[ad_1]

Justin Sullivan

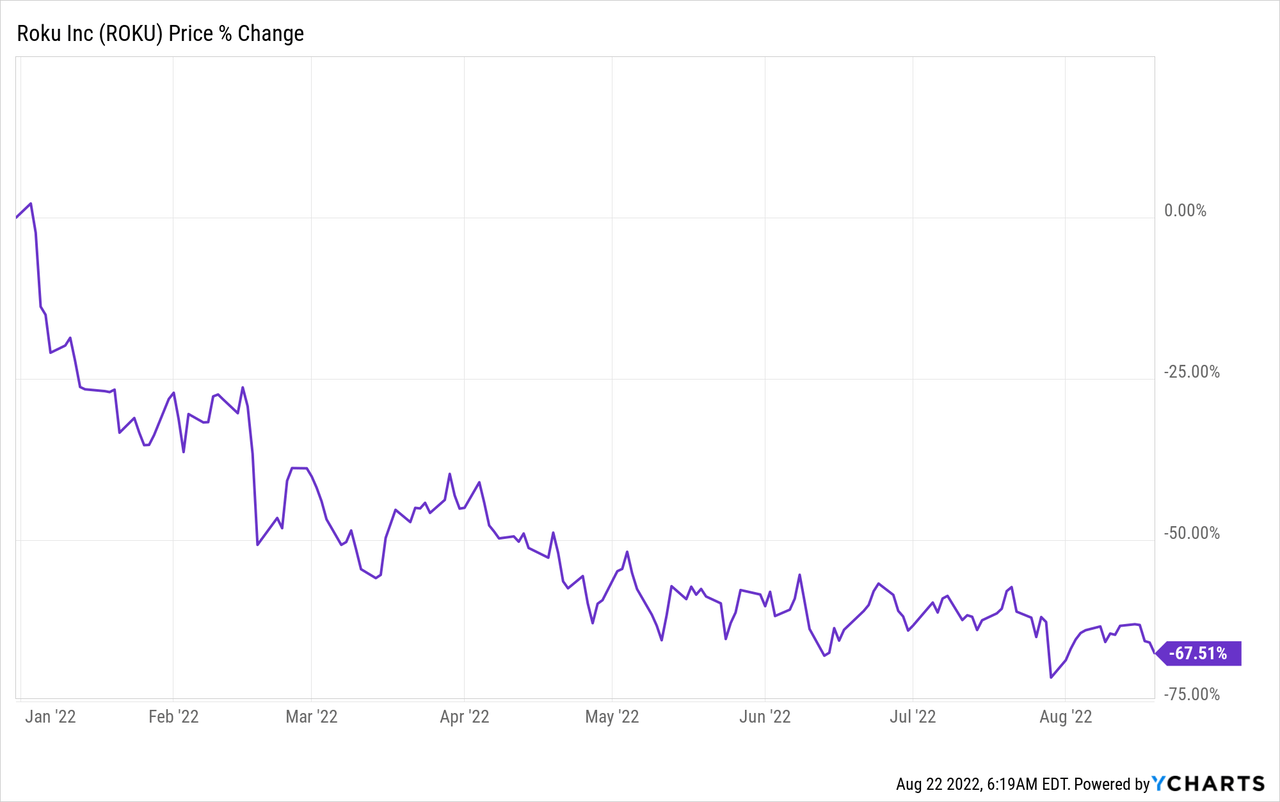

Shares of Roku (NASDAQ:ROKU) have lost about two-thirds of their value in 2022 and the company’s second-quarter earnings sheet did nothing for the stock either. Roku is going through a post-pandemic adjustment period in which it sees a slowdown in advertising spending in the TV streaming market and slower account and average revenue per user/ARPU growth. However, favorable long-term trends are creating a strong foundation for Roku’s rebound and the firm’s valuation is attractive relative to its historical standards!

Slowdown in active account and ARPU growth

The pandemic made Roku a winner, with streaming device sales and platform revenues soaring. But now, as pandemic effects have worn off and the market prices in the possibility of an earnings recession due to a pullback of advertisers, Roku’s prospects for growth are questioned perhaps more than ever.

In Q2’22, Roku’s active accounts grew 14% to 63.1M, which was the same rate active accounts grew at in Q1’22. These are not terrible growth rates, but ARPU – which is a key measure for streaming companies to measure internal revenue growth and monetization – was just up 21% in Q2’22 as opposed to 34% in Q1’22.

|

Actual Results |

Q2’22 |

Q1’22 |

Q4’21 |

Q3’21 |

Q2’21 |

Growth Y/Y |

|

Active Accounts (millions) |

63.1 |

61.3 |

60.1 |

56.4 |

55.1 |

14% |

|

Streaming Hours (billions) |

20.7 |

20.9 |

19.5 |

18.0 |

17.4 |

19% |

|

Average Revenue Per User/ARPU ($) |

$44.10 |

$42.91 |

$41.03 |

$40.10 |

$36.46 |

21% |

(Source: Author)

What is causing the slowdown in Roku’s business?

A slowdown in ad spending due to increasing macroeconomic uncertainty is driving a reset in Roku’s business. The uncertainty is chiefly driven by high inflation and fears over a recession.

Roku’s platform revenues, which include advertising revenues, increased 26% year over year to $673.2M in Q2’22. Roku’s growth in platform revenues decelerated from 39% in Q1’22 as marketers trimmed their advertising budgets for the TV streaming market.

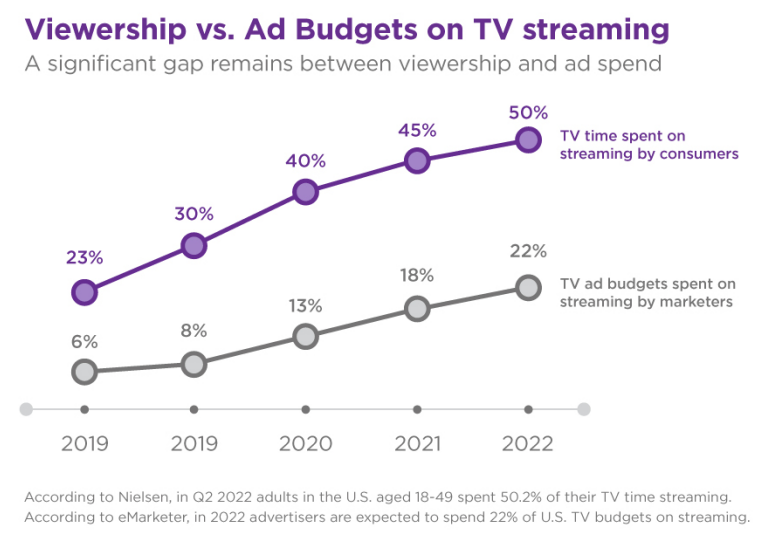

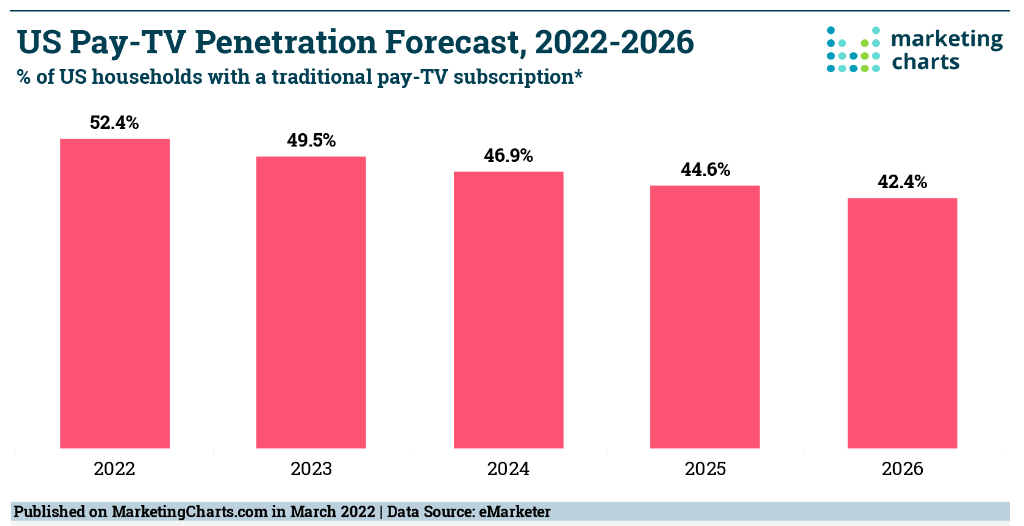

However, I believe the Roku platform has a lot of potential to grow advertising (and platform) revenues in the long term because advertisers are under-spending on TV streaming platforms. Roku’s core audience spends about 50% of their TV time streaming while at the same time TV streaming platform only get a 22% share of advertising budgets, meaning advertisers are not fully utilizing the potential that platforms like Roku present. The ad budget adjustment in the second quarter hurt Roku’s platform revenues, but there is an opportunity for Roku to close this gap longer term. Since audiences for streaming TV platforms are growing, at the expense of legacy pay-TV subscriptions, it will only be a question of time, I believe, until advertisers ramp up their ad spending on these platforms again.

Roku: Streaming TV Viewership vs. Ad-Spend

The advertising industry experienced a large down-turn in the second quarter, with major social media companies like Snap (SNAP) reporting increased topline pressures due to advertisers dialing down advertising spending. The longer-term trends in the TV streaming business, however, are very favorable to Roku. As viewers continue to cut the cord and ditch legacy pay-TV subscriptions, Roku is in a unique position to grow the Roku platform… and attract advertisers. According to eMarketer, less than half of US households are projected to have a traditional pay-subscription in FY 2023.

eMarketer: US Legacy TV Share

Roku’s valuation is truly silly

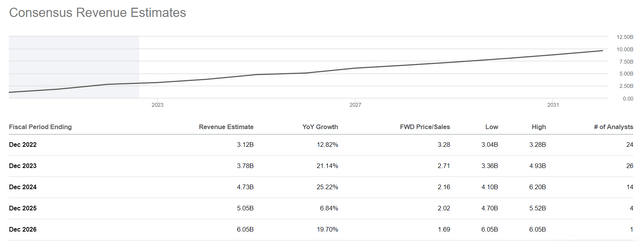

Roku is seeing a slowdown in its top line and active account growth, but the platform is still growing at attractive rates. The streaming platform is expected to generate revenues of $3.12B in FY 2022 and $3.78B in FY 2023, implying top line growth rates of 13% and 21%. Roku’s topline is expected to grow at an average rate of 18% between FY 2022 and FY 2026.

Seeking Alpha: Roku Revenue Estimates

Cord-cutting trends generate favorable dynamics for Roku’s long-term growth and simultaneously improve Roku’s value proposition in the TV streaming advertising market.

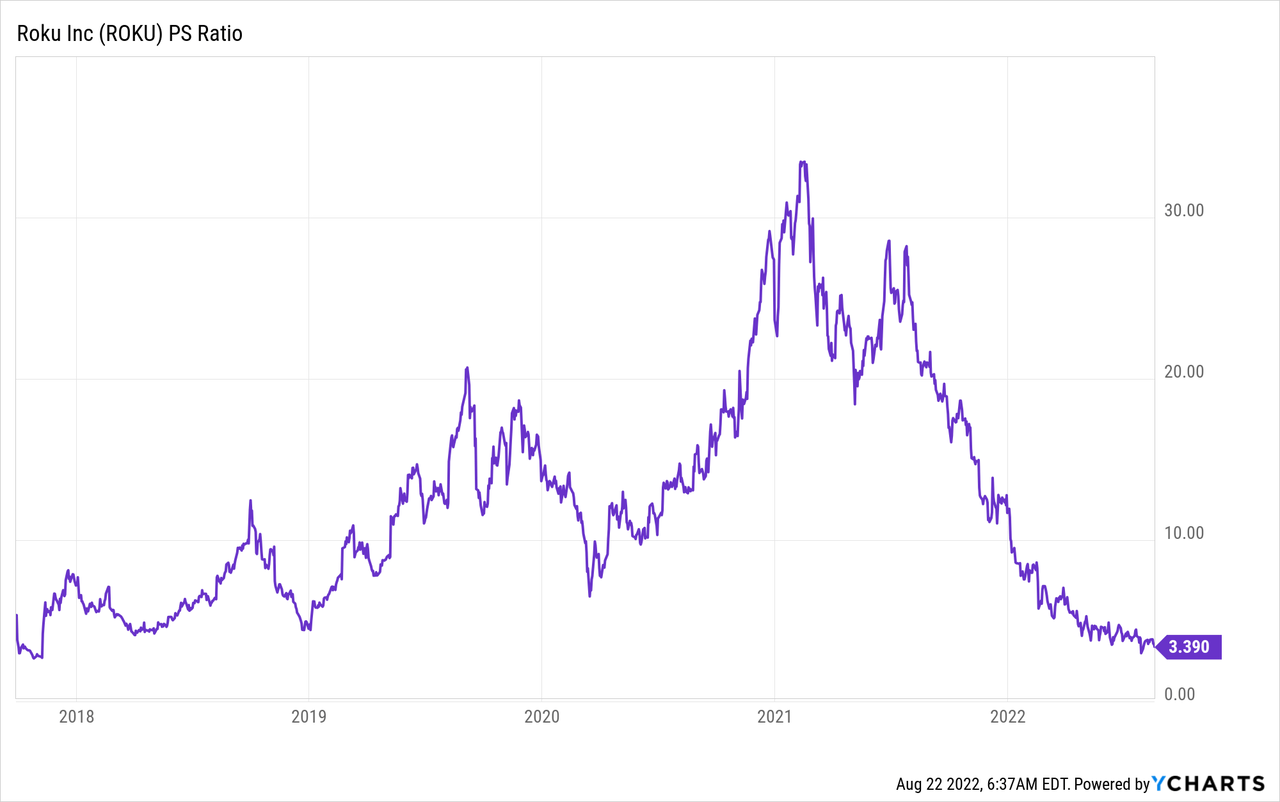

Roku is now trading at its lowest valuation since FY 2019 with a P-S ratio of 3.4X which I believe greatly undervalues Roku’s growth potential in the streaming TV market.

Risks with Roku

A deterioration in Roku’s platform metrics related to a continual pullback of advertisers is possibly the biggest risk for Roku and the stock. Despite a slowdown in post-pandemic active account growth, it should be clearly understood, however, that Roku will not stop growing. Roku’s active accounts increased 14% year over year, which is a healthy growth rate. Going forward, Roku will continue to add new customers to its platform, but the firm may grow slower than expected as positive pandemic effects on Roku’s business wear off and a recession potentially impacts consumer spending.

Final thoughts

Roku’s valuation doesn’t make very much sense and is downright silly considering that trends in the streaming TV market massively favor Roku’s growth long term. Although the firm is moving past a period of hyper-growth enjoyed during the pandemic, I believe Roku has a lot to offer for investors. The TV streaming market is under-utilized by marketers and advertisers will eventually return to Roku… because this is where the audience is.

Roku may no longer enjoy the hyper-growth rates of the FY 2020-2021 period, but the firm is not contracting either. With 21% growth in ARPU in Q2’22, I believe Roku is making steady progress regarding customer monetization as well. Given the potential Roku has in the streaming TV market, the stock appears wildly undervalued!

Source link