[ad_1]

Lintao Zhang/Getty Images News

Rocket Lab (NASDAQ:RKLB) is a leading rocket company that has an elite list of customers which includes NASA and the Space Force. The business has recently helped with the NASA Artemis program, which will be human’s first return to the moon in a very long time.

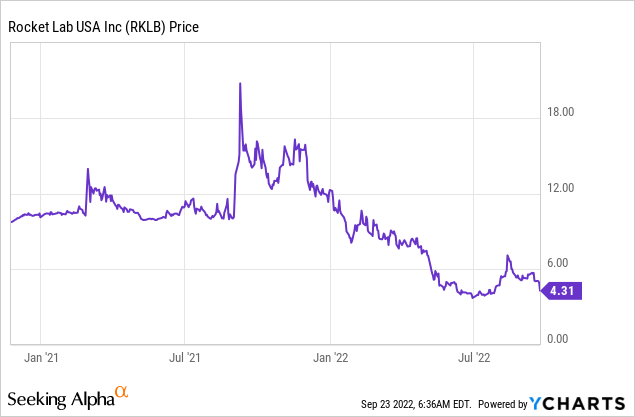

The company went public via a SPAC merger in 2021 with Vector Acquisition Corporation. Now, although many SPACs were slaughtered due to zero revenue and high valuations, Rocket Lab is the opposite. This company has recently beat analyst revenue estimates for the second quarter and has half a billion dollars’ worth of backlog from government contracts. In addition, the stock is undervalued intrinsically and analysts from Stifel have a $15 buy price, which indicates the stock could more than triple from this point. Its profit margins are difficult to analyze, as the old joke says how does a “billionaire become a millionaire, start a rocket company”. However, all jokes aside, Rocket Lab has a $2 billion market capitalization while SpaceX has a private market valuation of $125 billion. Now although this company isn’t on the same scale as SpaceX they do offer a cheap payload to space service, while SpaceX is focusing more on larger scale services (such as getting to Mars) with its enormous Starship rocket. Thus, in this post, I’m going to break down the company’s business model, financials, and valuation, let’s take off.

Business Model

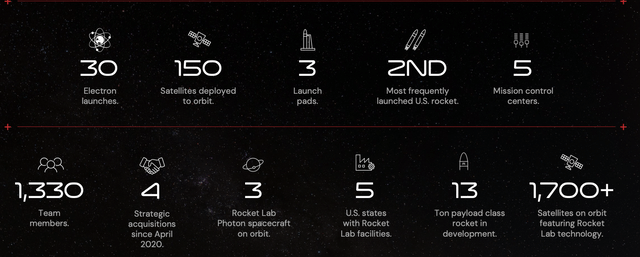

Rocket Lab is a rocket company that aims to provide open access to space to improve life on earth. The company currently has 150 satellites deployed to orbit across 27 successful missions. It offers 132 launch slots annually which can be booked, and then launches can occur from one of its 3 launch sites in the US or New Zealand.

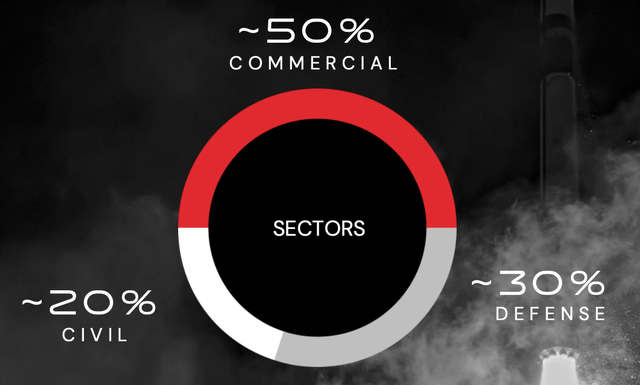

The company’s rocket is the 2nd most frequently launched in the US, and they provide a variety of services from small to large payload launches. Its customers include 50% commercial, followed by defense at 30% and then Civil at 20%. They include big names such as NASA, the US Space Force, Canon, HawkEye, and many more.

Customers (Investor Day Presentation September 2022)

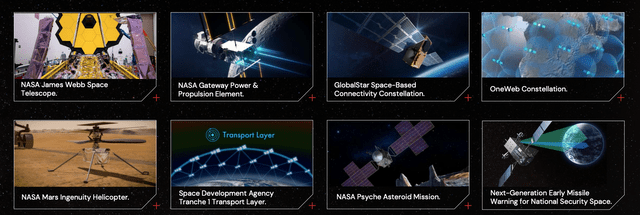

Approximately 1,700 satellites in orbit currently use Rocket Lab. The company has supplied hardware and software to big-name projects such as the NASA James Webb Space Telescope and the Mars Ingenuity Helicopter.

Projects (Investor presentation September 2022)

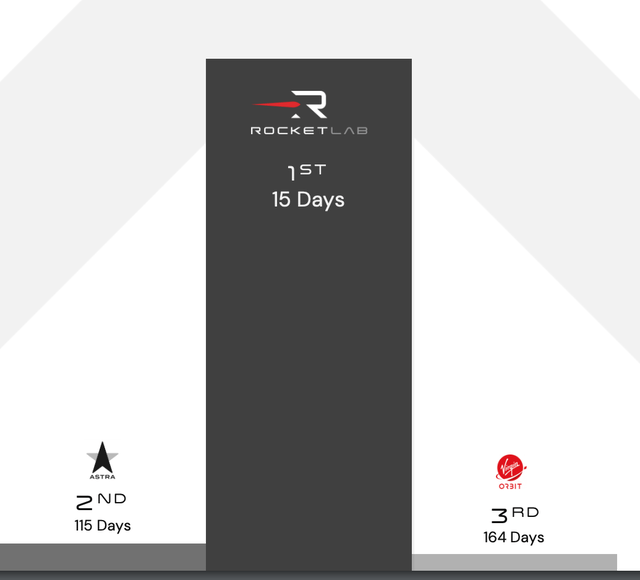

These customers use Rocket Lab because they offer dedicated, cost-effective launches and rapid turnaround. For example, Rocket Lab takes just 15 days to turnaround, which is much faster than other small launch providers such as Astra which takes 115 days and Virgin Orbit which takes 164 days.

Turnaround (Investor presentation September 2022)

Part of Rocket Lab’s secret sauce is its ability to reuse the first stage of its Electron rocket, which saves up to 65% of the total build cost. The company accomplishes this through reusable fairings, and they are even working on a Parachute system that can then be captured by a helicopter, which is like something out of a James Bond movie.

Rocket Lab has also created the highest efficiency space solar cell technology in the world at 33.3% efficiency which is incredible, while it’s also 40% lighter than traditional solar cells. The technology is called inverted MetaMorphic (IMM) and is patented by the company, thus providing a protective moat around the business. In addition, it is the only technology that meets the Space Force roadmap.

Growing Financials

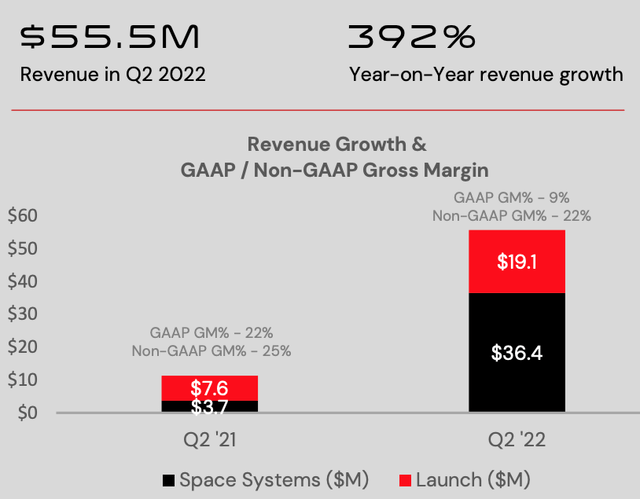

Revenue was $55.47 million in the second quarter, which beat analyst estimates by $6.23 million and grew by a blistering 392% year over year. Sequentially, revenue popped by 36% quarter over quarter, driven by strong launch systems growth of 191%. In 2022, successful missions such as NASA CAPSTONE and BlackSky Global also helped to boost revenue growth.

Revenue (Q2,22 Earnings Report)

The company has a strong backlog of $531.4 million, which is fantastic. This has been driven by a five-year NASA program for rideshare missions, which has a total budget of $300 million in launch contracts. In addition, the company was awarded a contract to remove space debris from orbit for Astroscale. Rocket Lab also scored a $143 million contract to design and build seventeen 500 kg spacecraft buses for Globalstar constellation.

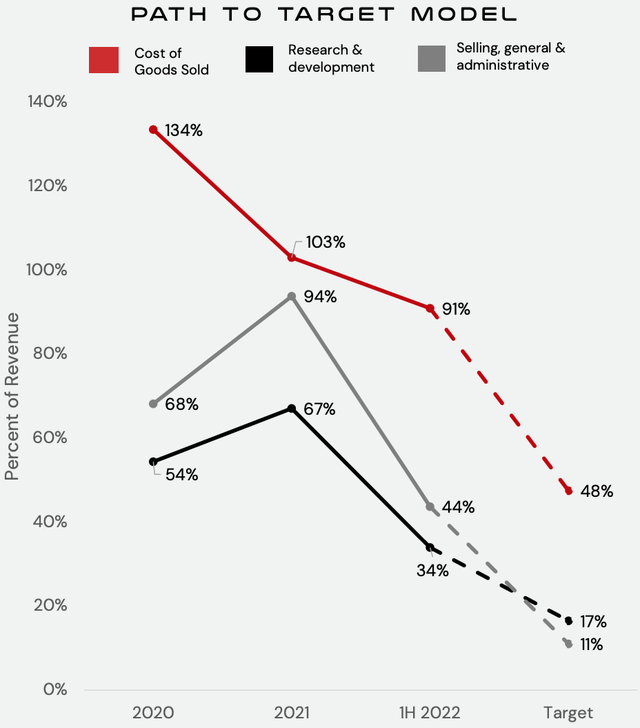

Rocket Lab is on track toward its target operating model, which includes a reduction in cost of goods sold, R&D, and SG&A expenses as a proportion of revenue.

Target Model (Investor Presentation September 2022)

The reduction in Research and Development spend is possible as the core product is proven and reliable, thus requires not as much future investment. The Electron rocket has a core R&D team now built, and thus, any new headcount is primarily for scaling production. The company also has stronger negotiating power thanks to its greater scale. In addition, the Rocket reusability should also help to improve costs longer term.

The company’s Gross Margin across space system components is above its target with the exception of SolAero which has lower margins.

Despite the positive outlook for costs, earnings per share did miss analyst estimates slightly by -$0.02 with -$0.08 achieved. The company also had higher consumption from operating activities, which increased by $12 million to $38 million. This was driven by higher R&D expenses and stock-based compensation.

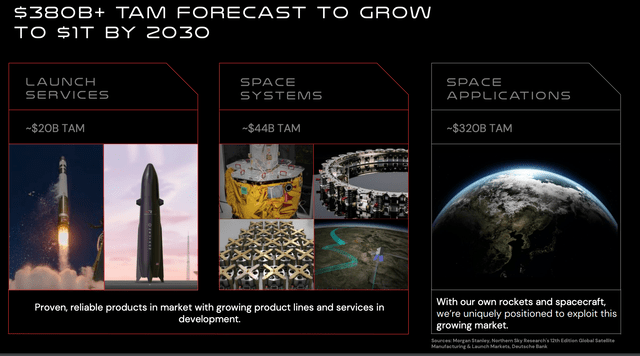

Moving forward Rocket Lab has a total addressable market of $380 billion across launch services, space systems, and space applications. This TAM is expected to expand to a staggering $1 trillion by 2030 and thus there is plenty of runway ahead for growth. Space companies tend to have strong competitive advantages once they reach a certain scale due to the high capital outlay required initially. For Q3,22 Rocket Lab expects revenue between $60 million to $63 million, which would represent growth of 26% quarter over quarter.

TAM (created by author Ben at Motivation 2 Invest)

Rocket Lab has a strong balance sheet with $546.6 million in cash, cash equivalents and restricted cash. In addition, they have long-term debt of just $98.6 million.

Valuation

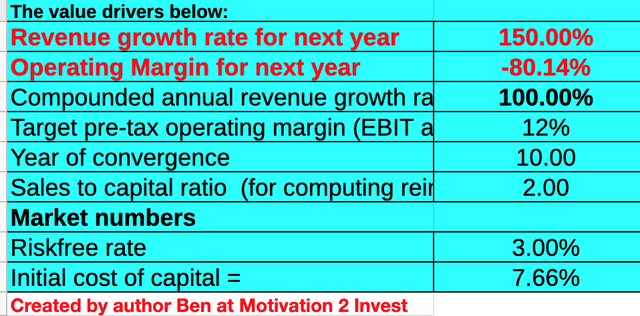

Rocket Lab is very difficult to value as the company has a lot of growth baked into the stock. Therefore, I have forecasted 150% growth for next year, which is based upon guidance for the next quarter and then an acceleration expected in the latter half of the year. Keep in mind that the business has a low base of revenue to grow from, and revenue grew by 392% last year. In addition, Rocket Lab has over half a billion in order backlog.

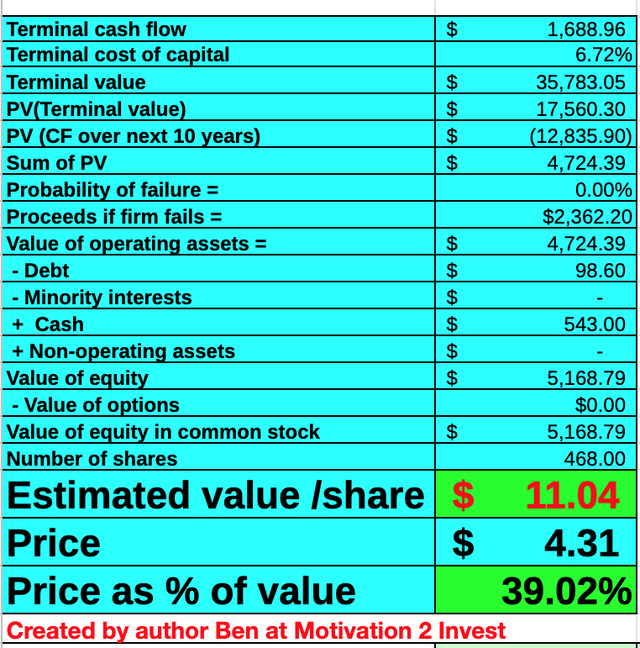

Rocket Lab stock valuation (created by author Ben at Motivation 2 Invest)

I forecast margins to improve to 12% over the next 10 years as the business reaches greater scale, and it also starts to increase its software sales. In addition, I have capitalized R&D expenses to increase the accuracy of the valuation.

Rocket Lab stock valuation (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $11 per share, the stock is trading at ~$4.31 per share at the time of writing and thus is ~61% undervalued.

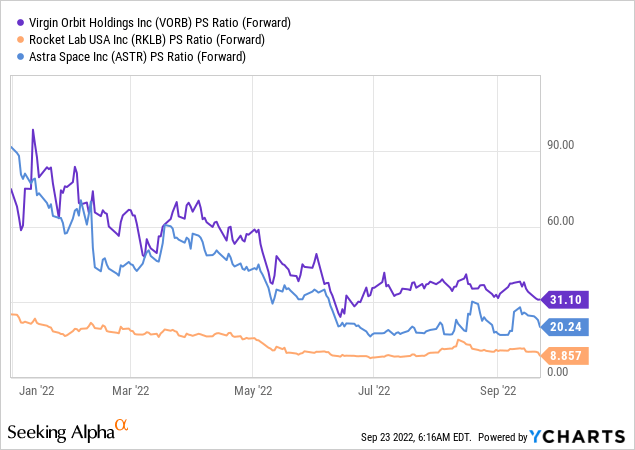

As an extra data point, Rocket Lab trades at a Price to Sales Ratio = 8.9, which is cheaper than historic levels. In addition, the company is much cheaper than Astra Space (ASTR) which trades at a PS = 20 and Virgin Orbit (VORB) which trades at a PS = 31.

Risks

This is Rocket Science

As the old saying goes “it’s not rocket science” but in this case it is. Rocket science is not easy and neither is launching rockets into orbit in a cost-effective manner. There are also huge safety concerns from debris, and that is not to mention human passengers. Making space travel normal will be the greatest feat of human achievement ever, and while I think this is possible, let’s not underestimate huge costs and major risks.

Recession

Governments and Billionaires tend to look to the stars when core businesses on earth are doing well, and they need a new challenge. However, there are many serious problems on earth which include global warming, the Russia-Ukraine War, and of course high inflation and a pending recession. Now, although many space companies offer to “help earth from space” I believe fewer contracts may be signed if there is much uncertainty on earth. Rocket Lab hasn’t seen any sign of this yet, but it is a risk in the upcoming quarters as a lot of growth is baked into the stock.

Final Thoughts

Rocket Lab is a leading rocket company that offers a cost-effective rapid turnaround payload to space service. The business has a huge total addressable market and management has achieved its goals so far. The stock is undervalued intrinsically and relative to competitors and thus this looks to be a great speculative investment for one’s portfolio, watch this space.

Source link