[ad_1]

Sascha Schuermann/Getty Images News

Investment Thesis

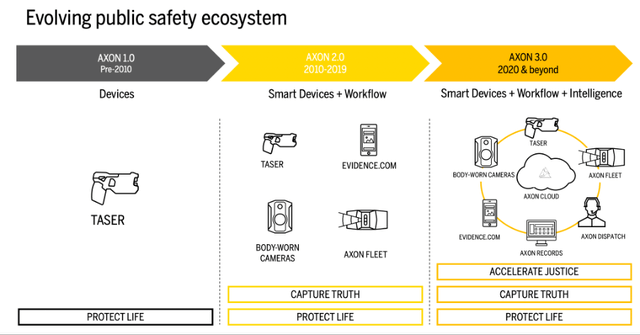

Axon (NASDAQ:AXON) has been transforming law enforcement in the United States for decades, initially with its non-lethal TASER products and more recently with its expansion into body cameras, in-car systems, and even cloud-based software for the entire justice system. Axon already had a monopoly with its TASERs, and it has used this existing network to build a monopoly across multiple law enforcement verticals, with additional opportunities to expand beyond the U.S.

The basis of my investment thesis for Axon is the following: the company benefits from an existing network of virtually all law enforcement agencies in the U.S. to which it can upsell its newer products and solutions, with the SaaS offering integrating with Axon’s body cameras and other products creating a very sticky ecosystem. To ensure this is on track, I would look for fast growth within Axon’s SaaS solutions, consistent growth among its other products and new products being rolled out and adopted.

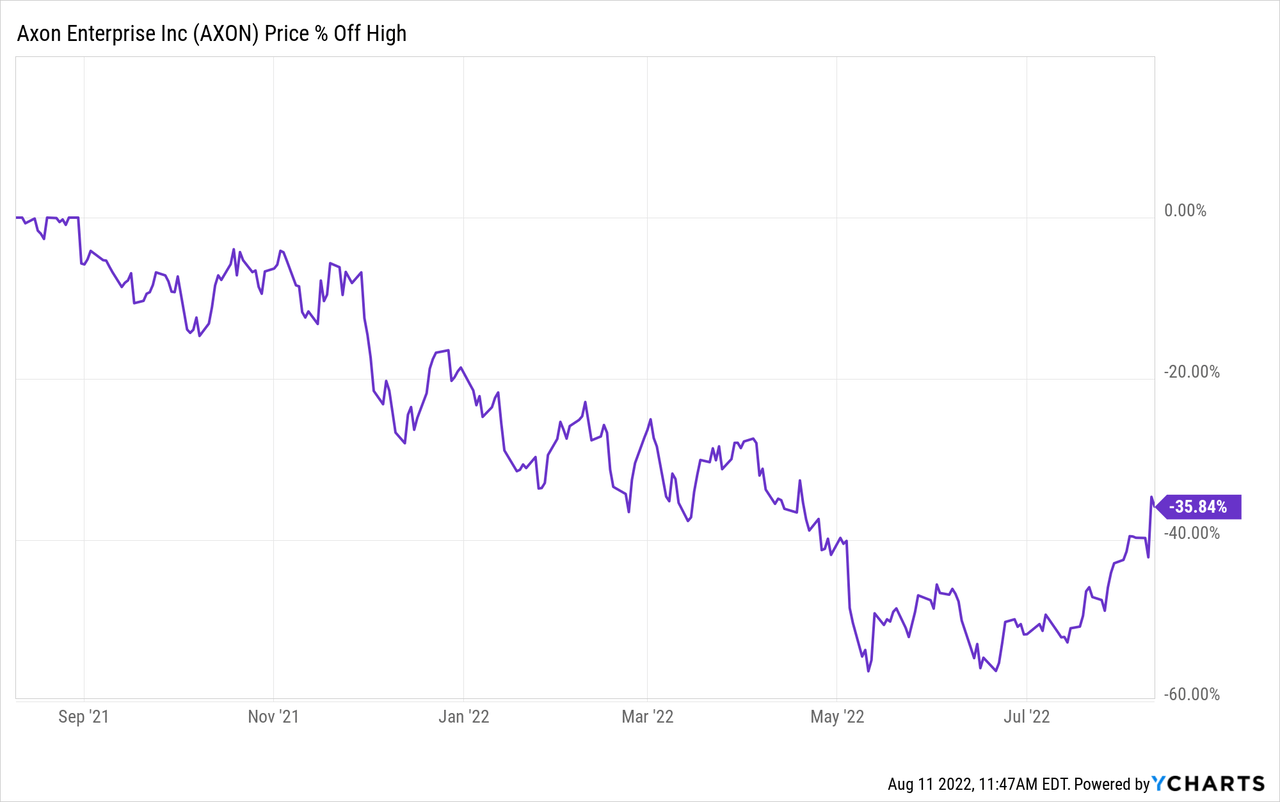

Axon may not be recognized as a technology company yet, but its shares certainly sold off like one over the past year. Yet a recent bump up in the share price driven by a combination of strong Q2 results (spoiler alert) and positive data regarding inflation means that Axon shares are down only 35% from their 52-week highs.

So what happened in Axon’s Q2 earnings that sent shares soaring 15%, and is the investment thesis still on track for this company? Let’s take a look.

Earnings Overview

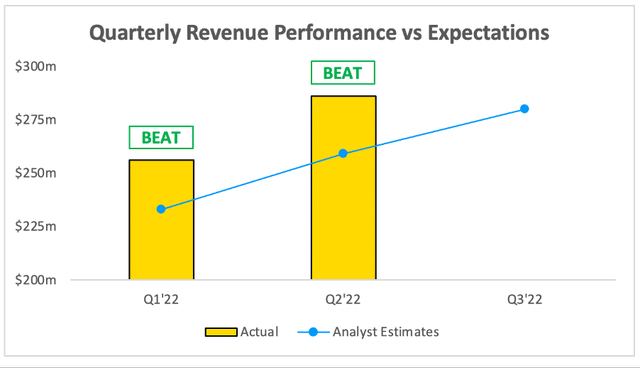

Starting from the top, and Axon’s Q2’22 revenues grew 31% YoY to $286m, completely smashing analysts’ estimates of $259m. The company updates its full year guidance each quarter, and does not give a Q3 outlook – analysts’ were expecting $280m in Q3’22 before these results were released, but I’d imagine that those expectations will be raised shortly.

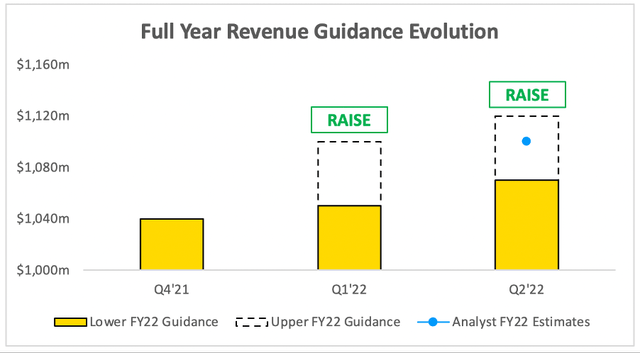

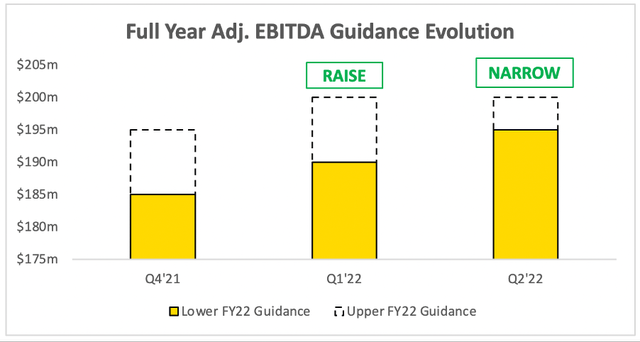

If we go onto full year guidance, Axon raised its outlook for the second quarter in a row, with the previous guidance of $1.05-$1.10B being raised to $1.07-$1.12B, although analysts’ estimates of $1.10B sit comfortably within this guidance range.

A beat and raise on the top line is great to see, and Axon also narrowed down the range for its full year adjusted EBITDA outlook. Although it didn’t officially change its range of the $190-$200m Q1’22 guidance, according to the shareholder letter management believes that Axon should come in ‘at the higher end of the previously communicated range’ – so, more positives!

Finally moving down to EPS and Axon doesn’t actually give guidance on this at all, so I don’t pay as much attention to it. But, it was yet another beat by the company, with EPS coming at $0.44 compared to analysts’ estimates of $0.39.

Now would you look at all that green? Every single comparison in the green for Q1, Q2, and the full year outlook – I’ve written quite a few articles this earnings season, and I’m pretty sure Axon is the first company to go green across the board! This certainly helps to explain why shares popped 15% after these results were released.

Business Performance

Moving onto the numbers behind the numbers and a good deal of Axon’s 31% YoY growth was driven by both Axon Cloud (+29% YoY) as well as demand for Axon’s Body 3 and Fleet 3 systems, which resulted in the Sensors & Other segment experiencing 45% YoY growth! A highlight for me was the fact that Axon’s new SaaS products saw revenue almost triple YoY; that revenue is probably coming off a low base, but it’s great to see new product adoption.

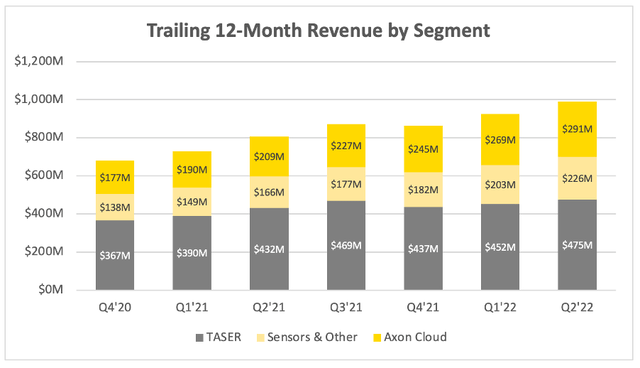

It’s worth highlighting that Axon can sometimes receive substantial orders and contracts within a certain quarter, and so for the below charts, I’m using the trailing 12-month revenues in order to smooth out these ebbs and flows. We can take a look at the TTM revenue below for each segment.

Most notably from Q4’20, the growth has been driven by Axon’s newer segments of Sensors & Other and Axon Cloud. In fact, the CAGRs over this period for TASER, Sensors & Others, and Axon Cloud were 19%, 39%, and 39% respectively – with Sensors & Other helped by a big boost so far in 2022.

Whilst I’d prefer to see Axon Cloud’s growth leading the charge, this feels more like overperformance from Sensors & Other rather than underperformance from Axon Cloud – which is amazing, as it’s great to see Axon continuing to be successful in the newer products that it rolls out, SaaS or no SaaS.

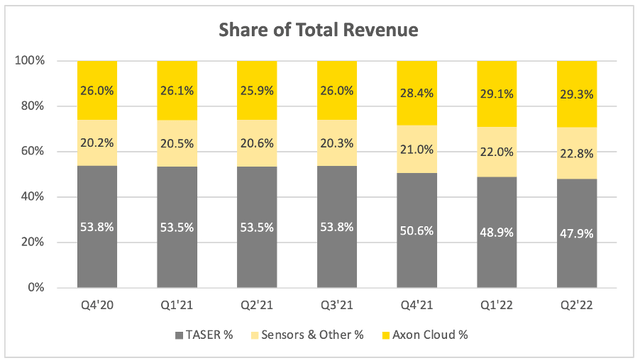

Another promising trend is the higher margin Axon Cloud continuing to take up a greater share of revenue over time. I would expect to see this continue, and it’s fantastic to see the continued growth of Sensors & Other as Axon successfully expands into more product lines.

On the earnings call, Co-Founder & CEO Rick Smith had nothing but praise for his company during this excellent quarter, adding some color that should give investors even more confidence in this business going forward.

We’re seeing broad-based strength across our product numbers, and we’re really energized by the growing number of agencies that are buying nearly everything we offer and signing up for 10-year contracts, sometimes even 12 years. It’s exciting to see an agency go all in with Axon.

We set a vision several years ago that an agency wouldn’t just say, well, we have a TASER device or maybe we have body cameras and Evidence.com, but would instead simply describe Axon as their technology partner. And that’s starting to happen now. When agencies sign up for all of our software solutions, plus our body camera, dash camera, the TASER 7, the VR training, our drone solution and so on. Customers are increasingly demonstrating their confidence that we are the right technology partner for them for the next decade. We made it easy for our customers to bet on us, because our team delivers.

Also, new COO Josh Isner gave some more details on how Axon plans to continue expanding, and the potential new product routes that the company can go down:

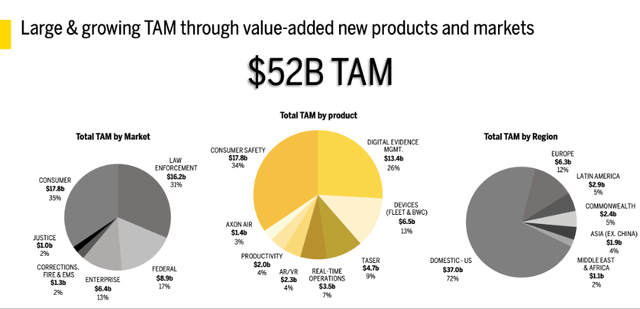

I will be ensuring that we are aggressively pursuing our total addressable market opportunity. We value that at $52 billion, and it continues to grow as Axon unveils new products and unlocks new markets. We view our channel as one of Axon’s core differentiators, and we will continue to invest into new geographies and customer segments such as commercial enterprises, federal and adjacent markets. We will also be scaling our VR, drones, records and dispatch businesses.

For every single one of our product lines, our best days are ahead. That includes the TASER business, which is changing the world for the better and it’s just getting started internationally. I think you’re going to be very pleased with what you see unfold here over the next couple of years.

Axon is currently a U.S. monopoly with a market cap of ~$9 billion, but as you can see, there is still plenty of growth to come for this high-quality business.

Valuation

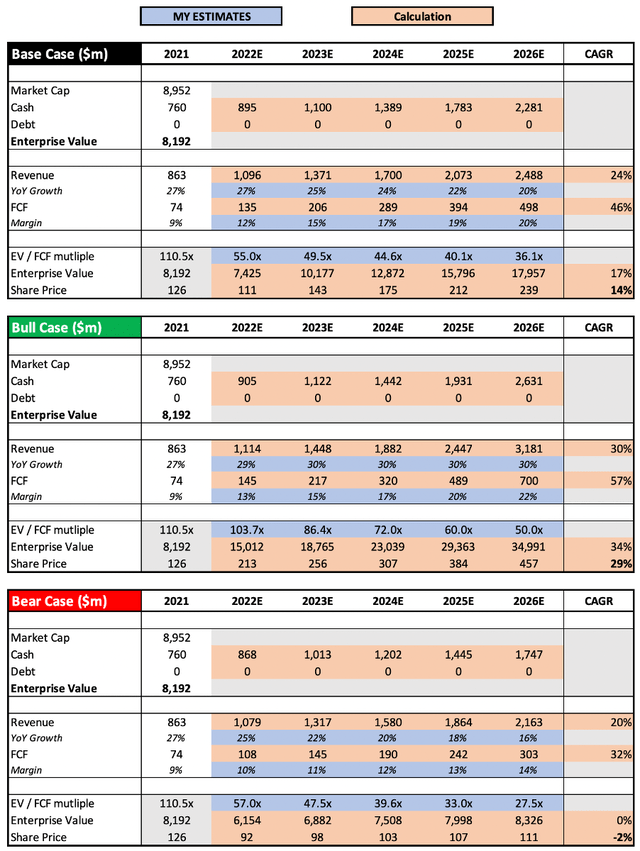

As with all high growth, innovative companies, valuation is tough. I believe that my approach will give me an idea about whether Axon is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

I have slightly changed my valuation model to better reflect the impact of bull and bear case scenarios, although my base case 2026 forecast remains similar to my previous article – with the main updates being stronger revenue growth and lower capex spend following in 2022 management’s latest guidance.

My bull case scenario assumes that revenue growth remains at ~30% each year through to 2026, which is quite possible given that Axon is now able to roll out new software solutions easily through Axon Cloud, and it is seeing strong growth in its Sensors & Other segment. This increased revenue growth comes with better FCF margins as Axon scales up, as well as a higher EV/FCF multiple due to the potential for further growth and margin expansion for 2026 onwards.

My bear case scenario assumes that YoY growth slows down throughout the period, with Axon achieving a 20% revenue CAGR. The knock-on effect is lower margins as the benefits of scale are not realised and a lower EV/FCF multiple.

Put all that together, and I can see Axon shares achieving a CAGR through to 2026 of (2%), 14%, and 29% in my bear, base, and bull case scenarios respectively.

Investment Thesis: On Track/Strengthening

I couldn’t decide whether or not my investment thesis was just ‘on track’ or if it was indeed strengthening, so I went somewhere in the middle!

I’m tempted to say that it’s actually getting stronger due to the impressive performance of Axon’s Sensors & Other segment, implying that Axon has been able to branch out into even more different markets and churn out new products that are being adopted by its customers. This is part of the reason that Axon’s TAM has grown from $27B in 2020 to $52B in 2021.

All in all, a fantastic quarter from Axon that exceeded the expectations of myself and Wall Street. The share price rise was truly merited, but I think there is still plenty of upside from here for investors with a long-term mindset. Taking everything into consideration, I will reiterate my ‘Strong Buy’ recommendation for Axon.

Source link