[ad_1]

andresr/E+ via Getty Images

Like many other SPACs that entered the market, Taboola.com (NASDAQ:TBLA) share price has only gone down and down since entering the public market in 2021. The company operates in the digital advertising space and as such is definitely experiencing some near-term hardship. Global spending in advertising is shrinking and Taboola’s growth is therefore slowing a lot; nevertheless, the market seems to have discounted really a lot of pain, and shares are now trading for just 0.3x last 12 months sales. A valuation this cheap I believe represents an interesting entry point for a very tiny portion of my portfolio. Let’s review better what Taboola does and why I think it could be an interesting play.

Open Internet vs. the Walled Gardens

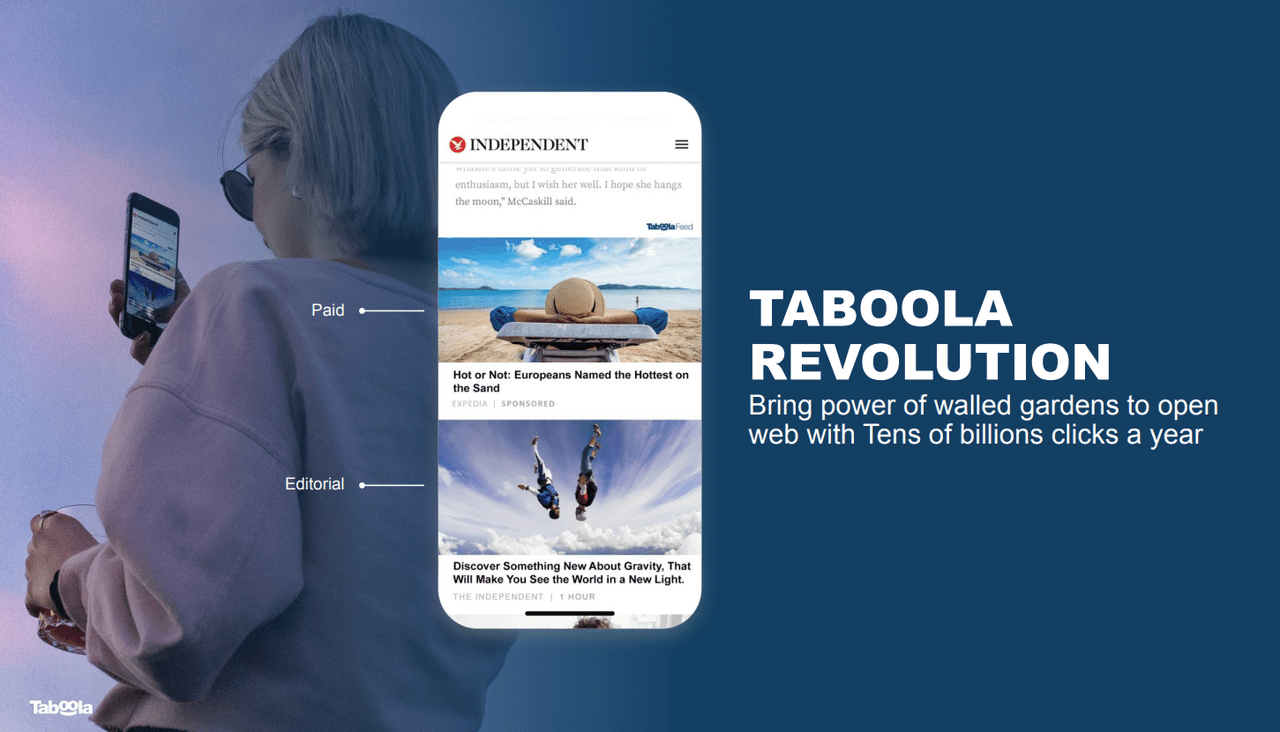

Taboola is a technology company that operates in the growing sector of digital advertising. Taboola partners with “digital properties” (apps, websites, mobile devices) that effectively rent out a portion of their screen for advertisements to appear. When users click and view these advertisements, Taboola generates revenue from the advertisers and shares a portion of it with the digital property’s owner. The company generally runs native advertising, which means that the ads are usually designed to look as if they were part of the original website/app editorial offering.

What is interesting about Taboola’s offering is that it does not rely on direct data about user’s profiling such as a social media profile or a search engine entry. This is the model adopted by the biggest digital advertising platforms in the world, the so-called “walled gardens” (Facebook, Google, and Amazon). In order to drive the recommendation platform, Taboola developed an AI-based algorithm that analyzes a customer’s digital property and tries to match their audience with the best content produced by the publishers that partner with Taboola. With time, the algorithm will understand what the user base of each digital property is interested in and will ultimately finetune the recommendations in an attempt to provide high value.

Taboola Q2 2022 Earnings Report

Taboola benefits from clear industry macro trends, such as the continuous shift from advertising on legacy media towards digital marketing in all of its forms. Moreover, in the latest annual report the company detailed how more than half of the budget for digital advertising is spent within the walled gardens. The remaining $67 billion spent in 2021 on the Open Web is then spread over a highly fragmented and diversified offering, of which Taboola is trying to gain share thanks to its agnostic platform. During 2021 Taboola worked with over 15,000 different advertisers and served over 500 million daily active users.

In its short journey as a public company, Taboola already finalised a big acquisition when in September 2021 announced that the company would acquire Connexity, one of the largest e-commerce media platforms. The company issued 17 million shares to complete the acquisition valued at a total of $157.7 million and also paid around $593.9 million in cash. An additional 3.6 million shares will be issued separately over the next 3 years to cover compensation for Connexity employees.

The purchase of Connexity adds another layer to Taboola’s offerings as the company now also includes e-commerce focused content and monetization for publishers. Taboola’s customers can therefore include over 500 million product listings as a native content on their digital property and create a new monetization stream while also generating consumer engagement on the platform.

The company also claims a somewhat resilience from the rolled-out deprecation of third-party cookies. Taboola’s recommendations algorithm runs based on first party identifiers and as such should be shielded from what other big companies’ initiatives, such as Apple’s launch of IDFA in 2021 that severely impacted Facebook’s business. However internet is very complicated and interconnected, as such there is always the risk that a change in the regulatory environment in terms of user’s privacy might impair the company’s ability to effectively target ads.

Macro headwinds are taking a toll on the operations

On paper there is nothing wrong with Taboola’s business. Then why are the shares down to such a cheap valuation? Let’s see more in detail about the recent performance of the company.

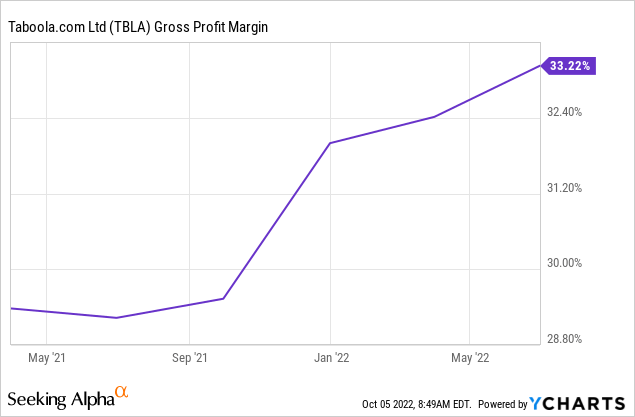

Taboola published Q2 2022 results on 9th August. The company’s revenue came in the upper part of what was previously guided at $342.7 million, up 4.1% YoY. Gross Margins improved from 30% to 33%, which is a much welcome improvement considering that Taboola is currently running in general at quite low gross margins. On the profitability side the company lost $5 million on a GAAP basis, much better than the $61.4 million loss reported last year. Unfortunately on a Free cash flow basis the company lost $7.3 million in this quarter compared to a gain of $6.9 million posted in 2021. It is worth mentioning however that the company attributes a negative impact of $22 million to operating cash flow due to a one-time event, in absence of which free cash flow would have been actually positive.

All in all a mixed quarter considering that the revenue grew quite slow and free cash flow turned negative, albeit barely. For a company operating basically at break-even while trying to achieve the necessary scale the balance sheet appears to be in an acceptable shape, with $308 million of cash and short-term investments and about $284 million of long-term debt. The company’s liquidity position does not seem to warrant much worry at this stage as it is not burning through much cash and has recently announced a cost restructuring to ensure more lean operations going forward. Moreover, the improvement in gross margins has been consistent since becoming public and gives hope that the company will at some point reach a sufficient scale to generate meaningful positive earnings.

YCharts – Seeking Alpha

The company has also demonstrated some degree of optionality with the recent success of Taboola News, which is a sort of Apple News equivalent on Android. Taboola News partners with OEMs and device manufacturers to provide new ways to show partnered editorial ads on mobile devices. Taboola News grew triple digits in revenue this quarter and is on track to reach $50 million in annual run rate by the end of this year and as such will start to have a material impact on Taboola’s financials as a whole. In addition this is an enhancement of the network effect that the company’s model benefits from as more users brings in more publishers, which in turn brings in more digital properties and so on.

The company is experiencing some clear headwinds caused by the macro economy as the general ad spending is decreasing. Firms around the world are pulling back on discretionary spending due to fears of an imminent recession or decreased earnings in general. This created an odd occurrence in Q2 in which Taboola generated about $22 million of revenue from new digital properties, while existing ones actually contributed to a decrease in revenue of about $8 million. The company attributed this churn to the weakness in the economy in Europe and the US

As far as guidance, the company expects revenue to come in between $311 and $331 million, which assumes some negative growth even at the highest point (Q3 2021 revenue was $338 million). On the bottom line the company expects to post a Non-GAAP loss between $8 to $2 million. More commentary below from management on the guidance:

I should note that our guidance assumes continued weakness in the macroeconomic environment at current levels. This weakness has translated into the lower advertising demand we experienced throughout the second quarter. Our guidance does not assume a further weakening of demand or a departure from our normal fourth quarter seasonality.

Valuation and key takeaways

All in all, Taboola seems to be a promising business operating in a growing field which is experiencing generational tailwinds but also some near-term difficulties. The margins profile at the moment are too low for a great business but they are improving and operationally Taboola is posting some good successes. There is an argument to be made that the company is actually succeeding in improving its network effect (and thus its moat), which is opening to potential market share gain, margins expansion and increased profitability. The near term appears challenging due to reduced advertising spending worldwide, but does not seem to threaten Taboola’s existence as the balance sheet is in an acceptable shape and the company is generally posting positive free cash flows.

What is interesting to me is that the current valuation seems extremely cheap, with a market cap of $457 million and a Price / Sales (TTM) of just 0.32. If the company manages to consistently grow free cash flow to $50 million, that would already be a P/FCF of just 10. $100 million in free cash flow would translate to a P/FCF of 5 at current levels which is really cheap. Since we are talking about a company generating almost 1.5 billion in revenue that doesn’t seem too farfetched. The market is clearly discounting a lot of pain and zero growth going forward but I am not convinced that this will be the case for Taboola. I am not expecting explosive growth, but this might be an interesting play on the long-term recovery of the advertising market given that in my opinion the current valuation offers a decent safety to further price drops. I am interested in opening a very small position in the company and monitor its performance in the future as I like this risk/reward profile.

Source link