[ad_1]

SimCh/iStock via Getty Images

Albireo (NASDAQ:ALBO) remains in a transformation process and continues to advance from a clinical development company to a profitable commercial company. Overall, Albireo has tremendous growth potential with three significant fundamental value drivers. Bylvay is the backbone of the company and the key value driver underpinning the company’s market capitalization – despite the early stage of commercialization and untapped large potential. In addition, Albireo is addressing with its clinical development pipeline another two value drivers to create shareholder value.

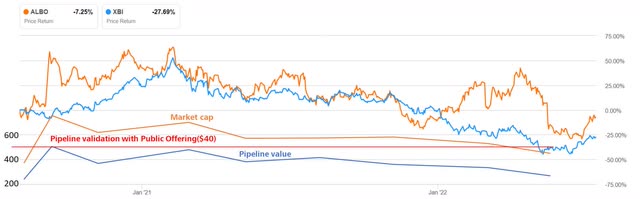

Although the management has an excellent track record and keeps highlighting that commercialization is proceeding according to expectations, the market is struggling to adequately value Bylvay and its potential in PFIC and beyond. Furthermore, the launch of commercialization is proceeding more slowly than many investors had hoped. This is reflected, among other things, in the share price volatility in recent months. The chart shows both the evolution of the share price compared to the SPDR S&P Biotech ETF (XBI), as well as the change of the valuation of the pipeline (which is basically the market capitalization discounted with the net cash). The value of the pipeline was validated by a public offering after announcing positive phase 3 results in September 2020.

The valuation of Albireo’s assets over time (Source: Author’s Chart, with data from filings)

By the end of the year at the latest, many uncertainties will be clarified and Albireo should be valued at a fair value. In my opinion, fundamental long-term investors need to have this stock on their radar and follow Albireo closely in the coming weeks in order to benefit maximally from the development.

In advance of the next quarterly report, which will probably be published in early August, I want to compile the content of my previous articles (which can be found here) together with the current developments and provide a new outlook. Overall, the outlook remains the same as before, but the latest quarterly report shows that investors still need to be more patient and management’s ability to commercialize Bylvay remains under review.

Investment Thesis

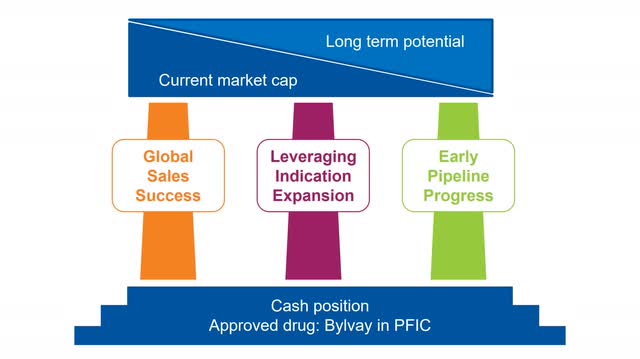

The current valuation is based on the stable foundation of financial strength and the approval of Bylvay in PFIC. In addition, Albireo is working on three tremendous growth drivers that will unlock long-term growth potential over the coming months and years.

The growth driver’s of Albireo (Source: Author’s Chart)

Albireo has a stable foundation with its proven management team, its financial strength and its commercialized product Bylvay. This provides an excellent starting position for the long-term success of developing Albireo into a relevant player in liver diseases. At the same time, the value of this foundation was validated by the major players in the industry at the last public offering following the publication of the Phase 3 results.

Since validating the value of the pipeline, Albireo is moving forward with the commercialization of Bylvay and the development of the growth drivers. Although the overall development of the company and its assets is on schedule, half of the valuation has been depreciated since the validation. For this reason, Albireo still has an excellent risk-reward profile in my opinion at current prices.

On top, the three key value drivers primarily reflect future prospects and long-term potential. The first value driver is the international sales potential of Bylvay in PFIC, which can be up to 50% of the global sales potential. The second value driver is the potential leverage of Bylvay’s indication expansion in ALGS and BA, which significantly increases the addressable patient population. The third value driver is the unlimited and long-term research and development potential with the help of the early clinical development programs – these are currently manifested by the rapidly emerging adult cholestatic and viral liver disease products and their unique mechanisms of action.

I have already written several articles about Albireo and focused and analyzed a specific valuation topic in each article. The following list gives an overview of the major topics of my previous articles.

- Why Albireo Must Be Valued Higher Than Its Competitor Based On The Value Of Odevixibat:An outlook on the potential of Bylvay (Odevixibat) and an assessment and comparison with the only relevant competitor Mirum (MIRM).

- Reasons For A Successful Transformation Into A Commercial Company: An analysis on the sales launch of Bylvay in PFIC and further developments in the pipeline.

- Albireo: Successful And Accelerating Global Launch Drives Sales Revenue: Explaining the expectations and progress of Bylvay’s european and international sales.

- The R&D Engine Drives Albireo’s Long-Term Prospects: A market and competitive analysis to assess the potential of the early stage assets A3907 and A2342.

In summary, I have covered all the individual valuation elements that will add up to assess the value of Albireo’s pipeline in my previous articles. The goal of this article is therefore to combine all previous articles into a coherent whole and to update them based on recent developments. Please let me know, for example, via the comments, which evaluation aspects have not yet been sufficiently considered.

Business of Albireo Pharma

Logo of Albireo Pharma (Source: Company Homepage)

The launch is going as planned, and we are delivering on our global strategy to reach the estimated 2,500 PFIC patients worldwide. Source: Pamela Stephenson, Q1 2022 Business Update

Albireo is a commercial-stage biopharmaceutical company focused on diseases of the liver, particularly ultra-rare pediatric diseases. In addition to the IBAT inhibitor Bylvay, approved in PFIC, the pipeline includes other novel bile acid modulators to treat adult cholestatic and viral liver diseases.

Performance and outlook of the key value drivers

In the following sections, I will discuss the individual components and developments of my investment thesis and relate them to each other.

Foundation

The backbone of my investment thesis is the approved product Bylvay in PFIC combined with the financial strength of Albireo. These two components secure Albireo’s current market capitalization, which is why I view Albireo as a low-risk investment.

Especially in these turbulent times, a very good financial position and the ability to generate revenue are an important fundamental factor to value a company. With low debt, over $215 million in cash on hand, and growing revenues from the Bylvay sales, Albireo is in a position of financial strength and able to advance both the international Bylvay sales and the development of its clinical pipeline. Albireo expects that current cash is sufficient to last into 2024 – Investors therefore don’t need to fear any capital increases in the near future.

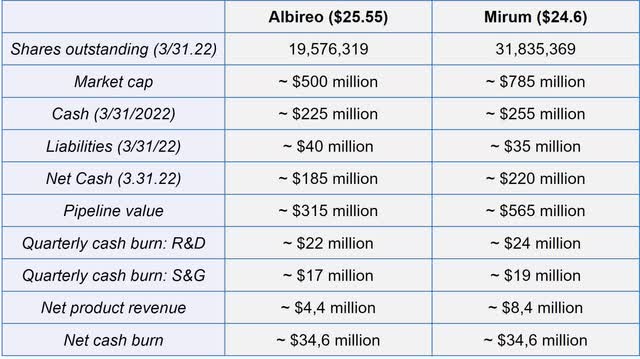

Financial overview of Albireo compared to Mirum (Source: Author’s Chart (with data from filings))

In addition, Albireo continues to drive sales of Bylvay and is still far from reaching its full potential. Management continuously communicates that both the sales launch speed and initial patient population are on track and in line with expectations.

Every week, we’re capturing more patients, creating a stronger and stronger annuity for growth. Clinical trials are on track or ahead of expectations. Source: Cooper, Q1 Business Update

In my opinion, the sales launch was acceptable, but not very successful. In particular due to the strong sales figures of the competitor Mirum and their product Maralixibat, many investors are not satisfied with the sales launch so far. Overall, Albireo is looking to do at least $30 million in sales this fiscal year, which I think is a very conservative target. The high refill rates, which are currently above 90%, and the low rate of discontinuations remain very positive, especially in the context of the lifetime treatment period.

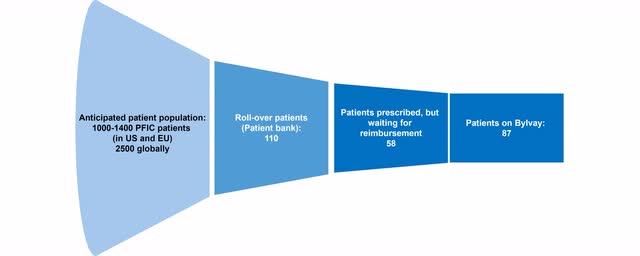

Patient funnel of Bylvay in PFIC (Source: Author’s Chart)

Albireo itself assumes that patients with the greatest medical need have been cared and treated to date. In the coming months, they will also address the second wave of patients, those who are receiving care but are not in crisis.

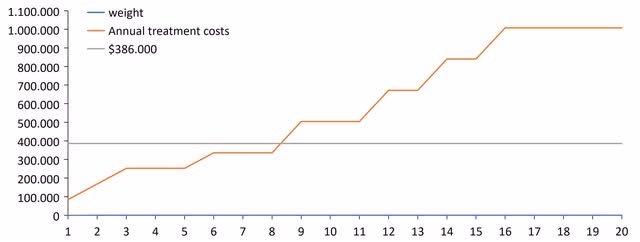

For the future, it will continue to be important to steadily attract and, above all, retain the patients. Since Bylvay is a weight-based chronic therapy with high gross margins, each patient represents a significant growth annuity. The next figure illustrates the benefits of weight-based dosing and pricing. The better Bylvay works and helps to avoid liver transplant, the higher the sales or annual treatment costs per patient will be. As also discussed above, the patents for Bylvay run until at least 2036 in Europe, which is for another 14 years.

The advantages of weight-based dosing and pricing (Source: Author’s Chart)

Of course, annual sales of $30 million dollars don’t sound like much at first glance, especially since these sales are offset by distribution costs that are about twice as high. On the other hand, Albireo has already convinced 255 patients of Bylvay globally, which corresponds to annualized sales of about $100 million dollars. Accordingly, Albireo would already be profitable if reimbursement were already approved for all patients. Furthermore, the true value of Bylvay, the weight-based dosing, will only fully emerge in the coming years.

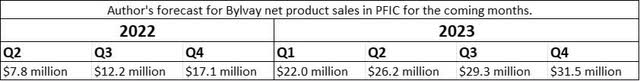

Based on the sales launch to date, I am adjusting my forecast for net sales of Bylvay in PFIC for the coming quarters. Both patient recruitment and the launch in international markets are slower than anticipated. Furthermore, it should be considered that PFIC is only the beginning and the smallest of the three possible indications.

Author’s forecast for Bylvay net product sales in PFIC for the coming months. (Source: Author’s Chart)

Growth driver 1: International Sales Progress

International markets play an important role; up to 40% of sales are expected to be generated outside the USA. Currently, the focus is on gaining reimbursement in the individual European countries. Following the fastest NICE HST assessment to date, patients in the UK are able to obtain reimbursement from their health insurers since the end of May. Furthermore, Albireo has applied for reimbursement in another 12 European countries and is confidently awaiting decisions in the coming weeks and months.

Growth driver 2: Indication expansion

The indication expansions are of tremendous importance to the mind-blowing success of Albireo. First, the indications address a larger market potential; the available patient population in ALGS is about twice as large and in BA about six times as large as in PFIC. Second, the existing distribution and cost structure can be leveraged, as the same prescribers and contacts will need to be addressed for all indications. In particular, approval for BA is seen as a critical milestone to achieve sales of more than one billion in the second half of the decade. To reach the sales target, Albireo requires access to approximately 3000-4000 of the estimated 100000 pediatric cholestatic patients around the world. However, the only downside is that Albireo is not eligible to receive another PRV with Odevixibat, although the conditions are certainly given, especially in BA.

Management is confident of Bylvay’s success in both indications based on the insights gained from the available trial data in PFIC. Compared to many other phase 3 studies, Albireo has many information like the correct dosage of Bylvay and furthermore, the efficacy of the Bylvay has already been validated.

The total addressable market of Bylvay (Source: Albireo)

The total addressable market for Bylvay with these estimated patient numbers across all 3 indications is close to $6 billion per year – with a patent term for Bylvay granted until 2036 in Europe. The aim here is to highlight the enormous sales potential of Bylvay. At this point, I have to point out that Bylvay has not yet received approval in ALGS and BA and that there is currently another competitor in the form of Mirum.

I will only briefly discuss the competition at this point. Mirum has received FDA approval in ALGS with its drug candidate Maralixibat and is in the middle of the approval process in Europe. Furthermore, Mirum is investigating Maralixibat in a phase 2 trial in BA and expects topline data from their Phase 3 trial in PFIC in the fourth quarter. Overall, I expect fierce competition between the companies. Although I still see Albireo in the leading role, Mirum has caught up enormously in recent years.

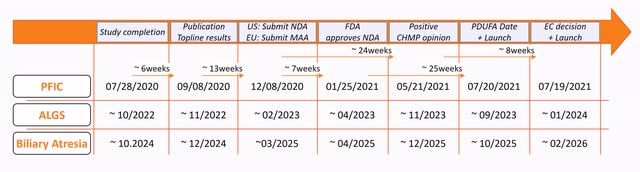

To estimate when an approval can be expected for Bylvay in ALGS and BA, I made a comparison with the approval process of Bylvay in PFIC. Overall, however, I expect that both Albireo and the agencies will be able to accelerate preparations and assessments for the approval process.

In ALGS, the last patient was enrolled on 03/31/2022, so if I apply the 24 weeks of treatment plus an additional 28 days of additional safety and tolerability monitoring, the study should be completed by mid-October at the latest. The ongoing BOLD study remains on schedule to enroll all patients this year and deliver results by the end of 2024.

Following the study, Albireo needs approximately 6 weeks to prepare, analyze and publish the data. Following positive study data, a new NDA is submitted in the U.S. and a MAA in Europe. By announcing a PDUFA date, the FDA confirms that all regulatory submissions have been received and that the application is being processed.

In the U.S., the review of the NDA in both indications is completed within 6 months under the priority review process. In Europe, on the other hand, approval will take slightly longer because Bylvay had PRIME status in PFIC, which accelerated the assessment by 60 days.

The road to approval for Bylvay in additional indications (Source: Author’s Chart)

Growth driver 3: Early clinical pipeline

As a third value driver, I consider Albireo’s research and development capabilities to tailor new drugs to attractive indications, based on their expertise in disorders in bile acid irregularity and liver diseases. This expertise resulted specifically in the two rapidly emerging early assets A3097 and A2342. Both of the assets have a unique, one-of-a-kind mechanism of action and both products have garnered a lot of strategic interest.

We have the capabilities and plans to develop both A3907 and A2342 in rare disease, at the same time, both drugs have generated strategic interested with the potential to develop the products in more or larger diseases, so we remain open minded at this stage to the path forward for value creation. Source: Cooper, Q1 business Update

Albireo anticipates to start a Phase 2 study with A3907, an ASBT inhibitor, later this year. A3907 is expected to address the major unmet medical needs in adult cholestatic liver disease like PBC and PSC, which affect more than 600,000 people worldwide. Should Albireo partner A3907, the company could target additional and bigger indication such as NASH.

With respect to A2342, an NTCP inhibitor, Albireo plans to initiate a Phase 1 trial later this year. A2342 is being developed as an oral treatment option for combination therapies for more than 11 million patients with viral liver disease like hepatitis B or D. A2342 may also be considered as an oral alternative to the approved product Hepcludex from Gilead (GILD).

Overall, too little attention is still being paid to these two assets. In my opinion, both product candidates will be partnered – this is the only way Albireo can unleash the full potential from these one-of-a-kind drugs. With partnering at the latest, the mass of investors will discover the potential or value of these assets and start to value them.

Risks

Despite the excellent long-term prospects, I would also like to point out potential risks. Currently, I see the biggest risks related to the commercialization of Bylvay in PFIC. PFIC is an ultra rare disease and there is no data source to confirm Albireo’s patient estimates. For this reason, the market potential may be lower than indicated. In addition, another product, Maralixibat, could be approved in 2023, which would intensify competition.

In addition, the commercialization of Bylvay is not yet profitable and Albireo is also pushing its pipeline development. While Albireo is currently in a position of financial strength, additional capital may be needed in the future.

In terms of the three growth drivers, the results in the further clinical trials are particularly relevant. Only the approval of Bylvay in additional indications will open up the full market potential. However, these approvals are dependent on the results of the phase 3 trials and are therefore subject to a high degree of uncertainty and risk. Negative study results would considerably limit the market potential of Bylvay.

Summary

In my opinion, investors should definitely follow the further development and performance of Albireo. Due to the strong price fluctuations after the publication of the quarterly results, I am publishing this article in advance of the numbers, even though I am aware that many figures will be outdated again after publication.

In my opinion, Albireo remains significantly undervalued based on the long-term potential listed above. Not only the foundation, but also each individual growth driver on its own has the potential to justify the current pipeline valuation.

After the decline in sales revenue due to the reduction of inventories of Bylvay, sales should reflect continuous growth in the following quarters. In particular, reimbursement in the international markets will lead to a jump in sales and patient numbers. In my opinion, it makes sense to start investing in Albireo even before these developments are reflected in the sales numbers, which will provide a foundation for a fair valuation.

In summary, I continue to be very optimistic about Albireo, for this reason I would like to give an outlook on the upcoming milestones.

Upcoming Milestones in the second half of 2022

- Continuously increasing sales and patients.

- Launch in other international markets.

- (Positive) Top-line data from the phase 3 ALGS study.

- Full patient enrollment in the BOLD study.

- (Partnering A3907 or A2342?)

- Initiation of the phase 2 study of A3907 and definition of the target indication.

- Initiation of the phase 2 study of A2342.

Upcoming Milestones in 2023

- Approval & Launch of Bylvay in ALGS?

- Albireo achieves profitability on an annualized basis?

- (Positive) study data from A3907.

- (Positive) study data from A2342.

Upcoming Milestones in 2024

- (Positive) Top-line data from phase 3 BOLD study.

- Study results of A3907 and progress into a phase 3 study.

- Study results of A2342 and progress into a phase 2 study and definition of a target indication.

Source link