[ad_1]

HJBC

Thesis

I have recently published a negative article on Exxon Mobil (XOM), as I believe the oil price will likely trade considerably lower by year end. However, my Sell recommendation on XOM was strongly influenced by the company’s relative valuation versus European industry peers, where I believe valuations still imply significant upside even with an oil price of < $70/barrel. That said, I believe European oil majors hold some value. One name that I particularly like is TotalEnergies (NYSE:TTE). TotalEnergies trades at an approximate 70%-100% discount to US oil majors and is valued at a one year forward P/E of < x4. I value TTE based on a residual earnings framework, anchored on analyst EPS consensus, and see more than 50% upside. My target price is $71.52/share.

About TotalEnergies

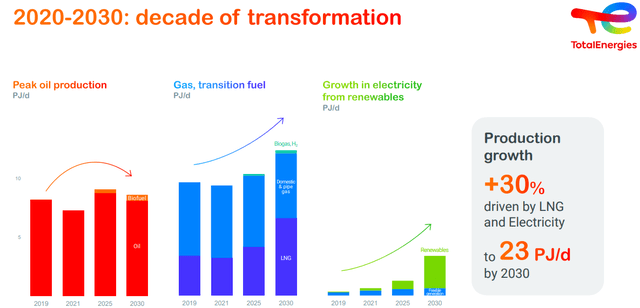

TotalEnergies is a European Oil Major, with headquarters in Paris, France. Approximately 80% of the company’s assets are invested in Oil Exploration & Production and about 20% in Refining & Marketing. From a revenue perspective, however, Refining & Chemicals account for nearly 40% of sales, Marketing & Services are about 40%, Integrated Gas & Renewables are approximately 10% and Exploration & Production accounts for the rest. In 2021, in the context of a major rebranding effort with regards to the company’s Net-Zero ambitions, Total SE rebranded to TotalEnergies. Total is aiming to accelerate the company’s green energy push and add about 10 GW of renewable energy capacity to its portfolio. At the same time, Total acquired a 20% stake in Adani Green Energy, one of the world’s largest solar developers.

In my opinion, TotalEnergies is well positioned to successfully transition to a low-carbon energy portfolio, while also maintaining a meaningful exposure to the oil and gas industry. My judgment is anchored on the company’s track-record to invest sensibly in renewable energy projects and maintaining a strong-cash flow profile from the company’s E&P business, which has an estimated pre-dividend breakeven price for oil of about mid-$20/barrel. Notably, CEO Patrick Pouyanne has not talked as aggressive about a green energy transition as, for example, BP’s (BP) Bernard Looney. This indicates to me that TotalEnergies has not switched to an ideological capital allocation framework, but is still concerned about ROI and shareholder value generation.

TotalEnergies Investor Presentation

Extremely Bullish Performance

TTE stock has strongly outperformed the market for the past 12 months, as the rapid price appreciation in oil prices supported the company’s operations. For reference, TTE is up about 10% versus -7% for the CAC Index. The energy price inflation pushed Total’s revenues for the past 12 months up to $294 billion (up 59% as compared to the prior period) and profits to $33.5 billion (up about 50%, respectively), based on an 11.4% margin. As oil prices are still elevated, profitability should remain strong. In fact, analysts expect Total to deliver record Q2 2022 numbers, which should be supported by record-refining volumes and margins. That said, the thesis for investing in oil & gas companies is deeply anchored on the oil price.

Attractive Despite Oil Downside

This week Edward Morse, the global head of commodities strategy at Citi with half a century of experience, shared the view that oil (WTI benchmark) could fall to $60 per barrel, if the global economy were to slip into a recession. Although I see the oil price declining to about $60/barrel by year end, driven by the prospects of a recession, rising cost of capital and falling asset prices, I am still positive on Total. My favourable outlook for Total is driven by a relative undervaluation versus US peers and an absolute undervaluation based on multiples and EPS estimates. For reference, TTE trades at a one-year forward P/E of x3.6, an EV/Revenue of x0.5 and a P/B of approximately x1. XOM trades at a one-year forward P/E of about x7, an EV/Revenue of x0.95 and a P/B of approximately x2. This is a premium of about 100%! Notably, both companies equally share in profit windfalls/contractions driven by oil price volatility.

Residual Earnings Valuation

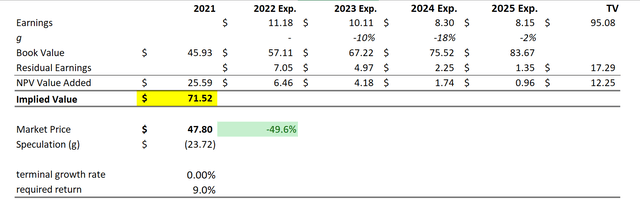

Let us now look at the valuation. What could be a fair per-share value for the company’s stock? To answer the question, I have constructed a Residual Earnings framework and anchor on the following assumptions:

- To forecast EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise. That said, EPS are estimated at $11.18, $10.11 and $8.30 for 2022, 2023 and 2024 respectively.

- To estimate the cost of capital, I use the WACC framework. I model a three-year regression against the CAC 40 to find the stock’s beta. For the risk-free rate, I used the U.S. 10-year treasury yield as of July 15, 2022. My calculation indicates a fair required return of 9%.

- To derive TTE’s tax rate, I extrapolate the 3-year average effective tax-rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply a 0 percentage points to reflect the balance of a secular decline for oil and gas business and the transition towards green energy.

Based on the above assumptions, my calculation returns a base-case target price for TTE of $71.52/share, implying material upside of about 55%.

Analyst Consensus; Author’s Calculations

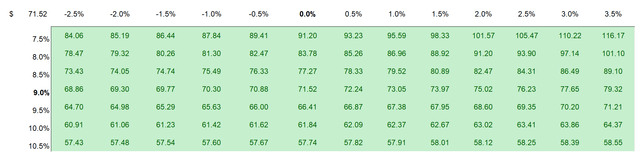

I understand that investors might have different assumptions with regards to TTE’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Analyst Consensus; Author’s Calculations

Risks To My Thesis

My thesis is connected to the implication that there are no structural differences between European and US oil majors. This, however, is not necessarily true since the respective regulatory exposure is somewhat different. Arguably, the European Union is slightly more aggressive with regards to the green energy push and US stocks generally trade at a premium. Nevertheless, a 100% relative valuation discrepancy is not justified, in my opinion. In addition, investors should note that I assume a sustainable oil price of about $60/barrel. While this might seem bearish for some readers, others might argue that the fair value for oil is much lower. As the 2020 covid-19 induced sell-off has shown, oil can even trade at negative price-levels. If oil would break considerably below $60/share and does not recover within a sensible time-period, the bull thesis for TotalEnergies would break.

Conclusion

TotalEnergies stock is undervalued. The argument is easy to prove if we consider a relative multiple valuation versus Exxon Mobil, which trades at about 100% premium compared to TTE. This discount is not justified, in my opinion because European and US oil majors equally share exposure to the oil price. Moreover, I believe TotalEnergies is well positioned for sustainable value generation, given the company’s diversified energy strategy. All that said, I see more than 50% upside supported by a residual earnings valuation. My base-case target price is $71.52/share.

Source link