[ad_1]

vzphotos

Micron Technology (NASDAQ:MU) as reported very weak earnings and guidance for the near term, showing that the current downturn is much more severe than expected some months ago. This is a stock that long-term investors should avoid for the time being.

Background

As I’ve analyzed in previous articles, I’m bullish on the semiconductor industry over the long term, but I don’t usually invest in companies with a higher cyclical profile, as I want my portfolio to be exposed to secular growth trends. Nevertheless, about one year ago, I bought Micron as a tactical play, given that its valuation was quite cheap compared to its peers and its own historical valuation.

At the time, Micron was trading at less than 6x its forward earnings, which was at the bottom of its historical valuation and much cheaper than other ‘out of favor’ companies in the sector, such as Intel (INTC) that was trading at some 11x forward earnings.

However, despite its relatively low valuation, Micron’s business is quite cyclical and there were some signs of weakness in the DRAM market at the beginning of this year, thus as earnings estimates were revised downwards and its valuation get closer to its historical average, I decided to sell my position and booked a small profit from this trade back in February.

While there were some expectations that weakness in the DRAM market could be temporary, this was not the case and Micron’s share price has been on a downtrend this year and has underperformed the semiconductor sector, as shown in the next graph (Micron is the white line).

Price performance (Bloomberg)

As I’ve not covered Micron over the last year, I think it is now a good time to revisit its investment case considering that the company has released quarterly earnings yesterday, to examine if it is a potential recovery play over the coming months or if it’s better to stay away from this stock for some more time.

MU Q4 & FY 2022 Earnings Analysis

Micron has reported yesterday its financial results related to the Q4 and full fiscal year (FY) 2022 results, with annual revenues increasing to $30.8 billion (+11% YoY), reaching a new record high, and net income of $9.5 billion.

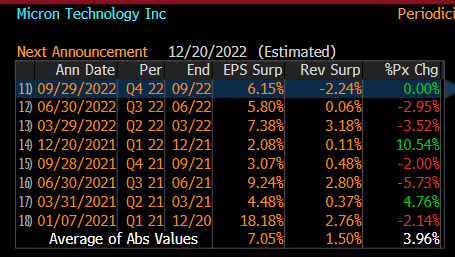

While the annual results were positive, Micron’s operating momentum has become much weaker in the past few months, as results related to the most recent quarter were quite weak. Indeed, revenue declined by 23% compared to the last quarter and was down 20% YoY to $6.6 billion, and was slightly below expectations. On the other hand, its adjusted EPS of $1.45 was 6% above estimates, as shown in the next graph.

Earnings surprise (Bloomberg)

While the decline in revenue was not completely a surprise for the market, it shows a worrisome trend that weakening economic conditions is having a negative impact on consumer demand, which is leading to lower DRAM prices and inventory adjustments from Micron’s customers.

This is very important because Micron gets more than 70% of its revenue from DRAM, and pricing risk is mainly on Micron’s side, given that customers can change pricing conditions from the moment of order to deliver. This means that on moments of declining demand, Micron will be hit considerably as the company does not have much pricing power. This explains to some extent how Micron’s revenue can decline so fast in just a matter of months, and also why the market values its business at very low multiples.

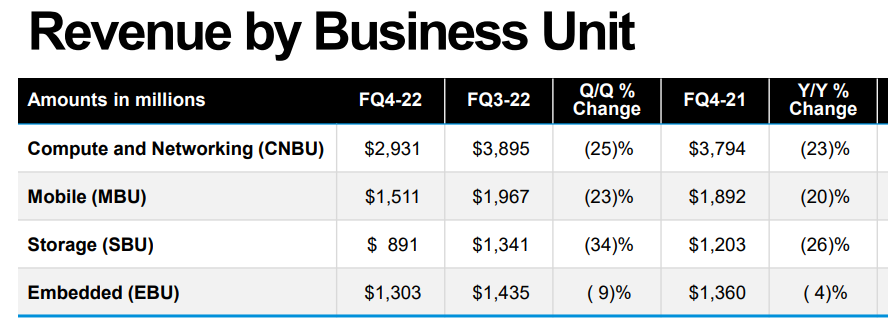

Nevertheless, all business segments reported declining revenue during the past quarter, showing that weakness is broad-based and not related to any specific end-market, not boding well for its operating momentum in the coming quarters.

Revenue (Micron)

Not surprisingly, beyond lower revenue, its business margins also deteriorated as pricing declined both in DRAM and NAND. While Micron’s gross margin was close to 46% in FY 2022, in the last quarter gross margin declined to 40.3% (vs. 48% in Q4 FY 2021), the lowest level over the past six quarters. This is also another sign that Micron’s business is very exposed to economic cycles, as gross margin can change significantly from quarter to quarter, being another negative driver for earnings.

Another negative factor for earnings were rising costs, considering that operating expenses increased by 7% QoQ to more than $1 billion in Q4. As Micron’s revenue plunged, gross margin decreased and costs rose during the last quarter, all negative trends in earnings, not surprisingly the company’s operating income declined by 49% QoQ to $1.52 billion. Its operating income margin was 22.9%, much lower than 34.8% reported in Q3 FY 2022.

Regarding its bottom-line, Micron achieved a net profit of $1.49 billion in Q4, a decline of 43% from the previous quarter, and $8.7 billion in FY 2022 (up by 48% YoY). Capital expenditures in FY 2022 amounted to nearly $12 billion, and its free cash flow was close to $3.2 billion.

While its annual figures were still positive, the extent of the current downturn is more severe than expected some months ago, a situation the company acknowledges and is reacting to. Indeed, its guidance for the next quarter was awful, as Micron only expects to generate some $4-4.5 billion in revenue (a decline of 32-39% QoQ) and its gross margin is expected to be between 24-28% (vs. 40.3% in Q4).

This means that after a very weak quarter, Micron expects even worse for the next quarter, showing that the current market downturn is having a big impact on the company’s business. Micron also announced other measures to offset current weakness, namely cuts to supply growth coming from a decline on planned capex for next year, which is now expected to be about $8 billion or a 30% reduction from its previous estimate, and also from reducing utilization in its factories.

These measures will help the company to preserve cash, which is key to maintain a strong balance sheet, and is a headwind for equipment suppliers, such as Applied Materials (AMAT). Investors should note that Micron’s balance sheet remained strong with a net cash position of $4.1 billion at the end of 4Q FY 2022, but deteriorating operating trends can change this financial profile quite rapidly.

For instance, capex was projected to be around $11.6 billion in FY 2023, thus lower investments in capacity will save the company some $3.6 billion during the next year, which would be difficult to finance though operating cash flow as revenue and profits decline in the coming quarters. Indeed, in the next quarter, assuming that Micron delivers at the bottom of its guidance, the company will report a net loss.

Thus, cash flow generation may be limited and, if industry conditions don’t improve during calendar year 2023, a cut to its shareholder remuneration policy is likely in my opinion. This could be another negative factor for Micron’s investment case, which is likely not currently expected by the market, as the company guided for a more balanced supply-demand position in the second half of 2023. However, market dynamics are quite uncertain at this time, especially regarding demand, and forecasting a rebound in the second semester of FY 2023 should be taken with a grain of salt.

Medium-Term Estimates & Valuation

As Micron’s operating trends have collapsed in the past three months and are expected to remain weak in the near future, it is quite difficult to forecast how its business will evolve over the medium term. Moreover, analysts’ estimates are still to be updated following its most recent earnings, thus at this time looking for medium-term estimates is an exercise that is quite likely to be too optimistic.

For instance, revenue estimates for Q1 FY 2023 are still at about $5 billion, considerably above the company’s guidance, and were above $6 billion before Micron’s earnings release. This means that the estimates for revenue and earnings over the next few years are likely to be revised downwards in the coming days, which is not supportive for Micron’s share price.

Revenue estimate (Bloomberg)

Nevertheless, the current consensus is for Micron to report some $21 billion in revenue in FY 2023 (-29% YoY), while in my previous article the market expectation was for revenue to be about $38 billion. The market expects 2023 to be the bottom of the cycle and a rebound to $28 billion in revenue is expected by FY 2024, followed by growth to $32.7 billion revenue by FY 2025.

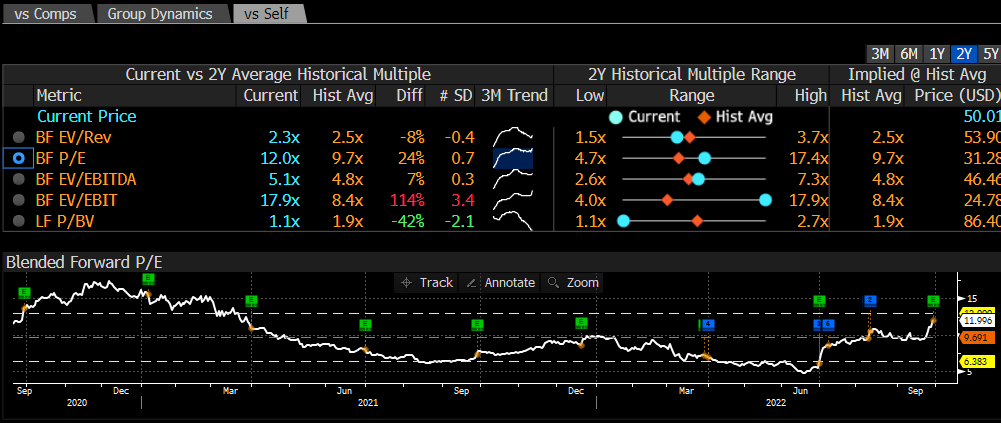

Regarding its valuation, due to lower earnings expected in the next few quarters, Micron is currently trading at 12x its forward earnings, which is above its historical average over the past couple of years. This shows that Micron’s weak share price is justified by the company’s deteriorating fundamentals, as the business is very cyclical and may turn from profits to losses quite rapidly.

Valuation (Bloomberg)

This means that unless industry conditions for the memory segment improve in the coming quarters, which seem unlikely right now, Micron is somewhat overvalued based on its historical valuation pattern.

Conclusion

Micron’s operating momentum is awful and a quick rebound seems unlikely, even if the company is trying to manage expectations for a recovery in the second half of next year. However, investors should note that Micron has said since the last quarter of 2021 that weakness was temporary and related to inventory adjustments, with a recovery likely in the following 6-9 months.

That has clearly not played out as expected, and Micron’s recent earnings and guidance for the coming quarter were very weak, contrary to management ‘guidance’ some months ago. Therefore, long-term investors should stay away from this stock, while more risk-taking investors should see Micron as a potential speculative cyclical play on a potential recovery in industry dynamics over the coming quarters.

Source link