[ad_1]

PeopleImages

While many investors believe Clorox (NYSE:CLX) to be a safe haven company, recession-proof, I am not one of them.

Despite Clorox declining over 40% from its all-time-high set during the pandemic the stock is still wildly overpriced and expensive.

The Short Thesis

We’ve all heard the short thesis for Clorox – it trades at a high P/E, cash flow is low, and revenue and earnings are stagnating. That’s all true, but I’ve thought that for a long time and didn’t short the stock before.

This week I initiated my first short position in CLX for 2022 earlier this week due to a material change that occurred this month: Rates spiking above the earnings yield and dividend yield of Clorox.

With this material change in the macro environment Clorox is not only overvalued to bears, but increasingly unattractive to regular investors.

In this article I’ll walk you through why the saying “don’t fight the Fed” applies just as much to safe haven stocks like Clorox as it does to growth stocks and present the case for shorting Clorox for more than just its gross overvaluation.

We will start with a brief valuation model of Clorox to demonstrate it’s current overvaluation, and the concern rising rates pose to it’s ongoing lofty valuation.

Baseline Valuation

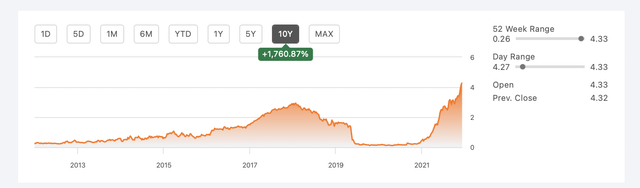

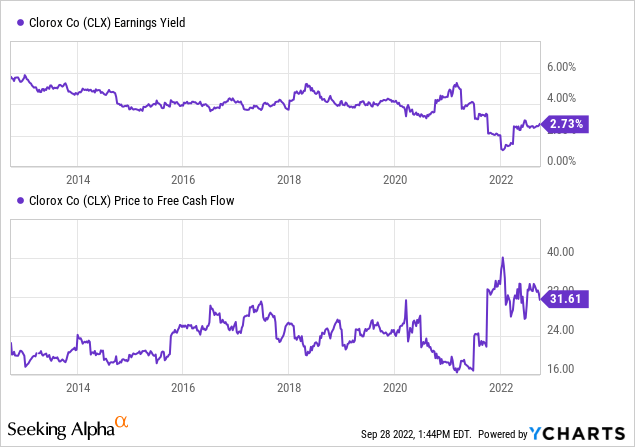

Due to this being a thesis built on macro we’ll be looking at the 10-year chart of these metrics: Price to free cash flow, and Earnings Yield.

Why these two?

These are the two most relevant metrics in a rising rate environment in my opinion: how much the company is yielding from an earning perspective, after reinvestment, and how much the company is earning after reinvestment.

On a historic basis both of these metrics are quite bad – with earnings yield substantially lower than the majority of the last 10 years and P/FCF higher than almost anytime in the last 10 years.

Normally this isn’t an issue as bonds are yielding next to nothing, making an expensive company like Clorox that has generally stable, consistent, recession-proof revenues what many call a “bond proxy.” So-called “bond proxies” were called this as the equities were seen as recession-proof and cash-flowing kings with minimal earnings downside risk.

That largely was true of such names, like Clorox, and still is true; Over the next year Clorox is expected to make $4.08 per share vs $4.11 over the last year.

With bond yields that are now above the net earnings yield, and Free cash flow Clorox produces, the ‘bond proxy’ element of Clorox largely goes away.

Afterall Clorox is still subject to market conditions, competition, etc, while bonds are essentially risk-free. Why would you choose a bond proxy with more risk when you can choose a risk-free option that yields more?

Above you can see the US2Y is at 10-year highs, currently sitting at 4.27% – while not entirely risk-free it’s very close to being so, and with the Fed projected to raise the Fed-Funds Rate to 4% -> 4.5% at a minimum over the coming months.

It’s arguable that the 2-year yield has nowhere to go but up, which would put further weight on all stocks as their greater risk relative to the 2 year begins to offer less and less material upside potential.

Do I believe the 2-year yield is going up from here? Sure – I’d argue it could go up marginally further, but that’s not the point of mentioning the yield they provide.

The point is a dividend investor could swap out their shares for 2-year treasuries right now and yield not only higher yields than Clorox provides (3.33%/year as of writing), but also more than the net earnings (2.73%) Clorox generates on a yearly basis.

Why Would You Hold Clorox?

So from a fundamental perspective, purely on valuation, why would someone keep Clorox when 2 Year treasuries yield more in all aspects?

There are only three things that could be causing this:

- They believe Clorox’s IP is extremely valuable, or Clorox’s margins, revenue, etc, will explode higher

- They believe the Fed will win against inflation quickly – crushing rates and making treasuries unattractive once again

- They’re ignorant of how to sell the stock without impairing large capital gain taxes

For the ignorant if they want to get rid of the stock they can sell an ITM call significantly below current prices to lock in the shares current price today, becoming near delta-neutral and getting rid of almost the entire risk of the position while delaying the tax consequences indefinitely or significantly depending on how the stock trades over the option term. I’d encourage those unfamiliar with this strategy to familiarize their self with it.

That leaves us with two groups, and for those groups I ask you to look at the 10-year yield with me now.

Currently the US10Y is at 3.85% at the time of writing, which once again is above all the relevant metrics I’d use to value Clorox: cash-flow, Net-Earnings, and dividend yield.

In all metrics the US 10-year yield outperforms. This is undeniable.

The Lose-Lose Scenario

For the optimistic types out there, those that believe the Fed is going to win their battle with inflation quite quickly. Those that believe rates will be going down soon after, making Clorox a better cash generator than treasuries.

I would disagree, as I believe inflation will stay elevated and rates will not come down substantially for some time, but we could bicker about that all day, but truth be told neither of us knows what will happen with rates short-term.

There are too many moving parts, we can’t accurately define the percentile chance of each of our assumptions and price them accordingly.

What we can do is define what’s likely to happen if each of our base cases is correct.

For my base case, rates staying elevated along with inflation, Clorox will be living rent-free in investors’ minds, constantly trying to be evicted by US treasuries.

For your base case, rates going down along with inflation, making capital cheaper – Clorox experiences capital inflows due to its superior or on-par yield versus treasuries.

The thing is, Clorox investors lose in both cases relative.

CLX vs IEF Total Return (TTM) (SeekingAlpha)

Allow me to explain: When comparing Clorox’s performance versus the performance of the 7-10 year bond fund, IEF, over the last year Clorox has outperformed from a total return perspective.

That’s great.

But looking out a year from now, in my base scenario, bonds and Clorox would go down – as yields would be the same or rise slightly, making capital more expensive and Clorox less attractive to investors. This combines with likely a liquidity event caused by a general decline in stock prices, further encouraging investors to pull from potentially more stable safe-haven positions, like Clorox, to prevent liquidation or to raise capital to buy stocks that have dropped further.

But maybe I’m wrong – maybe rates drop relatively quickly and we have a soft landing. How will that look for Clorox?

If yields go down bond prices go up, so this 1-year underperformance would likely manifest in the opposite direction, as an outperformance, relative to Clorox – unless Clorox’s business fundamentals substantially improve, say due to better margins thanks to lower inflation rates.

My question to you, if you believe that scenario is most likely, is why you would own Clorox and not Bonds? Better yet if inflation is down, rates are down, and easy money is back, why own a low-growth high-pe stock at all? Why not own stocks with higher growth, or lower p/e’s?

These are questions Clorox investors, and most dividend investors, need to ask themselves in the current environment. There are valid answers to them where it makes sense to invest in Clorox despite the risks I’ve outlined – such as if you believe Clorox is materially undervalued.

Is Clorox Undervalued Today?

The last folks to address are those who think Clorox is undervalued today.

We can’t quantify is how much Clorox will earn into the future, the relative value of their IP, or other operating metrics to define if they’re going to outperform bonds from here. We can speculate on it, project, but that’s about it.

The wallstreet analysists and Clorox management seem to largely agree on the future earnings over the next year, and the results are:

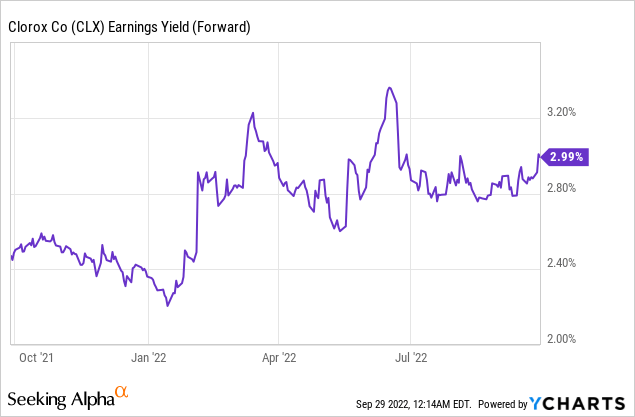

With the next year Clorox being projected to only have a 2.99% earnings yield, similar to last year, they’re priced to perfection and, in my opinion, will become increasingly less attractive to investors as yields stay elevated.

If you disagree I can respect that – I have not valued the IP of Clorox, I’ve just looked at the cash-generation side of the business and its relative value compared to peers such as Church & Dwight (CHD).

General Takeaways

- Clorox Appears Overvalued on a FCF and Earnings-yield perspective

- Rising rates are likely to severely impact the attractiveness of Clorox

- If rates rise clorox is likely to fall to adjust to match or exceed the yield bonds provide

- If rates stay as they are clorox is likely to slowly lose attractiveness

- If rates go down clorox is unlikely to have valuation expansion and other assets, including bonds, would likely net higher returns

Actionable Takeaways

If an investor in Clorox agrees with my thesis and believes rates will stay elevated or rise they should consider selling ITM short calls to mitigate their downside risk, or liquidate the position.

For opportunists and people open to going short they have a variety of options that make sense:

- Short Clorox and Long IEF Bonds or TIPs bonds (low-return, low-risk, good if rates are flat from here for an extended period of time)

- Sell an OTM call in Clorox (low-medium risk, low-return, good if rates are do not drop substantially).

- Short Clorox and long a competitor like CHD that has better valuation metrics (low-medium risk, low-medium return – indifferent to bond rates)

- Short Clorox and sell a covered-put against it (my choice – medium-risk medium-return, good in sideways to up rates).

- Short Clorox in a raw fashion with no option premium collected (very high risk, high return – good if you believe rates will spike to an extreme degree)

- Short Clorox and long growth names (very high risk, very high return – good if rates decline).

Ultimately all the above have merit depending on an investors assumption.

My preference is to collect premium while being short, as I don’t expect the move to be violent and quick on bad news, but rather slow as investors seek alternatives and slowly pull liquidity from Clorox into Bonds and other assets. This is why I decided to sell the stock paired with a short put – premiums are high and I believe time will be on my side, rather than a swift downmove occuring.

Potential Risk to Shorts

While the above setups may be suitable for some investors, including myself, they’re definitely not for everyone – shorting a stock is often outside the risk-tolerance of investors, as losses can theoretically be unlimited.

A few aspects potential shorters need to consider:

Potential Profit Margin Expansion

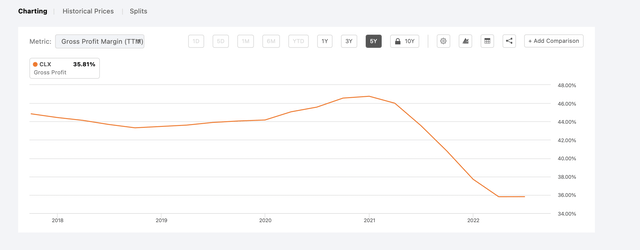

As you can see above Clorox’s profit margin has declined from 46.76% in Q4 2020 to 35.81% in the last earnings report.

There’s a risk that this expands once again if inflation is brought under control, to some degree, by the FED. In such a scenario I’d expect Clorox to go up above $150/share, even if rates stay elevated.

Potential Macro Instability

While in theory it may be a reasonable strategy to short Clorox and Long TIPs as outlined above, or shorting CLX while longing a competitor such as CHD, there’s numerous macro conditions that can ruin such trades – or the thesis as a whole.

As we’ve already mentioned if rates rise it’d likely ruin the thesis – but if rates rise too quickly we could also see a liquidity crisis, and while such an event may help the short case as people pull from Clorox it may not turn out like that.

Extreme volatility is always unpredictable and in such a scenario being long/short anything can be extremely dangerous.

Options & General Net-Short Risks

Many of the strategies I mentioned include options, and while selling a stock and a short put against it can be advantageous, allowing you to be net short and collect premium, it can be hard to get in such a position due to poor liquidity in the options market – at least without legging in, which carries additional risks.

If someone does not need the cash shorting provides it’s generally easier and more manageable to simply sell a short ITM call instead, as such a position is nearly identical to a short-stock short-put strategy.

Both of these strategies have unlimited upside risk to the upside, so it’s important to consider the liquidity issues they can cause in a portfolio if Clorox unexpectedly moves up swiftly. You can mitigate this risk by buying call option (guaranteed) or a stop-loss (less guaranteed) – around the $150-155 level looks to be a good place for that in my opinion.

Conclusion

While this wasn’t a traditional short article bashing the company’s last earnings report (which wasn’t pretty for Clorox either) I hope I presented my case for shorting Clorox here effectively.

We can all look at the P/E ratio, dividend yield, and earnings reports and come to different conclusions, and there have been many cases sharing the bear case on here already.

I’d encourage folks to supplement this article with this one by Trapping Value, which was released in early August.

I agree with essentially everything said in the article, and it presents a great bear case for the stock, however lacked the connection to macro I believe is needed to justify initiating a short position versus simply avoiding the stock.

Specifics about my personal positioning currently

I’ve been bearish on this stock since late 2020 and have never liked the stock – I’ve also initiated a new short position on the stock this week at $143.31 with a short put (Nov 18th ’22, 140p) attached to the order to collect premium, for a potential of earning $585 of premium, $331 of capital appreciation, and around $100 of USD-financing benefits.

These positions are due to my view on Clorox as well as needing financing for long positions in the portfolio.

Source link