[ad_1]

Seremin/iStock Editorial via Getty Images

Skyworks (NASDAQ:SWKS) had a tough few quarters. The last time I wrote about the company was 16 months ago, and I’ve been wrong about price action and learned a few things.

I was overly enthused about the 5G market and expected demand to remain high, ignoring the cyclicality and structural problems. I highly recommend reading my previous article – Skyworks: Reliance On Apple Leads to Bigger Discount.

It’s crucial to understand why I was wrong at the time. Here are a few key reasons.

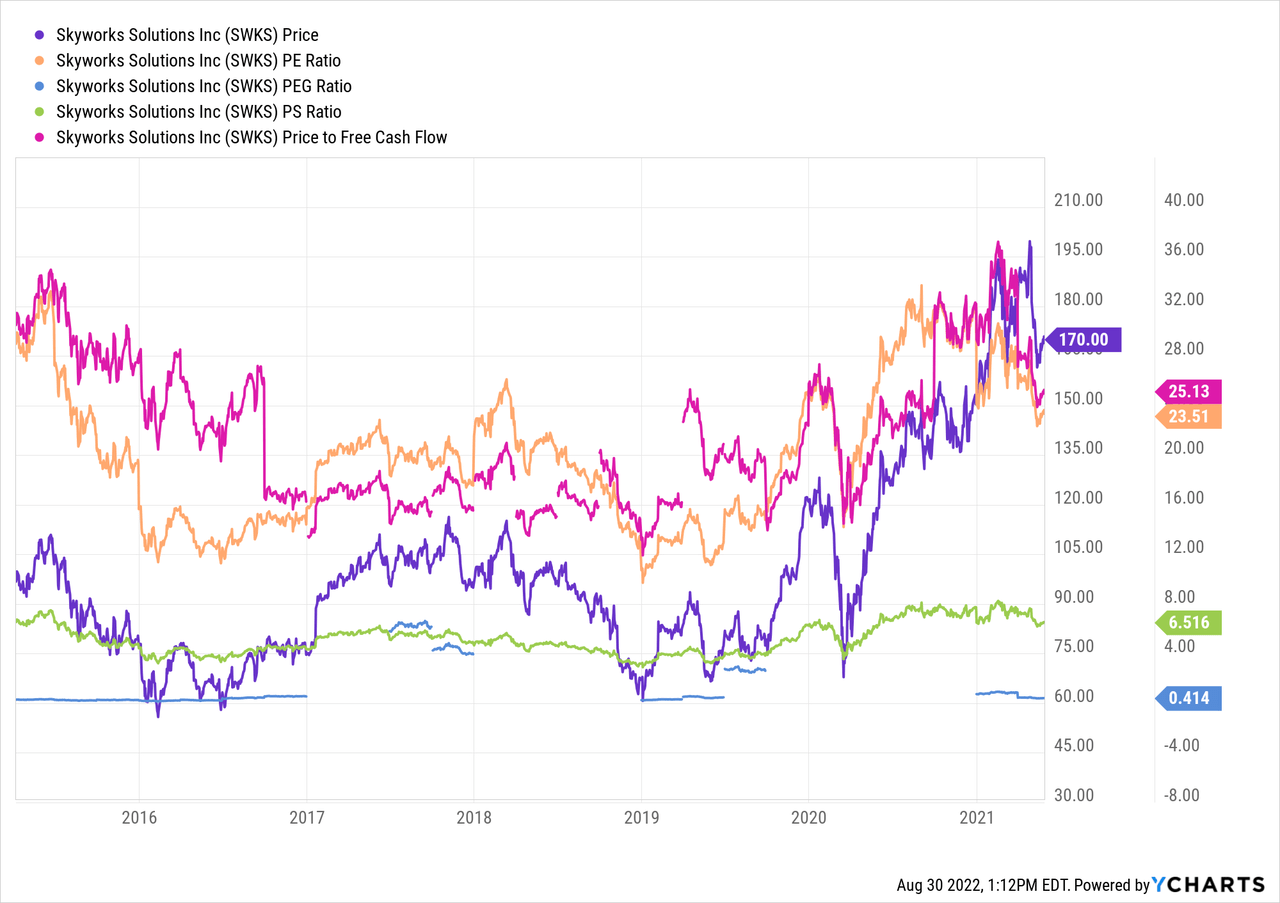

- Skyworks was trading at elevated valuation multiples, and even though it experienced some retracement when I was writing about it, its valuation was still high.

- Demand was historically high at the time. For it to grow at the same growth rate was naïve.

- Skyworks was trading a cyclical high.

Caution!!! The chart below shows Skyworks’ share price from 2015 to June 2021!

A few things have changed since then. Demand in the Chinese market crashed. Further, demand in many other countries decreased rapidly too. All but the high-end smartphones had their demand drop.

The market doesn’t set the value on an absolute level, it’s always relative. If demand is already elevated and too much optimism is baked into Skyworks stock price, it’s difficult for Skyworks to surprise to the upside on a comparable basis.

Introduction

Skyworks’ valuation has retraced plenty since I last wrote about it. The stock price fell ~40% since I wrote about it, while the S&P 500 fell only 3.7% over the same time.

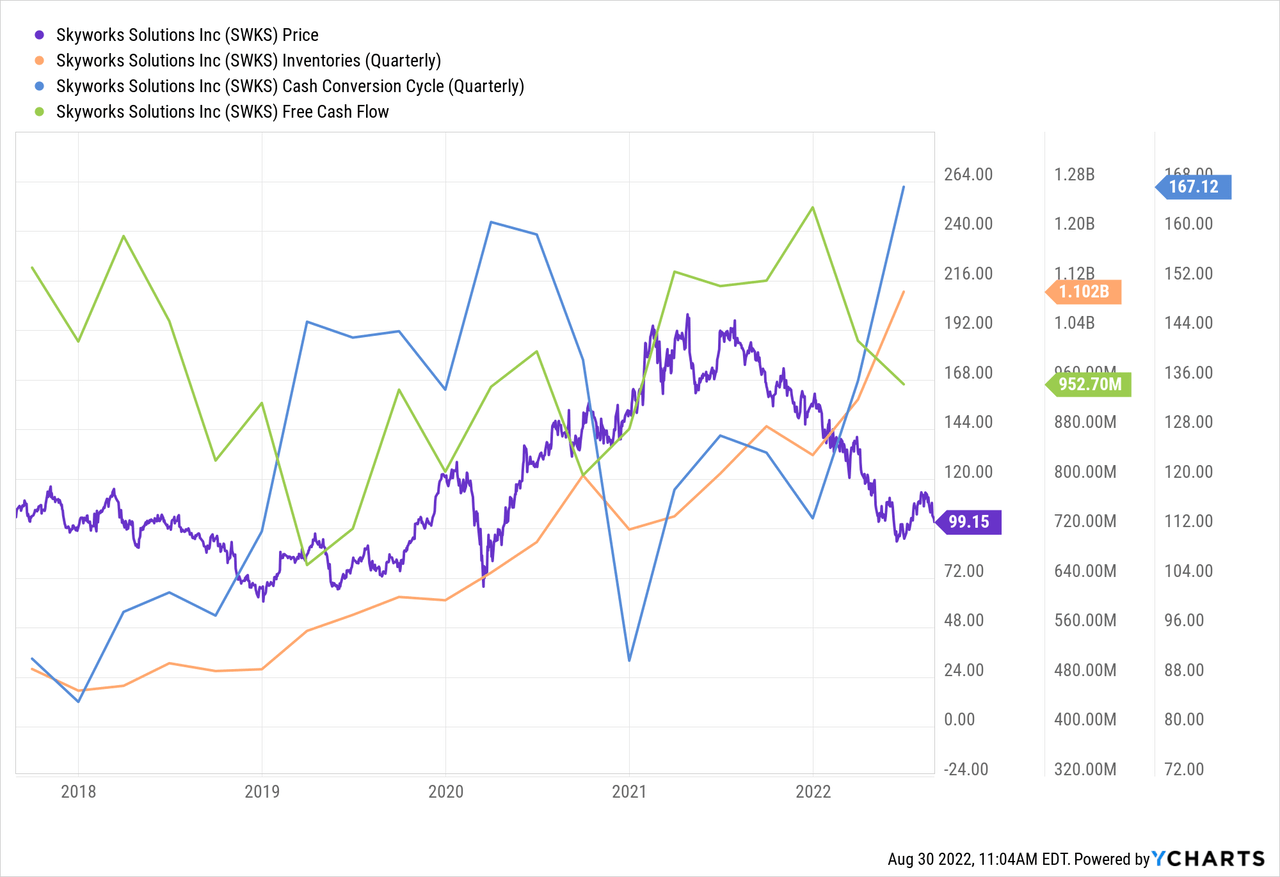

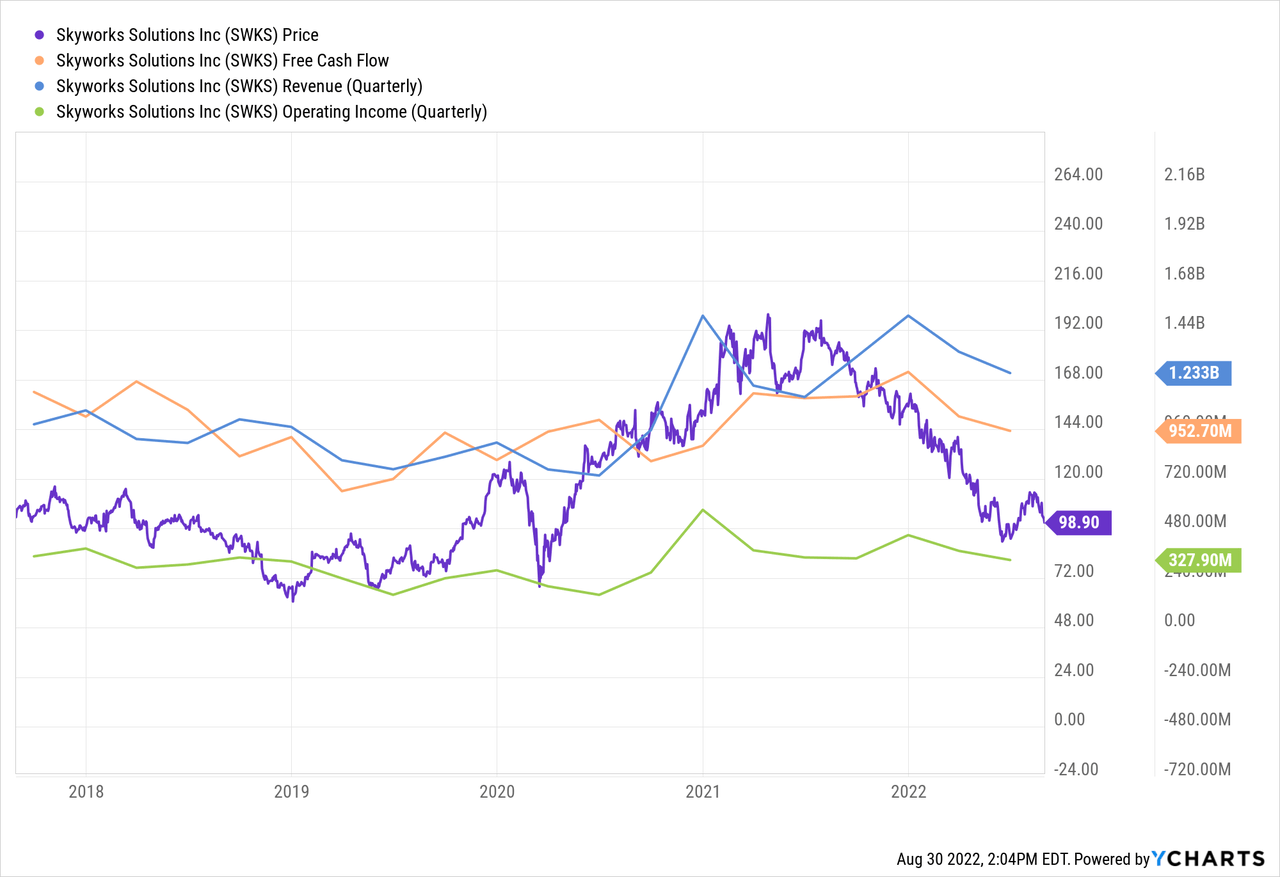

Like the rest of the semiconductor industry, Skyworks anticipated higher demand, which has been the case and has bloated up its inventory. Not to an unhealthy extent, but it negatively impacted free cash flow.

Skyworks is trading at a decent valuation in a historical and industry-wide context. Skyworks operates in many growth industries, like 5G, autonomous vehicles, optical data communication, and data centers. This will make sure that demand will exist for Skyworks’ products.

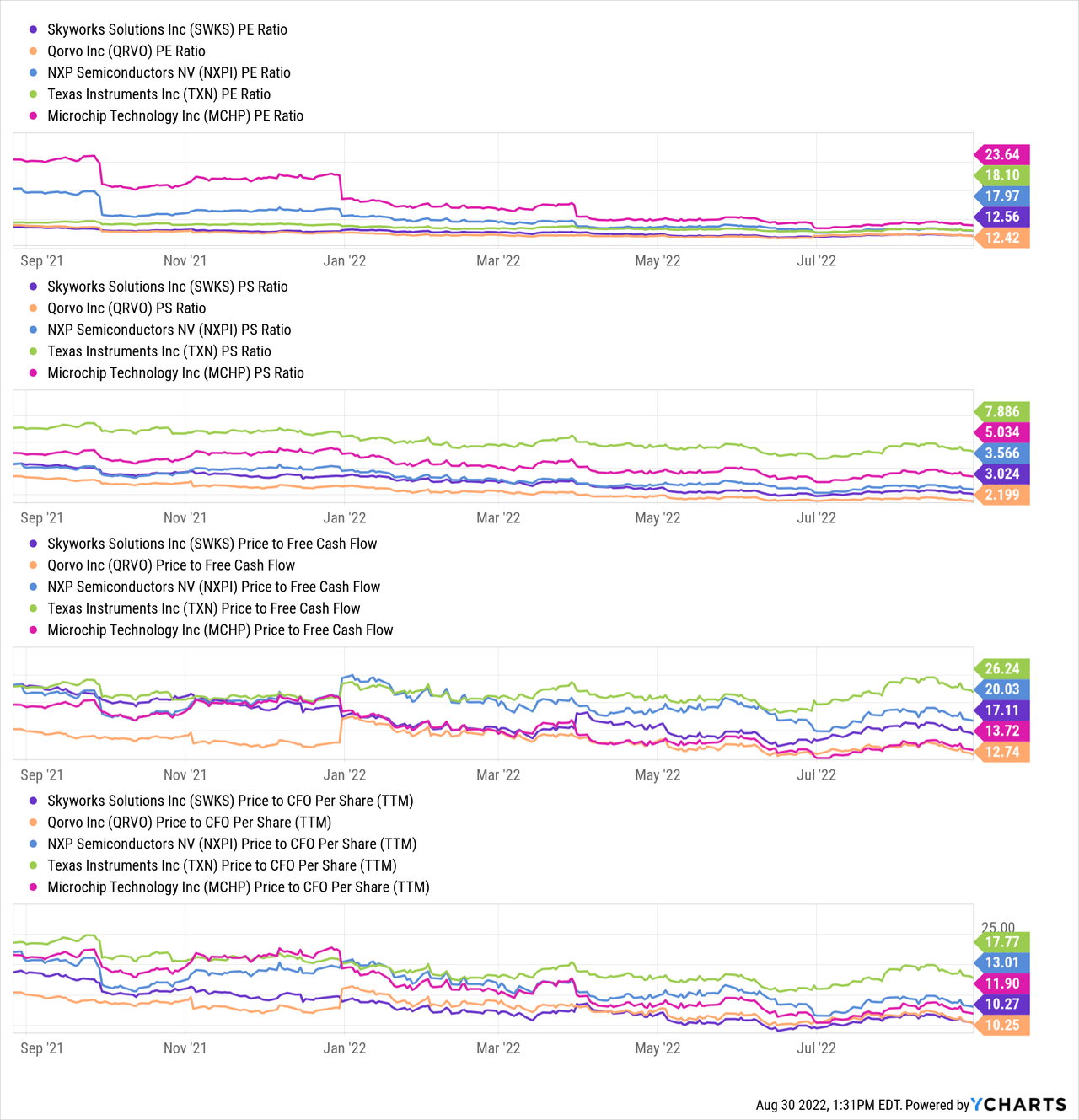

Compared to its peers, Skyworks’ valuation is in the bottom quintile. The industry as a whole is experiencing elevated inventory levels and lower cash flows.

Demand for Luxury Goods Is Low

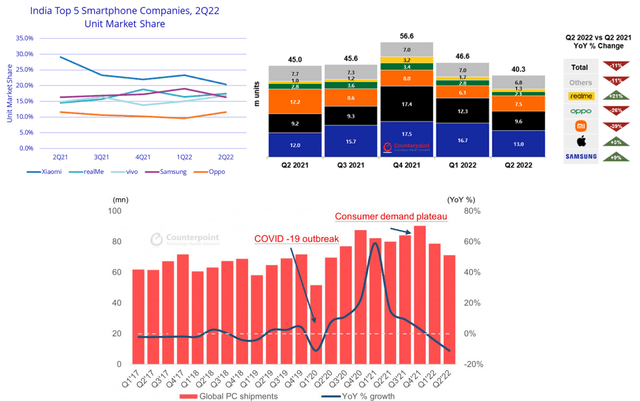

Decreasing demand in China hit Skyworks hard. Revenue in China in Q2 2021 was $262mn and fell to $98.9mn in Q2 2022. Lockdowns, high inflation, a debt crisis, and geopolitical tensions contributed to this.

China Quarterly Smartphone Sales (Counterpoint Market Research)

There was some demand spike in late 2020 or early 2021, but that changed quickly.

Skyworks’ products are used in various applications like smartphones, tablets, laptops, wearables, gaming, automotive, and more. They don’t break down revenue into segments as their product portfolio is naturally broad.

Global Smartphone and Laptop Demand (Display Daily)

Europe smartphone shipments declined 11% YoY in Q2 2022, India smartphone demand declined 1% YoY in 1H22, demand in China decreased, notebook PC shipments fell 15% in Q2 2022, and so on.

The macro environment is not good. High inflation, rising interest rates, and geopolitical tensions led to demand erosion in luxury goods. The focus is currently on buying necessities instead of a new smartphone.

Skyworks’ Historic Valuation

Due to all the reasons discussed above, Skyworks’ valuation declined and is low compared to its historical average.

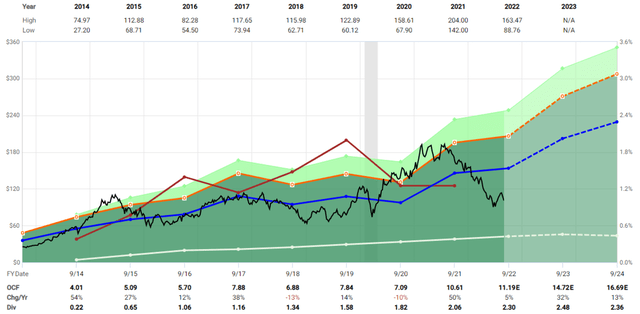

Skyworks Historical Valuation (Fastgraphs)

It has kept revenue, free cash flow, and operating income constant over the same time. Even though growth has stalled a bit, overall demand for Skyworks’ chips is healthy.

In July 2021, Skyworks purchased assets, rights, and properties from Silicon Laboratories (“Silicon Labs”) infrastructure and automotive business, for which they issued ~$2.5bn in debt. Before, Skyworks was one of the few debt-free companies in the semiconductor market. They even stopped stock repurchases to buy Silicon Labs, which is a positive sign because they focused on expanding their business instead of favoring shareholder return at any expense.

Besides the debt, Skyworks’ balance sheet is healthy, which would allow them to weather even worse market conditions.

Final Thoughts

Valuation matters! I made a mistake and took valuation lightly and was overly enthusiastic about the growth industries in which Skyworks operates.

Skyworks’ stock price has declined for nearly 15 months and is now trading below its historic valuation metric averages.

If you buy, should you immediately expect a gain? No, we’re still in a murky macro environment with inflation high, interest rates rising, energy prices rising, China still in lockdown, and demand erosion in many luxury goods industries.

Buying now puts investors at odds of performing well compared to other names in the semiconductor industry, trading at higher valuations.

Skyworks is trading at a price to an operating cash flow of 9.05. Its historical average is between 14 and 16. Buying at these prices provides an adequate margin of safety. If you want to reduce your capital risk further by entering Skyworks, you can dollar-cost-average over the next 3-9 months.

This article should only be regarded as the first step in your due diligence process.

I always welcome constructive criticism and open discussions. Please feel free to comment about my calculations and/or sources that I use in my articles.

The post Skyworks Stock: Cheap? Yes; Cheap Enough? Maybe (NASDAQ:SWKS) appeared first on HumanitasConnects.

The post Skyworks Stock: Cheap? Yes; Cheap Enough? Maybe (NASDAQ:SWKS) appeared first on .

[ad_2]Source link