[ad_1]

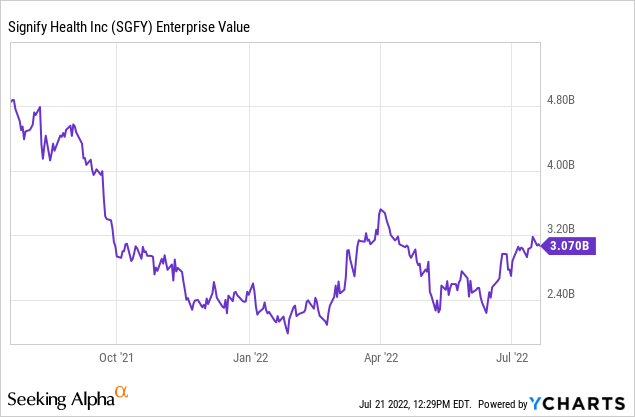

FG Trade

Signify Health’s (NYSE:SGFY) recently announced wind-down of its Episodes of Care (ECS) business segment, including the Bundled Payments for Care Improvement-Advanced (BPCI-A) program, will come as good news to investors. The ECS segment has consistently disappointed post-IPO, taking the shine off the outperformance of the HCS segment (already on track for ~2.4m in-home health evaluations this year) as well as its exposure to attractive secular tailwinds. ECS’ outlook was not getting any better either – a recent reconciliation update from the Centers for Medicare and Medicaid Services (CMS) lowering the target price for ECS would have significantly limited the opportunity for savings for SGFY and providers going forward. With SGFY remainco now trading at an implied ~11x EV/EBITDA despite being positioned for continued double-digit % revenue growth and EBITDA margin expansion, I think the risk/reward has turned favorable for the stock.

Winding Down the ECS Segment

Having toughed it out for over a year, Signify has finally announced the winding down of its ECS segment (including a full exit from the BPCI-A program). Per management, the latest CMS reconciliation update lowering the target price for episodes of care was the straw that broke the camel’s back, limiting the long-term financial opportunity for SGFY and providers. For context, retrospective trend adjustments were first introduced to BPCI-A in 2021 (or Model Year 4), with CMS delivering SGFY’s 2021 retrospective trend adjustment report in late June/early July this year.

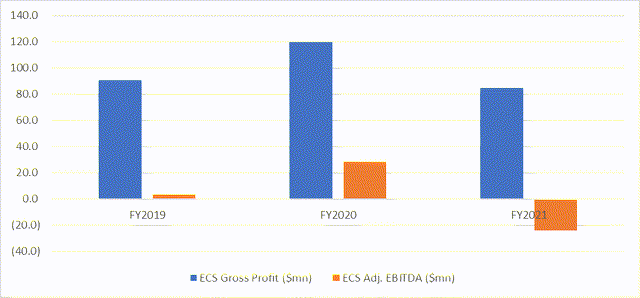

In effect, 2021 BPCI-A benchmark rates will see a downward revision – despite inflationary pressures from labor and supply chain disruptions during the period. Thus, the proposed 2021 trend adjustment will further reduce the savings attributable to convener participants such as SGFY and in turn, adversely skew the risk/reward of the ECS segment. Given the BPCI-A business had already been loss-making at the EBITDA level for five consecutive quarters (~$24m negative EBITDA contribution in 2021), exiting ECS was the only rational outcome, in my view.

A Clear Strategic and Financial Positive

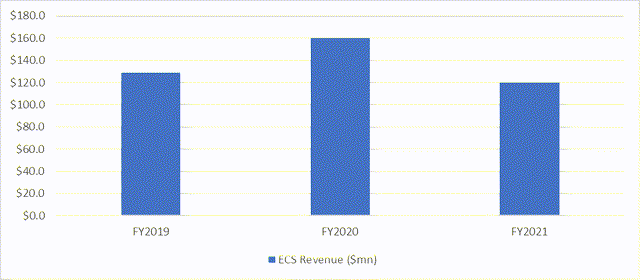

SGFY’s overall business has undergone a massive change since the acquisition of Caravan Health in March this year – recall that pre-acquisition, BPCI-A comprised ~90% of ECS segment revenue, with the commercial bundles business contributing the remaining ~10%. Given ECS segment revenue had also declined to ~$120m in 2021 (down from ~$160m in 2020) amid COVID-driven pressure on case volumes, the diversification was a welcome move.

In recent months, the industry backdrop for ECS has materially worsened, led by ongoing changes to the terms and conditions of participation. With many BPCI-A providers rushing for the exit as a result, provider participation in BPCI-A has declined, leading to SGFY’s program size, admin fee, and shared savings revenue coming under significant pressure. With the decline in provider participation looking more structural than transitory, ECS revenue headwinds would likely have persisted for the remainder of the BPCI-A model, and thus, SGFY’s decision to cut its losses here makes a lot of sense.

On a positive note, the ECS exit will not impact the state of the recently acquired Caravan Health business, which will continue to operate on a stand-alone basis. From a cost perspective, SGFY has guided to $25-$35m of restructuring charges post-exit as well as a non-cash impairment to goodwill and intangible assets of $450-$530m. These charges will eliminate ~$85m of annualized ECS costs and $30-$35m in shared cost savings (out of $60-65m of total shared costs) by the end of 2022. Thus, the wind-down (expected to be completed by the end of 2022) should prove accretive to earnings as soon as next year – presenting upside to the current ~$275m consensus EBITDA estimate and driving stronger free cash flow generation going forward.

|

USD ‘m |

Comments |

|

|

Consensus EBITDA (Pre-Wind Down) |

275 |

|

|

(+) 2023 Losses Attributable to Legacy ECS (Pre-Exit) |

32.5 |

Midpoint of guidance to eliminate $30-35m (out of $60-65m of shared expenses to ECS) |

|

(-) 2023 Contribution from Caravan (Pre-Exit) |

20 |

Caravan contribution to standalone HCS adjusted EBITDA at >20m (100% YoY growth guidance) |

|

= Implied 2023e HCS Segment EBITDA (Pre-Exit) |

288 |

|

|

(-) Annual Shared Costs Retained |

27.5 |

Midpoint of guidance to retain $25-30m (out of $60-65m of shared expenses to ECS) |

|

(+) 2023 Contribution from Caravan (Post-Exit) |

20 |

>100% y/y adjusted EBITDA growth |

|

Total 2023e Adjusted EBITDA (Post-Exit) |

280 |

|

|

Implied Remainco Adjusted EBITDA Margin |

27% |

Sources: Author, Signify Health Disclosures

ECS Wind Down Sheds Light on Compelling Remainco Valuation

Net, SGFY’s decision to wind down the ECS segment is a clear positive for the long-term investment case, improving the operating consistency, revenue growth trajectory, and margin profile of the overall company. While exiting ECS could result in a near-term revenue decline, the business had long been a drag on EBITDA, and thus, cutting out the program presents SGFY with an opportunity to lower costs and further expand its EBITDA margins over time. Plus, the stock trades at ~11x remainco 2023 EBITDA – a compelling valuation given its >20% revenue growth and EBITDA margin expansion potential remain intact. The upcoming Q2 2022 earnings report in August could be a potential upside catalyst, with management set to provide additional guidance on the state of the remainco post-ECS win down.

Source link