and to maintain a competitive edge; the firm needs to keep innovating. This puts stress on the profit margins of the firm. Synopsys has efficiently managed this risk till now, but with the emergence of new competitors in the space, it is something that needs to be kept in check.

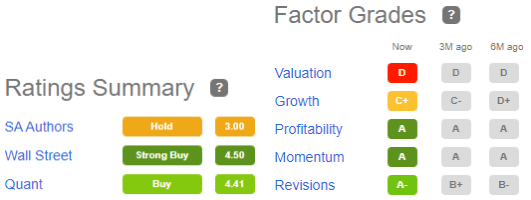

Quant Ratings

Seeking Alpha

The Quant Ratings align with my thesis of a buy rating for Synopsys. I want to point out the improvement in the growth factor grade, which has continuously improved over the last six months. I believe there is a lot of growth potential in the firm, given the robust demand it is experiencing even during the economic slowdown. Once the market conditions improve, the firm will gain fresh momentum. The company received a D rating for valuation, but with the solid future growth prospects, I believe the current price level is a good entry point.

Valuation

Synopsys has a market cap of $46.5 billion. The company is currently trading at $303.70; a YTD decrease of 16%. The company is trading at a P/E multiple of 47.28x. Synopsys is trading at a higher valuation, but I believe this valuation is justified given the company’s consistent performance and a strong future outlook. Also, the company is solid in terms of liquidity.

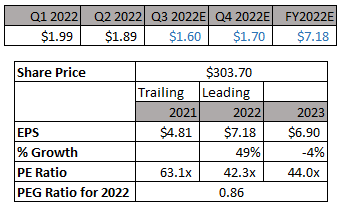

PEG Ratio Analysis by Author

I believe the estimates stated by management are conservative and the real EPS for FY 2022 will be in the range $6.80 to $7.18. The leading P/E multiple of the company is 42.3x which is very high, but I think if we consider the future prospect of the company, the company is currently undervalued. The PEG ratio (Leading PE divided by EPS growth) of 0.86 times the FY2022 justifies the future growth in stock price.

Conclusion

The company is a beneficiary of the rising demand from China and the company has also completed the strategic acquisition of WhiteHat Security which will provide key SaaS capabilities and market-segment-leading dynamic application security testing. Despite the high P/E multiple, the PEG ratio analysis indicates that the company is currently undervalued. After considering all these factors, I believe the company has a bright growth prospect ahead, and hence I assign a buy rating on the stock.

Source link