[ad_1]

Leon Neal/Getty Images News

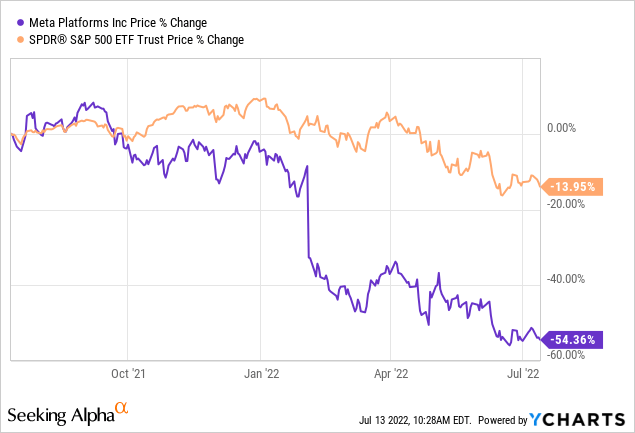

It seems like an arduous task for the broader market to recover its losses experienced this year. However, we believe there’s cause for optimism as many technology stocks seem oversold. According to our analysis, Meta Platforms (NASDAQ:META) has room for recovery as the integrated technology powerhouse is well positioned for future growth and its stock’s price level is attractive after a more than 50% year-to-date drawdown.

Although Meta is a high beta stock (1.41), we believe it could serve investors well, even if a recession had to occur, as the positives outweigh the negatives by far; here’s why.

Business Verticals Analysis

Advertising Revenue

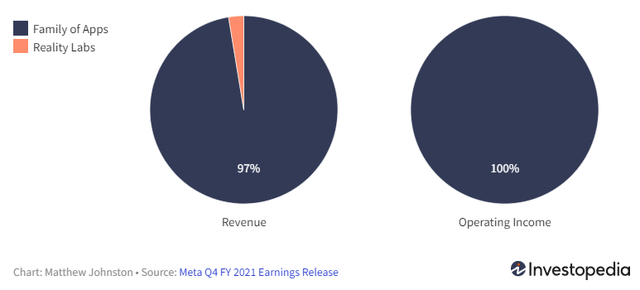

Meta generates almost all of its revenue from advertising (approximately 97%). As such, most of the stock’s market value should be priced according to the segment. The economic challenges this year has thrown into our path could cause many enterprises (and individuals) to cut down on their advertising spending. However, even if enterprise spending declines, it won’t necessarily derail the industry as CAGR (compound annual growth rate) remains robust at 10.4%, nearly five times the U.S. annual GDP growth.

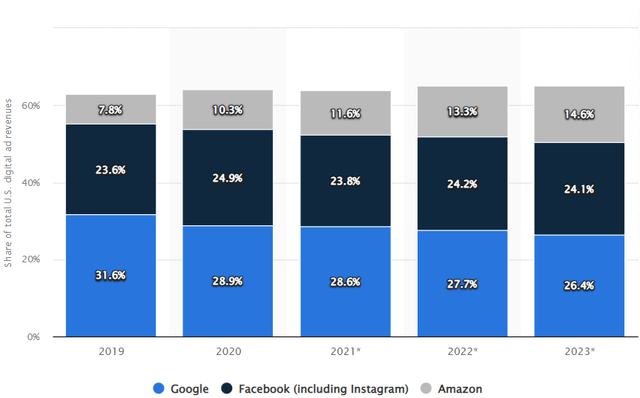

Meta holds down a large part of the advertising space and is projected to own 24.1% of the industry by 2023. I’d actually argue that economic turmoil could support Meta’s position in the advertising market because many of the smaller players likely won’t be able to withstand reduced revenue in the short run and, in turn, go out of business. In contrast, Meta sports $59.52 billion in cash from operations, which could see it cannibalizing much of the rising competition.

Furthermore, Meta’s family app model integrates leading social media platforms such as Instagram, Facebook, and WhatsApp. Thus, allowing the firm to be less susceptible to any fluctuations in platform-relative users. In addition, its array of integrated applications allows Meta to synergize its human capital and scale its products at maximum efficiency.

Reality Labs

Although “Reality Labs” makes up a small part of Meta’s revenue, many investors are at a crossroads when it comes to the segment’s spending versus its potential growth.

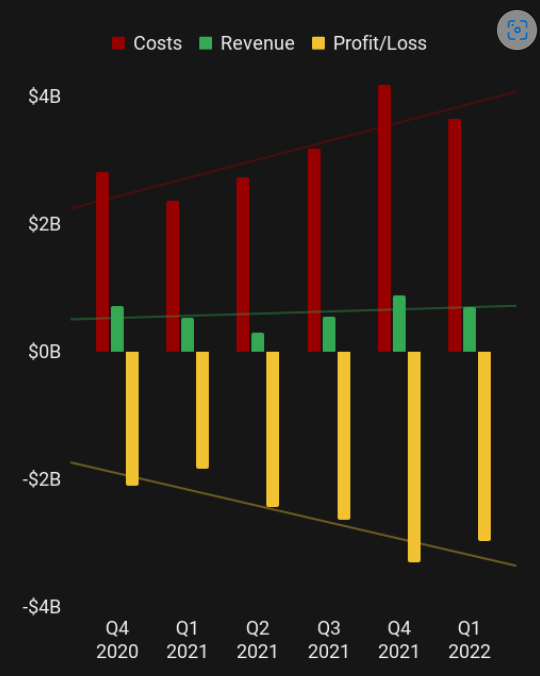

Meta’s aggressive spending on the segment contributed to broad-based losses worth $6.2 billion in its previous two quarters. However, the company’s reality labs segment is in hypergrowth mode at 35% year-over-year revenue gain. Furthermore, the chart below conveys that cost is outstripping revenue growth. Nevertheless, most of these costs are R&D related and could taper with time as the segment gets optimized.

Furthermore, the metaverse’s (a reality labs sub-market) forecasted CAGR (until 2026) is 47.6%. If the metaverse’s forecasted growth realizes, we could see Meta’s reality labs being a key segment for the firm to sustain its recent growth.

UPLOAD

Broad-Based Growth & Market Relevance

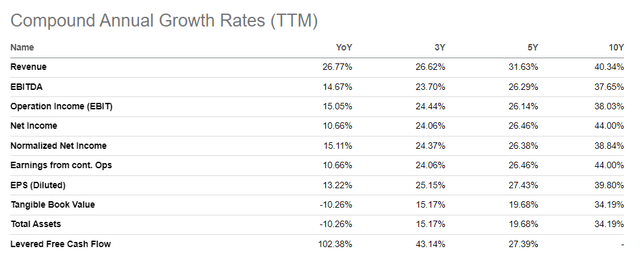

Throwing it all together, it’s clear that Meta is a secular growth (or at least high growth) company. The firm’s financial gains are in hyper mode across its income and cash flow statements. Although its tangible book value and total assets have receded over the past year, it should be taken with a pinch of salt as technology firms’ assets are usually mostly intangible and thus have fluctuating valuations that don’t necessarily influence the company’s stock price.

Meta’s high-growth status bodes well in the current market climate. Often, investors opt to invest in hypergrowth companies during a bear market as their financial results aren’t cyclical but instead exponential. Moreover, Meta is a dominant company in its domain, which presents it as a safer bet to investors than many of the other technology stocks. Thus, if risk aversion persists, we’ll likely see investors allocate their capital to large and proven companies like Meta rather than to smaller growth stocks.

Valuation & Price Level

I approached my valuation analysis based on a relative vantage point that looks at normalized value peaks and peer group valuations.

Growth companies’ relative valuation metrics will almost always read at premiums relative to their respective financial statement line-items. As such, it’s more productive to compare the metrics relative to their cyclical peaks.

Meta’s price-to-sales and price-to-cash flow ratios are at 5-year discounts of 59.89% and 58.18%, respectively, suggesting that the stock is undervalued on a cash and an accrual basis.

Furthermore, Meta’s price-to-earnings is at a 55.57% discount to its 5-year average, conveying a value gap. Additionally, the stock’s PEG ratio of 0.93x implies that the market underscores Meta’s earnings-per-share growth.

| Price-to-Sales | 3.80x |

| Price-to-Cash Flow | 7.67x |

| Price-to-Earnings (GAAP) | 12.36x |

Source: Seeking Alpha

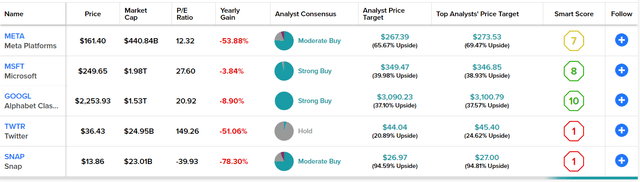

A peer group analysis implies that Meta is undervalued relative to some of its peers as its price-to-earnings ratio is significantly lower. A peer group analysis normalizes the sector’s price-to-earnings ratio, providing a better indication of where the analyzed stock’s valuation stands in the context of its business activities.

Technical analysis should ideally not be utilized in isolation. However, a stock’s past price can be used as a lagged variable to determine future prices.

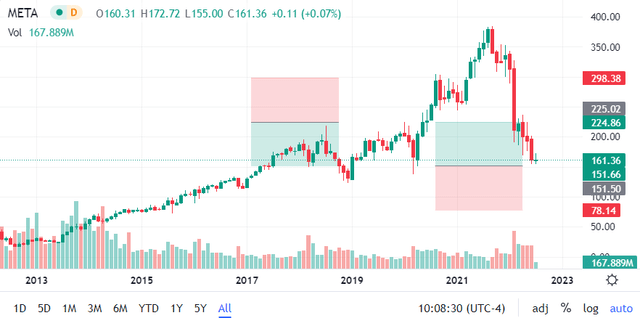

The chart below indicates that Meta has recently breached a support level at the $160 handle, which could last up to the $225 handle, where a resistance level is embedded. Thus, if you’re a believer in technical analysis, the chart below implies that it’s an excellent time to enter a position in Meta stock.

Risks

From a qualitative viewpoint point, Meta is faced with rising competition in its industry amid surging digitalization during the past few years. Although I argued earlier that Meta could cannibalize rising competitors, it needs to be considered that with a growing industry comes increasing traction, which could dilute the overall market share in the online advertising space for the existing players.

Regarding market share, Laura Martin of Needham believes that Meta could be set for a challenging period. According to Martin, Meta could lose its moat in the coming years, subsequently driving up costs and eroding revenues.

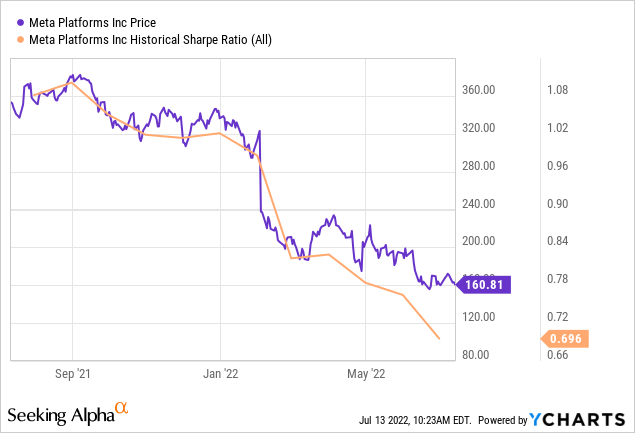

Furthermore, Meta hosts quantitative risks. The stock’s Sharpe Ratio of 0.696 implies that its risk versus return is poorly aligned. Ideally, you want to see a Sharpe Ratio of above 1.00 as an investor.

Concluding Thoughts

Meta stock’s year-to-date capitulation has drawn it into an investable level. The company’s growth rates remain firm despite a waning economy, and its reality labs segment serves as an opportunity for it to pivot into a more diversified revenue mix. In addition, quantitative metrics reveal that Meta is undervalued on a relative basis and has reached a price support level.

Source link