[ad_1]

JHVEPhoto/iStock Editorial via Getty Images

Thesis

Rockwell Automation, Inc. (NYSE:ROK) stock is down >40% YTD, and long-term investors might appreciate the share-price weakness as a buying opportunity. Personally, I am bullish on Rockwell Automation, as I see enterprise automation as one of the most attractive secular growth drivers for the next few years. Based on a residual earnings framework, which I anchor on consensus analyst EPS estimates, I calculate a fair implied share price of $234.49/share.

About Rockwell

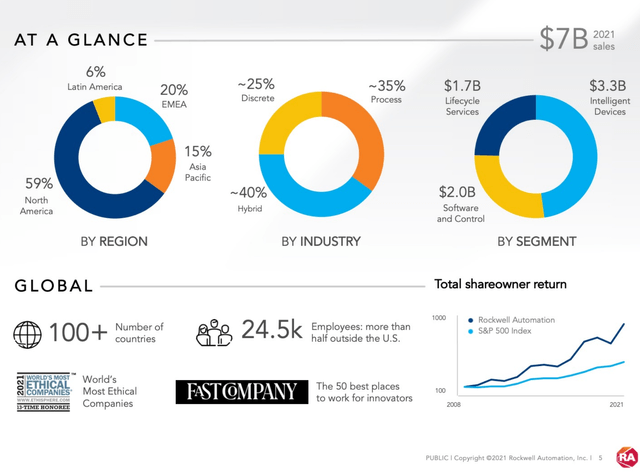

Rockwell Automation is a leading vendor for industrial automation services. The company supports companies across a broad range of manufacturing activities and enterprise digitalization. Rockwell operates three main segments: Intelligent Devices (approximately 45% of sales), Software & Control (about 30% of sales), and Lifecycle Services (about 25% of sales). The intelligent device segment is a portfolio of technology solutions in the context of smart manufacturing. The Software & Control segment includes software and hardware to support enterprise connectivity and analytics. Finally, the segment “lifecycle services” offers value-added solutions to complement the company’s technology through product support, advisory and technology maintenance. Rockwell serves customers across industries, with a notable focus on automotive, semiconductor, food, life-sciences and oil & gas.

From a geographical perspective, Rockwell operates worldwide-with North America being the largest market accounting for approximately 60% of sales, followed by EMEA with about 20%, Asia Pacific with nearly 15%, and Latin America with about 5%.

Rockwell’s Opportunity

Rockwell is poised to benefit from a multi-year secular growth trend with regards to enterprise automation and digitalization investments. There are three fundamental drivers which I consider especially important. First, the COVID-19 pandemic has pushed a general acceleration of enterprise digitalization. Second, inflationary pressures have gently forced many industries to squeeze productivity improvements and mitigate wage inflation through automation. Third, geopolitical tensions have pressured many companies to rethink their supply chain and re-shore production, which requires new manufacturing investments.

Thus, in my opinion Rockwell is well positioned to benefit from an enormous CAPEX investment cycle, which is arguably still in the early beginning. Moreover, Rockwell is strongly exposed to selected highly attractive end-markets, including EV/Batteries, Oil and Gas, Life-Sciences and Semis. These industries have pushed particularly strongly for new investment spending in manufacturing capacity, digitalization and automation.

Given these tailwinds, it is no surprise that Rockwell’s financials are attractive. In 2021, the company generated $6.99 billion of revenues, which represents an increase of approximately 10% as compared to 2020. Based on a 19% net profit-margin, the company achieved $1.34 billion of sustainable earnings (operating earnings), or $11.69/share. Rockwell’s financial leverage is acceptable. By the end of Q1 2022, the company held $449 million of cash and short-term investments and $4.48 billion of total debt. For reference, Rockwell’s total asset base is $10.7 billion and the company’s market capitalization is slightly more than $23 billion.

How Analysts See It

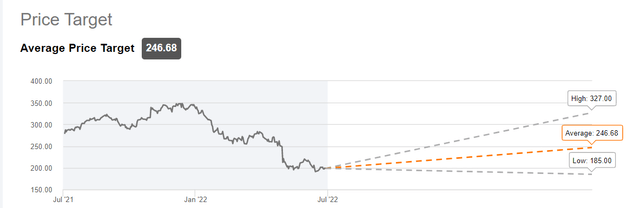

Analysts are neutral on Rockwell. Out of the 25 analysts who cover the stock, who cover the stock, 7 analysts assign a Strong Buy rating, 3 are Buy rated, to say Sell and 3 believe that ROK is a Strong Sell. The average target is $246.68/share and the highest target stands at $327/share and the lowest at $185/share. If we would anchor on the average target price, ROK would have an implied upside of approximately 25%.

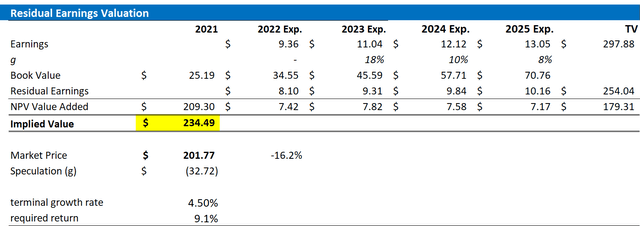

According to the Bloomberg Terminal, as of July 2022, analyst see Rockwell’s business both growing and generating economic value. Revenues for 2022, 2023 and 2024 are estimated at $7.8 billion, $8.5 billion and $8.9 billion. This would equal a 3-year CAGR of approximately x2 nominal GDP growth, from 2022 to 2025. Respectively, EPS are estimated at $9.36, $11.04, and $12.12.

Residual Earnings Valuation

So, if analyst consensus is right about ROK’s business forecast, what could be a fair per-share value for the company’s stock? To answer the question, I have constructed a Residual Earnings framework and anchor on the following assumptions:

- To forecast EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise.

- The estimate the cost of capital, I use the WACC framework. I model a three-year regression against the S&P to find the stock’s beta. For the risk-free rate, I used the U.S. 10-year treasury yield as of July 05, 2022. My calculation indicates a fair WACC of 9.1%.

- To derive ROK’s tax rate, I extrapolate the 3-year average effective tax-rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply expected nominal GDP growth plus one percentage point to a favorable growth outlook.

- I do not model any share-buyback-further supporting a conservative valuation.

Based on the above assumptions, my calculation returns a base-case target price for ROK of $234.49/share, implying material upside of about 16%.

Analyst Consensus; Author’s calculation

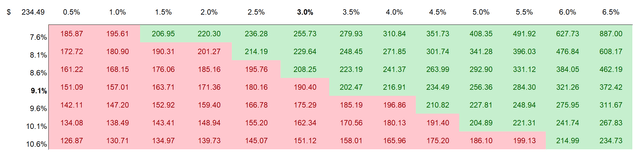

I understand that investors might have different assumptions with regards to ROK’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation. The risk/reward looks highly favorable to me.

Analyst Consensus; Author’s calculation

Risks

Despite my bullish thesis, I have identified a few notable risks that could cause ROK shares to materially differ from my target-price: First, ROK’s business segments have historically been correlated with business cycles. That said, is the global economy sliding into a recession? While the current economic-challenges seam unique, investors should closely monitor the macro headwinds such as rising real yields, inflation, geopolitical developments and supply-chain, and identify how these headwinds impact ROK’s quarterly results. Secondly, much of ROK’s share price volatility is currently driven by investor sentiment towards risk and growth assets. Thus, investors should expect price volatility even though ROK’s business outlook remains unchanged. Finally, investors should monitor general risk such as corporate strategy, operational execution and industry competition.

Conclusion

Investing in ROK stock offers favorable risk/reward opportunity, in my opinion. While accelerating investments in enterprise digitalization offer attractive upside potential on potentially higher revenues and EPS, the company’s current earnings limit share-price downside risk. Personally, I calculate a fair valuation of $234.49/share, implying approximately 16% upside. My calculation is based on a residual earnings framework, which I anchor on consensus analyst EPS estimates. Buy.

Source link