[ad_1]

Justin Sullivan

Thesis

In the current market environment investors are arguably well advised to overweight quality and underweight growth. While there are different definitions of ‘quality’ for stocks, here is what I look at: steady value accumulation (1), a strong competitive moat (2), a relatively attractive valuation (3), and a nice dividend yield (4). One stock that fits the screen very well is Gilead Sciences (NASDAQ:GILD).

Gilead Sciences trades attractively at a one-year forward P/E below x10. And amidst a turbulent market the stock has shown strength. For reference, GILD stock is down less than 10% YTD, versus a loss of almost 12% for the S&P 500 (SPY). In addition to the slight outperformance, GILD stock has been less volatile than the broad market.

Based on a residual earnings valuation model, anchored on analyst EPS consensus, I see more than 40% upside. My target price for the stock is $90.77/share.

About Gilead

Gilead Sciences, Inc., is a global pharma company with headquarters in Foster City, California. The company researches, develops, and markets medicines with a focus on antiviral drugs–which have applications in the treatment of HIV/AIDS, hepatitis, and various types of influenza, to name a few.

Gilead defines its purpose as follows:

Gilead is committed to advancing care for patients around the world by bringing forward medicines in areas of unmet medical need.

The Value Thesis

When I introduced my bullish argument for Gilead, I indicated four pillars that support a value thesis. In the following section, I will discuss these pillars in more detail and in relation to Gilead.

Steady value accumulation (1)

Investors should consider that from a long-term perspective, Gilead’s fundamentals point clearly upwards. From 2012 to 2021, the company’s revenues increased at a 13% CAGR, from $7.2 billion to $21.8 billion. Earnings from continuous operations jumped from $2.6 billion to $6.2 billion, reflecting a 10% CAGR.

Over the same period, Gilead’s balance sheet size expanded from $21.2 billion to $68 billion. And book value available to equity investors more than doubled, increasing from $9.6 billion to $21.1 billion

Strong competitive moat (2)

Again, this pillar is broadly supported by the nature of the pharma industry, where patents, other IP, partnerships, and R&D capabilities build a very defensible competitive moat. But generally speaking, a company’s margins are the best indicator to judge a competitive moat. If high margins are sustained over a long time-period, this indicates that it is difficult for competitors and/or newcomers to enter a business opportunity.

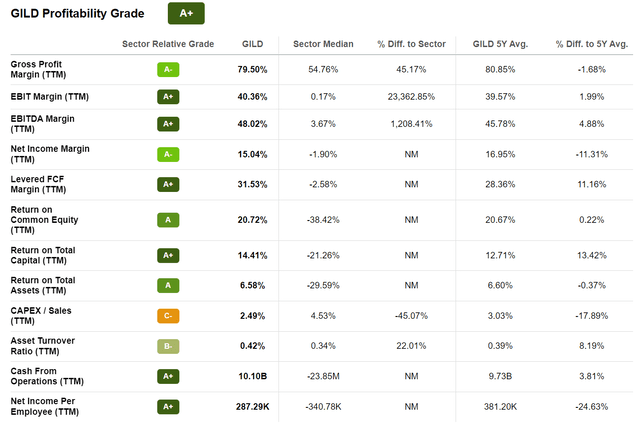

That said, Gilead’s margins are very strong and have been for years. Most notably, Gilead currently claims a gross-profit margin of almost 80%, which 50% above the industry median. Gilead’s EBIT margin is 40%, versus almost 0% for the sector peers (as calculated by Seeking Alpha). Moreover, investors might appreciate that these margins are in line with Gilead’s historical 5-year averages.

A nice dividend yield (3)

For the next twelve months, Gilead is expected to pay a dividend of $2.92 per share. Accordingly, this would indicate a dividend yield of close to 4.5%. And judging the dividend in relation to Gilead’s fundamentals (take reference above) it is acceptable to claim that Gilead’s dividend is sustainable and relatively low risk. Moreover, investors should note that Gilead’s dividend yield as compared to the sector median is 200% higher.

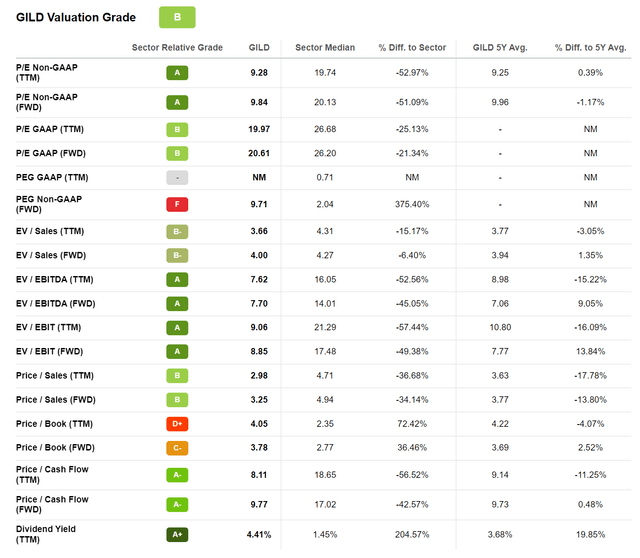

Relatively attractive valuation (4)

Gilead currently trades at a one-year forward P/E of about x10 and a P/S of slightly more than x3. This is cheap, I argue. And it is especially cheap for pharma companies. Investors should consider that the sector median for the industry, as calculated by Seeking Alpha, is x20 for P/E and close to x5 for P/S. This is a more than 50% and 30% undervaluation, respectively.

Residual Earnings Valuation

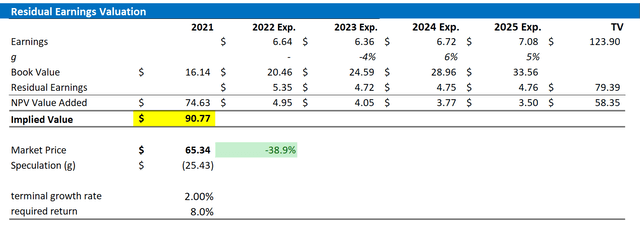

While Gilead’s multiples relative to peers point to a strong undervaluation, let us now look at Gilead’s valuation in more detail. I have constructed a Residual Earnings framework based on the analyst consensus forecast for EPS ’till 2025, a WACC of 8% and a TV growth rate equal to nominal GDP growth, which I conservatively estimate at 2%. Although the effective cost of capital for Gilead is considerably below 8% (about 8.3% according to the Bloomberg terminal as of 18. August 2022), I think an adjustment upwards to 9% is reasonable in order to reflect a conservative valuation.

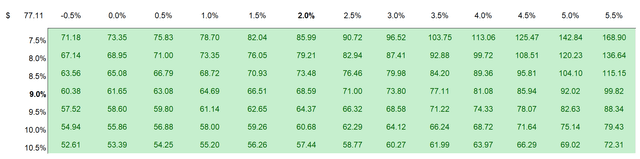

In addition, the long-term growth assumption equal to zero might definitely be an underestimation, in my opinion, but I prefer to be conservative. If investors might want to consider a different scenario, I have also enclosed a sensitivity analysis based on varying WACC and TV growth combination. For reference, red cells imply an overvaluation, while green cells imply an undervaluation as compared to Gilead’s current valuation.

Based on the above assumptions, my valuation estimates a fair share price of $90.77/share, implying almost 40% upside potential based on accounting fundamentals.

Analyst Consensus Estimates; Author’s Calculation Analyst Consensus EPS; Author’s Calculation

Risks

Although I think Gilead is significantly de-risked at the current valuation of close to x10 P/E, no investment is without risks. The primary risk, as for every pharma company, is competitive pressure to innovate successfully and to legally protect and defend intellectual property. Apart from that, investors should consider the general risk sources such as management execution of strategic ambitions, operational efficiency, and currency exposure.

Conclusion

With Gilead stock investors are very unlikely to make a mistake. In this article I have presented arguments why I believe that Gilead screens well for a value thesis: steady value accumulation (1), a strong competitive moat (2), a relatively attractive valuation (3), and a nice dividend yield (4). Moreover, a residual earnings valuation indicates almost 40% upside – based on a $90.77/share target price. I am confident to initiate coverage with a Buy recommendation.

Source link