[ad_1]

MOZCO Mateusz Szymanski/iStock Editorial via Getty Images

Investment Thesis

CBRE Group (NYSE:CBRE) is a high-quality business that is uniquely positioned in the commercial real estate industry by operating as a pick-and-shovel play in the industry; it essentially functions as a royalty on the growth of others. It also operates relatively under-the-radar and has consistently grown revenue, earnings and free cash flow over the years.

The stock has fallen more than ~33% from its peak in December 2021, but the underlying business continues to grind on, which gives investors a good opportunity to pick up shares in a wonderful business at a fair price.

Background

Founded in 1906, CBRE Group is the world’s largest commercial real estate services and investment firm (based on 2021 revenue). It operates as a holding company and operates through the following segments:

-

Global Workplace Solutions: provides a suite of integrated, contractually based outsourcing services to occupiers of real estate (e.g., facilities management and project management); typically multi-year and multi-service outsourcing contracts (~62% of revenues).

-

Advisory Services: provides a comprehensive range of services globally, such as leasing services (property leasing), capital markets (property sales and mortgage services), property management and valuation services (~34% of revenues).

-

Real Estate Investments: includes investment services provided globally, development services in the US, UK and Continental Europe, and legacy office space solutions (~4% of revenues).

CBRE generates both stable, recurring (large multi-year portfolio and per project contracts) and more cyclical, non-recurring sources (commissions on transactions). Their revenue mix has become more heavily weighted towards stable revenue sources (~62% of revenue) and its dependence on cyclical property sales and lease transaction revenue has declined. In 2021, the company generated revenue from a diversified base of clients, including over 93 of the Fortune 100 companies.

The company’s main competitors are, among others, Jones LaSalle (JLL), Cushman & Wakefield (CWK), Colliers International Group (CIGI), and Newmark Group (NMRK). CBRE has over 105,000 employees and operates in over 100 countries.

Valuation

With 332m shares outstanding and a current price of ~$72, the market cap is ~$24b.

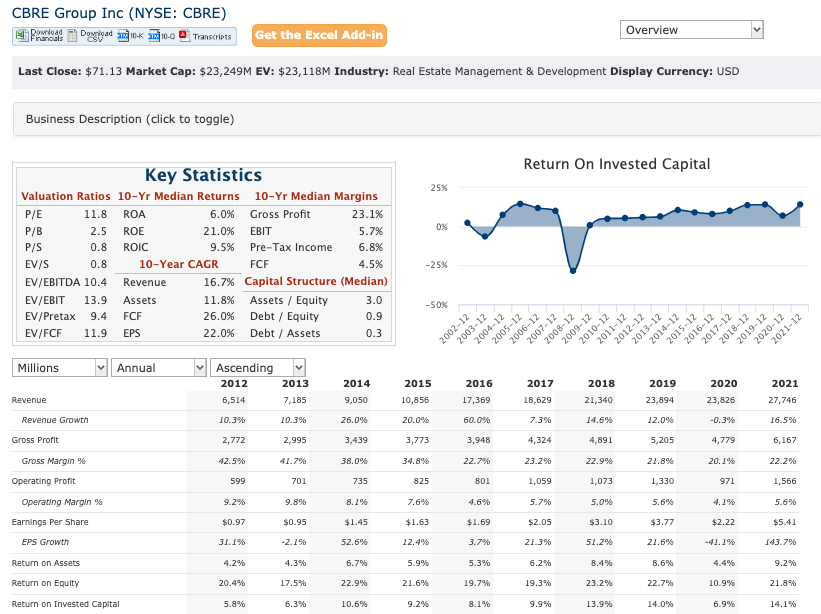

QuickFS (CBRE Group)

CBRE has consistently grown revenue, earnings and FCF over the past decade. 10-Year CAGRs:

-

Revenue: 16.7%

-

FCF: 26%

-

EPS: 22%

It seems that the company will earn between $4-5/share, so it is currently trading between 14-18x PE. For a company that has consistently demonstrated growth on every metric and earns >20% returns on equity, I would argue that CBRE is a high-quality business and is trading at an attractive valuation.

-

P/E: $4-5 per share, which puts the P/E at ~14-18x

-

P/B: 2.5x (not terribly relevant as CBRE is a real estate services company and has profitable operations, so it shouldn’t be valued on a liquidation basis)

-

EV/FCF: ~12x

-

P/S: 0.8x

-

Yield: no dividend

-

Leverage: not really leveraged, debt/equity of 0.9x

Since CBRE is a company of higher quality, it makes sense to value it based on its returns on equity as well and to consider more “qualitative” factors, such as the economic moat and underlying business model (think Buffett’s See’s Candies). CBRE has been consistently in the ~21% ROE range (keep in mind that average ROE is probably ~10-12%). If you assume that the return of an asset will approximate ROE, then CBRE is a clear high-quality business to hold for the long term (even if you pay up for it).

Underlying Business Model

The majority of its business is from contractually based outsourcing services to occupiers of real estate (Global Workplace Solutions segment) and generating commissions from providing services to real estate investors (Advisory Services segment). It’s harder to imagine a better business in the entire real estate ecosystem; in times of inflation, CBRE will be able to raise prices accordingly, all without having to worry about higher interest rates that plague the typical real estate investor. In short, CBRE’s business operates silently behind the scenes and is strategically placed in the industry.

For a similar business in the healthcare industry, check out my recent article on Charles River Laboratories: High-Quality Company At A Fair Price.

Catalysts

-

Share Repurchases: CBRE has been buying back stock, ~$185m in total in November/December 2021; a quick glance at the historical share count shows that it has been very static over the past 12 years, growing at a 0.13% CAGR (which is good, as shareholders are not being diluted)

-

Continued Execution: commercial real estate is an industry that will probably never go away and will continue to grind on as populations around the world continue to rise and demand more space to live, work, store/transport goods, etc.; as such, CBRE is perfectly positioned to benefit from that long-term trend

Risks

-

Low Insider Ownership: insiders own less than 1%, but the CEO does own ~$44m worth of shares, which is pretty high relative to his total compensation of ~$14m (or salary of ~$1m); normally I would like to see a higher percentage, but I think the quality of the business model outweighs the low insider ownership.

Takeaway

The best business is a royalty on the growth of others, requiring little capital itself. – Warren Buffett (1997 Email Exchange on Microsoft)

CBRE is uniquely positioned to benefit from the growth of the commercial real estate industry. In other words, the company benefits as a royalty on the growth of others (as the industry grows, CBRE will grow right alongside it without taking on much risk) and satisfies Buffett’s criteria for a “best business”‘; in this case, the growth of real estate, the increasing need to outsource related services, as well as the need for relevant advisory services.

The company operates quietly in the background with little need for advertising and is integral in the entire real estate ecosystem. Those are the high-quality businesses that one should yearn to own.

Based on the analysis above, I recommend a long position in CBRE with a holding period of a few years (maybe even forever). I have no idea what the stock price will do in the short term, but I would look to add more if it continues to decline, as I see the company having the ability to compound for many years to come.

Source link