[ad_1]

Rachel Luna/Getty Images Entertainment

In this article, we’ll take a look at healthcare company Cigna (NYSE:CI). I’ve had the company in my eyes for some time – even bought a small starter position at trough valuations, and I consider this business to be one of the absolutely safest around.

In this article, we’ll look at the company’s valuation, the potential upside you can expect from investing in Cigna, and why if applicable, the company is better than other sector alternatives for investment here.

Let’s get going.

What is Cigna?

Cigna was formed back in 1982 by merging two large insurance businesses. The name Cigna arose from a mix of the two companies, CG and INA as their symbols/abbreviations. The roots of those previous companies go back nearly to the time of the American Revolution, giving the company indirect roots going back over 220 years.

Before essentially selling off every single piece of its operations in domestic and global P&C, the company was actually one of the largest insurance businesses on earth. It could compare to businesses such as Allianz (OTCPK:ALIZY) and AIG as well as Zurich (OTCQX:ZURVY). However, Cigna made the choice to focus strictly on its core business. It later sold off almost all of its life insurance operations to Lincoln National (LNC) in – 97.

The company was almost purchased by Anthem (ANTM) back in 2015 for around $47B in cash and stock, but this transaction was blocked by the DoJ due to antitrust issues, with courts deciding on the matter in 2017, ultimately blocking the deal. After this, Cigna turned to growth and acquired Express Scripts for $67B instead, and this deal went through without any hitches.

The company’s current services are centered around global health services, with the stated mission and goal of making health care affordable and available to more individuals. The company’s current portfolio, as of 2021, can be split into two segments.

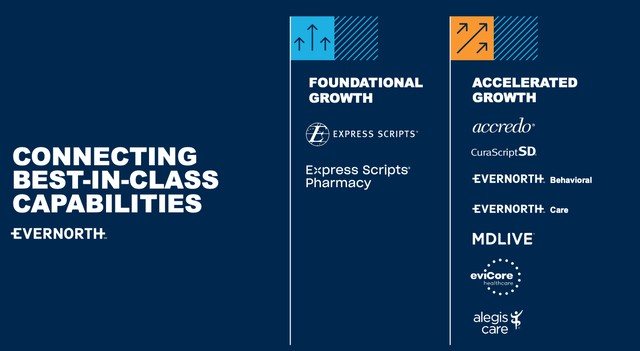

Evernorth, which is the company’s service portfolio. This segment focuses on coordinated services and management solutions, care delivery, and analytics, provided to health plans, employers, government, and other health care providers.

Cigna Healthcare focuses on US Commercial, government, and International health segments, where the company coordinates healthcare for employers and individuals.

It is the goal of the company, using these two platforms, to provide quality and affordable healthcare. More detailed company products include a broad portfolio of health-related solutions and services, offered either stand-alone or as part of a plan, as well as integrated behavioral and pharmacy medical solutions, analytics, and management expertise. Specific health care areas include, but are not limited to medical, pharmacy, behavioral, dental and vision health, and health advocacy programs for a range of insured and self-insured customers. Government solutions involve Medicare Advantage, Medicare Supplement, Medicare D plans for seniors, and individual health insurance plans both inside and outside of public exchanges.

The company also boasts international healthcare operations, both for expats and others – and Cigna, as an example, offers coverage for Expats living in Sweden. The company covers globally mobile individuals and employees of multinational companies and organizations

Cigna serves over 180 million customers worldwide, making it one of the largest healthcare organizations on the planet. The company works with a total addressable market of $900B, and 60% of all of the health plans in the US use one or more of the company’s Evernorth services. Express scripts alone impact 33% of the US population.

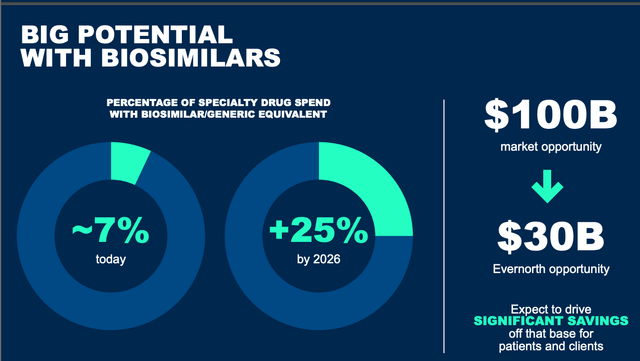

The economics of scale of such an organization is massive. Through its supply chain and sector expertise, Cigna is able to drive massive amounts of annual savings for its policyholders and customers. The current structure and cost segmentation of the US healthcare system is ripe for driving costs down, as 2% of customers represent more than 50% of total pharmacy spending in the specialty segment. This market is further expected to grow by $70B in less than 5 years – and the company is growing significantly faster than the broader market.

Cigna also sees a significant opportunity in biosimilars – because the number of biosimilars for crucial medications is expected to more than triple by 2025, to around 25% by 2026, making it into a $100B total market opportunity, or $30B for Evernorth alone.

On a high level, Cigna is one of the most conservative plays on the future need of quality, affordable healthcare in the US. No matter what happens with this market, it’s my stance that Cigna will be a core part of this, and the company’s services and driving of expenses will be an important part in making this affordable for individuals and organizations.

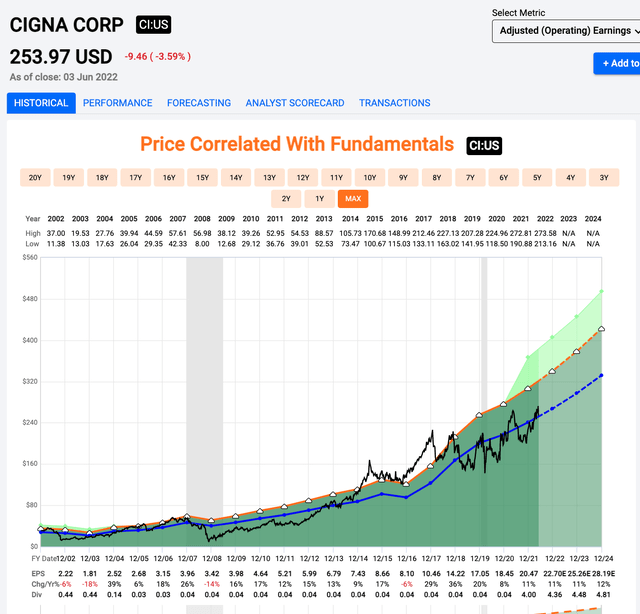

Fundamentally, Cigna is an extremely attractive organization, because the company has 11% average EPS growth for the past 20 years. It’s extremely rare for the company to see negative earnings.

The company’s dividend tradition, beyond a minuscule 4 cent dividend, is very new. In 2021, the company shifted its dividend strategy. Its current payout is $4/share, and is expected to grow, going forward. This translates to a yield slightly south of 1.8% at a current share price of $253/share.

The company has an A-rated credit from S&P Global, and an LT debt/cap of less than 40%, with a market capitalization of north of $80B.

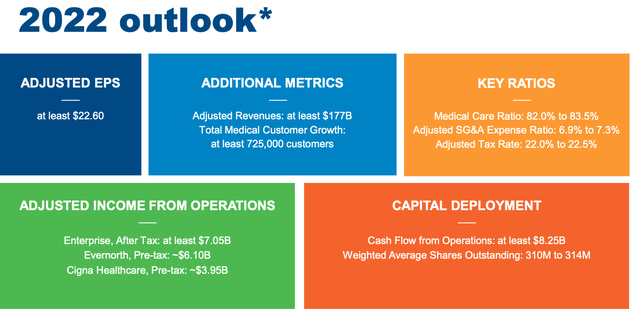

Recent results have confirmed the company’s upside and fundamental advantages. The company has delivered a 2022 outlook that has recently been raised, and the company believes itself able to deliver significant growth moving forward.

Based on these trends, it’s time to move into company valuation and see what the company can offer us.

Cigna’s Valuation

If you read about the company’s qualities and fundamentals, you might expect a 15-25X P/E valuation as sort of a standard for this business.

You would be wrong, surprisingly enough.

Cigna trades at no more than an 11-14X average P/E for the past 20 years, in spite of the company’s massively attractive EPS growth rate. Investors in Cigna have turned a $10,000 investment into close to $84,000, representing a 762% total RoR since 2002.

There is, to be fair, a great degree of volatility in the valuation. Again, though, this does not represent the company’s EPS growth numbers and prospects.

Cigna Valuation (F.A.S.T. Graphs)

As you can see, it’s not unlikely for the business to drop below 10X P/E, at which point investors can expect significant outperformance when the company reverts to above-average valuations. While there have been times the company was overvalued to its P/E, even bought at close to 20X P/E back in 2018, you still would have made around 4% per year, which is impressive given the degree of overvaluation you would have been ignoring.

The current valuation for the business is around 11.5X on average. The 5-year normalized P/E for the company is around 13.5X, which would imply an upside of at least 18% annually even at this point, compared to almost 30% at trough around half a year ago. The company could easily go up to 15X again though, and this would imply a 23% annualized RoR.

Analysts are very capable at conservatively forecasting the company’s earnings. Over the past 10 years, and with a 10% margin of error, analysts have only missed a single time, coming to an 8% miss ratio both for a 1-year and 2-year forward period. This means that the expected earnings have a high likelihood, as I see it, of materializing. The corresponding returns are therefore also not unlikely in the least.

S&P Global would agree with such a positive assessment. The average target for the company comes to around $290/share, which is around a 14% upside to the current share price. 15 out of 24 analysts consider the company a “BUY” here.

I would give Cigna a higher target. Given the company’s EPS growth rate, and a 13X average forward P/E, I give Cigna a conservative price target of $300/share. Under this valuation, I believe that investors can expect alpha when investing in Cigna.

Because of these fundamentals and potential upside, I consider the company having an upside here, and rate it as a “BUY”.

Here comes my thesis for Cigna.

Thesis

Cigna has the following upside:

- Cigna is a fundamentally appealing healthcare company, active in several crucial segments. There are significant short-term and long-term upsides to the business based on current and future trends in the business.

- Given its size and market position, I view very few companies, perhaps with the exception of Anthem, as being better-positioned than Cigna.

- I view Cigna as having an upside of 15-20% until 2024E based on current forecasts, which I view as valid.

With that, I see it as a “BUY”.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (bolded).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has realistic upside based on earnings growth or multiple expansion/reversion.

Source link