[ad_1]

choochart choochaikupt/iStock via Getty Images

Introduction

On July 13th Unity (NYSE:U) announced they would be acquiring ironSource (NYSE:IS) in an all-stock deal, valuing the company at $4.4 billion. Shares tanked on the announcement, moving down double digits as investors and the gaming community scratched their heads, seemingly confused by the deal.

It seemed to me that almost nobody was excited by this deal…

Investors in Unity, potentially frustrated by dilution and executional missteps, balked at the prospect of more dilution and a further shift from Unity’s original vertical, game creation.

Meanwhile, ironSource investors were frustrated at what they may have perceived as too low of a valuation for their business. Or perhaps the frustration stemmed from the fact they were being acquired by an unprofitable company during a market cycle where those companies are being punished.

To make matters worse, the game developer community voiced their upset against the deal citing concerns about ironSource’s connection to adware and recent layoffs at Unity.

I want to try to clear up this confusion.

Within this article, I’ll:

-

Explain why I believe this deal has been so misunderstood

-

Argue that this deal is quite the smart move

-

Provide my updated valuation model for Unity

Context is Key

Before I explain the merits of the deal Unity made with ironSource it’s important to understand the context behind this deal being struck. Let’s start with one of the goals I believe permeates throughout the ethos of Unity: to democratize real-time 3D development tools.

As I outlined in my first article on Unity, the democratization of these tools allows creators to focus on creation, and much less so on coding. For a moment, imagine if artists had to first code their version of photoshop to start editing photos. Photoshop, and tools like it, made it so anyone can edit photos. It’s almost preposterous to think about, but having to build your engine was the reality for a long time in the gaming community.

So how does ironSource fit into that framework?

ironSource’s bread and butter is ad mediation, not game creation. Sure they have a small publishing house, but ironSource’s clear focus is on ad delivery and sales.

This is where context is important. It’s one thing to have a goal, but it’s another thing to run a business that allows you to achieve that goal. Businesses have owners, they provide capital to businesses with an expectation to earn a return. Up until last year or so investors, and management teams, had been rewarded for growth at all costs, profitability was optional.

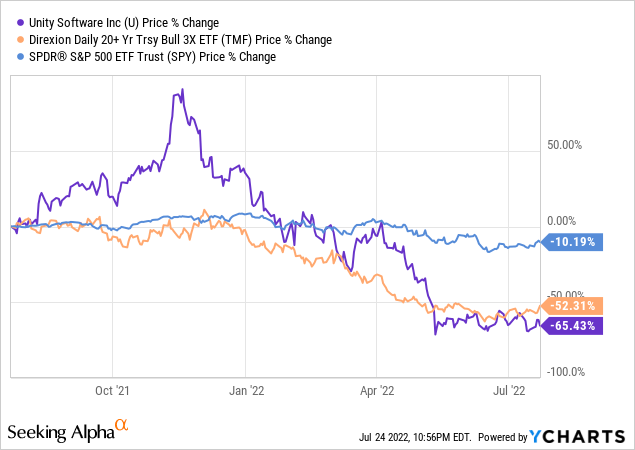

But as it turns out, money isn’t free. Due to supply-side issues inflation soared. Rates jumped, and investors fled from high-growth names like Unity and other high-duration assets.

And just like that Unity lost its ability to raise capital at 20x price to sales multiple and had to reassess.

I imagine that management pondered the following question:

How can we continue to grow if we are unprofitable and capital is exponentially more expensive?

One Solution? ironSource

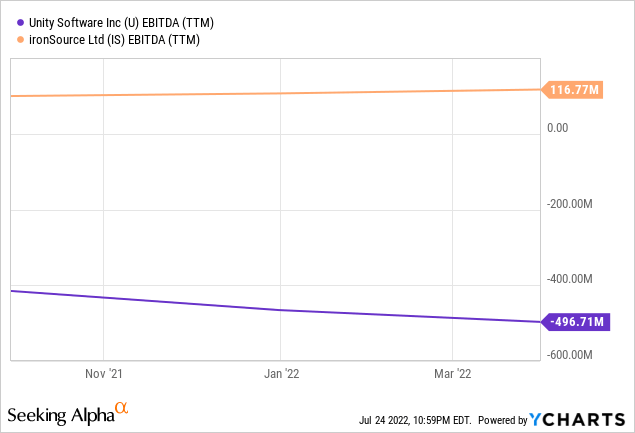

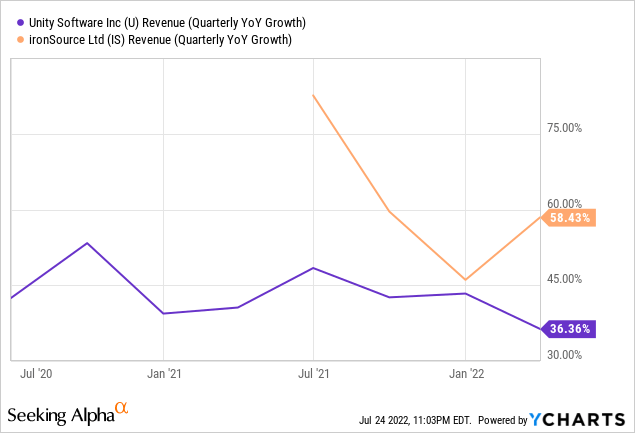

That brings us to the ironSource merger, because ironSource, unlike Unity, is highly profitable.

Using the average analyst expectation for ironSource’s 2023 EPS ($0.14), their forward PE works out to be ~27x, or using a more optimistic prediction of $0.24, shares trade for just 16x next year’s earnings. And when you factor in revenue, Unity is getting ironSource at less than 4x sales, add in revenue synergies and it might be closer to 3x sales.

ironSource is a cash cow, one could quibble about the cyclicality of the ad business, and I think there are some merits to that critique, but ironSource provides Unity with a source of recurring internal capital when they need it the most. The power of that cannot be understated.

Ultimately, ironSource may not help advance Unity’s core engine, but it’ll give them the funds they need to continue developing it.

Unity vs Unreal (Epic Games)

Epic, like Unity, raises money from time to time, but unlike Unity, they can fund much of their development using the internal cash-flows spinoff from their hit franchise, Fortnite. What Epic has with Fortnite is truly special, it’s both highly cash-generative, and a platform for Unreal to test new features, and improve their game engine. It’s essentially self-funded R&D.

Unity doesn’t have anything like this

But not for lack of trying.

Earlier this year, at GDC 2022 Unity announced Gigaya, an ambitious project to build a game internally within Unity to showcase best practices and identify challenges faced by indie developers. That game would then be released for free on steam and given to developers to tinker on and learn from.

But seemingly out of nowhere, Unity canceled the project and laid off the entire team working on it. This dealt a major blow to the indie developer scene who hoped to use Gigaya as a tool to advance their learning and skills in the Unity engine.

As sad as layoffs are, and the disappointing loss of what could have been a useful tool for developers, I believe this was the right call.

If you can issue shares at 20x sales to investors, why not build Gigaya? But when every penny counts, it’s hard to convince a board of directors that Gigaya, a free game, will yield a high ROI. Because, unlike Fortnite, Gigaya was not designed to be a multi-player game filled with microtransactions, it’s just a small single-player game.

Gigaya was an expensive passion project

It is a pity though because I believe the cancellation of Gigaya paired with the large ironSource acquisition surely left a foul taste in many developers’ mouths who might now believe Unity as having lost its roots and distracted. No need to mention the disparaging remarks shot off by John Riccitello which only added more fuel to the fire.

Structure

As I mentioned, Unity is acquiring ironSource in an all-stock deal. What’s especially unique about this deal is that Unity concurrently announced a $2.5B buyback and convertible bond sale to Silver Lake and Sequoia. At first glance, this was head-scratching. I wondered why wouldn’t Unity just buy ironSource using a combination of debt and equity, after all, ironSource trades for much less than Unity itself.

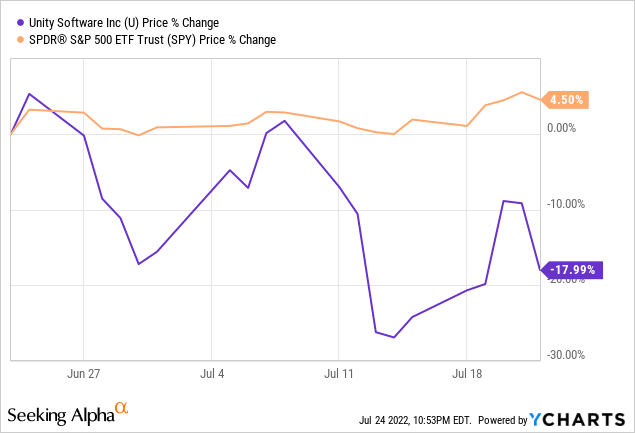

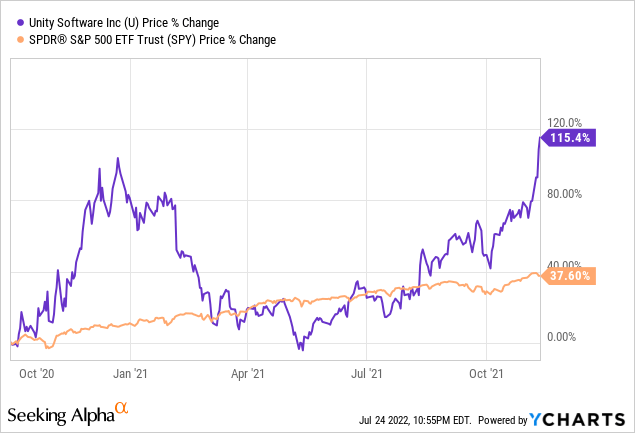

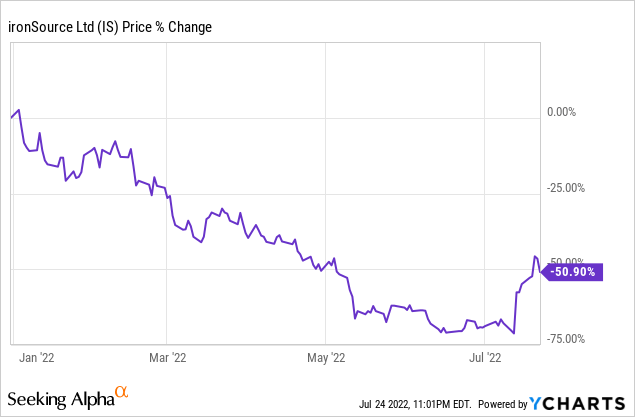

Looking at ironSource’s share price performance helps to answer that question.

After such a steep decline and its relatively low valuation, I’d wager that any cash-backed sell-out, partial or not, would have deeply upset long-term ironSource shareholders. But unfortunately for Unity shareholders that means massive dilution. So that’s where the buyback comes in, $2.5B won’t be enough to cover the entire transaction cost, but it’ll help.

Of course, I’d prefer if they used more cash to buy ironSource outright, but for the sake of making a deal, one has to be flexible.

Valuation

For a more in-depth discussion on Unity’s financials, I’ll refer you to either one of my prior articles on the company. But for this article, I felt it prudent to update my DCF to reflect my expectations for the new combined company.

Base Case: Discounted Cash Flow Analysis

|

Year |

2022 |

2023 |

2024 |

2025 |

2026 |

|

Revenue |

$2,165.0 |

$2,832.0 |

$3,398.4 |

$4,078.1 |

$4,893.7 |

|

Net Income |

($250.0) |

$300.0 |

$800.0 |

$1,008.0 |

$1,270.1 |

|

Cash Flow |

0.0 |

$400.0 |

$650.0 |

$802.6 |

$991.1 |

|

Metric |

Estimate |

|

Discount Rate |

10.00% |

|

Revenue CAGR |

20% |

|

Terminal Growth |

2% |

|

DCF Implied Share Price: |

$52.60 |

Source: Yahoo Finance and Author’s Calculations

ironSource brings on a significant increase in both revenues and earnings to Unity. Using a 10% discount rate, 20% revenue growth, and a 2% terminal rate, I come to a fair value per share estimate of $52.6 for the combined entity. Of course, as with any DCF, each input can be debated so I put together a sensitivity analysis too.

Sensitivity Analysis

|

9% Discount Rate |

10% Discount Rate |

11% Discount Rate |

|

|

Bull Case: 30% Revenue Growth |

$89 |

$75 |

$64 |

|

Base Case: 20% Revenue Growth |

$62 |

$53 |

$45 |

|

Bear Case 10% Revenue Growth |

$42 |

$36 |

$32 |

Source: Yahoo Finance and Author’s Calculations

Based on my analysis, under a variety of interest and growth rate scenarios, Unity is either a buy or close to fair value. If the combined company can grow close to its historical growth rates, then the bull case scenario becomes that much more likely.

Risks

As a relatively young, high-growth company, Unity has its risks. Chief among those are execution and the potential for an ad-sales slowdown. Earlier in the year unity ingested bad data into its machine learning model which they use to identify customers, the result was a sharp slowdown in ad sales which are sold based on how effective they are. The company is continuing to work on resolving the issue and expects to have it handled before the end of the year but it highlights how increasingly complex operations can lead to a higher risk of something going awry.

One large risk outside of Unity’s control is ad spending. As we saw in Snap’s earnings, (SNAP) the ad market appears to have entered a sharp contraction as companies curtail ad spending in expectation of a recession. With Unity’s acquisition of ironSource, they are further tied to the cyclical ad business, and less so to a SaaS model. Judging from the long-term performance of Facebook, and Google’s ad businesses I’m not overly concerned about this, I think the additional cash flow makes it worth the added risk. I now view Unity as a SaaS, ad-sales, hybrid company.

Conclusion

So what’s the takeaway from all of this?

Well everyone is free to draw their own conclusions, but from my perspective, this acquisition is a masterstroke.

For Unity to continue to grow it needs more capital, ironSource provides a cheap source of recurring revenues at an incredibly fair price. I believe the bull thesis is still intact.

ironSource will turbo-charge Unity’s path towards profitability. I expect Unity will be profitable before the end of 2023 and grow exponentially from there as they continue to democratize Gaming, VFX, and RT3D tools. As a profitable company, Unity’s share price could recover swiftly, giving them increased flexibility to acquire other companies using equity.

I believe Unity is a “Buy”

And ironSource is a “Strong Buy” given its discount relative to Unity proper.

Thank You!

As always, thank you for reading.

I try to engage with all my readers, so if something has interested you, or if you have a question, please feel free to comment. I will do my best to get back to all of you with a response!

Source link