[ad_1]

curioustiger/iStock via Getty Images

As a value investor, I tend to stay away from companies that are trading at lofty multiples, especially if those companies are not exhibiting tremendous organic growth. Growth by means of acquisition can be appealing under the right circumstances, but even that brings with it certain risks. Having said that, I don’t mind paying a lofty sum for a company that is trading at high levels if it is a leader in its industry and generates strong and consistent cash flows that are growing over time. One great prospect that fits this description is American Tower (NYSE:AMT). As its name suggests, the company owns a large number of communication towers in various parts of the world. It leases these out to organizations that require the transmission of data in order to function. The company also is starting to focus a lot on the data center market, viewing it as another space that has similar characteristics to the ownership of its towers. Recent financial performance achieved by the company has been rather impressive and, while shares are pricey, they do look to be more or less fairly valued compared to similar firms. All things considered, I would rate the enterprise a soft ‘buy’ in this environment, reflecting my belief that it should generate some performance that exceeds with a broader market should experience for the foreseeable future.

Great signals

The last time I wrote an article about American Tower was in early July of this year. I lauded the company’s historical growth, growth it came about from both organic means and the acquisition of other businesses. Because we live in a data-centric world that is guaranteed to experience continued growth in the consumption of data, I felt as though the future for the business would be exceedingly bright. I was also impressed with how high quality the company was and the robust cash flows it generated, leading me to rate the enterprise a ‘buy’. Although not much time has passed since the publication of that article, the business has generated a positive return of 2.9%. Unfortunately, that is weaker than the 4.8% upside experienced by the S&P 500. But investing takes time and I believe the long-term trajectory of the company remains intact.

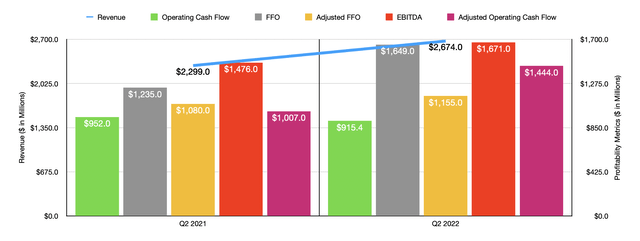

When I last wrote about American Tower, we only had data covering through the first quarter of its 2022 fiscal year. Today, we now have data covering through the second quarter. So far, financial performance achieved by the company continues to impress in most respects. To see what I mean, we need only look at revenue. During the quarter, sales came in strong at $2.67 billion. That represents an increase of 16.3% over the $2.30 billion generated the same time last year. This growth occurred across most of the company’s operations. But there were some bright spots to consider. The greatest upside involved the company’s data center operations. Sales in the latest quarter totaled $191.1 million. That’s far higher than the $2.5 million generated the same time last year. This rise was driven almost entirely by the company’s acquisition of data center firm CoreSite that closed in the final quarter of its 2021 fiscal year. It also saw a revenue increase throughout Europe to the tune of 104%, with sales climbing from $87.8 million to $178.8 million. The increase, management said, was driven in large part by $60.9 million in revenue from newly acquired or constructed sites, mostly related to its acquisition of Telxius Telecom S.A. The third fastest-growing part of the company involved its operations in Latin America. Sales there grew by 16% from 365.6 million to $425.2 million. This, management said, was driven mostly by nearly acquired or constructed sites and contractual escalations net of churn.

With revenue rising, profitability largely increased. Given the nature of the company, I don’t really put too much stock in the net income of the business. Instead, I like to look at alternative measures for cash flow. FFO, or funds from operations, grew by 33.5% from $1.24 billion in the second quarter of 2021 to $1.65 billion this year. On an adjusted basis, the growth was more modest, totaling 6.9% from $1.08 billion to $1.16 billion. Meanwhile, EBITDA for the company also expanded, climbing from $1.48 billion to $1.67 billion. The only metric to experience some weakness was operating cash flow. This fell from $952 million to $915.4 million. But if we were to adjust for changes in working capital, it would have risen from $1.01 billion to $1.44 billion.

For the 2022 fiscal year as a whole, the company should continue to benefit from organic growth and from the aforementioned acquisitions that it made. Though they won’t have an impact covering the entire year, certain deals the company has made should also help in the long run. For instance, in July of this year, the company partnered with Stonepeak, a leading alternative investment firm that specializes in infrastructure and real assets. That particular enterprise will acquire a 29% ownership interest in American Tower’s US data center business as part of a long-term strategic partnership. That particular deal involves a mix of common equity and mandatorily convertible preferred equity in a transaction worth $2.5 billion, implying an enterprise value on that business of $10.5 billion. And at the end of August, American Tower struck a deal with telecommunications giant Verizon Communications (VZ) to help facilitate Verizon as it continues to deploy its 5G network across American Tower’s US communication towers. Unfortunately, we don’t know what the terms of this particular agreement should look like.

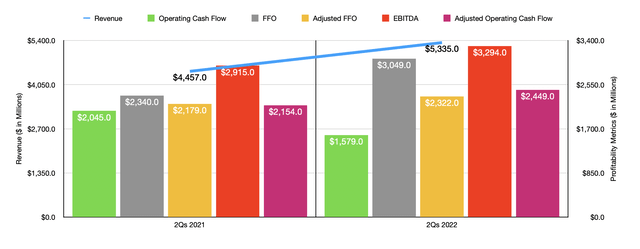

All things considered, management is expecting total property revenue for the 2022 fiscal year to come in at between $10.28 billion and $10.46 billion. At the midpoint, that would translate to a year-over-year increase of 13.8%. Adjusted FFO is forecasted to be between $4.455 billion and $4.565 billion, while EBITDA should come in somewhere between $6.535 billion and $6.645 billion. No guidance was given when it came to FFO or operating cash flow. But realistic assumptions would be $5.01 billion and $5.31 billion, respectively. As for adjusted operating cash flow, that should come in somewhere around $5.13 billion. To put in perspective just how much cash the company can spin off, consider that capital expenditures, excluding those dedicated to discretionary growth, are forecasted to be around $1.14 billion. Using the adjusted operating cash flow figure for the company, this would imply excess cash flow for shareholders of $3.99 billion that could be used for anything management wants.

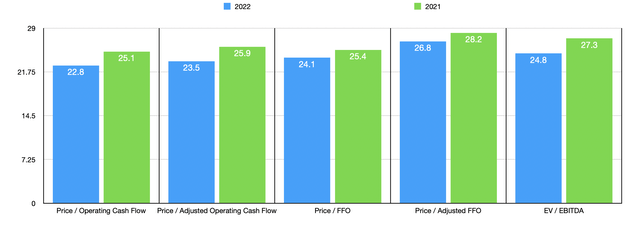

Using this data, it becomes pretty easy to price the company. In the chart above, you can see the pricing of the company both on a forward basis for the 2022 fiscal year and using data from 2021. As you can see, shares do get cheaper across the board. Having said that, these multiples are not exactly cheap. But for the sake of comparison, I did stack the business up against five similar firms. On a price to operating cash flow basis, these companies ranged between a low of 20.2 and a high of 29.2. And when it comes to the EV to EBITDA approach, these multiples are between 17 and 31.4. In both cases, three of the five companies were cheaper than our prospect.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| American Tower | 25.9 | 27.3 |

| Crown Castle (CCI) | 27.4 | 26.2 |

| Equinix (EQIX) | 20.2 | 29.8 |

| Digital Realty Trust (DLR) | 21.6 | 23.7 |

| SBA Communications Corporation (SBAC) | 29.2 | 31.4 |

| Iron Mountain Incorporated (IRM) | 21.5 | 17.0 |

Takeaway

All the data that I’m seeing suggests that the future for American Tower should remain bright. This is not to say that the company will always outperform the market. Shares are rather pricey on an absolute basis and look more or less fairly valued compared to similar businesses. But on the whole, this is a massive player in the space and it is a truly high-quality enterprise the likes of which I would consider putting all of my money into if I knew I were about to go into a 20-year coma. For investors who want that kind of stability and a strong likelihood of growth, the company most certainly makes sense to consider. And because of this, I have decided to keep my ‘buy’ rating on it for now.

Source link