[ad_1]

Douglas Rissing

Most news headlines concerning insider trading usually portray the activity in a negative light and ultimately lead to allegations suggesting some sort of fraud or other ill-doing. That being said, with respect to this article the act of insider trading is nothing more than an individual committing to purchasing or selling securities of the company at which they are an insider, and most of the trading done this way is, in itself, perfectly legal.

Who is considered an insider? Federal law defines an insider as a company’s officers, directors, or someone in control of at least 10% of a company’s outstanding stock. These company employees with significant access to privileged information report their trades to the Securities and Exchange Commission by filing S-4 forms in a timely manner. In fact, we believe that insiders supply the market with high-quality investment information every time they decide to trade their own company’s shares in the open market. An investor that is better informed than their competition can generate higher returns, and in the end, the one who possesses the ultimate level of corporate-specific knowledge is none other than the corporate insider themself.

So the objective shifts towards identifying if investors can use legal insider trading in order to form a profitable investment strategy and attempt to deliver alpha over the overall market.

What corporate insiders were buying

This is exactly the basis of today’s article. We analyzed thousands of S-4 fillings to find companies that have experienced periods of unusually concentrated purchasing activity by their corporate insiders. We have attempted to place emphasis on companies that enjoyed buying across the board from multiple insiders, in quantities that were not recorded previously, often after a period of selloffs.

Today, we’ll limit our discussion to small-cap stocks only, but you can access our second quarter mid-cap analysis through this link. We will shortly follow this up with an article covering large-cap stocks as well. For the purposes of this analysis, we defined small caps as having a market capitalization between $300 million to $2 billion. This is our short list of research-worthy small-cap companies that in our view enjoyed a period of unusual and atypical interest from corporate insiders during the second quarter:

Liberty Latin America Ltd. (LILA)

-

Active Corporate Insiders: 2

-

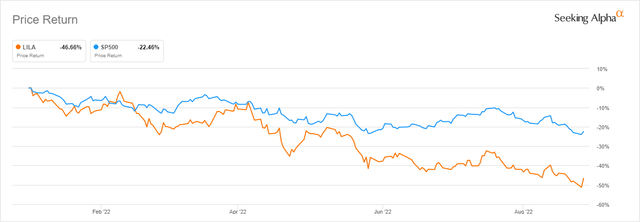

YTD Performance: -46.66%

- Total Bought Back: $4,772,439

It is not often that the “Cable Cowboy” himself moves to provide a company with his stamp of approval and that is exactly what has happened with Liberty Latin America. The Latin American branch of John Malone’s Liberty media and telecommunications empire was created in 2018 when LILA got spun off from Liberty Global (LBTYA). The company provides fixed, mobile, and subsea telecommunications services in the region through its subsidiaries C&W Caribbean and Networks, C&W Panama, Liberty Puerto Rico, VTR, and Costa Rica segments. It is on an ambitious path of capturing close to $450 million in operational synergies from its recent aggressive expansion in the region like acquiring America Movil’s operations in Panama, merging their Chilean operations into a JV with America Movil (AMX), as well as acquiring Telefónica’s (TEF) operations in Costa Rica.

LILA is currently trading at a very attractive valuation with an NTM EV/EBITDA of 5.06x and an NTM P/FCF of 5.16x. Still, the main bull argument here is that if the synergies are executed properly, the company could be trading at half of that valuation two years from now. Partially due to the fact, the telecom has been held in high regard by both Seeking Alpha Authors and Wall Street analysts. SA Authors have been long bullish on the company assigning it a “Strong Buy” rating with an average score of 5.00/5.00. Wall Street Analysts have assigned LILA a more modest “Buy” rating with an average score of 3.80/5.00. Liberty Latin America enjoyed extreme interest during the second quarter from the SVP Hussain Aamir and John Malone, who already owns a significant portion of the company and effectively control it through voting shares. They bought back a total of $4.77 million during the second quarter at an average price of $8.69 and $8.33 respectively. LILA currently trades at around $6.82 per share.

Liberty Latin American and S&P500 YTD Return (Seeking Alpha)

Yellow Corporation (YELL)

-

Active Corporate Insiders: 9

-

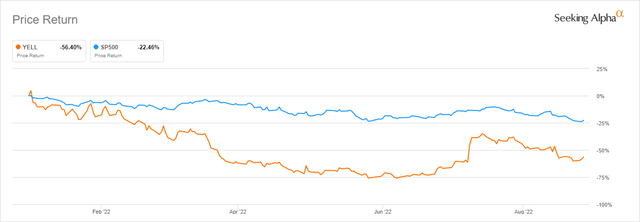

YTD Performance: -56.40%

- Total Bought Back: $1,316,816

Yellow Corporation is a U.S.-based trucking company operating in a niche segment of the transportation and logistics space, being almost solely focused on what it defines as “LTL” or Less Than Truckload and supply chain solutions to transport industrial, commercial, and retail goods. The company was formerly known as YRC Worldwide and has only recently changed its name to Yellow Corporation in February of 2021. Its shareholders have been on a bumpy ride, with the company struggling to provide stable returns with experiencing extreme volatility in its financial performance. This played a role in YELL significantly underperforming the market year-to-date, managing to generate a negative 56.40% return.

The company is trading at a relatively attractive valuation with an NTM EV/EBITDA of 3.83x and an NTM P/E of 2.92x, however, it still expects to generate negative free cash flow for the same period. Seeking Alpha Authors have a positive outlook on the company with a “Buy” rating and an average score of 4.00/5.00. Still, Wall Street Analysts remain unconvinced, assigning it a “Hold” rating with an average score of 3.00/5.00. Insider’s confidence in the business has recently hit an all-time peak, suggesting better days for stakeholders might be on their way. Shares of Yellow Corp have been bought by the CEO Darren Hawkins, CFO Daniel Olivier, President and COO Darrel Harris, EVP Leah Dawson, and seemingly half of the board of directors. Insiders bought back a total of $1.31 million during the second quarter at an average estimated price of $3.75. The company is currently selling at $5.31.

Yell and S&P500 YTD Returns (Seeking Alpha)

Franchise Group, Inc. (FRG)

-

Active Corporate Insiders: 1

-

YTD Performance: -51.11%

- Total Bought Back: $3,750,000

Franchise Group is a relatively unique company that owns and operates franchised and franchise-able businesses. It pursues an aggressive roll-up strategy of acquiring mostly corporate-led and in-distress businesses through leveraged buyouts. At this point, management seeks to rapidly restructure the acquired business by franchising the corporate-owned stores and turning them into cash-generative assets that require much less capital to maintain and operate. In the end, they own merely the brand, henceforth the name. It currently operates through six of its businesses: Vitamin Shoppe, Pet Supplies Plus, Badcock, American Freight, Buddy’s, and Sylvan. It recently attempted to acquire the retail behemoth Kohl’s (KSS) which didn’t end all that well. Franchise Group is trading at an NTM EV/EBITDA of 8.93x, NTM P/E of 6.52x, and NTM P/FCF of 4.51x, while offering a dividend yield of 9.53%. Due to ongoing concerns over high leverage and the possibility of the macroeconomic environment affecting some of the core businesses negatively, the company underperformed the market producing a negative 51.11% return.

Seeking Alpha Authors remain highly bullish on FRG, assigning it a “Strong Buy” rating with an average score of 5.00/5.00. Wall Street Analysts are slightly less enthusiastic about FRG prospects, assigning it only a “Buy” rating with an average score of 4.20/5.00. Franchise Group is the only company on today’s that experienced interest from only one corporate insider. CEO Brian Khan purchased $3.75 million worth of shares for $37.15 in the second quarter, which raised his ownership stake in the company to 28.20%. FRG also approved a $500 million stock buy-back during the same time. The company is currently trading at $26.40.

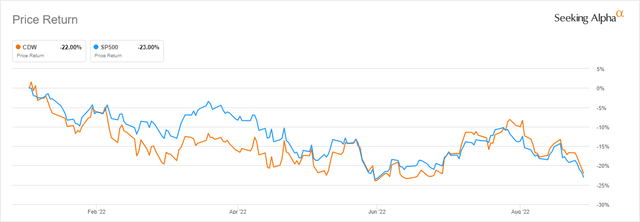

FRG and S&P500 YTD Returns (Seeking Alpha)

AFC Gamma, Inc (AFCG)

-

Active Corporate Insiders: 4

-

YTD Performance: -25.67%

- Total Bought Back: $2,035,664

AFC Gamma is a real estate investment trust (“REIT”) that represents an interesting and indirect way to approach the United States cannabis market. AFCG is in the business of providing institutional loans to high-quality cannabis operators nationwide in all aspects of production: cultivation, processing, and distribution. They offer loans and related facilities, generally secured by substantial assets such as real estate, licenses, and cash flow. Due to the lack of investment and capital inflow in the space, the company is able to generate significantly higher interest rates on its loans. Ironically, federal-level legalization could, as a result, actually endanger its business model as it would incentivize competition. Hence, AFC Gamma greatly benefits from the regulatory status quo.

It has largely traded in line with the market and generated a negative year-to-date return of 25.67%. The company is trading at a very attractive 6.26x P/AFFO and is offering a dividend yield of 12.19%. Seeking Alpha Authors have largely positive outlook on AFC Gamma, assigning it a “Buy” rating with an average score of 4.00/5.00. On the other end, Wall Street Analysts are even more bullish and have assigned it a “Strong Buy” with an average rating of 4.57/5.00. Shares of AFCG have been bought by the CEO Leonard Tannenbaum, CFO Brett Kaufman, as well as Managing Directors Jonathan Kalikow and Robyn Tannenbaum. Insiders bought back a total of $2.03 million during the second quarter at an average estimated price of $16.36. The company is currently trading at $16.00 per share.

AFC Gamma and S&P500 YTD Returns (Seeking Alpha)

KAR Auction Services, Inc. (KAR)

-

Active Corporate Insiders: 4

-

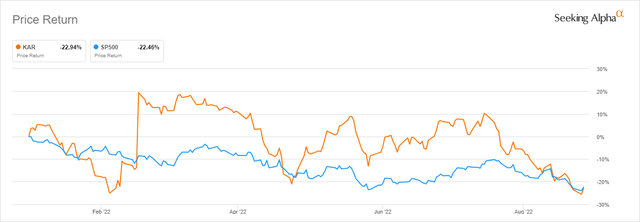

YTD Performance: -22.94%

- Total Bought Back: $2,189,284

KAR Auction Services is an Indiana-based technology company that provides an end-to-end platform that serves the remarketing needs of the world’s largest OEMs, dealers, fleet operators, rental companies, and financial institutions. By selling ADESA to Carvana (CVNA) in the second quarter, KAR parted ways with its physical auctions business and has now become a fully digital business. Last year, KAR leveraged its position to sell nearly 2.6 million vehicles around the globe valued at over $40 billion through auctions which led the way to almost $2.3 billion in revenue. KAR Auction Services, in fact, delivered a small alpha on the S&P500 (SPY), managing to generate a negative -22.94% return year-to-date.

The company is currently trading at a relatively pricey valuation as compared to the other companies on the list with a 14.17x FWD EV/EBITDA and 17.25x FWD P/E. Seeking Alpha Authors remain bullish about the potential of the company, assigning KAR a “Buy” rating with an average score of 4.00/5.00. Wall Street Analysts are somewhat less enthusiastic, assigning it a “Buy” rating with an average score of 3.77/5.00. Shares of KAR have been bought by the new CEO Peter Kelly, COB James Hallett, and Directors Mark Howell and Michael Kestner. They bought back a total of $2.18 million during the second quarter at an average estimated price of $13.06. Shares of the company can be currently purchased for $12.44.

KAR Auction Services and S&P500 YTD Returns (Seeking Alpha)

Tupperware Brands Corporation (TUP)

-

Active Corporate Insiders: 7

-

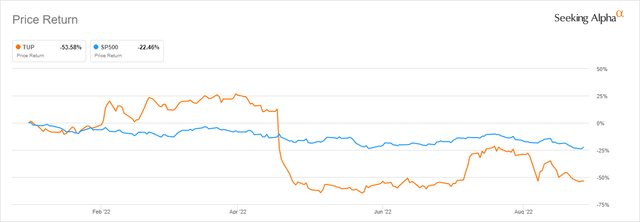

YTD Performance: -53.58%

- Total Bought Back: $2,154,640

Tupperware Brands is an iconic Florida-based food storage container company that was founded all the way back in 1946. The company is in the business of manufacturing, marketing, and selling an array of kitchen and home products under the Tupperware brand name. By extension, plastic food containers in general, regardless of brand, are sometimes referred to as “Tupperware.” It is also known for its use of multi-level marketing. TUP had a horrible year-to-date performance generating a 53.58% negative return. Still, it is selling at a seemingly very attractive valuation with an NTM EV/EBITDA of 3.81x, NTM P/E of 3.65x, and a P/FCF of x5.48.

Seeking Alpha Authors remain still largely neutral about the turnaround potential of the company, assigning it a “Hold” rating with an average score of 3.00/5.00. On the other end, Wall Street Analysts are slightly more bullish and have assigned it a “Buy” with an average rating of 3.66/5.00. Shares of Tupperware have been bought by the CEO Miguel Fernandez Calero, Executive Vice-Chairman Richard Goudis, Directors Tim Minges, Christopher Oleary, James Fordyce, Hector Lezama, Pamela Harbour. Insiders bought back a total of $2.03 million during the second quarter at an average estimated price of $6.00. The company is currently trading at $6.89 per share.

Tupperware and S&P500 YTD Returns (Seeking Alpha)

Final thoughts and conclusions

Many guides for fundamental analysis of companies suggest that reviewing corporate insiders’ sentiment remains an extraordinary resource at the disposal of the individual investor. However, not only can investors rely on insider trading data as a resource to add on top of their due diligence, they also have the ability to utilize insider data as a starting point for research into investment opportunities through back-testing and other analysis. We stand firmly by the belief that investors should utilize alternative data during their investment process.

Source link