[ad_1]

gorodenkoff

Investment Thesis

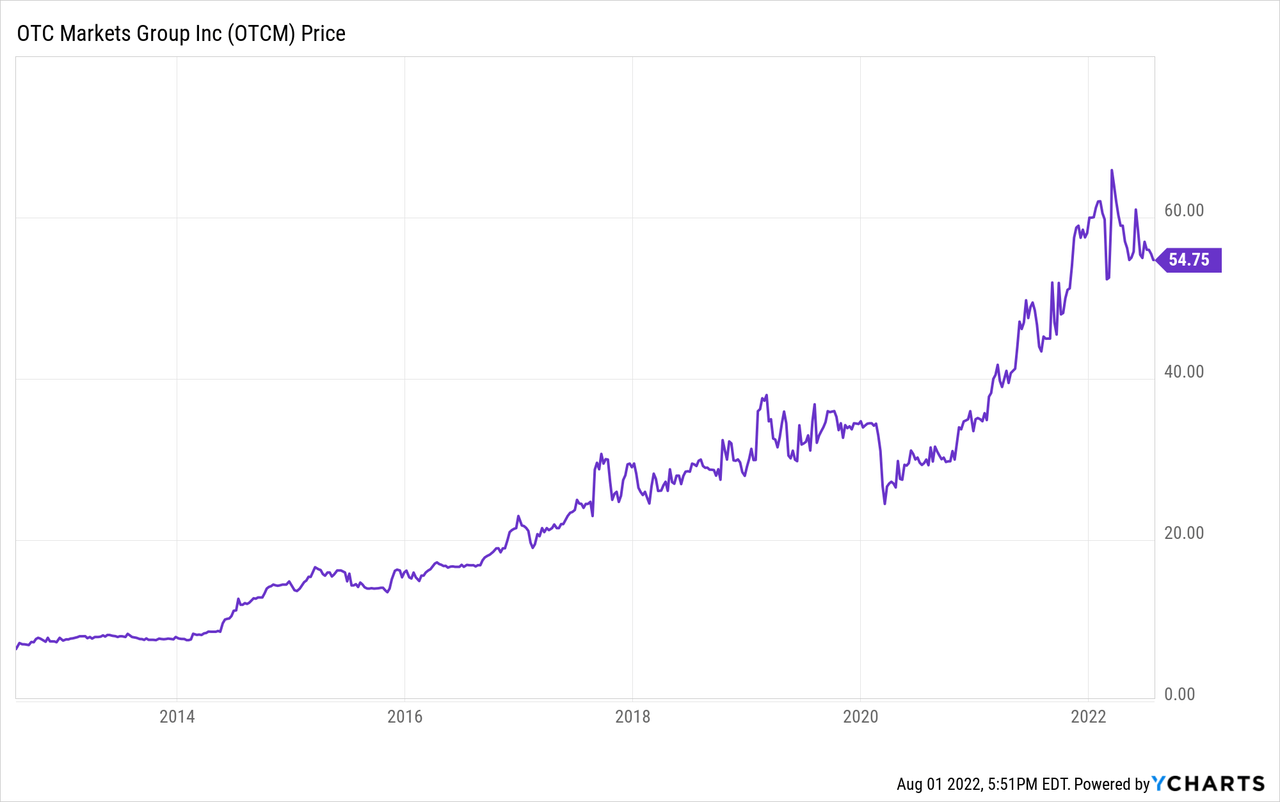

OTC Markets Group (OTCQX:OTCM) represents an opportunity for investors to buy shares in a high-quality business that is uniquely positioned in the financial ecosystem. It essentially operates as a quasi-monopoly that benefits from network effects, scalability, and embedded optionality. It operates under-the-radar and has consistently grown revenue, earnings, and free cash flow over the years. Insiders are also seemingly aligned with shareholders as they own 42% of the company. This is a good time for investors to pick up shares in a wonderful business at a fair price.

Company Description

OTCM is an American financial market company providing price and liquidity information for 12,000 US and international securities. Drawing from its 2021 Annual Report, the company operates 3 business lines:

- Trading Services: through OTC Link ATS (SEC regulated Alternative Trading System), OTCM connects US broker-dealers to provide liquidity and execution services; generates revenues through subscription arrangement and transaction-based fees to broker-dealer subscribers (~29% of total revenues)

- Market Data: distributes market data and financial information to multiple channels (e.g. Bloomberg, REDI Technologies, Thomson Reuters); generates revenues by licensing, on a subscription basis, their market data, compliance data, Blue Sky data, company data, and security information (~33% of revenues)

- Corporate Services: operates the OTCQX and OTCQB markets and offers issuers disclosure and regulatory compliance products; generates revenues by charging a one-time application fee and annual/semi-annual fixed fees, as well as from a host of Corporate Services products (e.g. DNS, Real-Time Level 2 Quote Display, etc.) (~38% of revenues)

OTCM estimates that in 2021, 73% of the revenues were recurring in nature (derived from subscription-based arrangement) and 27% were transaction-based revenues.

Under its Corporate Services segment, OTCM organizes securities into 3 markets based on the quality and quantity of the information companies disclose:

- OTCQX Best Market: provides efficient public trading for companies that meet minimum financial, disclosure and qualitative standards set out in the OTCQX Rules; as of 12/31/21, 570 companies traded (170 US, 400 international)

- OTCQB Venture Market: provides public trading for entrepreneurial and development-stage companies that meet the OTCQB Rules; as of 12/31/21, 1,150 companies traded (400 US, 750 international)

- Pink Open Market: companies that do not meet the OTCQX or OTCQB standards have their securities traded on the Pink market by default

As for recent business development:

- The company announced the acquisition of Blue Sky Data Corp, a provider of compliance data regarding state Blue Sky securities rules and regulations for ~40,000 equity and debt securities for ~$12M in cash. The acquisition closed on May 2, 2022 and the business will be included in the Market Data Licensing business segment.

- The company launched OTC Link NQB in Q3 2021, their third ATS (or Automated Trading System). However, the launch was not material to financial results and its impact on future financial results is still unclear.

Valuation Analysis

With ~12M diluted shares outstanding and a current price of $54.70, the total market cap is $652M.

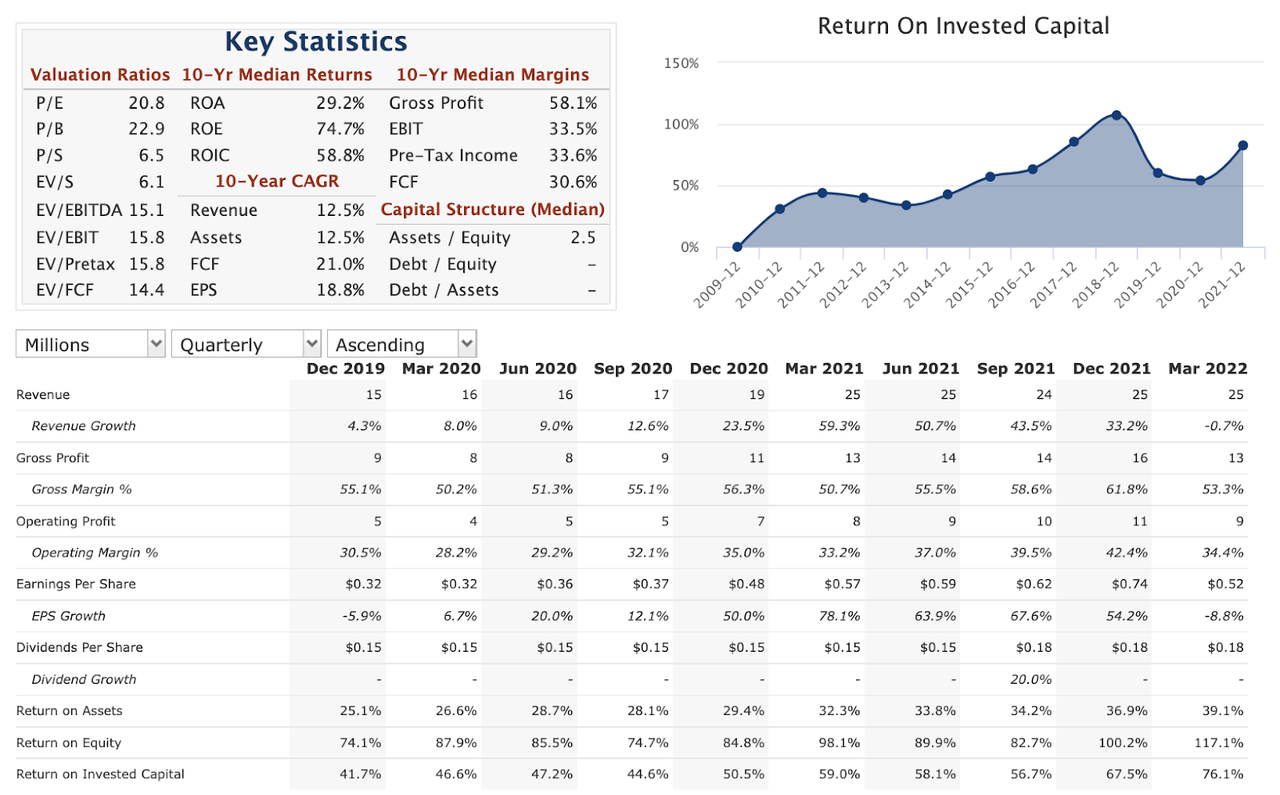

QuickFS

The financial metrics for OTCM are fantastic:

- FCF Margins: ~30%

- ROE: ~75%

- ROIC: ~60%

- Revenue CAGR (10y): 12.5%

- FCF CAGR (10y): 21%

- EPS CAGR (10y): 18.8%

- Debt: none

From a valuation standpoint, investors aren’t paying a high price for OTCM either:

- P/E: 20.8x

- EV/EBITDA: 15.1x

- EV/FCF: 14.4x

- Dividend: ~1.3% ($0.72/sh)

Although OTCM is not a formal financial exchange, I would consider it a close relative as it is a marketplace and the ultimate goal is to match buyers and sellers. And as such, the underlying economics are very similar to a financial exchange like Intercontinental Exchange (which I wrote up here: Benefitting From Network Effects, Scalability, Inflation, And Optionality).

- Virtual Monopolies: it’s hard enough to start a financial exchange, as there are only a handful of exchanges now and it’s pretty difficult to start a successful exchange from scratch; to top that, it’s probably even harder to start a market for OTC securities and compete with OTCM; OTCM’s quasi-monopolistic status is reflected by its 33% pre-tax income margins and 30% FCF margins

- Network Effects: once broker-dealers are on the platform (OTC Link ATS), they tend to stay on the platform as that’s where the other broker-dealers are

- Scalability: revenues can increase without a commensurate increase in capital expenditures; once the infrastructure is in place, the cost to adding more products and the ability to process more transactions is marginal, which means additional revenue essentially gets converted straight into free cash flow; in the case of OTCM, from 2012 to 2021, you can see that operating margin actually increased from 27% to 38% while revenue was up 300%

- Optionality: building off the scalability point, OTCM is able to add new securities (e.g. corporate bonds, preferred stock) at essentially zero-cost; in other words, OTCM has near unlimited call options on all future products/data/countries that have yet to be listed yet; OTCM also has a call option on increases in trading volume as well

I’ve also selected a few financial exchanges (ICE, CME, SPXCF, JPXGY) and financial technology / data / analytics companies (MSCI, INFO) below for comparison. It’s pretty clear that the current valuation for OTCM is on the low end of the valuation spectrum (source: QuickFS).

|

EV/FCF |

P/E |

FCF Margin |

|

|

OTCM |

14.4x |

20.8x |

30.6% |

|

ICE |

25.4x |

14.0x |

29.9% |

|

CME |

29.5x |

25.9x |

45.8% |

|

SPXCF |

17.2x |

23.7x |

43.6% |

|

JPXGY |

14.2x |

19.7x |

43.8% |

|

MSCI |

46.6x |

51.1x |

35.7% |

|

INFO |

39.4x |

35.9x |

22.2% |

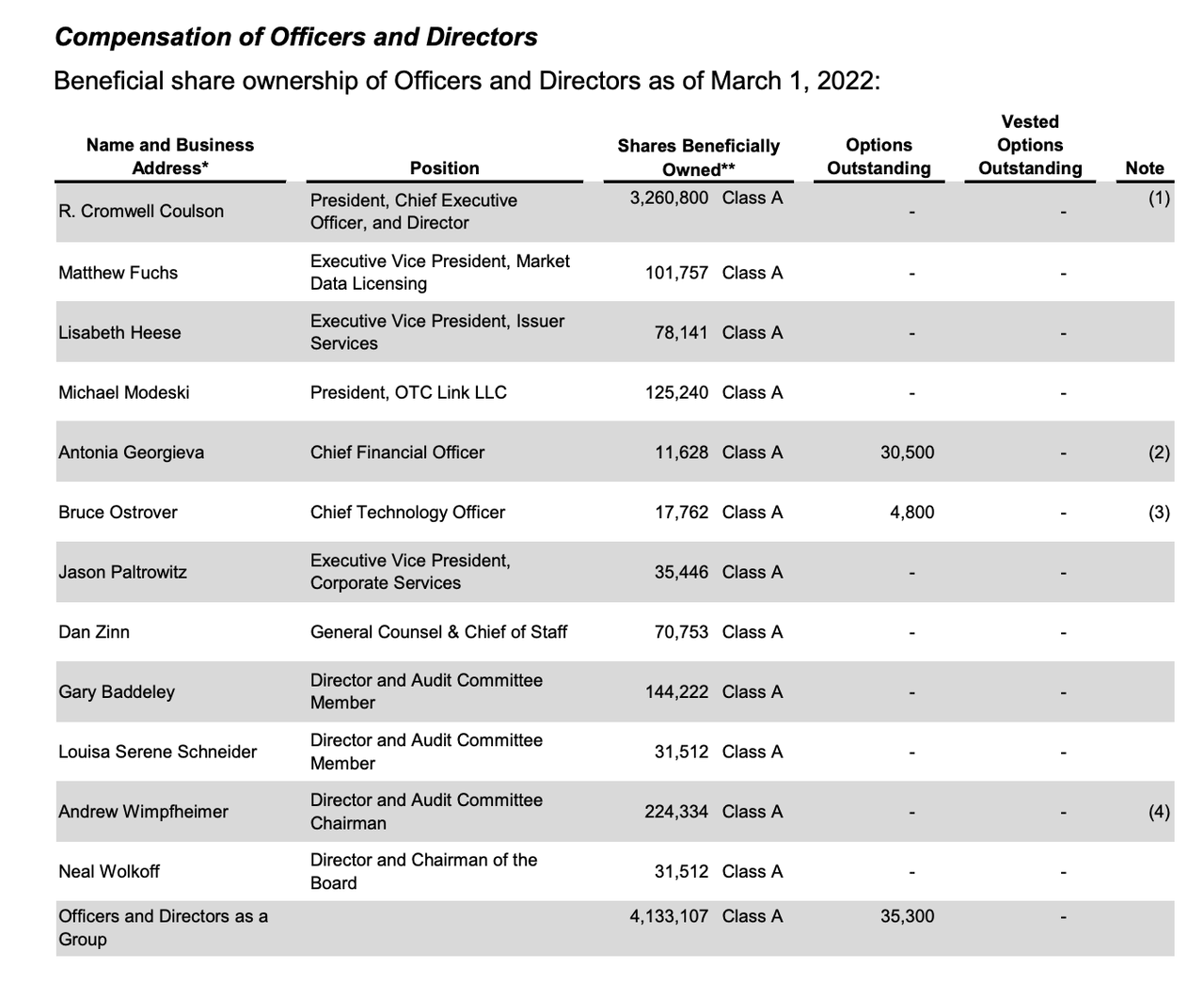

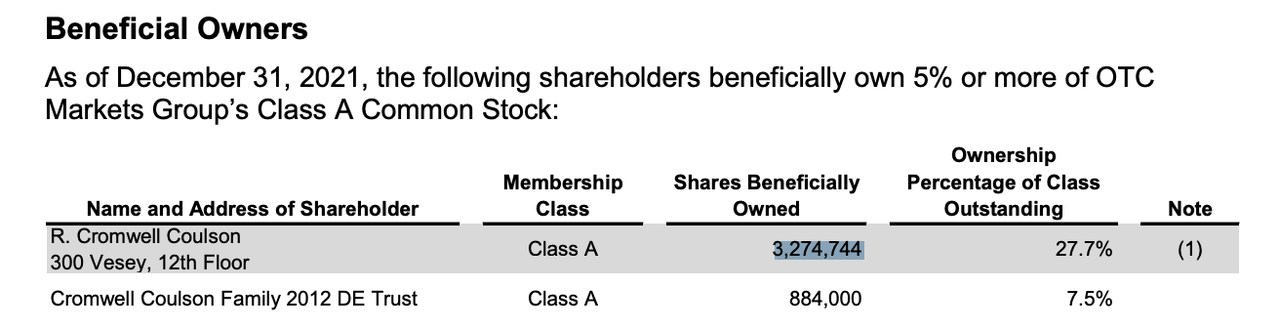

Insider Ownership & Transactions

2021 Annual Report 2021 Annual Report

Insiders own ~5M shares or ~42% of the company and the CEO effectively owns 4.2M shares or ~35%. Normally I look for an insider ownership percentage of ~5-10%, so OTCM’s 42% is comforting; in short, the insiders seem aligned with the shareholders.

Catalysts

-

Continued Execution: organic/inorganic growth and disciplined capital allocation will continue to help the business grow and expand, which will increase both the dividend and share repurchases

-

Rule 15c2-11: beginning September 28, 2021, this rule prohibited broker-dealers to display or submit quotes (e.g. bids or offers) of securities that have not met certain public reporting requirements; as a result, there was an increase in number of companies that subscribed to its Corporate Services products in 2021 and this may be a trend that continues

-

Untapped Pricing Power: OTCM has been raising prices recently; for example, they increased annual fees for OTCQX market from $20k to $23k and achieved a 96% retention rate; OTCM’s dominant position allows it to increase prices accordingly while retaining customers

Downside Risks

-

Illiquidity: the shares of OTCM are illiquid and thus not suitable for institutional money; 42% of the shares are held by insiders and daily trading volume is ~2,620 shares (~$144,000) per day; according to QuickFS, the share turnover rate is 5% (for comparison, OXY’s share turnover is 712%)

-

Competition From National Exchanges: a number of companies that trade on OTC Link ATS may also quality for a national securities exchange listing; if the companies leave OTC to list elsewhere, that would harm OTCM’s business

Investment Summary

The best business is a royalty on the growth of others, requiring little capital itself. – Warren Buffett (1997 Email Exchange on Microsoft)

OTCM is uniquely positioned to benefit from the growth in both trading volume and newly listed securities on the OTC markets, which include both new products (e.g. bonds, preferreds) and securities from countries that OTCM hasn’t reached yet. In other words, the company benefits as a royalty on the growth of others (without taking on much risk) and satisfies Buffett’s criteria for a “best business”; in this case, the continued growth of capital/financial markets, continual listing of new products and companies, and increased demand for data services.

Similar to my write-ups on high-quality companies like CRL, CBRE and ICE, OTCM operates quietly in the background with little need for advertising and plays an important part in the financial system. These are the high-quality businesses that one should yearn to own at a fair (or ideally, cheap) price.

Based on the analysis above, I recommend a long position in OTCM with a holding period of a few years (maybe even forever). I have no idea what the stock price will do in the short term, but I would look to add more if it continues to decline, as I see the company having the ability to compound for many years to come.

Source link