[ad_1]

Scott Olson/Getty Images News

Introduction

It’s time to talk about a stock that offers a terrific valuation, a decent yield, high dividend growth, and the chances to be acquired. That company is Cboe Global Markets, Inc. (BATS:CBOE), the Chicago-based option exchange operator with a market cap of $12.1 billion.

The company is holding up very well as it benefits from high equity volatility and a business model that almost prints money. The company has a very high free cash flow yield and a valuation that suggests way more upside. Moreover, given the company’s characteristics and valuation, I believe that the company is likely to be acquired in the future.

In this article, I will share my thoughts on the company and explain why it’s an attractive dividend growth investment for investors seeking financial exposure.

Quality Dividend Growth

I own CME Group (CME), the world’s largest provider of equity, bond, and commodity futures. The reason why I’m interested in owning companies in the financial data & stock exchanges industry is that it’s like owning “the house.”

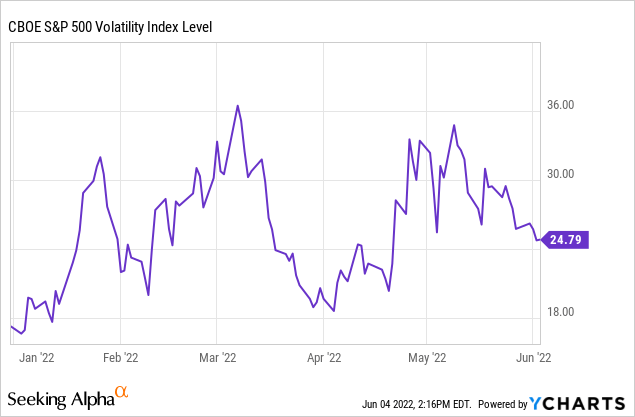

The beauty of companies like CBOE is the fact that as long as market corrections or recessions are short, they end up becoming big winners. After all, higher volatility is a blessing for them as it increases transaction volumes and, as a result, boosts income. A risk is prolonged recessions that drive away market participants, resulting in subdued volume on a prolonged basis.

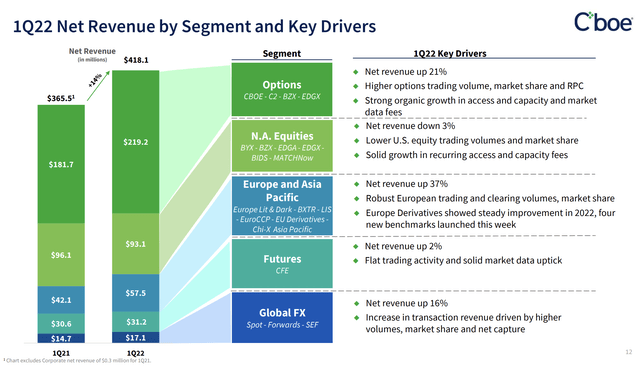

The company, which generates most of its money in options has had a tremendous year so far. In 1Q21, it saw 21% higher revenues in its options segment thanks to higher trading volume and a higher market share.

The same happened in its Europe and the Asia Pacific segment, which saw 37% sales growth, higher clearing and trading volumes, and a better market share. While North American equities were down a bit due to lower equity volume and market share, the company was able to grow total sales by 14.4%.

These numbers further improved as the market was hit by a wave of uncertainty in both April and May, causing the company’s own Cboe Volatility Index to spike.

It resulted in an average daily trading volume (“ADR”) of 10.7 million contracts in May. That’s 5% higher than it was in April and 18.7% above May 2021, as reported by Seeking Alpha. S&P 500 index options volume saw a record month with 45.5 million traded contracts in May.

Moreover, in its options segment, the company had a 33.0% market share in May. It started the year at 31.7%. In European equities, it had a 23.2% market share, up from 22.0% in January. That’s the highest number since August 2018.

As of April 29, 2022, the company expects total organic net revenue growth of 5% to 7% on a full-year basis.

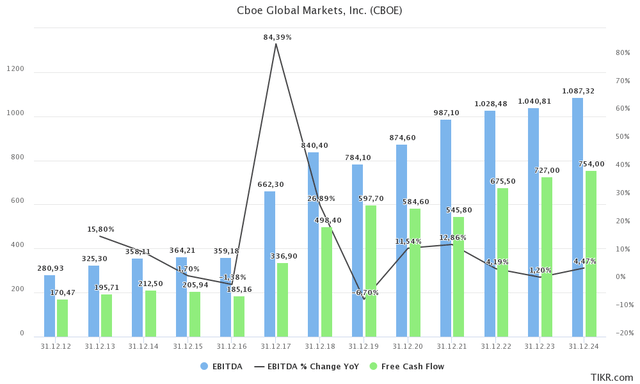

With that said, and to return to the main reason I’m writing this article: cash flow. Analysts believe that Cboe can generate more than $1.0 billion in EBITDA this year, more than at any point in its history. This would imply a 4.2% growth rate, which I believe it will beat. However, the company is also set to generate $675 million in free cash flow. This is based on $50 million in expected capital expenses, which is roughly the company’s own guidance midpoint.

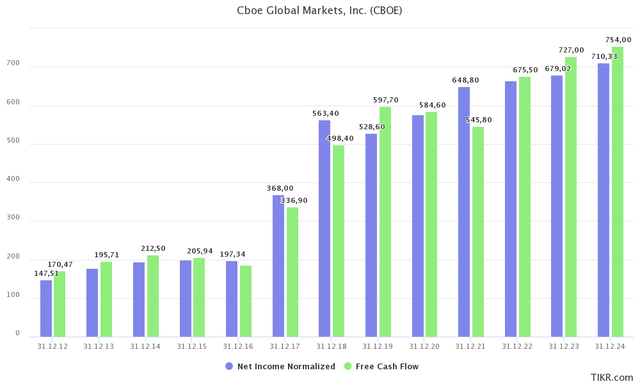

In the case of Cboe, we’re dealing with high-quality earnings as free cash flow is now consistently above net income. This is what Morningstar commented on this (emphasis added):

If net income is much larger than cash flow from operations, it’s a signal that the company’s earnings quality-the usefulness of earnings-is questionable. If cash flow from operations exceeds net income, on the other hand, the company may be much healthier than its net income suggests.

Next year, Cboe could do $727 million in free cash flow, which translates to a 6.0% free cash flow yield using its $12.1 billion market cap. What this means is that the company can, technically speaking, buy back 6.0% of its shares or distribute a 6.0% dividend in 2023 without using external funding or existing cash.

This obviously isn’t happening, but it shows how much value this company is generating. Some compare it to a money printer that does a lot of free cash flow while people are trading the market using Cboe’s options, equities, and services.

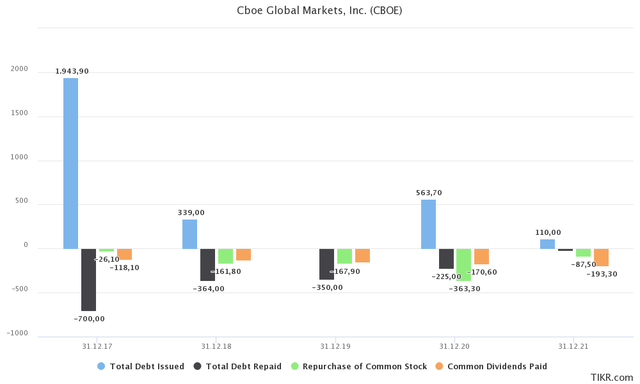

Over the past five years, Cboe has distributed cash via both dividends and buybacks. Overall a bigger percentage of money went towards dividends. Buybacks did not lead to an overall decline in shares outstanding. Between 2017 and 2021, the number of shares outstanding fell from 107.2 million to 107.0 million, which seems almost negligible, which is caused by acquisitions and stock-based compensation.

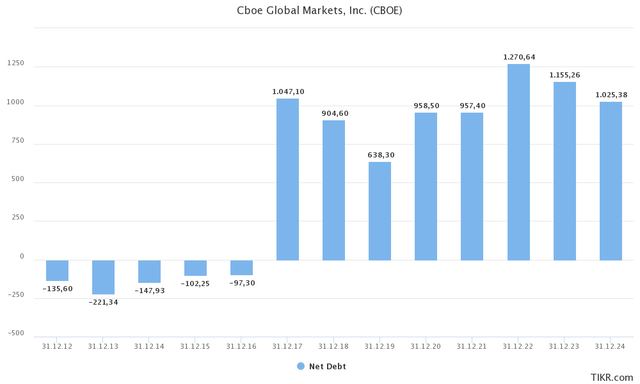

Moreover, the company has maintained a healthy balance sheet. In 2017, net debt went from negative net debt (positive net cash) to $1.0 billion after the $3.2 billion acquisition of BATS. The good news is that the net debt ratio is consistently below 1.0x EBITDA as the company uses free cash flow to reduce debt while its acquisitions quickly add to its top and bottom line.

Thanks to its healthy balance sheet, the company is actually able to use free cash flow to the benefit of its investors. If that were not the case, it would need more free cash flow to reduce debt.

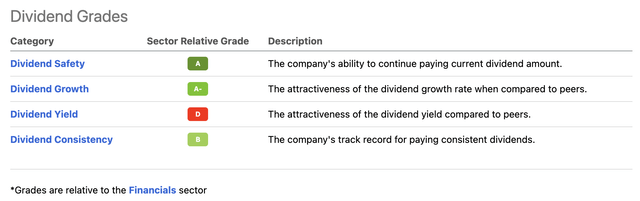

Using Seeking Alpha’s dividend grades, we see that the company scores high on everything except its yield. That’s no surprise as these scores are relative. In other words, Cboe is being compared to the financials sector. Financials include a lot of major and regional banks that have very slow growth and high yields. In this case, the dividend grade “D” looks worse than it actually is. The company pays a $0.48 quarterly dividend. That’s $1.92 per year and roughly 1.7% of its stock price. The S&P 500 is yielding 1.4%, so Cboe offers a small “premium.”

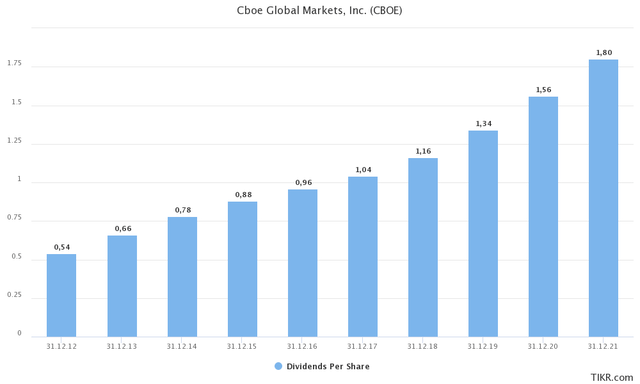

What I care about even more than its 1.7% yield is its dividend growth history. Over the past 10 years, dividend growth has averaged 14.9% per year. This number has now come down as the 5-year average is still 14.0%. The most recent hike was announced on August 19, 2021, when the company hiked by 14.3%. In other words, we should be close to another hike this summer, which I believe will be close to 14% again.

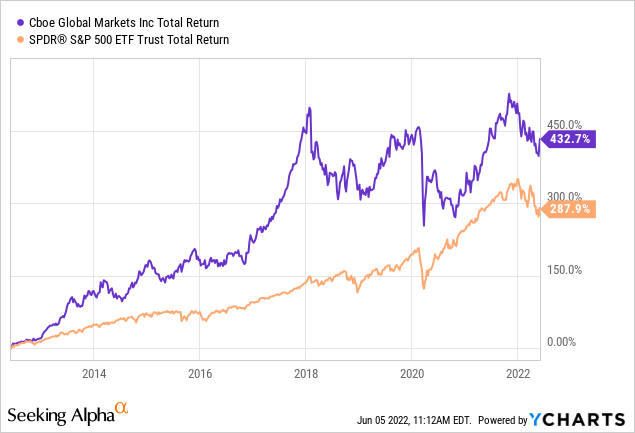

The qualities discussed in this article so far have allowed Cboe to outperform the market. Over the past 10 years, the CBOE ticker has returned 433% including dividends. The S&P 500 has returned 288% during this period, which isn’t bad either.

With that said, the valuation is way too cheap.

Valuation & Acquisition Potential

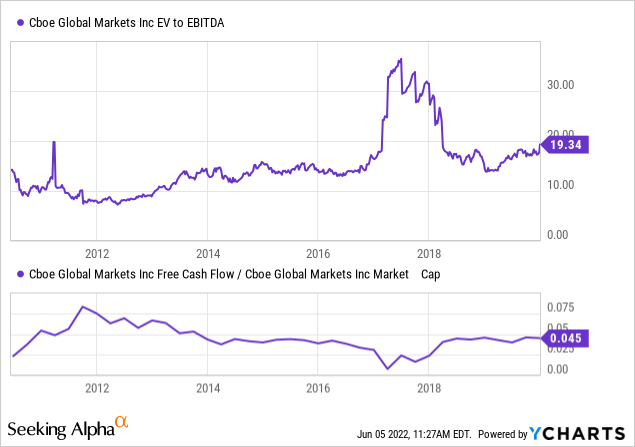

Using the company’s $12.1 billion market cap and $1.12 billion in expected net debt gives the company an enterprise value of $13.3 billion. That’s roughly 12.7x next year’s EBITDA estimate ($1.04 billion).

Using the historic valuation range (excluding the pandemic), we see that this valuation is the lowest since the first post-Great Financial Crisis pandemic years. Moreover, the implied 6.0% free cash flow yield is one of the highest in the past 10 years as well.

Based on this context, I’m bullish on Cboe because of its valuation, and because it’s a fantastic stock to generate long-term wealth through dividend growth, buybacks, and a business model that provides the cash necessary to achieve these goals.

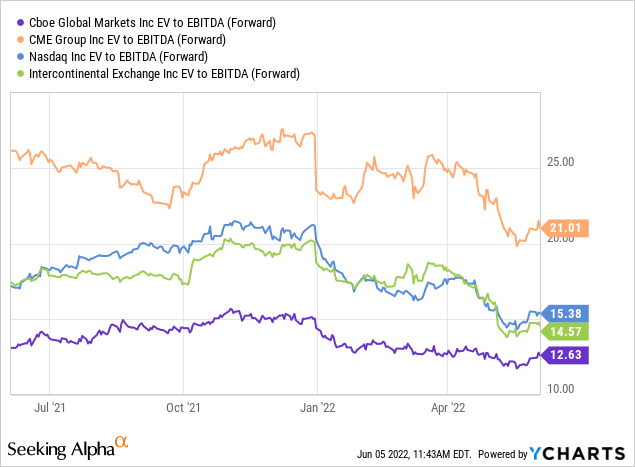

I also believe that Cboe is an acquisition target. Bigger peers like CME Group could buy it to add significant overseas equity and options exposure at a very attractive price. The company has the lowest valuation among its peers and using its ability to generate free cash flow would make servicing debt that comes with a potential acquisition relatively easy.

Last year in August, Cboe rallied as rumors were that CME Group was going to offer $16 billion to buy Cboe. It turned out to be wrong.

However, I think such a deal would make sense and if anything, this could be a case of “where there’s smoke there’s fire.”

The bad news is that predicting an acquisition is extremely tricky. It’s a bit like betting that a team will win the championship. It may happen based on its statistics versus other teams, but in the end, it often is a long shot. The difference is that betting on the wrong sports team ends up costing you your entire wager.

Reasons against a Cboe acquisition are the company’s own measures to grow. Last year, the company bought both ErisX and NEO to add Canadian and digital assets exposure to its business. Aggressive acquisitions (future M&A) could be a reason for potential buyers to wait before buying Cboe.

That said, I have never bought a company just because I expected it to be acquired. If anything, I think there is a good case for M&A and I see it as a bonus for long-term investors.

Takeaway

Cboe continues to impress me. Not only does it currently benefit from above-average volatility causing transaction volume to rise, but it is also way too cheap. The company is an attractive dividend growth stock capable of not only maintaining very high free cash flow but also raising free cash flow on a long-term basis.

Thanks to new acquisitions the company is constantly expanding its capabilities well beyond its roots in options.

Its dividend yield of 1.7% is higher than the S&P 500 yield, which is further supported by high dividend growth, which I expect to remain high on a long-term basis.

Moreover, as a bonus, I believe that Cboe is a very suitable M&A target in its industry. The company is cheap, generates a lot of free cash flow, and it offers larger peers the option to quickly expand their own product portfolio by buying the much smaller Cboe company.

Long story short, dividend growth investors looking to buy exposure in the finance sector are likely going to do very well on a long-term basis holding CBOE shares.

(Dis)agree? Let me know in the comments!

Source link