[ad_1]

Author’s Note: This is the free version of a Premium article posted on iREIT on Alpha on the 25th of June 2022.

ThomasSaupe/E+ via Getty Images

Dear Subscribers,

In this article, we’re going to take a deep look at the German industrial conglomerate ThyssenKrupp (OTCPK:TKAMY). The upside that’s realistically available here is one of the highest in the entire German market today if we’re looking at a company with a market cap of over €1B.

The upside we’re looking at here is over 160% – and in this article, I’ll deconstruct, explain and show you why this company is worth considering – especially if you have a bit of risk tolerance.

ThyssenKrupp – German Steel And Engineering

ThyssenKrupp is more of a conglomerate than a stand-alone company. It’s the result of a merger 22 years ago between Thyssen and Krupp, two of the foremost companies in steel/engineering in Germany at the time.

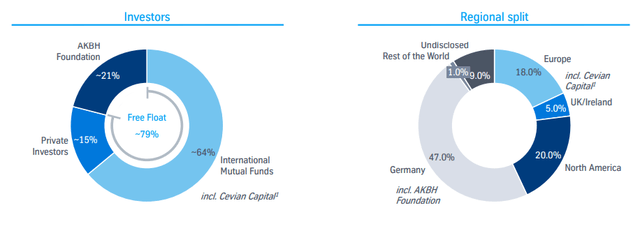

The conglomerate has a massive number, over 500+, global subsidiaries, and it’s owned to large parts by a family foundation and the equity firm Cevian Capital, a Swedish firm backed by Carl Icahn. Most of the shareholders here are international mutual funds.

Thyssenkrupp IR (Thyssenkrupp IR)

The roots of the two individual businesses go back over 200 years, as Krupp was founded all the way in 1811. The company has been involved in military production not only in Germany but all the way back when there was the Prussian empire, back in 1859 which ordered 300 gun barrels. It would be similar to investing in a company that has been in business, and in part in the same area, since the American Civil war.

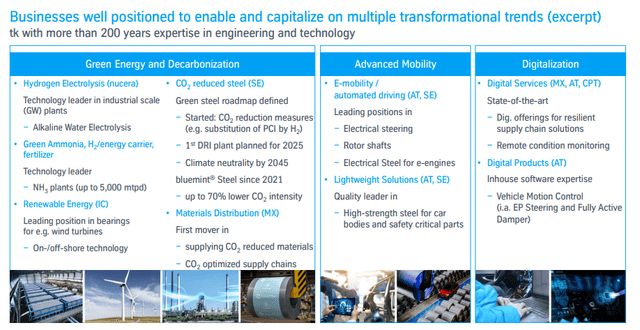

ThyssenKrupp IR (ThyssenKrupp IR)

Since that time, the company has been a very active M&A’er, acquiring and divesting all manner of operations and segments. The company has been in elevators, aerospace, maritime/naval production, and many other areas, until a major series of divestments and restructurings began in 2017.

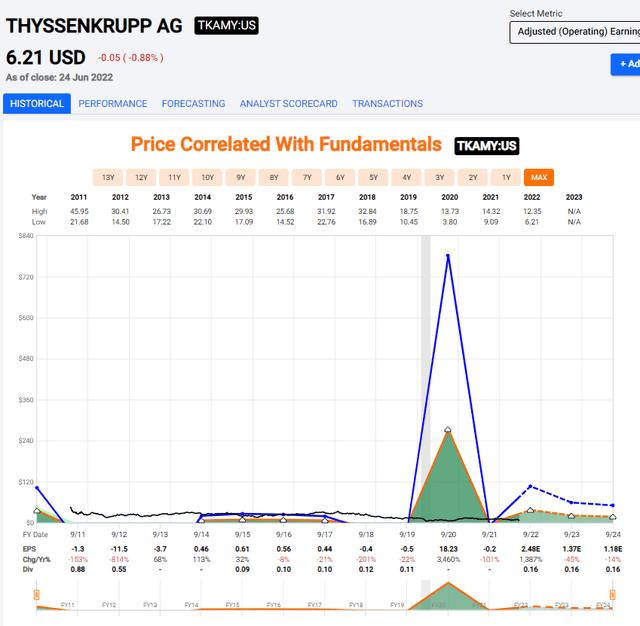

To call ThyssenKrupp “volatile” would be an understatement of herculean proportions. This company operates in the space of significantly negative EPS and massive spurts of growth. It was negative for 3 years after the Financial crisis and only delivered bare-bone EPS in 2014-2017, only to in 2020 deliver EPS growth of 3,500%, with ups and downs that could make even the most risk-tolerant investor uncertain.

ThyssenKrupp is junk-rated at BB- and has a market capitalization of around $3.9B. Today, the company is a mix of:

- Premium Steel Production

- Industrial Materials

- Supply Chain services

- Mission-critical ESG products, such as wind energy components

- H2 electrolysis technologies

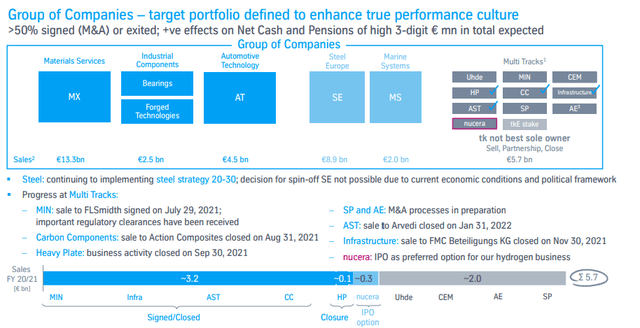

The company’s operations are split into the following reportable segments:

- Material Services (MX)

- Industrial Components (IC)

- Automotive Technologies (AT)

- Steel Europe (SE) – to be divested, but not yet.

- Marine Systems (MS)

- Multi Tracks (MT)

Its set of issues is largely derived from what is one of the largest foundational restructurings in history – which is still not yet finished, by the way.

Do not equate volatility with lack of safety. ThyssenKrupp has a very strong balance sheet, contrary to the indication from its credit rating. The company has an equity ratio of over 30%, net cash well above €2B (€3B by year-end if forecasts hold and liquidity in excess of €8B.

As a steel business, and due to its current position, ThyssenKrupp must handle excessive working capital requirements for its operations. However, the company has several levers it intends to pull to improve its operational safety and value as a company as an investment.

Among these are:

- Divestment of the appealing hydrogen business (IPO), Tk Nucera.

- Further streamlining through targeted divestments and spin-offs.

However, most of these ambitions have currently been cut short due to excessive market volatility and geopolitical instability. The company is waiting for things to calm down.

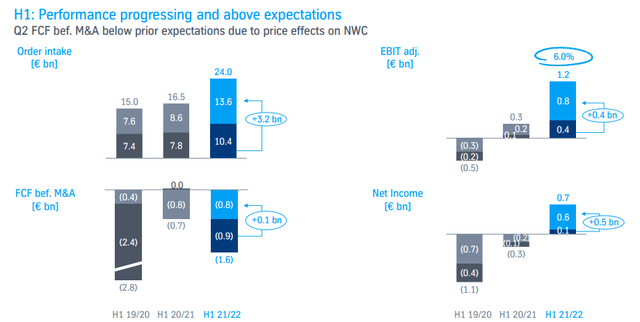

It’s also important to point out, that despite all the uncertainties, the company is seeing close to record levels of orders, EBIT, and a net income that’s now positive, even if Free cash flow continues to be negative due to working capital requirements.

ThyssenKrupp IR (ThyssenKrupp IR)

EBIT is higher than it has been for a long time. The company is progressing well on its restructuring plan, with 70% of the planned headcount reductions managed, with another ~3,000 on the horizon. The company is cutting expenses, and delivering high-3-digit savings in the millions until the mid-term of 2022-2023E, with original savings already realized as of now.

The long-term plan for ThyssenKrupp is to focus more on specialized engineering and products, as opposed to pure steel production which, for the most part, is the company’s legacy. Once this restructuring is completely finished, we’ll be dealing with a very different company than we have currently.

On a high level, the company obviously suffers from several sensitivities which are currently in the negative. This includes the natgas spot price, power pricing, logistical pricing (freight rates), Coking, Iron ore pricing, and the market price of rolled coil.

All of these trends remain, in the company’s own words “extremely volatile” with low visibility going forward. Energy pricing will remain high for the time being, and the company assumes all input factors to remain at the current, elevated 2Q22 levels. The company assumes continued unrestricted access to fossil fuels, which despite the natgas and power issues, I believe is a fair assumption, even if the prices go up.

On the flip side of all of this negativity, we have the positive trends that the company is clearly experiencing.

The company is reporting significantly improved earnings, with improvements across all KPIs despite these conditions. Material services and Steel especially are very strong contributors. The company has presented us with a solid 21/22 fiscal forecast, including a €1B annual EBIT for Material Services alone on the back of improved pricing – but with sales at roughly similar levels because of a regional slowdown in wind energy, supply chain bottlenecks, and some logistical issues in IC.

On the whole of it, the guidance calls for significantly improved EBIT to at least €2B, and this is mostly already confirmed by the YTD results. Of that, over €1B is going to be net income.

At the same time, working capital will spike in the three-digit-million euro range (middle) due to increases in raw materials, customer call-offs, and existing turmoil.

Here are the long-term current plans for the entire set of businesses – what stays and what goes.

TyssenKrupp IR (TyssenKrupp IR)

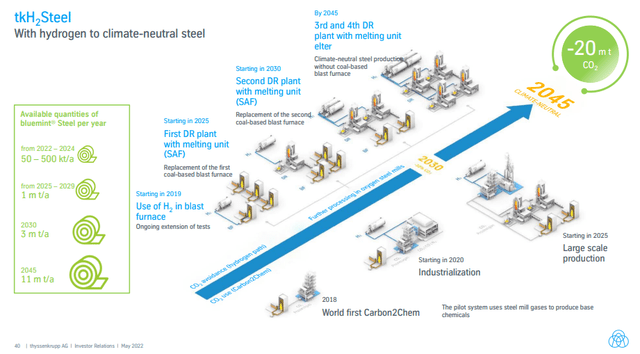

So, as you can see – the former 500+ subsidiaries are in the progress of being carved, sold, or divested in various ways. The target company that will come out the other side should be flexible and well-structured services, components, and automotive business without the risk and asset-heavy volatility we find in most legacy steel businesses – though you can still own the steel, given the IPO. The company is also near-world leading with its tkH2 steel, using hydrogen to create a so-called bluemint-steel, which is climate-neutral or even climate-positive.

ThyssenKrupp IR (Thyssenkrupp IR)

Company debt is a non-issue for ThyssenKrupp. The company has over €8B in available liquidity of which €6.5B is in Cash and equivalents, which is almost 2X the company’s total liabilities gross of leases. What’s more, these maturities are well-laddered going beyond 2025-2026.

Fundamentally speaking, there are no immediate cash dangers to the company. Yet the chaotic nature of the past 10 years makes the company’s low credit rating completely understandable. Still, ThyssenKrupp is a leading material processor and service provider across the western world.

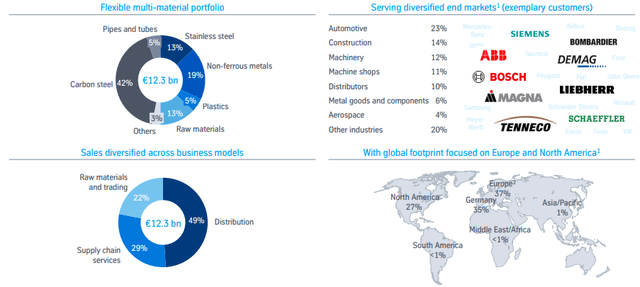

It’s the #1 Material distributor in Germany, in all of Europe, and #3rd in all of North America. It has a presence in 30+ countries, with 400 branches, and still employs 15,500 people.

The company uses carbon steel, aluminum, stainless steel, plastics, and inputs from over 4,000 suppliers in the world (purchasing over €10B per year), using these to produce materials and services for 250,000 customers with an average number of products of 150,000 multi-material products.

It serves, simply put, the entire world, but has a very strong NA/EU/Germany focus.

ThyssenKrupp IR (ThyssenKrupp IR)

ThyssenKrupp – Investing In The Company And Risks

The company is a junk-rated, but conservative European company in steel & metals/materials. It does not have a dividend – though it did once before it was cut in 2017/2018. It’s unlikely that even with the profits we saw in -20, the company will reinstate or work with that dividend in order to restore it, prior to the finishing of the reorganization and streamlining.

It’s also important to point out the very volatile trends that this company currently operates under. ThyssenKrupp, like other similar companies, is exposed to virtually every volatile pricing uncertainty that exists – from energy to logistics, to input material cost inflation. That’s also the reason why despite projecting record EBIT levels (or close), the company is currently trading down – significantly.

The bullish case for Thyssenkrupp calls for this company to recover in line with EBIT, reorganization, and automotive/market normalization. If this were to occur, the company’s projected EBIT would justify a valuation that’s more than twice the level it is today. Returns from capital appreciation alone, in such a scenario, could justify an investment here.

However, until that time, combined risks in the form of organizational risks (this has been going on for over a decade, it’s far from certain that it’s over), market risks, cost risks, and geopolitical risks, may turn this company into a no-go for some. That’s the bearish case – and it’s completely valid.

Still, I do believe it valid, and accurate to say that forecasts call for a positive, €1-2 EPS for this fiscal, and an EPS on the same, or similar for the year after.

Let’s look where the valuation takes us.

ThyssenKrupp Valuation

ThyssenKrupp trades at a fairly cheap valuation. At less than €7/share, the company’s share price represents a P/E of between 3-4X depending on where you forecast the business, as well as an EBITDA multiple of less than 3.5X. Despite the company’s high EBIT forecast, the multiple for EIBT is less than 6X here, and it trades at, despite its wide customer base, a sales multiple of less than 0.3X.

This is almost unheard-of-low multiples for this business or in the sector. In terms of book values, the company is also at less than 0.3x. For 2022, it’s expected that the company delivers net sales revenue of €34.4B, and about the same level for the year after. Extremely high WC and COGS still mean that gross margins are less than 14-17% here, with EBIT margins of 5-8% in the best of times. When looking at the company’s overall peers on the market, this shows Thyssenkrupp as being incredibly cheap. The company has lost 25.5% of its value in 1 year at this point, and while it’s not at a record-cheap price, it’s close to it at €5.89/share.

You can compare this to peers like ArcelorMittal (MT), JSW Steel, Nippon Steel, Reliance Steel (RS), Gerdau (GGB), and others, many of which trade at revenue multiples close to 1-1.5X and EBITDA multiples that are closer to 5-7X, which is a significant premium to where the company currently is. Consider for a second that ThyssenKrupp is expected to turn a €2B EBIT this year, and this discount will slowly cease to make sense – at least that is how I see it. I’ll discount it by 20% to reflect the company’s Euro focus, which is under heavier fire and effects, but that still leaves an upside of almost 40% to any sort of conservative target, with an implied peer-based PT of €10.5/share.

The company is, to me, clearly undervalued based on its positive earnings forecast and realistic expectations. Negative FCF is a drag, and likely to continue due to WC requirements, price hikes, and demand volatility. Once ThyssenKrupp starts delivering positive FCF, not just adjusted EPS and EBIT, the company will likely grow more appealing again. For now, this is the record that ThyssenKrupp must work with – and it’s far from a great one.

ThyssenKrupp Upside (F.A.S.T graphs)

The timeline regarding the mentioned IPO of TK Nucera is also unclear – even if the M&A process for some of the Multi-track segments is in full force. The company’s balance sheet, which is incredibly strong and completely at odds, in my view, with the poor credit rating, gives the company positivity here. The IPO of Nucera is expected to bring another half-billion or so to the company’s coffers.

The company is recently down due to wage numbers – which call for a 6.5% increase. It’s my view that this is not material for this year, and only has a small effect on the running business year, given it does not start until the 1st of August. The cost increase will be about €100M for the ThyssenKrupp business. In future years, the company will have to streamline profitability to offset this increase.

For the long term, it’s my view that this company’s earnings forecasts and streamlining efforts are completely at odds with the dirt-cheap valuations we’re currently looking at.

If you’re in any way a long-term investor and willing to shoulder a bit of timing risk (in the sense that it’s completely uncertain just when things will actually turn around), the potential returns you could generate from an investment in this company are nothing short of amazing. Using peer-similar NAV multiples to evaluate the company fairly, as well as DCF is tricky since the company is in the middle of a sales, divestment, and IPO process. I believe it is better to use peer multiples and discount them, as well as to look at what is expected on a long-term basis, even if those long-term forecasts are also subject to extreme uncertainty.

It is this uncertainty that really causes the issue for the company here. S&P Global has a price target range of €8.8 to €21/share. Note that every target, even the lowest is significantly higher than where the company is currently trading. TKA, the native share ticker, is currently trading at barely 25% of a fair NAV/share, and the S&P global average of €13.6 implies a 131% upside to the company at this time.

Equity analysts shoot even higher. The company’s share price implies a 172% upside to AlphaValue’s Thyssenkrupp target of €16/share. With my discount, I don’t reach quite that high, but I believe a range of €14.5-€15.5/share is a fair, discounted long-term value for the company when you take into account IPOs, M&As, and what the company actually represents in terms of pan-European market share.

My PT for the company is €15/share here – and that is for the long term. I consider TKA a “BUY” here.

Thesis

As for the exact timing, or even if you should buy the company here, that is of course a different story. The 150-160% upside is of course very attractive – but it could take years, and the volatility might not be over yet. You’re not getting a yield, the company has junk credit – there is a myriad of reasons why you might not want to “dig in” here, or even at all.

The alternatives available in a slightly undervalued (because we’re not that undervalued yet, generally speaking) market are very attractive. Even just pushing that money all into Realty Income (O) could be thought of as a safer, more consistently rewarding investment.

That is why TKA is certainly not for everyone. I’m going to start out with a small watchlist position and work from there. I do believe the company will turn around, and violently (it has before) once the market realizes the profit potential found here. The relevant ADR for ThyssenKrupp is TKAMY, and it’s a 1:1X, relatively thinly traded ADR. I’d go for the native using IBKR or a similar broker here.

Again – certainly not for everyone, but in terms of a €1B or above-market capitalization company in Germany that has tradition and overall safety, this is really the one that you may want to go for. It has a lot going for it, should things revert.

Source link