[ad_1]

Oleksii Glushenkov/iStock via Getty Images

Risk/Reward Rating: Positive

JELD-WEN Holding, Inc. (NYSE:JELD) is fast approaching its panic low reached during the COVID-induced market crash in March 2020. The company is reasonably well-positioned for the long term with a leadership position in the building materials market (primarily windows and doors). With the shares near the low end of a well-defined historical trading range, and substantial upside potential, we are adding it to the dox it! list for stoxdox members.

Technicals

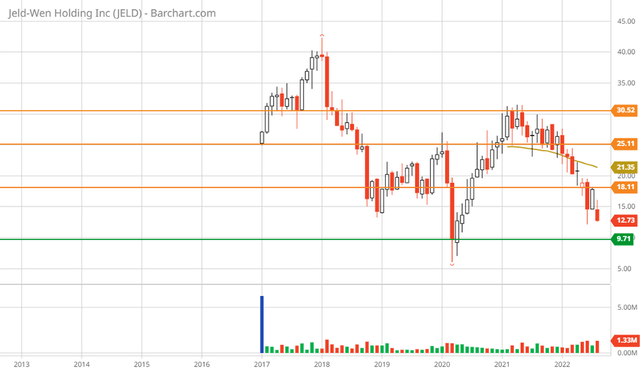

I view JELD-WEN to be a trading opportunity, though there is long-term investment potential as an industry consolidator. The well-defined trading range mentioned above is on display in the following 10-year monthly chart. On a monthly close basis, the trading range is roughly between $9 and $40. The shares are currently trading in the $12.70 area. If the range holds, the technical asymmetry is clearly to the upside with a potential return spectrum of -29% to +215%.

JELD-WEN 10-year monthly chart (Created by Brian Kapp using a chart from Barchart.com)

Note that the orange lines represent primary resistance levels, and the green line denotes the primary support zone. The 5-year weekly chart below provides a closer look at the technical setup and the more recent trading range.

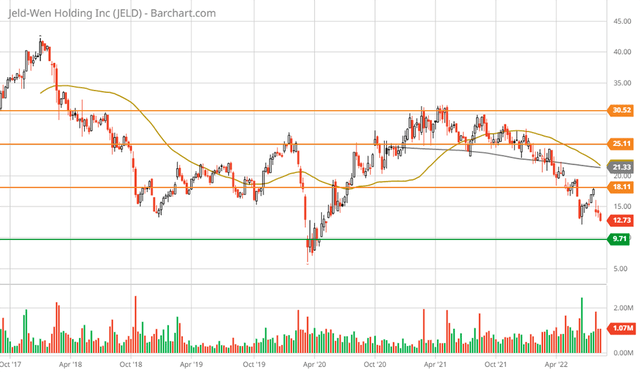

JELD-WEN 5-year weekly chart (Created by Brian Kapp using a chart from Barchart.com)

Interestingly, the 50-week moving average (the gold trendline) is converging on the 200-week moving average (the grey trendline) from above. Both trendlines are around $21 which is 65% higher than the current price. Additionally, the trendlines are in the middle of the first two resistance levels which encapsulate a range from $18 to $25. This range looks to be a high probability target over the nearer term, technically speaking.

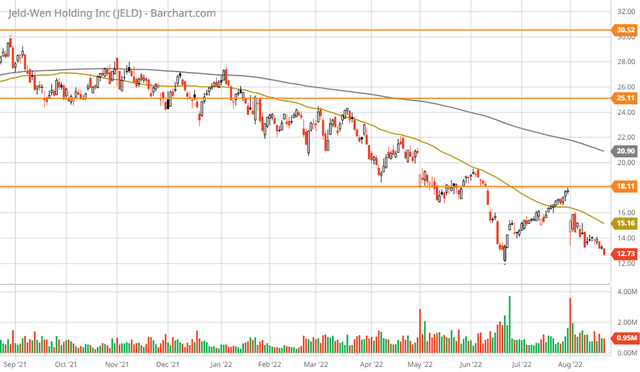

Zooming in below, the 1-year daily chart highlights the current test of the recent low near $12. If this test holds, a sizeable trading opportunity is likely at hand. If the test fails, looking to accumulate the shares into a lower test near $9 seems to be a reasonably attractive strategy.

JELD-WEN 1-year daily chart (Created by Brian Kapp using a chart from Barchart.com)

Expectations & Valuation

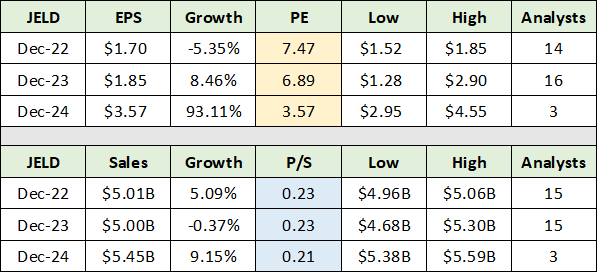

The positive risk/reward asymmetry on display above receives solid support from JELD-WEN’s deeply discounted valuation. The following table, compiled from Seeking Alpha, summarizes consensus earnings and sales estimates through 2024. I have highlighted the valuation columns for ease of reference.

Source: Seeking Alpha. Created by Brian Kapp, stoxdox

Given the extraordinarily low valuation, it is highly likely that the market is pricing in substantially lower earnings for JELD-WEN through 2024 than is currently reflected in consensus estimates. In terms of the current valuation on consensus earnings, I estimate that the market is pricing in one third to one half of the lowest analyst estimate each year (the “Low” column in the upper section of the table).

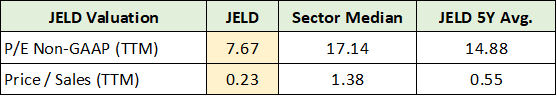

This conclusion finds support in the company’s historical valuation norms which are summarized in the following table compiled from Seeking Alpha. JELD-WEN is trading at half of its average valuation over the past five years using earnings and sales as the valuation metrics. Additionally, compared to the industrials sector overall, the company is trading at a steep discount to the sector median for each measure.

Source: Seeking Alpha. Created by Brian Kapp, stoxdox

Executive Shakeup

It should be noted that JELD-WEN has recently replaced key executives. Gary S. Michel, Chairman and CEO, resigned on August 5. David Guernsey, EVP of Strategic Programs, announced his departure on August 18. Additionally, the company recently appointed a new CFO, Julie Albrecht. These are the top executive positions within most companies and thus represent a material change.

While top executive resignations are usually not a positive development, given the late stage of the JELD-WEN share price bear market, I view the development as having the potential to manifest as a positive catalyst. Fresh leadership can be a powerful force.

Business Mix & Industry Trends

The company is well-established with a business mix that is heavily weighted toward North America and Europe. They represent 60% and 28% of sales, respectively. Roughly speaking, the sales mix is half new construction and half renovation and remodeling. The product mix is dominated by windows and doors. The fact that industry trends are currently negative is well reflected in JELD-WEN’s share price.

Special Risk Factor

The onset of negative macroeconomic conditions for the real estate sector is unfolding as JELD-WEN has been aggressively repurchasing its shares. Adding additional leverage via share buybacks opens the door to substantial risk should industry conditions become stressed. JELD-WEN’s debt load is relatively high at roughly $2 billion compared to an equity market capitalization in the neighborhood of $1 billion.

The share count is around 88 million today compared to roughly 102 million one year ago. Importantly, the current share buyback authorization is $200 million, which represents approximately 18% of the shares near recent prices. During Q2 2022, the company repurchased 3.4 million shares at an average price of $18.75.

Mitigating the leverage risk, JELD-WEN has no major debt maturities until 2025. The additional leverage risk does introduce additional upside opportunity. If industry conditions remain generally steady through mid-decade, the reduced share count opens the door to above-average earnings growth potential.

Summary

JELD-WEN offers an excellent trade opportunity in the nearer term. The shares are currently retesting the recent low on June 22, 2022 near $12. Whether this retest is successful or not will set the stage for the opportunity. If $12 fails to hold, accumulation into a retest of the COVID-induced panic low in the vicinity of $9 looks to be an attractive strategy. If $12 holds, a run at the first resistance level in the $18 area is a high probability. There looks to be additional upside opportunity into the upper end of the target zone closer to $25.

The nature and depth of the unfolding real estate correction will play a critical role in determining the ultimate JELD-WEN opportunity. We look forward to publishing a future report to shed more light on JELD-WEN’s prospects longer term. For now, the risk/reward asymmetry is decidedly positive.

Source link