[ad_1]

lavin photography/iStock via Getty Images

Dear readers,

In this article, we’ll take a look at Cincinnati Financial (NASDAQ:CINF), a dividend king and a P&C insurer with a long history. I’ve not written about this business before, so in this article, we’ll do a bit of a deep dive into this almost 75-year-old business based in Ohio.

Let’s see what we have here, and what could justify an investment in this business.

What does Cincinnati Financial do?

The business idea of CINF is simple – it offers various types of insurance – life/disability, property and casualty insurance, what’s known as P&C in insurance business lingo, and others, through its various subsidiaries and companies. As a business, the company has about 1% of the overall US domestic P&C premiums. This doesn’t sound much, but this is actually a very fragmented market. This single percentage point makes CINF one of the 20th largest insurance businesses by market share in the US.

Four agents founded the business in the 1950s. Today it has large insurance businesses under its umbrella, such as the Cincinnati Insurance Company, the Cincinnati Life Insurance Company, The Cincinnati Casualty Company – and others. CINF also has an investment arm called the CFC Investment Company which supports the various subsidiaries and their agents through leasing and financial activities, as well as offering asset management through its CinFin Capital Management.

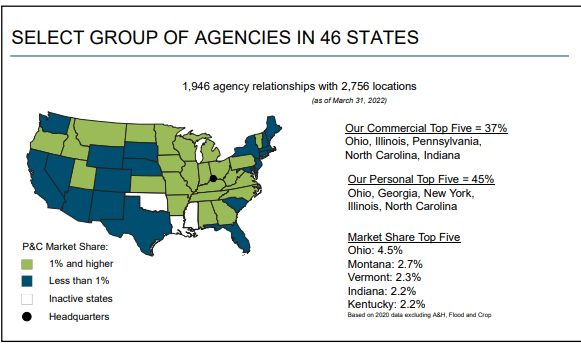

The company has various agency relationships – almost 2,000 of them in over 2,750 locations. Its biggest market share is obviously in Ohio, but CINF is represented in plenty of areas.

CINF IR

The company is, simply put a top 25 U.S P&C insurer, with over $6.5B in annual premiums, which come to over 55% from Commercial, and 24% from personal. The company uses and agency-centered business model. This is time-tested in the last 75 years, and these relationships have decades of strengthening behind them. Agency-focus means local decision-making based on local expertise, with a centralized organization at the same time contributing to a low expense ratio compared to a branch office structure.

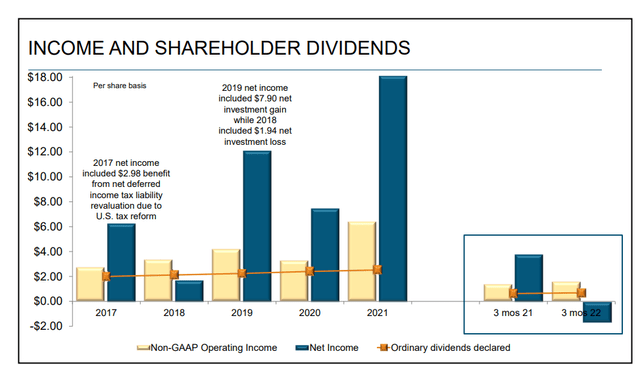

CINF is one of the best financial companies on record if we look strictly at the dividend growth tradition. The company has offered 61 years of consecutive increases in the dividend, making this one of the strongest dividend kings out there, and only seven public US companies can match this dividend payout record.

The increases aren’t small either – the latest increase in the payout was a 10% increase back in 1Q22, and a current yield of around 2.91%, which is above the company’s typical rate. CINF, due to its strengths, does not trade at the same sort of discounts we see in other financials and insurance companies. This makes sense when looking at this business’s fundamentals, including an absolutely stellar BBB+ rating.

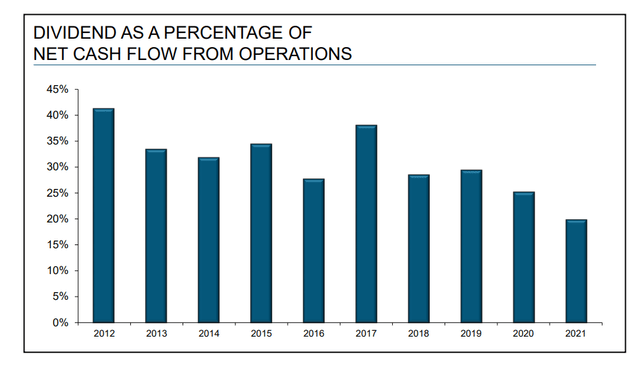

CINF has underwriting and conservative expertise spanning decades, and it has proven its ability to weather issues and challenges through many cycles. Despite its dividend tradition, the company averages a payout ratio of no higher than 51%, and the company’s payout percentage in relation to net CF from operations has actually been declining.

When looking at insurance companies in a rising interest rate environment, you want to make sure of a few things. First, you want to make sure that the company has the ability, based on historical and forecasts, to outperform the market-average premium growth rate over time. CINF does this. Its 7%+ premium growth rate on an annual base for 5 years is higher than the industry average of around 5.9%.

You also want to make sure that the insurance company you look at has a combined ratio – this is the sum of incurred losses and expenses and then dividing them by the earned premium, which in turn implies the percentage of premium earned covering actual risk. Simply put, it’s a common metric to measure the day-to-day performance of an insurance business. The logic here is that you actually want a lower ratio – the lower the better.

I usually want a 75-85% combined ratio. EU insurers tend to have better-combined ratios than US companies. For CINF, the company touches the 85-87% combined ratio level for 2021, which is good for a US company.

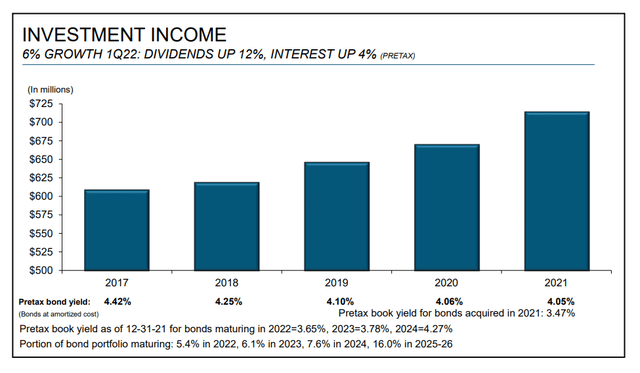

Third, and also something you want – you’re looking for good investment performance. These companies invest their surplus capital into usually short-duration securities and investments to earn an extra interest – and you want them to be able to manage this well as well, not just their main business.

CINF does this as well.

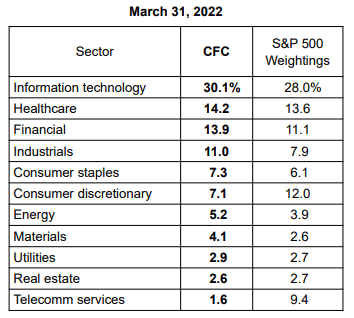

The company focuses on a mix of taxable fixed maturities, tax-free fixed maturities, stocks, and a small amount of prefs. The company’s bond portfolio fair value exceeds its insurance reserves liability by over 15% as of 1Q22, which is excellent. However, CINF is still heavily overexposed to the IT/tech sector when it comes to its investments.

CINF IR

Now, CINF checks a lot of boxes on the basis of its fundamentals alone – that much should be clear to you here. There are also additional advantages to the company. This business has some incredible safeties in its client base, which mostly come at very high credit ratings on average.

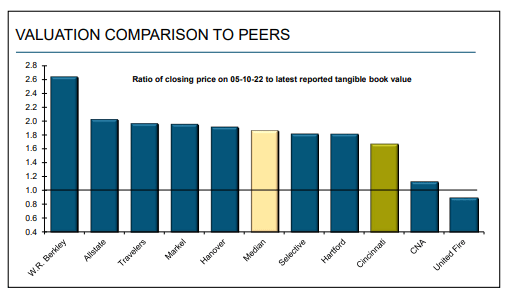

However, the biggest argument for CINF and for investing in it, is the combined factors of the strengths and fundamental outperformance I mentioned, coupled with the current low valuation compared to many of its peers. In the company’s peer group, CINF is at a very low valuation compared to many of its closest peers, despite its high quality.

CINF IR

Let’s look at the company’s valuation a bit more in detail to explore what exactly makes this company a “BUY” at this valuation.

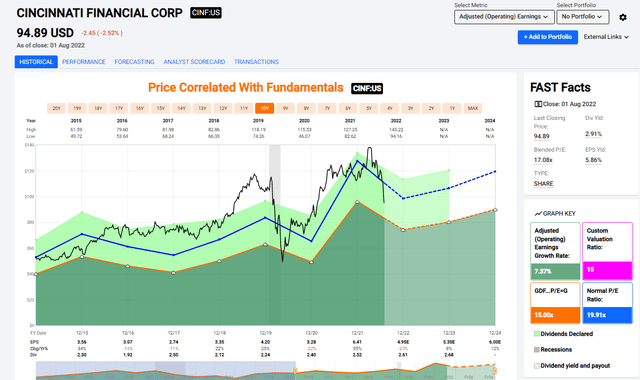

Cincinnati Financial Valuation

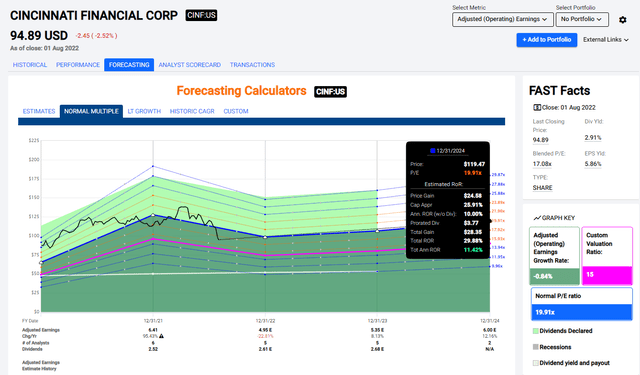

As mentioned, this company’s valuation is already at a pretty good level, from a historical perspective. This company’s average is close to 20x P/E, and the current average weighted valuation is around 17x P/E. The general rule for this company from a historical perspective has been that if you invest in the company at anything below its P/E average, you’re likely to do fairly well.

Now, we do have a complication in that the company is actually expected to see an earnings decline this year. Given that we’re already in challenging macro, it’s not unlikely therefore, that the company might decline further from today’s level.

The key to investing in CINF is valuation. While the company does perform very well over time, it’s not the sort of company to massively outperform the S&P500 index. What this means is that you can’t buy this company at any price and expect to do well.

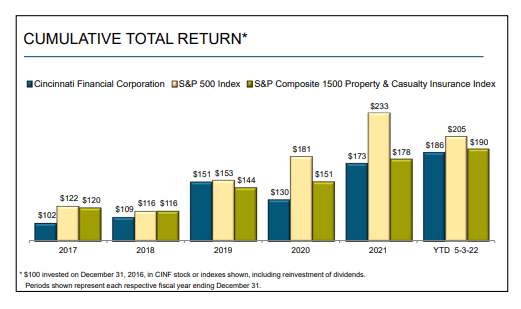

CINF TSR

However, this discount isn’t “any valuation” – it’s a good price, from a historical perspective. Forecasting the company based on its 20x P/E average gives us an upside here, and one of around 11-13% annually until 2024E.

You might not think of this as overly exciting, but let me remind you that this is the top-8 dividend king on the entire US stock market. Compared to other dividend kings, this company delivers not only safety but actually potentially market-beating returns. This is worth highlighting, and it might be worth investing in if you’re the sort of investor who values safety first.

Based on its history, the company has “just” become attractively valued. I base this on this double-digit realistic upside to the company’s near-term and based on the recent and rather sudden crash in valuation due to a more complex near-term. The company missed 2Q22 targets and reported a slimmer underwriting profit. This isn’t yet enough for me to consider the company as having broken any sort of trend or quality fundamental, but it’s worth at least noting here.

“Slowed activity for many businesses, reduced driving and closed courts, which delayed progress on some litigated insurance claims, have all increased the uncertainty of ultimate losses. As a result, second-quarter 2022 incurred loss ratios for several lines of business are higher than in recent periods.”

(Source: Steven J. Johnston, 2Q22)

The company continues to target a 10-13% TSR over the next five-year period, and on that basis, I believe the business will be able to deliver such results.

S&P Global would agree with the fact it’s possible to see an upside here. The average analyst target here is $110/share, with the lowest overall PT around $100 for the company here, and a high of $130/share. All of these targets are significantly below the current share price. 2 out of 4 analysts following the dividend king have either a “BUY” or an “Outperform” rating for the company. There’s still the question of how far the company could fall, with historical troughs suggesting a valuation closer to 15x, but the company could also revert here.

In the end, I would only suggest CINF as an investment for investors who want to be the safest and most conservative possible, even if this comes at the cost of higher upsides found in alternative overall investments. CINF won’t make you rich – you won’t be getting triple or quadruple digits in a few years.

However, the company will certainly safeguard your capital even if it drops a little more, and over time, I believe you will see an upside over the long term.

The upside in this company is considered to be about 16% here.

I consider the company having a double-digit overall upside to an attractive price target of $105 here.

Based on this, I consider CINF a “BUY” here – albeit one of the lower-upside ones in the finance sector, but a dividend king.

Thesis

My thesis for CINF is the following:

- This is a conservative, appealing insurance company and one of the market leaders in insurance in the USA. The company has some of the most qualitative portfolios and track records out there, being a dividend king with more than 60 years’ worth of dividend increases under its belt.

- At the right valuation, this company becomes a “must-buy”. Even at today’s valuation, CINF has a decent overall upside to a conservative valuation based on average historical valuations.

- Based on this, I consider CINF to be a “BUY” here with an upside of no lower than 10%.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them.

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has realistic upside based on earnings growth or multiple expansion/reversion.

Source link