[ad_1]

Astrid Stawiarz

Thesis

Michael Burry’s quarterly 13F SEC filings are always highly anticipated and closely monitored by investors. And his filing for the June 30 quarter did not disappoint. Dr. Burry sold everything he owned one quarter prior, including Warner Bros. Discovery (WBD), Meta Platforms (META) and Alphabet (GOOG, GOOGL). But one stock he kept: The GEO Group, Inc. (NYSE:GEO).

Is there a value thesis? In this article I will give investors my view on GEO Group and value the company based on a residual earnings framework. Given my analysis, I argue GEO stock is a Buy and the company should merit a fair trading price of $10.17/share.

For reference, GEO Group is down about 5% YTD, versus a loss of about 10% for the S&P 500 (SP500).

About GEO Group

The GEO Group, Inc. is the world’s second largest private “prison company.” The group operates more than 100 private prisons and mental health facilities with approximately 100,000 beds. In addition, GEO also offers educational programs and vocational training that are designed to support offenders’ public rehabilitation. From a geographical perspective, GEO Group operates in the U.S., Canada Australia and South Africa. The U.S. accounts for nearly 90% of the company’s revenue.

In my opinion, GEO Group is arguably a classical example of a cigar butt as defined by Warren Buffett:

Cigar Butt approach to investing is where you try and find a really kind of pathetic company but it sells so cheap that you think there is one good puff left in it

In other words, a cigar butt is not a good company, but the valuation is so cheap, that a value investor has a good chance to make some money based on the favorable risk/reward skew.

The Value Thesis

GEO group is currently trading at about $7/share, which implies a market capitalization of about $860 million. Notably, GEO stock is down about 80% from ATH. The reason for this is that the company has not achieved any growth since 2018. In fact, the company’s topline has shrunk at a CAGR of about 2%, down from $2.31 billion in 2018 to $2.25 billion in 2021. Respectively over the same period, net income almost halved: from $164 million to $84 million.

But there is still some value in GEO Group. Attentive investors might note that GEO Group’s operating cash flow has not shrunk by the same pace as net-income and with $282 million as of 2021 is still rich in relation to the company’s market cap (more than 25%). Accordingly, GEO is trading at a x3.4 price/Cash Flow.

The company’s balance sheet, although not stellar, is healthy enough to merit a speculative investment (again, Cigar Butt philosophy). As of June 30, GEO Group held about $587 million of cash and cash equivalents and total debt of $2.98 billion. But investors should also consider that net of intangibles ($910 million), GEO owns about $2.62 billion of long term tangible assets. Accordingly, in case of a liquidation, investors should be right to expect a net distribution that could cover the company’s market capitalization and thus investor’s equity commitment (calculated as tangible assets, less net debt, less other liabilities, less market capitalization).

But it is too early to speculate on a liquidation. For now, the company is still profitable and analyst consensus sees operating profits of $88 million in 2022, $343 million in 2023 and $356 million in 2024. Respectively, EPS are estimated at $1.32, $1.13 and $1.27 (Source Bloomberg Terminal as of August 15).

Residual Earnings Valuation

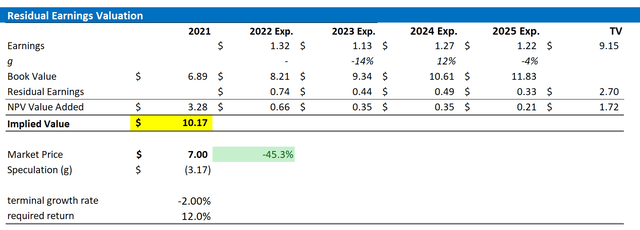

Let us now look at a possible valuation for GEO in more detail. I have constructed a Residual Earnings (“RE”) model based on the following assumptions:

- To forecast EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal ’till 2024. In my opinion, any estimate beyond 2024 is too speculative to include in a valuation framework..

- To estimate the cost of capital, I apply a very conservative 12% charge.

- To derive GEO’s tax rate, I extrapolate the 3-year average effective tax-rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply -2% percentage points to reflect a structurally shrinking business.

Based on the above assumptions, my calculation returns a base-case target price for GEO of $10.17/share, implying material upside of about 45%.

analyst consensus EPS; author’s calculation

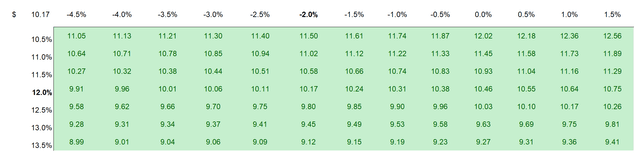

I understand that investors might have different assumptions with regards to GEO’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

analyst consensus EPS; author’s calculation

Investment Risks

Investing in “Cigar Butts” is risky. And so is investing in GEO Group. GEO Group is not growing its business (at least it has not in the past 5 years) and the company is arguably consistently depressing CAPEX < $100 million annually to boost free cash flow. Moreover, the company has a considerable debt position on the balance sheet, which could be especially problematic when considering the rising rate environment. And purely speculating on a liquidation is not a good call, either. As Charlie Munger said:

Yeah, it’s not that much fun to buy a business where you really hope this sucker liquidates before it goes broke.

Conclusion

Seeing that Michael Burry has sold his positions in Alphabet, I doubt he holds GEO Group because it is the best stock with the most favorable risk/reward. Arguably, something else is going on that is not transparent to investors who simply read the SEC F13 filing.

Is GEO Group a quality company? Well, no. But could the stock merit a speculative investment? Yes, l do think so. GEO Group is currently trading at about $7/share. And based on a residual earnings model, anchored on analyst EPS consensus estimates, I believe GWO should be fairly valued at about $10.17/share. Accordingly, I see about 45% upside.

Source link