[ad_1]

Warchi/E+ via Getty Images

Investment Thesis

Matterport (NASDAQ:MTTR) is a leading spatial data company focused on digitizing and indexing the built world with its hardware and software. The company went public last year through a SPAC merger with Gores Holdings VI. The stock soared over 200% from its SPAC price of $10 to over $30 with investors betting on its prime positioning for the metaverse. However, as the hype for the metaverse fades, the stock started plummeting. It is now trading at ~$4, down over 80% from its all-time high.

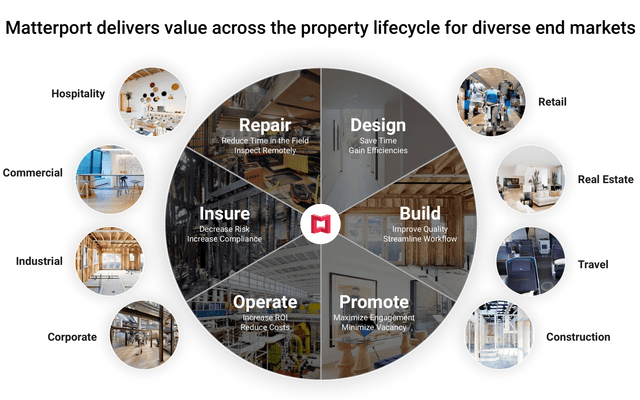

The Metaverse was never the primary market for Matterport in my opinion, it is more of an unprecedented bonus. The company’s main focus has always been on the real estate and construction industry. I believe Matterport has strong potential as its spatial data is able to provide insight for companies and individuals to better design, build, promote, and manage their spaces. The TAM (total addressable market) for digitization of the physical world is estimated to be $240 billion and Matterport’s current market cap is only around $1.5 billion which leaves a lot of room for growth. However, the valuation is still a bit stretched even after the drop, therefore I rate the company as a hold at the current price.

RJ Pittman, CEO, on future opportunities:

“Real property is the largest asset class in the world, now valued at an estimated $327 trillion, reflecting a $100 trillion increase in value in recent years as more than 15,000 new buildings are completed every day. Matterport is leading the industry with over 7 million digital twins, and we’re creating thousands more each day, while 99% of the world’s buildings have yet to be digitized. This enormous market opportunity is expanding, and we remain focused on efficiently scaling Matterport’s business to meet the rising global demand for software-driven property management.”

Introduction

Matterport was founded in California in 2011. It is the leading spatial data company that enables users to physical buildings into digital buildings and the process is easier than ever. Anyone can turn a physical space into an accurate and immersive digital twin which can be used to design, build, operate, promote, and understand.

Matterport requires a device to capture the image for the dedicated spaces. Then with the image, you can choose a subscription plan which includes free, starter, professional, and business.

Free

- 1 active user and active space allowed

- Able to view images on the cloud

- Able to Download photos and videos

- Able to take measurements

Starter

- 1 active user with 5 active space

- Feature from the plan above

- Can be shared and embedded anywhere

- Publish Google Street View free for a limited time

- Basic Space traffic analytics

Professional

- 5 active users and 25 active spaces

- Feature from the plan above

- Small team collaboration

- Automatic face blurring

- Schematic floor plans and technical file (on-demand with extra cost)

Business

- 20 users with 100 active spaces

- Feature from the plan above

- Large team collaboration

- Account administration

- Export traffic report

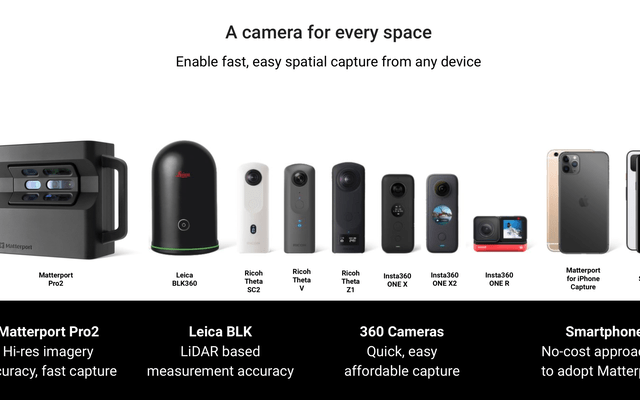

The current devices that Matterport supports are mobile phones, 360 cameras, Matterport Pro 2, and Leica BLK360 with each hardware having different capabilities. iPhone, iPad, and 360 cameras are usually meant for individuals to gain access to quick, portable, entry-level 3D scanning. Both devices have similar capabilities except the 360 cameras allow you to scan more room and spaces and have higher quality images and portability.

For example, 360 cameras can be used in capturing small homes, condos, and apartments for rental or selling. Matterport Pro 2 has the highest-quality 3D scans with unlimited 4K photography and long battery life for multiple scans whereas the Leica BLK360 has similar capabilities with the highest accuracy available. Both of these cameras are suitable for larger scan spaces such as hotels and commercial buildings.

Why Matterport?

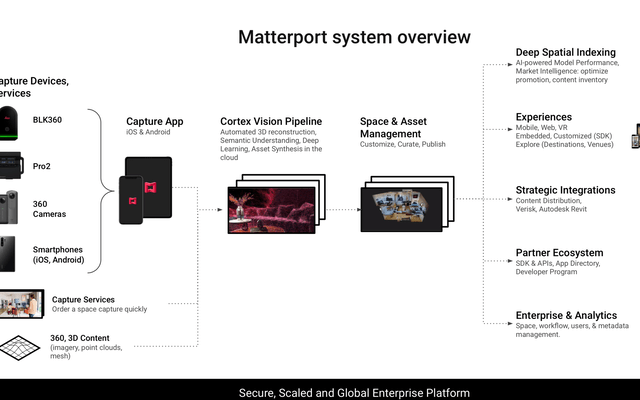

Matterport Capture allows you to capture the space with the devices mentioned above. Once the Matterport Cloud created the digital twin, users can edit their spaces in the Matterport Workshop. It has different capabilities such as labeling rooms, measuring spaces, selecting 4K quality photos, customizing a VR experience, and inviting collaborators to view, upload, and edit the space. Then by using Matterport Showcase, users and their audience can view and explore the space in its final format. It allows users to go through the space in different formats and experience the space in VR format if they have a compatible device such as Oculus. This is why Matterport may play an important role in the Metaverse as it builds the bridge between the real world and the virtual world.

Matterport allows industries like real estate, hospitality, and construction to work more efficiently. The digital twins (spaced that Matterport captured) are very useful in architecture, engineering, and construction because they can store essential information like building plans, exact measurements, and the status of specific projects. This enables companies to collaborate, design, and plan easily. In real estate and the hospitality industry, the digital twin enhances the experience of potential customers’ tours of the property’s spaces without having to invite them to come to the actual site, which allows purchases or rentals to be done much more easily.

Financials and Valuation

Matterport recently announced its first quarter results for FY22. The company reported total revenue of $28.5 million, up 6% compared to the first quarter of 2021. Subscription revenue was $17.1 million compared to $13.8 million, up 24% YoY (year over year). It now accounts for around 60% of total revenue. ARR (annualized recurring revenue) is now $86.8 million. The company is seeing strong engagement for the quarter, with total subscribers up 70% YoY to 562,000. While SUM (spaces under management) increased 49% to 7.3 million. Revenue guidance for the full year of 2022 to be between $125-$135 million while subscription revenue to be between $80–82 million, representing a continued strong growth of 31%-34%.

However, the company’s bottom line remains weak. Loss from operation widened from negative $(2.4) million to negative $(84.9) million. This is largely attributed to the increase in R&D expenses, which increased over 300% from $6 million to $26 million. Operating cash flow went from positive $1 million to negative $(25.5) million. Non-GAAP EPS decreased from negative $(0.01) to negative $(0.1). The company ended the quarter with a strong balance sheet. Cash in hand amounted to $600 million with no debt. This gives them a buffer to burn cash and invest in the business.

RJ Pittman, CEO, on Q1 results:

“We are pleased to report another strong quarter, increasing our subscriber count by 70% to 562,000 subscribers for the period. We expanded Spaces Under Management by 49% to 7.3 million spaces. That’s 7.3 million Matterport digital twins of homes, offices, factories, hotels, and so much more. One of our key strategic levers is subscription revenue, which increased by 24% year-over-year, comprising over 60% of total revenue for the quarter, and which continues to provide high and stable gross margins. Today, we are re-affirming our prior 2022 revenue and EPS guidance. With $600 million of cash on our balance sheet, we have the financial strength to navigate the macro environment and comfortably achieve our long term business plan.”

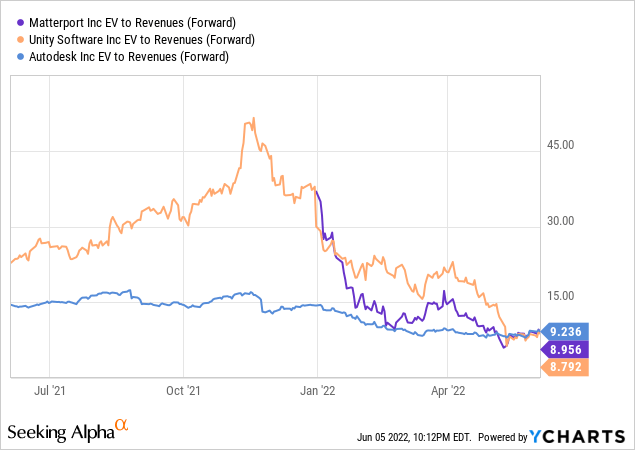

It is hard to value Matterport using most traditional metrics as it is still in growth-at-all-cost mode. Currently, the company is trading at a forward EV/sales ratio of 8.9, which is by no means cheap. From the chart below, you can see that its valuation is pretty much in-line with other 3D software companies like Unity (U) and Autodesk (ADSK). Matterport is a lot less mature compared to these companies and has much weaker profitability too. However, it has a massive untapped TAM that gives the company a lot of room to grow in the future. I believe the current valuation is fair given the opportunity ahead of Matterport.

Conclusion

In conclusion, Matterport has a huge potential in my opinion. Despite its recent growth, the company is only touching the tip of the iceberg when it comes to its TAM (total addressable market). Its spatial data will be very useful for the real estate and construction industry, with the metaverse being a bonus. A lot of Matterport’s subscribers and revenue are from individual users and the company is now shifting its focus to target enterprises, which opens up a lot more growth opportunities. Some notable move includes its collaboration with Meta to enable AI research.

Matterport is growing quickly with total subscribers up 70% YoY and SUM (spaces under management) up 49%. Its SUM is now 7.3 million with 22 billion square feet captured, 100x larger than the rest of the market, which creates a strong data advantage. While the company is still unprofitable, I believe it is more important to capture market share and expand the business rather than being conservative with R&D and S&M spending. It also has enough cash to sustain its current cash burn. The current valuation is in-line with similar software companies and I believe the company is a buy as it is a unique high-growth company with a huge TAM.

Source link