[ad_1]

Artur Nichiporenko

Overview

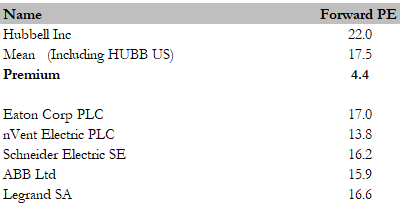

Hubbell Inc (NYSE:HUBB) is currently overvalued by ~25%. I aim to keep this post short as this is a very straight-forward thesis where the market has extrapolated peak earnings to the future, a typical setup for cyclical companies. I believe the market will recognize HUBB’s intrinsic value when growth starts to slow, and management starts commenting on the negative impact felt from declining commodity prices. I believe there is hardly any reason why HUBB should suddenly trade at a premium to peers when nothing structural has changed except the growth acceleration over the past few quarters, which benefited from a black swan event—the supply chain crisis. I believe HUBB should trade back to peers’ levels (15x forward earnings), which translates to ~$171 in FY23 based on consensus’ $615 million FY24 earnings.

Business description

HUBB has two business units: Electrical Solutions and Utility Solutions.

Hubbell Electrical Solutions is located behind the meter and caters to the needs of commercial and industrial customers. HUBB’s products are used in many different fields, such as light manufacturing, non-residential, wireless communications, transportation, data centers, and heavy manufacturing.

Hubbell Utility Solutions is a conglomerate of businesses that cater to the In Front of the Meter market by developing, fabricating, and retailing a vast selection of electrical distribution, transmission, substation, and telecommunications products. Utility T&D hardware consists of things like arresters, insulators, connectors, anchors, bushings, and enclosures.

As of 2Q22, electrical solutions represented 42% of revenue and 40% of operating profits, whereas utility solutions represented 58% of revenue and 60% of operating profits. HUBB mainly serves the US market, with 90% of revenue originating there.

Revenue growth to slow as commodity prices inflect downwards

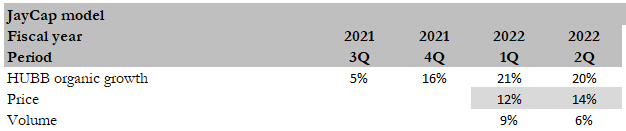

HUBB is extremely sensitive to fluctuations in the cost of raw materials like steel, copper, and aluminum. As a result of the commodity and supply chain crisis, commodity prices have recently risen, allowing HUBB to increase prices and inject new life into the economy. Note that HUBB is exposed to the same risks as other semiconductor businesses because their products are not heavily reliant on electronic parts (i.e., chips). As such, the growth that HUBB printed was largely a function of pricing, and not “organic” volume growth.

HUBB’s filings

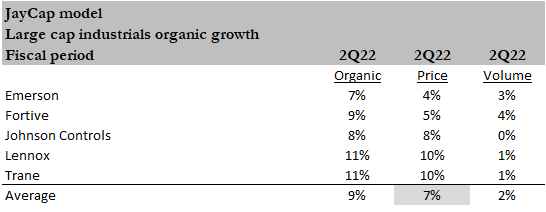

This enjoyment of best prices can be found throughout the US industrial sector. Prices for US industrials are at an all-time high because of rising costs and ongoing supply shortages. According to several company reports (Emerson (EMR), Fortive (FTV), Johson Controls (JCI), Lennox (LII), and Trane Tech (TT)), organic sales increased by 9% on average, with price growth accounting for 7% and volume growth contributing 2%. Some were flat or slightly quieter than others.

Company reports, Bloomberg Intelligence

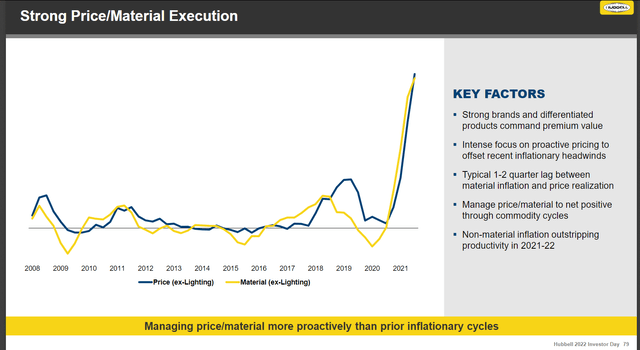

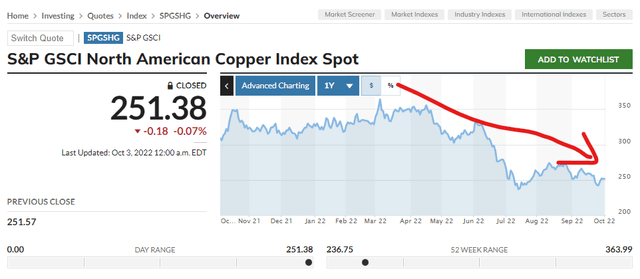

I don’t believe the recent re-rating of the company’s valuation is justified, as the company’s fundamentals haven’t changed despite the company’s astronomical growth in recent quarters. Steel, aluminium, and copper consumption, on the other hand, have been declining, which will be the catalyst for growth to slow. My viewpoint is supported by management disclosure in its most recent analyst day (see chart below), which suggests that if costs fall, prices must fall as well. As a result of “rising commodity prices,” I believe HUBB has run out of room to raise prices. Growth is expected to slow significantly in the coming quarters compared to previous quarters.

HUBB 7 Jun Analyst Day presentation Marketwatch Marketwatch Marketwatch

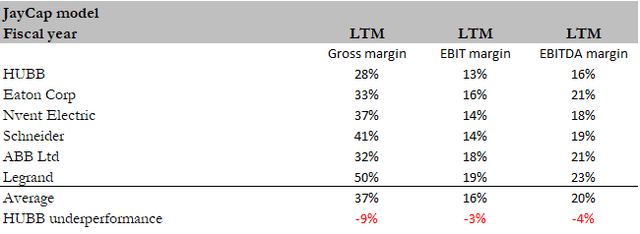

Relatively lower quality business should deserve a lower multiple

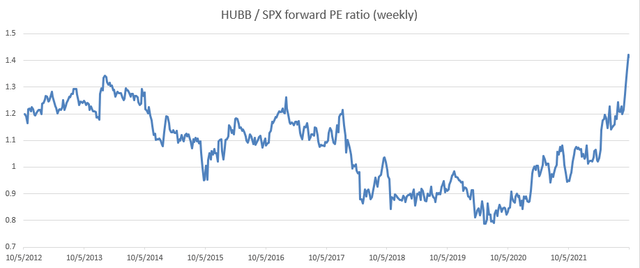

The fact that HUBB’s operations are fundamentally comparable to those of its competitors, despite the fact that it has lower Gross, EBIT, and EBITDA margins, justifies HUBB’s trading at a lower multiple. When compared to its historical performance, there is no reason to believe that it should be trading at a premium today. In fact, HUBB is currently trading at four times its competitors’ average multiple, while its valuation multiple is 1.4 times that of the S&P 500 (the highest in ten years). It is critical that I emphasize how absurd this premium to the S&P500 is in light of the current macro environment, which is extremely negative for asset prices as interest rates rise aggressively.

Company reports, Bloomberg Bloomberg Bloomberg

Forecast

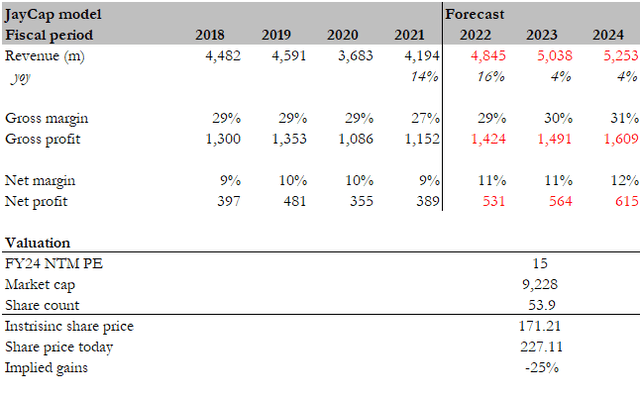

Based on my investment thesis, I expect HUBB to see a major slowdown in revenue growth given the drop in commodity prices, that have elevated revenue over the past few quarters. I believe that forecasting where commodity prices will be over the next few years is as good as anyhow guess, but still, it is important to have some numerical sense of things. Hence, I used consensus figures to illustrate the potential downside for HUBB. Consensus is expecting the company to achieve $5.2 billion in sales and a $615 million net profit in FY24, which I believe are fairly alright estimates in the absence of a deep recession – which I believe has a high chance of happening but did not model it in. However, where I differ from the market is valuation. The market is attaching a 21x forward earnings multiple, which I believe is absurd given the relative performance against peers. I believe HUBB should trade back to the average multiple that its peers are trading at—15x. Attaching 15x forward earnings in FY23 to FY24 $615 million earnings would result in a market cap of $9.2 billion, or $171 per share, or 25% downside.

Red Flags

Metal prices

The thesis relies on falling commodity prices; if metals start rising, HUBB will have every reason to raise prices, which would be disastrous for the valuation re-rating thesis because the company is now expanding at a much faster rate than its competitors.

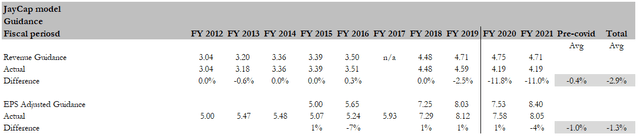

Management guidance

Management has a history of providing good guidance (actual figures are within low-single digits percentage difference). This could be seen as a risk if management were to guide a high growth figure despite what I expect to happen, the market might give the benefit of doubt, causing a positive reaction to the share price.

Conclusion

HUBB is overvalued at its current share price as of the date of this writing. HUBB has benefited from the supply chain crisis and rising commodity prices, which resulted in elevated growth, and the market is attaching a higher than average multiple due to the perceived “higher growth” over the past few quarters. This growth is not sustainable, in my opinion, as commodity prices are already plummeting. HUBB should eventually trade back to its peers’ level when growth subsides in the coming quarters.

Source link