[ad_1]

andresr/E+ via Getty Images

By The Valuentum Team.

The biopharmaceutical space is full of attractive investment opportunities, though early-stage firms without commercialized drug portfolios are quite risky investments given their lack of meaningful revenues and sizable negative cash flows. Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) is not one these. It has a commercialized portfolio of therapeutics that treat cystic fibrosis (“CF”), which enables the biotech firm to generate substantial revenues, and importantly, free cash flows.

Also boasting a robust net-cash-rich balance sheet, Vertex Pharma is one of our favorite names in this biopharmaceutical area. We think risk-seeking investors should definitely have this idea on their radar. The high end of our fair value estimate range for shares stands at $366 each (shares are trading at ~$290 at this time). We think Vertex Pharma’s stock has tremendous potential upside as it has both the capacity and financial wherewithal to drive investor returns higher via a unique pipeline that it continues to advance.

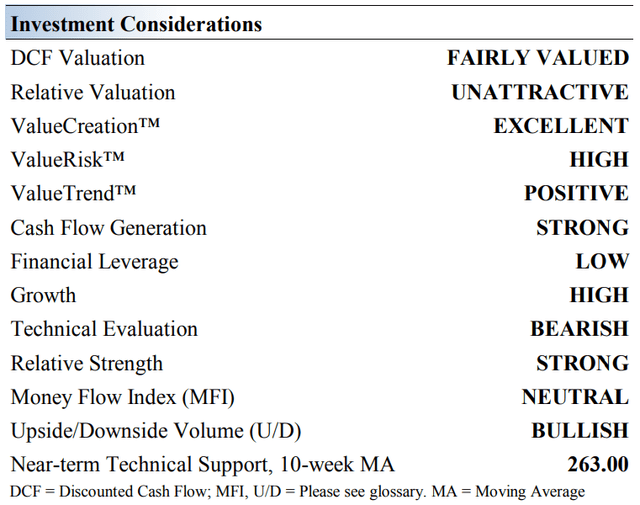

Vertex Pharma’s Key Investment Considerations

Image Source: Valuentum. The key investment considerations we look at with respect to Vertex Pharma’s shares. (Image Source: Valuentum)

Vertex discovers, develops, manufactures and commercializes small molecule drugs for patients with serious diseases. The company has obtained approval for several products that all treat certain forms of cystic fibrosis: TRIKAFTA, ORKAMBI, KALYDECO, and SYMDEKO. Vertex’s long-term goal includes being able to treat up to 90% of cystic fibrosis patients.

Vertex Pharma reported first quarter 2022 earnings on May 5 that beat top-line estimates, but missed bottom-line estimates. However, the firm reiterated its full-year product revenue guidance for 2022, which closely tracks its overall revenue performance. Sales of its CF drug portfolio, represented by its TRIKAFTA/KAFTRIO, SYMDEKO/SYMKEVI, ORKAMBI, and KALYDECO therapeutics, were up 22% year-over-year last quarter. Revenue growth helped its GAAP operating income rise 17% year-over-year last quarter, as Vertex Pharma aggressively stepped up its investments in R&D while its other corporate-level expenses increased moderately. Its R&D expenses grew 32% year-over-year last quarter and represented 29% of its total revenues during this period.

Vertex launched a share buyback program with $1.5 billion in repurchasing authority in June 2021 that runs through December 2022. The company has a robust drug pipeline, something that we will expand upon later in this article, and the firm possesses the financial capacity to buy back its stock while investing in the business. In the first quarter of 2022, however, it did not repurchase a significant amount (or any) through its share repurchase program (though it did spend $0.1 billion on “payments in connection with common stock withheld for employee tax obligations”). Its strong stock price performance of late has apparently encouraged management to hold off on buying back stock for now.

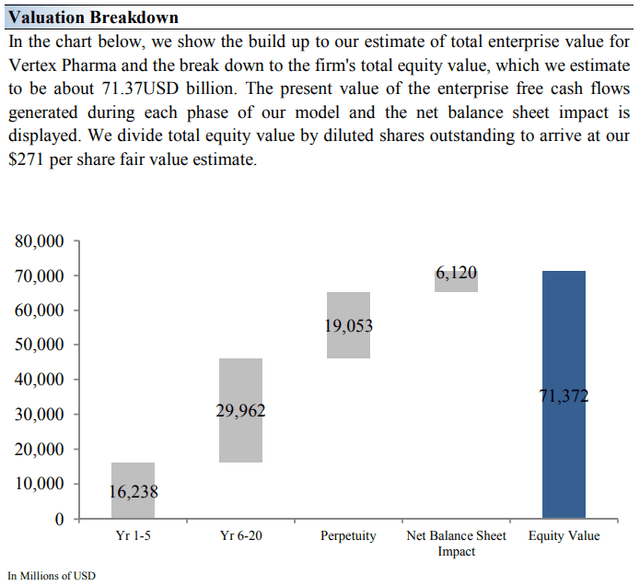

Our discounted cash-flow valuation model assumes that Vertex’s powerful revenue growth trajectory continues in the coming years and that it has some success with its robust drug pipeline in the longer run, and that greater economies of scale lead to meaningful operating margin expansion. Should Vertex stumble for any reason, however, that would likely hurt our estimate of its intrinsic value by a significant margin given the duration of value composition (there’s an image that follows in this article that provides greater detail). Still, we think investors might consider the high end of our fair value estimate range as a fair price for Vertex at the moment, given the significant promise held within its developing and unique pipeline.

Vertex’s financial and operational performance has held up relatively well in the face of the COVID-19 pandemic, too. The firm benefits from its high quality cash flow profile. For starters, unlike many upstart biotechs, its sizable free cash flow generation will allow Vertex to grow its cash balance over time, while enabling it to reinvest into its pipeline or develop brand new therapies via partnerships. It is doing this with CRISPR gene-editing technology, an area of which we are particularly excited.

Update on Vertex Pharma’s Most Promising Drug Candidates

Vertex Pharma’s efforts are primarily focused on cystic fibrosis and autoimmune diseases. The firm’s drug pipeline includes treatments for sickle cell disease, beta-thalassemia, Type 1 diabetes, APOL1-mediated kidney diseases, pain management, and more. With CRISPR Therapeutics (CRSP), Vertex Pharma is also “evaluating in Phase 3 clinical trials CTX001, an investigational CRISPR/Cas9-based gene-editing therapy for severe sickle cell disease.”

We’re excited about its exposure to groundbreaking CRISPR gene-editing technologies. In this article, we talk about three more of its potential therapies that could pave the way for tremendous long-term potential growth at Vertex Pharma.

Update on VX-548

We were blown away by the phase II results released March 31 at Vertex Pharma for its non-opioid, non-addictive pain killer, the NaV1.8 inhibitor VX-548, and we think the molecule has the potential to provide a solution to the widespread opioid crisis in a meaningful way. According to the U.S. Department of Health and Human Services, tens of thousands of deaths each year are “attributed to overdosing on synthetic opioids.”

The company’s phase II results for VX-548 provide “proof of concept” in order to push the study to more advanced studies, and we are highly encouraged. We also note that the long-term revenue and earnings potential for VX-548 is not included in our valuation model for Vertex Pharma and would offer pure incremental upside to our fair value estimate (which is yet another reason why we are pointing to the high end of our fair value estimate range as a fair price for shares). VX-548 could be a game-changer in the fight against the opioid epidemic, in our view.

According to the press release:

Treatment with an initial dose of 100 mg followed by 50 mg every 12 hours of VX-548 (high-dose) compared to placebo resulted in a rapid, statistically significant and clinically meaningful improvement in the primary endpoint of the time-weighted Sum of Pain Intensity Difference over 48 hours (SPID48), which was consistent in both trials. The study also included an active reference arm of the opioid hydrocodone bitartrate/acetaminophen (HB/APAP) to support the evaluation of the VX-548 treatment effect.

Management noted that the VX-548 could potentially become a “first-in-class non-opioid treatment for acute pain,” and that there was “remarkable consistency in the safety, tolerability and efficacy results” in the VX-548 studies. We can’t reiterate enough how excited we are about the potential for this non-addictive alternative to treat acute pain and Vertex’s advancing pipeline, more generally.

Update on VX-880

Another one of Vertex Pharma’s innovative drug candidates is VX-880. The investigative drug candidate is a potential cell replacement therapy for patients with Type 1 diabetes that have impaired hypoglycemic awareness and severe hypoglycemia. Here is a summary of the potential therapeutic, which is derived by stem cells:

VX-880 is an investigational allogeneic stem cell-derived, fully differentiated, insulin-producing islet cell therapy manufactured using proprietary technology. VX-880 is being evaluated for patients who have T1D with impaired hypoglycemic awareness and severe hypoglycemia. VX-880 has the potential to restore the body’s ability to regulate glucose levels by restoring pancreatic islet cell function, including glucose-responsive insulin production. VX-880 is delivered by an infusion into the hepatic portal vein and requires chronic immunosuppressive therapy to protect the islet cells from immune rejection.

Currently, VX-880 is undergoing Phase 1/2 clinical trials, with Part A of this process involving two patients receiving half a dose and Part B expected to involve five patients receiving the full dose. In May 2022, Vertex Pharma noted that “VX-880 [was] generally well tolerated in all three patients dosed to date” and that none of these patients had experienced serious adverse events (“SAEs”) relating to VX-880 (there were some instances of SAEs which did not relate to VX-880).

Additionally, the company noted that “the majority of adverse events (“AEs”) were mild or moderate in all patients treated to date” and that “the data from the first two patients in Part A established proof-of-concept for VX-880” as the initial results in the first two patients were promising. However, the U.S. Food and Drug Administration (“FDA”) placed a clinical hold on trials conducted in the U.S. involving VX-880 “due to a determination that there is insufficient information to support dose escalation with the product,” though that does not necessarily mean the drug candidate is flawed.

Vertex Pharma is working with the U.S. FDA to provide the necessary information so the clinical trials can resume in earnest. We hope that work on this potential therapeutic can resume in a timely manner.

Update on VX-147

One of Vertex Pharma’s drug candidates that is farthest along the clinical trial process and closest to potentially receiving regulatory approval is VX-147, an investigational therapy that aims to treat patients with proteinuric kidney disease mediated by two mutations in the APOL1 gene (“AMKD”). According to Vertex Pharma, this disease impacts roughly 100,000 people in the U.S. and Europe, its two key geographical markets (at least initially).

Vertex Pharma announced positive results from its Phase 2 clinical trials covering VX-147 in December 2021. This set the stage for the company to move towards “pivotal development” starting in the first quarter of 2022. In March 2022, Vertex Pharma announced its VX-147 drug candidate was getting ready to begin a Phase 2/3 clinical trial. According to Vertex Pharma, positive data from this clinical trial could lead to an accelerated approval from regulators, though nothing is for certain. We are keeping a close eye on its VX-147 drug candidate, and if successful, this would represent Vertex Pharma’s first commercialized drug outside of the CF realm.

By the end of March 2022, Vertex Pharma aimed to begin enrollment in the Phase 2/3 clinical trial. Here is what a March 2022 press release had to say on the matter:

The company will evaluate the safety and efficacy of VX-147 in a single pivotal clinical trial designed to assess the impact of VX-147, on top of standard of care, on kidney function and proteinuria in people with AMKD. The primary endpoint of this study is reduction in the rate of decline of kidney function as measured by estimated glomerular filtration rate (‘eGFR’) slope versus placebo at approximately two years. The study is also designed to have a pre-planned interim analysis at Week 48 evaluating eGFR slope in VX-147 versus placebo, supported by a percent change from baseline in proteinuria. If positive, the interim analysis may serve as the basis for Vertex to seek accelerated approval of VX-147 in the U.S. for patients with AMKD…

This randomized, double-blind, placebo-controlled Phase 2/3 adaptive study will first evaluate two doses of VX-147 for 12 weeks to select a dose for Phase 3 and subsequently evaluate the efficacy and safety of the single, selected dose in the Phase 3 portion of the study.

Patients aged 18 to 60 years, with two APOL1 mutations, urine protein to creatinine ratio (‘UPCR’) ≥0.7 g/g to <10 g/g, eGFR ≥25 to <75 mL/min/1.73m2 and on stable doses of standard of care medications are eligible to enroll. Approximately 66 patients are planned to be enrolled in the Phase 2 dose-ranging portion of the study, and approximately 400 additional patients are planned to be enrolled in the Phase 3 portion of the study.

The primary efficacy endpoint for the final analysis is eGFR slope in patients receiving the VX-147 selected dose compared to placebo. The secondary efficacy endpoint is time to composite clinical outcome, which will also be assessed at the final analysis and is defined as a sustained decline of ≥30% from baseline in eGFR, the onset of end-stage kidney disease (i.e., maintenance dialysis for ≥28 days, kidney transplantation or a sustained eGFR of <15 mL/min/1.73 m2) or death. The final study analysis will occur when subjects have at least two years of eGFR data and when approximately 187 composite clinical outcomes have occurred.

During Vertex Pharma’s latest earnings call, management stated that “it is really simply too early to comment on enrollment dynamics for VX-147” in response to an analyst’s question on the issue. However, management was clearly upbeat on the VX-147 drug candidate’s chances, and we are as well.

Vertex Pharma’s Economic Profit Analysis

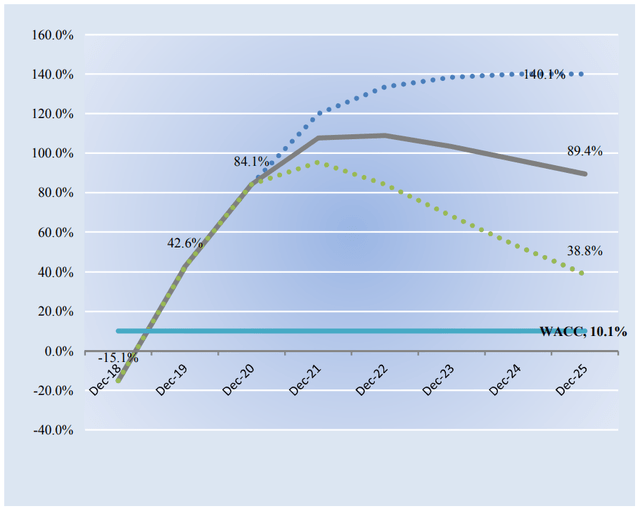

Now let’s take a close look at the company’s economic profit potential. For those that are new to investing, economic profit differs from accounting profit in that it compares a company’s return on invested capital with its weighted average cost of capital. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. Vertex Pharma’s 3-year historical return on invested capital (without goodwill) is 37.2%, which is above the estimate of its cost of capital of 10.1%.

As such, we assign Vertex Pharma a ValueCreation rating of EXCELLENT. In the chart below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate. In part because of the lack of capital-intensity of Vertex Pharma’s business model and its earnings generating capacity, we expect the firm to start generating tremendous value for shareholders to a magnitude like never before in the coming years.

Image Source: Valuentum. Our forecasts of Vertex Pharma’s future expected economic profit creation. (Image Source: Valuentum)

Vertex’s Cash Flow Valuation Analysis

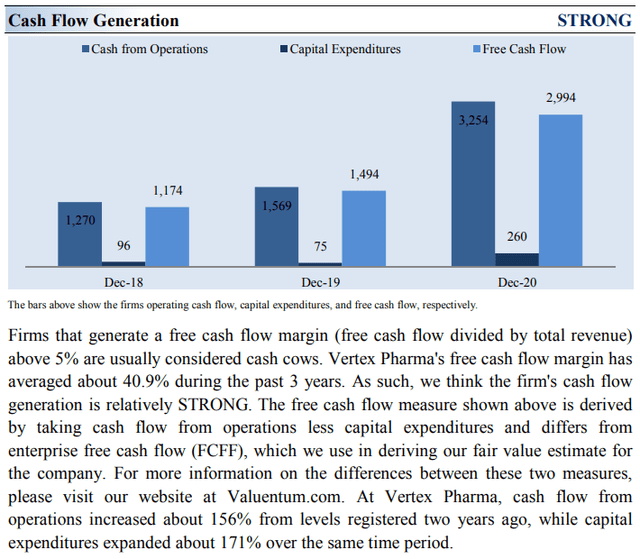

Image Source: Valuentum. Vertex Pharma remains a strong free cash flow generator. (Image Source: Valuentum)

Due to the asset-light nature of Vertex Pharma’s business model (most expenses flow through R&D expense on the income statement, and the firm does not have large capital expenditures in the “Investing” section of the cash flow statement), Vertex Pharma’s capital expenditure requirements to maintain a given level of revenues are relatively modest, making free cash flows easier to come by. Vertex Pharma also has a fortress-like balance sheet. Its impressive financial strength enables the company to fund the development of several promising drug candidates, as noted above, without needing to issue debt or equity to meet its funding needs.

At the end of March 2022, Vertex Pharma had $8.2 billion in cash, cash equivalents, and current marketable securities with no short-term debt and $0.5 billion in long-term finance lease liabilities. The firm also had modest amounts of other non-cancellable financial liabilities on the books at the end of this period. Vertex Pharma’s fortress-like balance sheet represents one of the reasons we are huge fans of the biotech company.

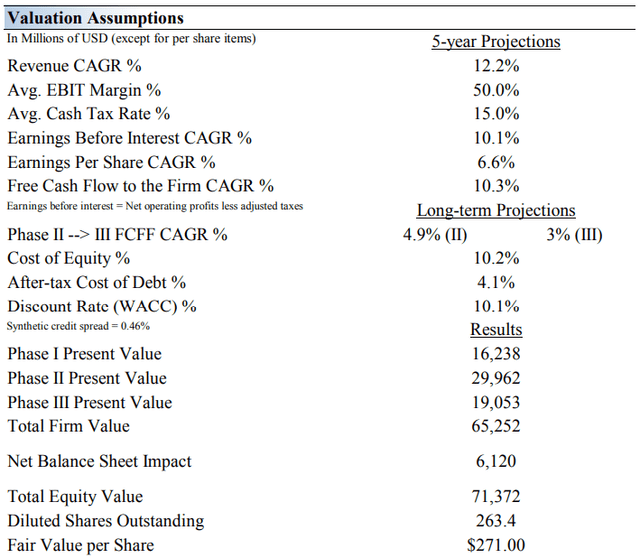

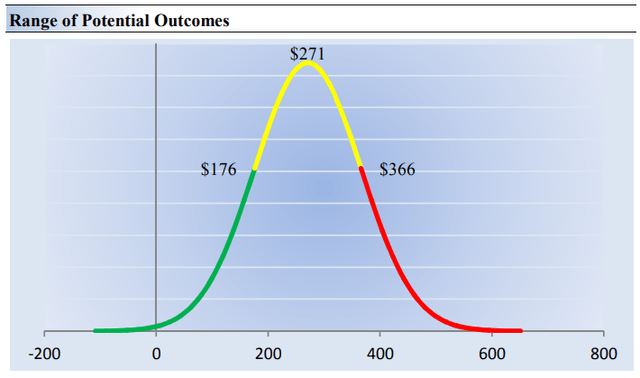

On the basis of our discounted cash flow valuation, we think Vertex Pharma is worth $271 per share, with a fair value range of $176-$366. The margin of safety around our fair value estimate is driven by the firm’s HIGH ValueRisk rating, which is derived from an evaluation of the historical volatility of key valuation drivers and a future assessment of them.

Our near-term operating forecasts, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our model reflects a compound annual revenue growth rate of 12.2% during the next five years, a pace that is lower than the firm’s 3- year historical compound annual growth rate of 35.6%.

Our valuation model reflects a 5-year projected average operating margin of 50%, which is above Vertex Pharma’s trailing 3-year average. Beyond year 5, we assume free cash flow will grow at an annual rate of 4.9% for the next 15 years and 3% in perpetuity. Please note that our perpetuity value assumes several of Vertex’s drugs in its pipeline reach commercialization.

For Vertex Pharma, we use a 10.1% weighted average cost of capital to discount future free cash flows. We also use a comparatively higher-than-average discount rate relative to our general coverage universe due to the inherent risks related to any biotech’s pipeline development.

Image Source: Valuentum. The key valuation assumptions we use in our model to value Vertex Pharma. (Image Source: Valuentum) Image Source: Valuentum. The duration of value composition for Vertex Pharma. The longer-term value of the firm is largely dependent on the development of its unique pipeline of molecules. (Image Source: Valuentum)

Vertex’s Margin of Safety Analysis

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows. Although we estimate Vertex Pharma’s fair value at about $271 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

This is an important way to view the markets as an iterative function of future expectations. As future expectations change, so should the company’s value and its stock price. Stock prices are not a function of fixed historical data but rather act in such a way to capture future expectations within the enterprise valuation construct.

Our ValueRisk rating sets the margin of safety or the fair value range we assign to each stock. In the graph below, we show this probable range of fair values for Vertex Pharma. We think the firm is attractive below $176 per share (the green line), but quite expensive above $366 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion. In light of the many things going right for Vertex Pharma at the moment, we think the high end of our fair value estimate range may be most appropriate.

Image Source: Valuentum. The fair value estimate range we ascribe to Vertex Pharma’s shares. We think the high end of the fair value estimate range may be most appropriate. (Image Source: Valuentum)

Concluding Thoughts

We’re huge fans of Vertex Pharma on the basis of its strong balance sheet, solid free cash flow generation, impressive and commercialized CF franchise, and collaborations to advance CRISPR gene-editing solutions. We view VX-548 as icing on the cake (this molecule could become a huge needle-mover to combat the opioid epidemic).

We are impressed with Vertex Pharma’s performance of late, and appreciate that its drug development pipeline is steadily progressing in the right direction. The company’s relentless focus on innovation is clearly paying off.

Our fair value estimate for Vertex Pharma sits at $271 per share, but we think the high end of our fair value estimate range, which sits at $366 per share, may be most appropriate given the vast upside potential for shares. Vertex Pharma’s stock price has been on a nice upward trend during the past year, and we see room for shares of VRTX to potentially run significantly higher going forward.

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Source link