[ad_1]

NicoElNino/iStock via Getty Images

KT Corporation (NYSE:KT) is a South Korean telecommunications giant that we believe presents a wonderful inflation hedge and a dividend growth opportunity. KT can provide stable cash flow growth while waiting to see if its new business expansion plans in B2B can provide further growth in the long term.

Company Overview

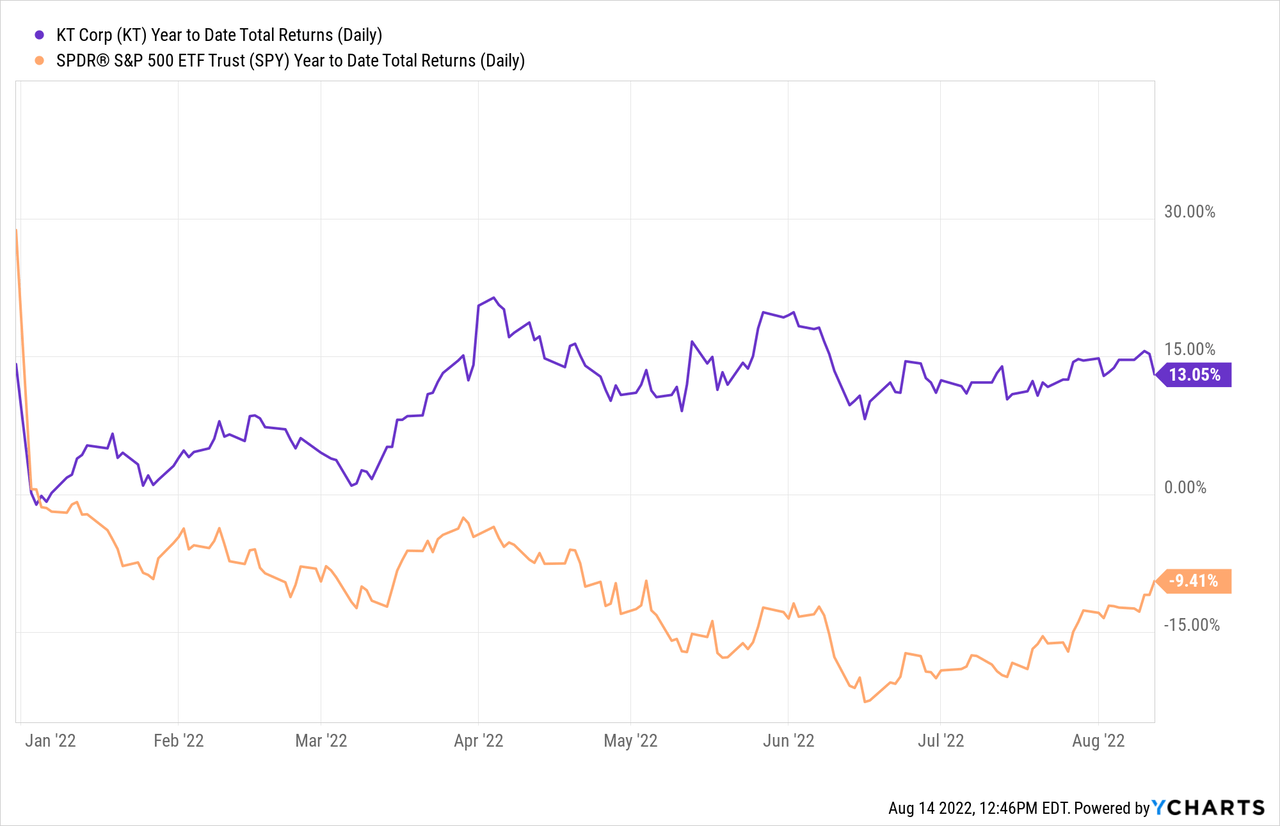

KT has operations globally and provides numerous services and products related to the wireless communications industry. They have businesses in ICT Business, Data Services, Global Operation, Voice Traffic Wholesale Services, Consulting, and other services. Year-to-date, KT has outperformed the S&P 500 by a sizable margin, and is positive for the year.

Stable Revenue and Dividend

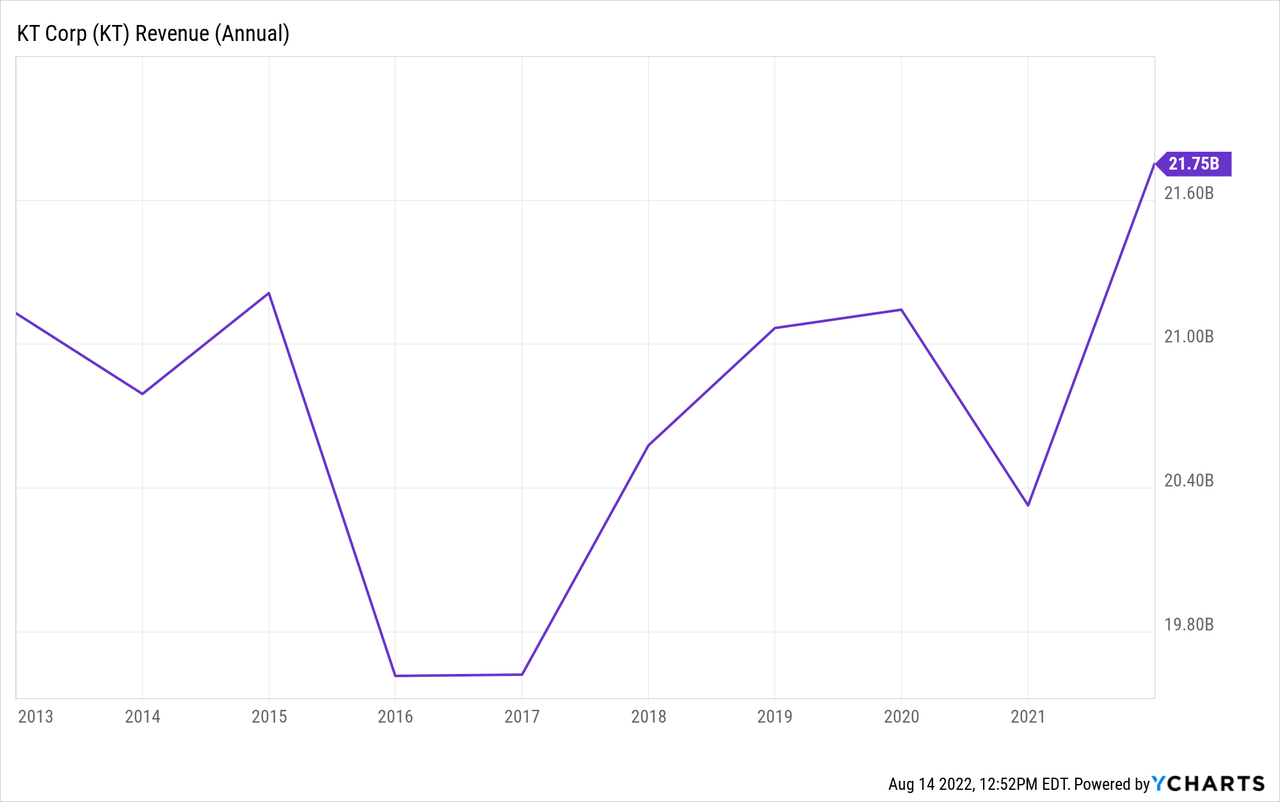

In the past 10 years, KT’s top line numbers have been extremely stable, ranging between $19 billion to $22 billion. Despite considerable competition in the domestic markets, KT has been able to generate consistent revenue and maintain its industry leading market position despite the uncertainty. Given this consistent revenue performance, KT has been a reliable source of dividend income for many investors. In the past 3 years, KT has generated a 20% CAGR (10% CAGR in the past 5 years) in dividend growth for investors.

And based on its current price, the trailing dividend yield for the company now stands at a whopping 5.3%. That is extremely high for a company that is growing its revenue and has numerous business tailwinds. As will be discussed in the rest of the article, KT has numerous business opportunities to continue growing its revenue, grow its dividend for long-term investors, and therefore provide great inflation hedges for investors.

B2B Business Opportunities

KT has invested heavily in 5G and has been an industry leader in the spread of 5G, and provided widespread unlimited 5G services to Korea in 2019, which is far quicker than many other developed nations. Given this early mover advantage, KT has been able to roll out numerous services and product offerings centered around 5G. 5G is still in its early stages of development and application, and KT has positioned itself well to take advantage of this secular industry change. Already, many of KT’s new services, outside of its core telecom business, involve providing consulting and digital transformation services to other businesses. KT has reported a 45% YoY growth in its B2B business, and management has shown continued interest in this department:

For the B2B business, underpinned by our strength in public, defense, and financial sector, we delivered customized services for customers across different sectors, growing the number of orders booked… Cloud and IDC business is now established as a separate special entity, setting itself up as a solid growth pillar. We are at the forefront of the market, pre-emptively responding to demand as we equip ourselves with managed services capabilities for the cloud business and build additional IDC capacity.

Furthermore, KT has recently reported that it expects its B2B business to make up 50% of its revenue by 2025. This side of the business has seen “accelerating” growth, and we believe that this new business segment will become the main driver of KT’s shareholder value appreciation for the long term.

Valuation

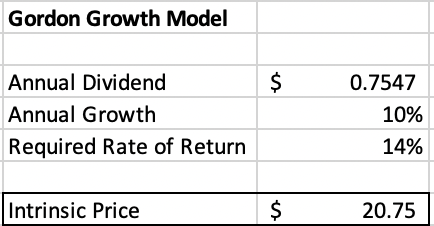

Though there are numerous methods of valuation, we believe that the Gordon Growth Model would be the best fundamental, conservative valuation model for this high dividend paying South Korean business. We used its historic five-year dividend CAGR of ~10% as the baseline growth assumptions, and used a required rate of return of 14% (based on ROE of Business & Consumer Services as proxy for Required Rate of Return).

We believe these dividend growth assumptions are conservative as the current dividend payout ratio stands at around ~45%, and can continue to raise dividends even if earnings growth were to stall. Based on these conservative assumptions, we find that the intrinsic value of the stock is $20.75, which presents a 46% upside from its current levels.

Sweet Minute Capital

Risks to Thesis

KT faces a substantial risk that its B2B operations do not pan out, and its 5G ambitions are lost from increasing competition from larger communication service businesses abroad, such as U.S. based companies like AT&T (T) and Verizon (VZ). However, its core telecommunications business remains strong and is unlikely to deteriorate anytime soon. For example, even in a saturated market like Korea, KT has reported a 1.4% YoY growth in revenue in the telecom business in Q2 2022. Due to the vital importance of wireless services in the modern economy and high pricing power, KT will be able to rely on the strength of its telecom business to support KT’s cash flow needs and new business operations – as well as continue to pay out dividends to sustain shareholder value.

Conclusion

KT is a great investment for investors who are looking for a stable dividend play during economic uncertainties while waiting for future growth. KT has been able to deliver consistent financial results, strong dividend payouts in recent years, and has numerous business opportunities that are in the early stages of expansion. In addition, using the Gordon Growth Model, KT is undervalued by the market, and the opportunity presents a near 50% upside. KT at its current price provides investors a great opportunity to buy a high-dividend, stable stock with large potential for price appreciation over time.

Source link