[ad_1]

alexsl/iStock via Getty Images

DigitalBridge Group, Inc. (NYSE:DBRG) is a former Real Estate Investment Trust (“REIT”) which owns ~25 portfolio companies across the digital industry. This company has executed an aggressive acquisition strategy over the past 5 years, which has resulted in it becoming a key player in the digital infrastructure industry. DigitalBridge is poised to be the backbone of at least three rapidly growing and converging industries: 5G, Data Centers, and Edge Computing. Here are some statistics to get your teeth into.

- The 5G services market was valued at $64 billion in 2021 and is forecasted to grow at a blistering 45% compound annual growth rate (CAGR), reaching a staggering $1.87 trillion by 2030;

- The Data Center industry is forecasted to grow at a 4.95% CAGR from $215 billion in 2021 to $288 billion by 2027; and

- The Edge Computing market was worth $36.5 billion in 2021 and is forecasted to grow at a rapid 19% CAGR to $87 billion by 2026.

Edge Computing aims to bring the power of the data centers closer to the applications. The goal of this is to reduce latency and has the potential to power unique applications from 3D live video streaming to the Metaverse.

With any new technology it can be very hard to pick the winners. However, by investing into the backbone infrastructure, you effectively have a “toll road” style position, which benefits from the new technologies. The next challenge is choosing a Digital “backbone” stock. In this case, I noticed that a legendary value Investor, Seth Klarman, who has been dubbed “The Next Warren Buffett,” was recently buying this stock at an average price of ~$4.88, which is close to where the stock trades at the time of writing. Klarman increased his stake to 30.5 million shares, which means he now owns 5% of the company, according to a filing by the SEC.

My valuation of DigitalBridge also showed it to be undervalued relative to competitors. Let’s dive into the company’s business model, financials, and valuation for the juicy details.

What does DigitalBridge do?

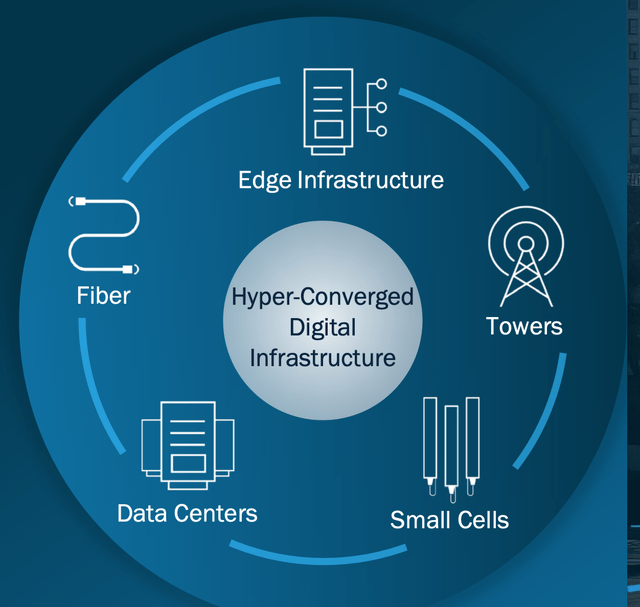

DigitalBridge invests and operates private businesses which own a variety of assets such as data centers, cell towers, small cells, fiber, and edge infrastructure.

DigitalBridge (Investor Presentation)

A small selection of it’s 25 portfolio companies include;

I. Vantage Data Centers

A flexible data center operator which owns over 10 million square feet of space across 18 markets and 5 continents.

II. Vertical Bridge

A Tower Infrastructure provider which builds, buys and leases cellular towers of all sizes.

III. Zayo Group

A Fiber optics network provider which also has over 18,000 small cells and on net towers.

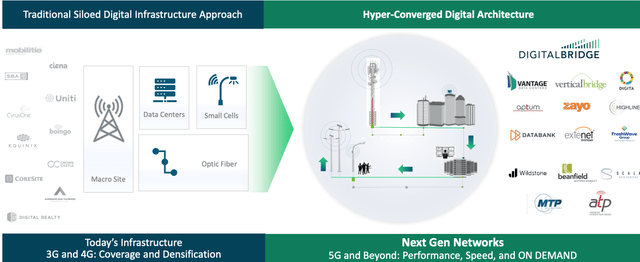

DigitalBridge (investor presentation)

DigitalBridge offers a unique model in which it can operate, partner and provide redundancy to customers through its vast network of digital infrastructure.

Background

DigitalBridge was formerly known as “Colony Capital” until a rebrand to “DigitalBridge” in 2013 and ticker symbol change in 2021.

Colony Capital was founded in 1991 and was the 3rd largest private equity real estate fund in the world, just behind Blackstone and Morgan Stanley Real Estate. Colony Capital was involved in high profile real estate deals such as the late Michael Jackson’s Neverland Ranch, French Soccer club Paris Saint Germain and Raffles hotels. I believe this well-established experience in the high profile real estate industry may give the company a credibility edge when finding deals and an operating edge when securing and running the businesses.

Aggressive Acquisitions

DigitalBridges M&A division are very experienced and active in acquisitions in order to expand it’s network. Here are a few highlights from 2022:

- March 2022 – DigitalBridge also recently announced a deal to purchase Telenet Group in an all cash transaction for €745 million or $820 million. This platform includes a footprint of 3,322 sites and 1,164 third party sites.

- April 2022 – DigitalBridge bought out Wafra’s stake in its management subsidiary for $800 million. This has led the company to transition from a REIT to a traditional C-Corp. The transition to a C-Corp will allow DigitalBridge to be more flexible and pursue its goal of being a “Serial Compounder of shareholder value.” Management believes negative tax implications can be avoided due to prior net operating losses which can be carried forward.

- April 2022 – DigitalBridge Investments has agreed to acquire AMP Capital for $328 million, a UK based Digital infrastructure investor which operates similar but smaller model to Digital Bridge.

- May 2022 – The company announced the acquisition of leading Data center provider Switch.

DigitalBridge aims to be a “Full Stack” digital infrastructure investor across Core assets, Credit, and Ventures. Its Venture Capital arm recently led a $60 million Series C funding round in Celona, a leader in 5G infrastructure. The private company is forecasted to grow by over 5X to $6 billion by 2024.

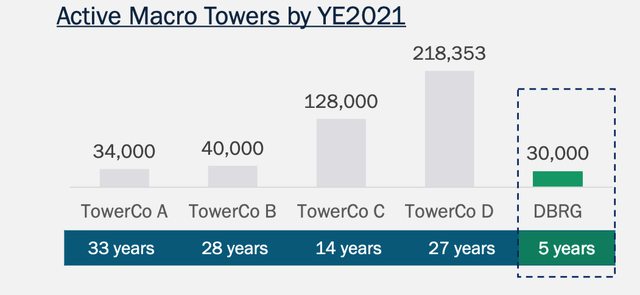

Managements aggressive acquisition looks to be paying off, as the company had 30,000 Active Macro Towers by the end of 2021. This is despite other players in the industry having a head start of decades compared to Digital Bridge at just 5 years.

DigitalBridge (Investor Presentation)

Growing Financials

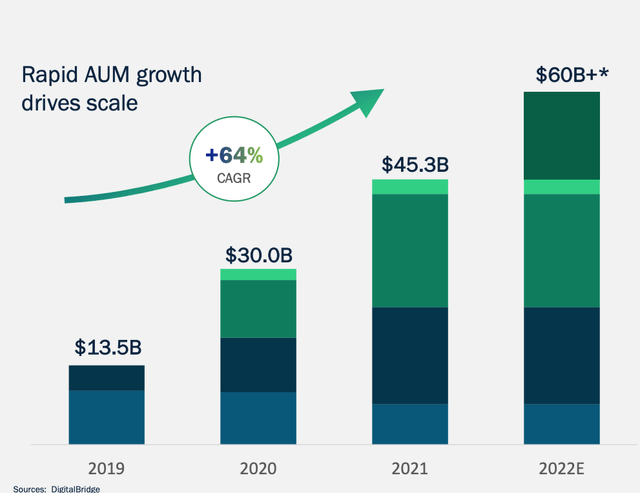

DigitalBridge has grown its assets under management (“AUM”) at a tremendous 64% Compounded Annual Growth Rate between 2019 and 2021. Its AUM are forecasted to reach over $60 billion by the end of 2022.

Assets Under Management (Q1 earnings report)

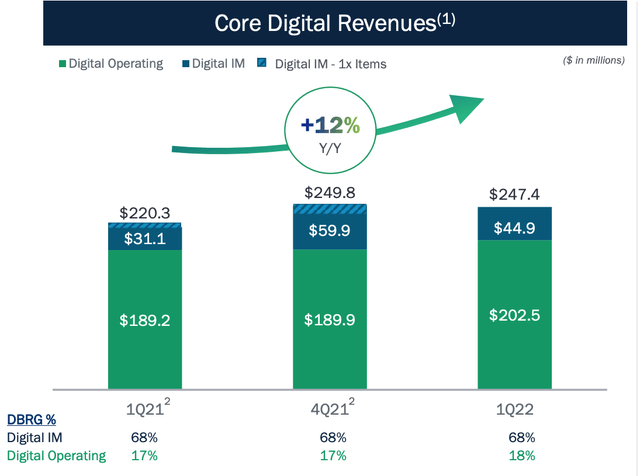

The company has generated strong financials for the first quarter of 2022. Revenue has increased by 12% year-over-year to $247 million. However, it is down slightly over the prior quarter due to extra one-time fees earned during the Q421.

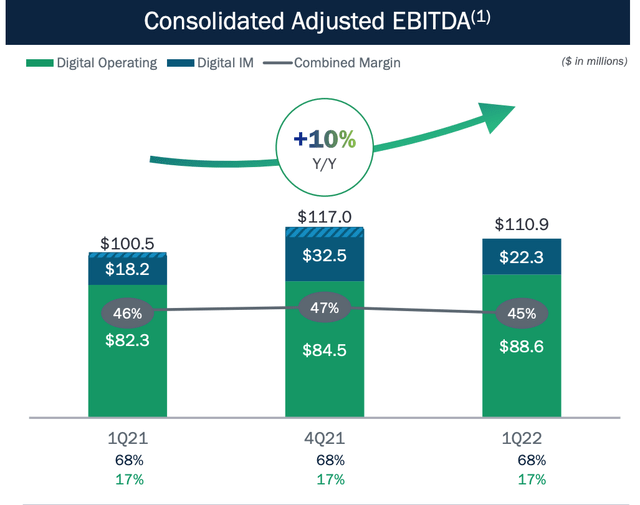

Consolidated Adjusted EBITDA was up 10% year-over-year to $100.9 million. As mentioned prior, this was down slightly compared to the prior quarter due to extra one-time catch up fees earned during Q421. Without these one time extra fees, EDITDA would actually increase by $2 million compared to the prior quarter.

Adjusted EBITDA (Earnings report Q1)

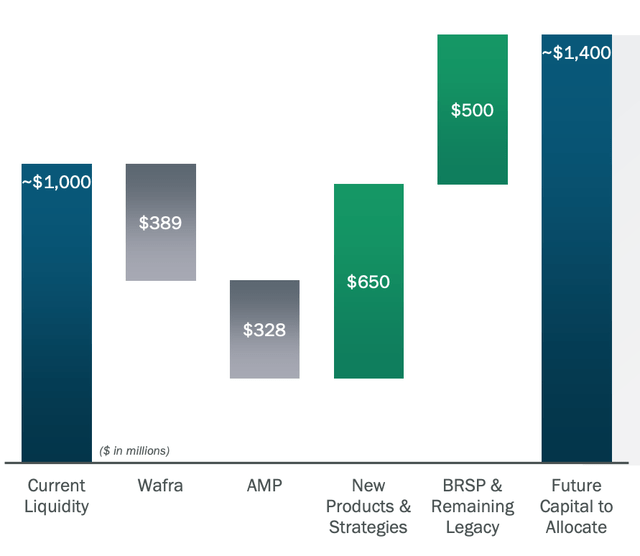

Management is extremely efficient with capital generation. As of the first quarter of 2022, the company has $1 billion in capital. We can then minus the acquisitions of Wafra ($389m) and Amp ($328m) after close. After which the company expects to generate $650 million from new products and strategies in addition to $500 million, which can be harvested from legacy investments. Overall this should leave the company with $1.4 billion, which offers plenty of dry-powder for more aggressive acquisitions. As of Q122, the company has $5.1 billion in long-term debt, which is fairly high but not uncommon for a former REIT.

Capital to Invest (Earnings report)

Management is bullish on the company’s prospects, and it authorized $200 million in share repurchases. In addition to a reverse stock split, which although officially doesn’t change shareholder value, it may make the stock look more premium.

Valuation

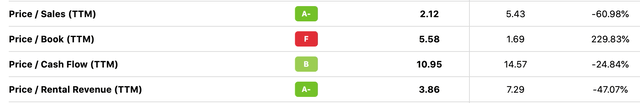

Valuing DigitalBridge is an interesting challenge as it is a former REIT and has a complex portfolio of multiple businesses. I believe Price to Earnings ratio will not be very relevant and thus I will analyze the Price to Sales (P/S), Price to Cash Flow, and Price to Rental Revenue.

As you can see from the below chart, the company has a Price to Sales Ratio = 2, which is 61% cheaper than the Real Estate Sector median of 5.43.

Note: The Price to Book Value can be ignored, as that is more relative for valuation of a Bank stock.

DigitalBridge Valuation (Seeking Alpha)

The Price to Cash Flow Ratio is 10.95, which is 25% cheaper than sector median of 14.57. The Price to Rental Revenue is 3.86, which is a 47% cheaper than the sector median of 7.29.

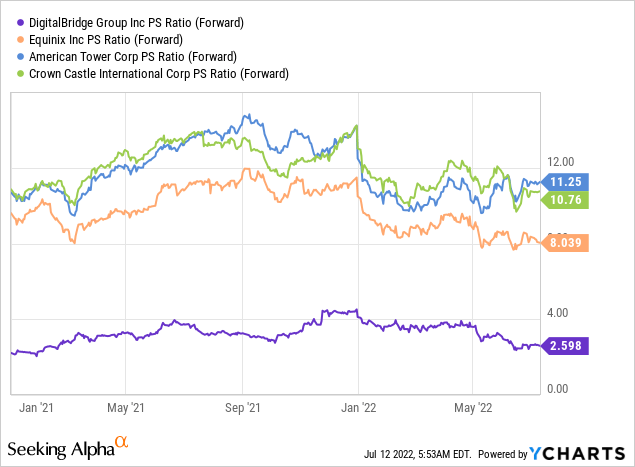

To give a more granular view of similar but more established funds which operate in the Digital Infrastructure market, we can see DigitalBridge is the cheapest with a Forward Price to Sales Ratio = 2.6.

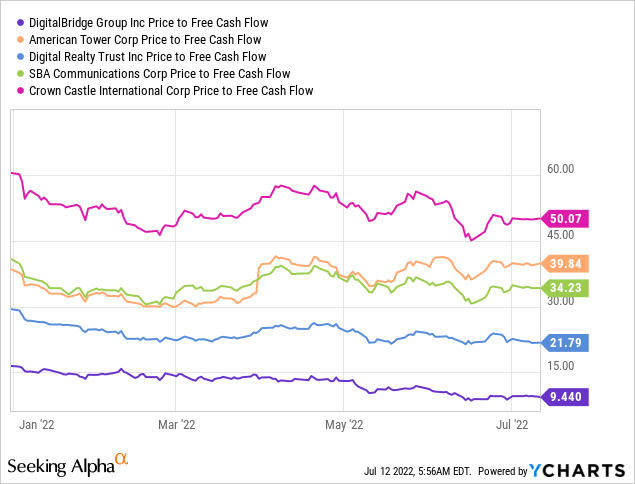

We can see from the chart below, DigitalBridge has a Price to Free Cash Flow ratio = 9.44. This is substantially cheaper than similar Digital Infrastructure holding companies in the industry.

Note: I have not included Equinix in the above chart as it skews the graph. Also the Price to Cash Flow Ratio varies slightly between Seeking Alpha and Y Charts, but DigitalBridge is the cheapest in either scenario.

As mentioned in the intro, Seth Klarman of the Baupost Group owns a 5% stake in the company. Klarman aims to invest into companies with a competitive advantage. He buys stock when undervalued to ensure a “margin of safety,” which was the title of his last book. Thus, one could safely assume the stock is undervalued at the fund’s average buy price of $4.88.

Risks

Jim Chanos Short Sell Thesis

Infamous Short seller Jim Chanos is raising capital to bet against data center REITs. In an Interview with the Financial Times on June 29th, Chanos believes the value of the cloud is going to the hyperscalers (Amazon Web Services, Microsoft Azure, Google Cloud) and they will build their own. Thus he believes the legacy data centers will not be utilized as much. This is an interesting point, but one in which Wells Fargo Analyst Eric Luebchow, calls “misguided.”

He makes the point that hyperscalers are struggling to build due to long lead times for equipment and power. He notes that the big cloud providers “outsource up to 60% of their capacity demands.” Thus the short selling thesis by Chanos is contrary to the facts on the ground. However, it is still a risk to be aware of.

Complex Financials

I tend to be weary of companies with complex financials and lots of “adjustments” for EBITDA. Warren Buffett in the past has stated companies can use adjustments to “dress up numbers.” Buffett has a very strong view on the subject:

“We won’t buy into companies where someone’s talking about EBITDA. If you look at all companies, and split them into companies that use EBITDA as a metric and those that don’t, I suspect you’ll find a lot more fraud in the former group. Look at companies like Wal-Mart, GE and Microsoft — they’ll never use EBITDA in their annual report.”

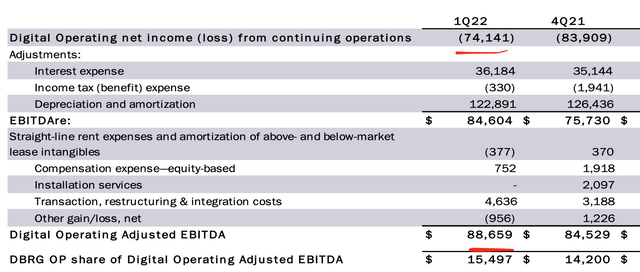

Now although this is an extreme view (as EBITDA is a common measure), he does make a point. You can see from the screenshot below that the Digital Operating segment of DigitalBridge reports a loss of -$74 million. However, after adjustments for Depreciation and Amortization, everything is rosy.

One factor which does give me peace of mind is the investment by Legendary Value Investor Seth Klarman. Klarman is a disciple of Buffett and thus this gives me peace of mind into the integrity of the company’s adjustments.

Lower IT Spending in the short term

Analysts from Nomura forecast a “shallow but long recession” starting in the 4th quarter of 2022. This may lead to a slowdown in IT spending for businesses in the short term.

Final Thoughts

DigitalBridge is a tremendous company which offers a way for investors to get exposure to rapidly growing 5G and Data Center industries. Its management team is very experienced and active with acquisitions and they are pursuing a “land grab” strategy, which is working well so far. The stock is currently undervalued after its substantial decline, and value investor Seth Klarman adds an extra data point of investment security. Overall, this looks to be a great long-term investment on the future of 5G, Datacenters and Edge Computing.

Source link